Are you gearing up for a career in Claims Account Specialist? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Claims Account Specialist and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

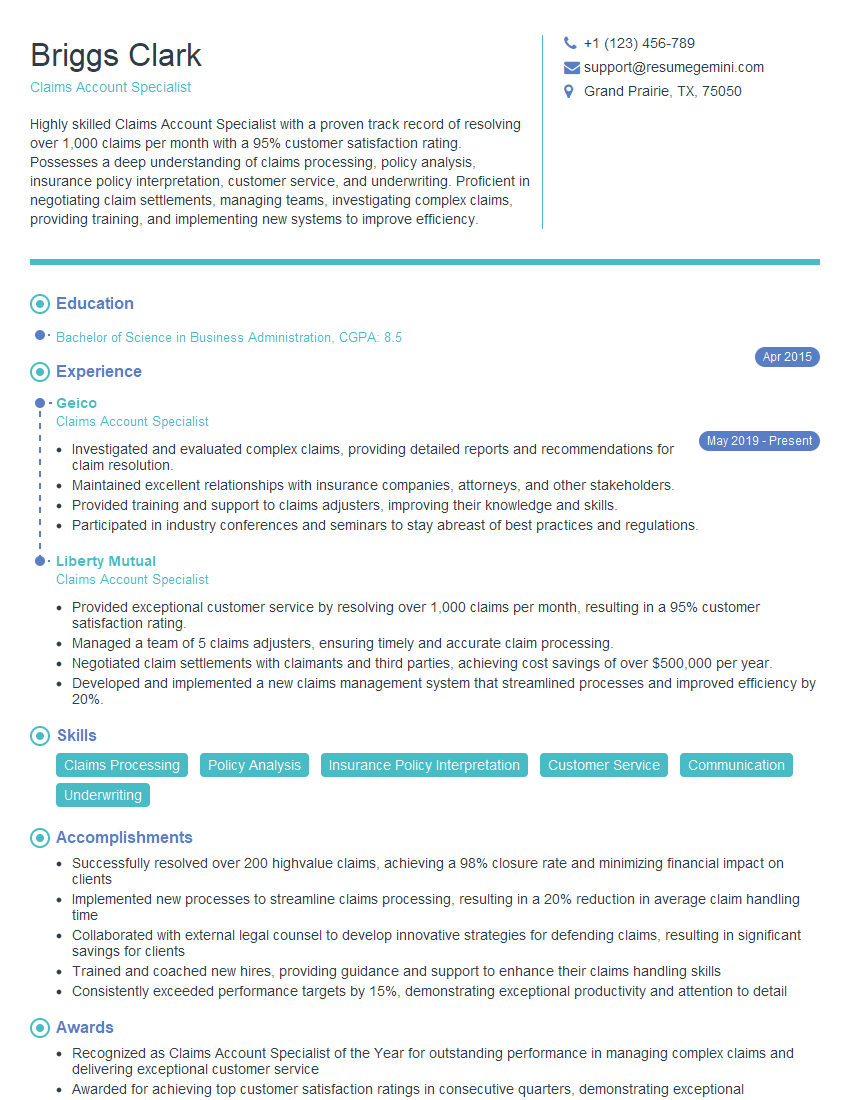

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claims Account Specialist

1. What are the key responsibilities of a Claims Account Specialist?

The key responsibilities of a Claims Account Specialist typically include:

- Processing and evaluating claims submissions to determine coverage and liability.

- Communicating with policyholders, claimants, and other parties involved in the claims process.

- Investigating claims to gather evidence and make informed decisions.

- Negotiating settlements and managing claim reserves.

- Maintaining accurate records and documentation related to claims.

