Are you gearing up for a career in Claims Adjudicator? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Claims Adjudicator and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

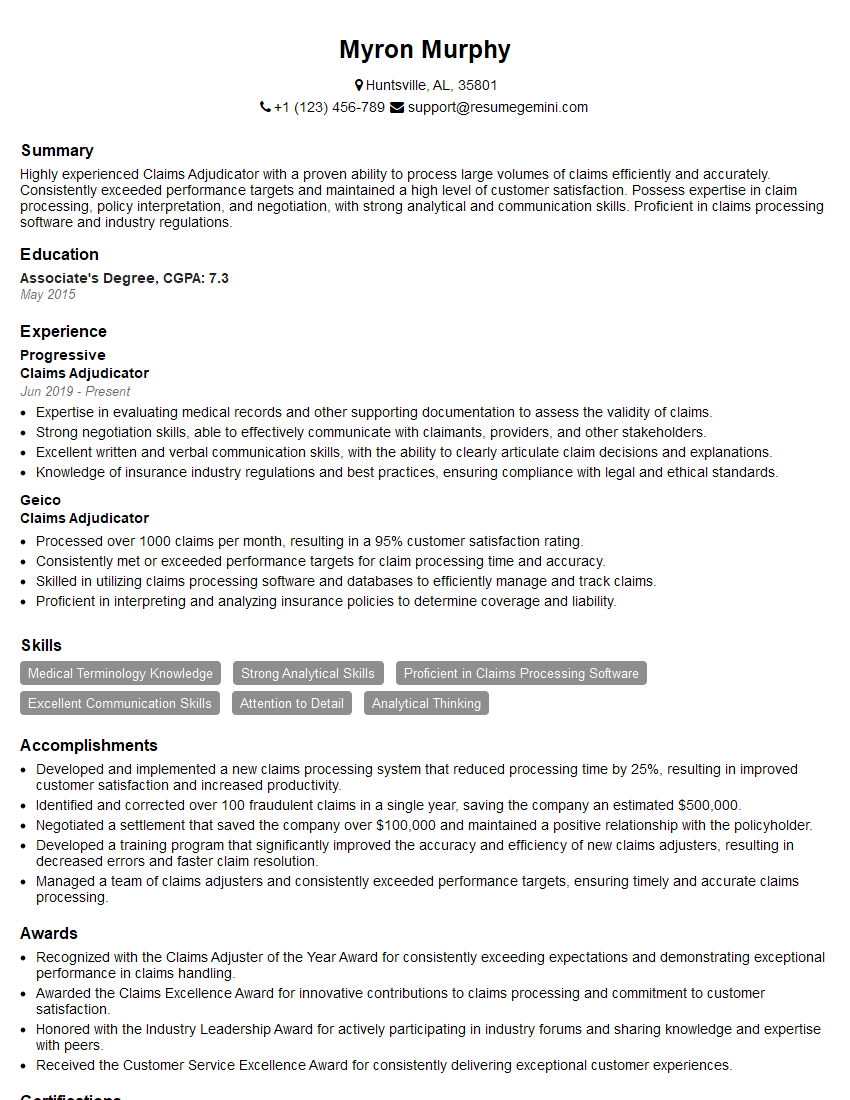

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claims Adjudicator

1. Describe the steps involved in processing a health insurance claim.

The steps involved in processing a health insurance claim are as follows:

- Receive and review the claim form.

- Verify the patient’s eligibility and benefits.

- Review the medical record to ensure that the services provided are covered by the insurance policy.

- Determine the amount of payment that is due to the provider.

- Send the payment to the provider.

2. What are some of the most common reasons for health insurance claims to be denied?

Some of the most common reasons for health insurance claims to be denied include:

- The service is not covered by the insurance policy.

- The patient is not eligible for benefits.

- The claim form is incomplete or contains errors.

- The medical record does not support the services provided.

3. What are some of the challenges that you have faced in your previous role as a Claims Adjudicator?

Some of the challenges that I have faced in my previous role as a Claims Adjudicator include:

- Keeping up with the ever-changing health insurance regulations.