2. Describe the different types of claims that you have handled in your previous experience.

Property Claims

- Residential property claims (e.g., fire, theft, water damage)

- Commercial property claims (e.g., business interruption, equipment damage)

Liability Claims

- Bodily injury claims (e.g., auto accidents, slip-and-fall accidents)

- Property damage claims (e.g., damage to third-party property)

3. How do you approach the investigation of a complex claim?

When investigating a complex claim, I follow a systematic approach that includes:

- Reviewing all available documentation (e.g., police reports, medical records, witness statements).

- Interviewing relevant parties (e.g., policyholders, claimants, witnesses).

- Conducting site inspections (e.g., to assess property damage or accident scenes).

- Consulting with experts (e.g., engineers, medical professionals) as needed.

- Analyzing evidence and developing a logical theory of the case.

4. How do you handle claims that involve disputes or conflicts between parties?

When handling claims involving disputes, I prioritize the following:

- Remaining impartial and objective in my assessment of the claim.

- Facilitating communication and negotiation between the parties involved.

- Exploring alternative dispute resolution methods (e.g., mediation, arbitration) when appropriate.

- Documenting all discussions and agreements thoroughly.

5. Describe your experience in negotiating settlements with claimants.

In my previous role, I was responsible for negotiating settlements with claimants in a variety of claim types. My approach to settlement negotiations typically involved:

- Evaluating the merits of the claim and the potential exposure to the insurer.

- Assessing the claimant’s needs and objectives.

- Developing a fair and reasonable settlement offer that balanced the interests of both the claimant and the insurer.

- Negotiating effectively to reach a mutually acceptable agreement.

6. How do you stay up-to-date on changes in insurance regulations and industry best practices?

To stay up-to-date on changes in insurance regulations and industry best practices, I regularly engage in the following activities:

- Attending industry conferences and workshops.

- Reading trade publications and online resources.

- Participating in webinars and online training programs.

- Consulting with legal counsel and other experts as needed.

- Networking with other professionals in the insurance field.

7. What is your understanding of subrogation and how have you applied it in your previous role?

Subrogation is the right of an insurer to seek reimbursement from a third party who is legally liable for a loss or damage covered by the insurance policy. In my previous role, I applied subrogation in the following ways:

- Identifying potential third-party liability in claims.

- Investigating and pursuing subrogation claims against liable parties.

- Negotiating settlements and recovering reimbursement for the insurer.

- Maintaining relationships with attorneys and other professionals involved in subrogation.

8. Describe your experience in using claim management software and technology.

In my previous role, I used a variety of claim management software and technology to support my work, including:

- Claim tracking systems to manage the claims process from intake to closure.

- Data analysis tools to identify trends and patterns in claim data.

- Communication platforms to facilitate collaboration with colleagues and external parties.

- Artificial intelligence (AI) tools to automate certain tasks and improve efficiency.

9. How do you prioritize your workload and manage multiple claims simultaneously?

To prioritize my workload and manage multiple claims simultaneously, I use the following strategies:

- Establishing clear priorities based on the severity and urgency of claims.

- Developing an efficient workflow and delegating tasks as appropriate.

- Using technology tools to automate certain tasks and track my progress.

- Communicating regularly with policyholders and other stakeholders to keep them informed and manage expectations.

10. What are the ethical considerations that you take into account when handling claims?

The following ethical considerations guide my work as a Claims Account Specialist:

- Maintaining confidentiality and protecting sensitive information.

- Treating all parties involved in the claims process with fairness and respect.

- Avoiding conflicts of interest and disclosing any potential conflicts.

- Complying with all applicable laws and regulations.

- Acting in the best interests of the policyholders and the insurer.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claims Account Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claims Account Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Claims Account Specialists play a vital role in the insurance industry, supporting policyholders and ensuring claims are processed efficiently. Their responsibilities involve handling claims-related inquiries, analyzing documentation, and facilitating communication between policyholders, agents, and insurance providers.

1. Claims Processing and Settlement

Accurately reviewing and processing insurance claims, including coverage assessments, damage valuations, and determining claim payments.

- Evaluating claim reports, policy documents, and supporting documentation to determine liability and coverage eligibility.

- Inspecting damaged property or vehicles, taking photographs, and compiling evidence to support claim assessments.

- Calculating claim settlements based on policy terms, coverage limits, and applicable regulations.

- Negotiating and finalizing settlements with policyholders, ensuring fair and equitable outcomes.

2. Policyholder Communication and Support

Providing clear and empathetic communication to policyholders throughout the claims process, explaining coverage, procedures, and payment timelines.

- Answering policyholder inquiries promptly and accurately, providing guidance and resolving concerns.

- Maintaining open and regular communication with policyholders, keeping them informed about claim status and updates.

- Handling escalated claims and complaints, ensuring timely resolution and customer satisfaction.

3. Claims Management and Administration

Managing claims files, maintaining accurate documentation, and ensuring compliance with internal processes and industry regulations.

- Maintaining comprehensive claim files, including all relevant documentation, correspondence, and settlement records.

- Coordinating with external vendors, such as repair shops, medical providers, and legal counsel, to facilitate claim resolutions.

- Adhering to established claim processing guidelines, ensuring compliance with company policies and industry best practices.

4. Underwriting and Risk Assessment

Understanding insurance policies and underwriting guidelines, assessing risk factors, and recommending coverage options to policyholders.

- Analyzing policy applications, reviewing risk exposures, and determining appropriate coverage recommendations.

- Evaluating financial and underwriting information, such as credit history, loss history, and property inspections.

- Communicating underwriting decisions and coverage recommendations to agents and policyholders.

Interview Tips

Preparing thoroughly for your Claims Account Specialist interview can increase your chances of success. Here are some essential tips to help you ace the interview:

1. Research the Company and Role

Take the time to research the insurance company and the specific Claims Account Specialist role you are applying for. This will help you gain a deeper understanding of the company’s culture, values, and business objectives. It will also demonstrate your interest and preparation.

- Visit the company website to learn about their mission, products, and services.

- Read industry articles and news to stay updated on insurance trends and best practices.

- Connect with current or former employees on LinkedIn to gain insights into the company and role.

2. Practice Your Answers

Common interview questions for Claims Account Specialists often focus on their knowledge of insurance, claims handling, and customer service skills. Prepare thoughtful answers to these questions, using specific examples from your experience.

- Describe a challenging claim you handled and how you resolved it successfully.

- Share an example of how you effectively communicated complex insurance concepts to a policyholder.

- Explain your understanding of insurance underwriting and risk assessment.

3. Highlight Your Skills and Experience

Emphasize your relevant skills and experience in your resume and interview answers. Claims Account Specialists need a strong foundation in insurance principles, excellent communication and negotiation skills, and a commitment to customer service. Showcase these abilities through real-world examples.

- Quantify your accomplishments using specific metrics, such as the number of claims processed or the percentage of satisfied customers.

- Use keywords from the job description in your resume and interview answers to demonstrate your alignment with the role.

- Be prepared to discuss your experience with insurance software and technology tools.

4. Ask Thoughtful Questions

Asking well-informed questions at the end of the interview demonstrates your interest in the role and the company. It also gives you an opportunity to gather additional information to help you make an informed decision.

- Ask about the company’s claims process and how it aligns with industry best practices.

- Inquire about training and development opportunities for Claims Account Specialists within the organization.

- Ask about the company’s commitment to diversity, equity, and inclusion.

5. Be Confident and Enthusiastic

Project a positive and confident attitude throughout the interview. Enthusiasm for the role and the insurance industry will make a lasting impression on the interviewer. Dress professionally and arrive on time for your interview.

- Maintain eye contact, speak clearly, and listen attentively to the interviewer’s questions.

- Be prepared to ask questions and demonstrate your interest in the role and the company.

- Follow up with a thank-you note to reiterate your appreciation and interest in the position.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Claims Account Specialist interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!