- Dealing with difficult customers.

- Processing a high volume of claims in a timely manner.

4. What are some of the qualities that you believe are essential for success in this role?

Some of the qualities that I believe are essential for success in this role include:

- Strong attention to detail.

- Excellent communication skills.

- Ability to work independently and as part of a team.

- Knowledge of health insurance regulations.

5. What is your understanding of the Affordable Care Act (ACA) and its impact on health insurance claims?

ACA’s Impact on Health Insurance Claims

- Expanded coverage to millions of Americans.

- Prohibited insurers from denying coverage for pre-existing conditions.

- Set limits on out-of-pocket costs.

- Required insurers to provide essential health benefits.

ACA’s Impact on Claims Adjudication

- Increased number of claims.

- More complex claims.

- Need for adjudicators to be more knowledgeable about the ACA.

6. What are some of the emerging trends in health insurance claims processing?

Some of the emerging trends in health insurance claims processing include:

- The use of artificial intelligence (AI) to automate tasks.

- The use of blockchain technology to improve security and efficiency.

- The use of mobile apps to make it easier for patients to submit claims.

7. What are your goals for your career as a Claims Adjudicator?

My goals for my career as a Claims Adjudicator are to:

- Become an expert in health insurance regulations.

- Develop strong relationships with providers and customers.

- Contribute to the development of innovative claims processing solutions.

8. Tell me about a time when you went above and beyond to help a customer.

One time when I went above and beyond to help a customer was when I helped a woman who had been denied coverage for a life-saving surgery. I worked with her to appeal the decision, and ultimately she was able to get the coverage she needed.

9. What is your experience with using [specific software or system]?

I have been using [specific software or system] for the past [number] years. I am proficient in using the system to process claims, manage customer accounts, and generate reports.

10. What are your salary expectations for this position?

My salary expectations for this position are in the range of [lower salary] to [higher salary]. I am confident that I have the skills and experience that you are looking for, and I am eager to contribute to your team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claims Adjudicator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claims Adjudicator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Claims Adjudicator is responsible for reviewing and processing insurance claims, ensuring they adhere to company policies and regulations. Key job responsibilities include:

1. Reviewing and Analyzing Claims

• Inspecting and evaluating insurance claims for accuracy, completeness, and validity.

• Assessing the nature and extent of the damages or losses claimed.

- Example: A homeowner’s insurance claim involves water damage. The adjudicator reviews the claim, examines the damage report, and interviews the homeowner to verify the extent of the loss.

2. Investigating Claims

• Conducting thorough investigations into claims to determine liability and coverage.

• Collecting evidence and interviewing witnesses as necessary.

- Example: In an auto accident claim, the adjudicator investigates the circumstances of the accident, gathers police reports, and interviews the drivers involved to establish fault and determine coverage.

3. Determining Coverage

• Interpreting insurance policies and applying them to claims.

• Identifying covered and non-covered expenses.

- Example: A health insurance claim for a specific procedure. The adjudicator reviews the policy and determines if the procedure is covered under the patient’s plan.

4. Calculating Benefits

• Calculating the amount of benefits payable under the insurance policy.

• Considering factors such as policy terms, damages, and applicable state laws.

- Example: A disability insurance claim. The adjudicator calculates the monthly benefit amount based on the insured’s income and policy provisions.

Interview Tips

To ace the interview for a Claims Adjudicator position, consider the following preparation tips:

1. Research the Company and Position

• Thoroughly research the insurance company and the specific role.

• Familiarize yourself with the company’s products, services, and policies.

2. Practice Your Claims Handling Skills

• Review common claim scenarios and practice analyzing and adjudicating them.

• Prepare examples of your problem-solving and decision-making abilities in claims handling.

3. Highlight Your Knowledge of Insurance Policies and Regulations

• Demonstrate your understanding of insurance policy provisions and regulatory requirements.

• Be prepared to discuss relevant laws and industry best practices.

4. Emphasize Your Attention to Detail

• Showcase your ability to review and process claims accurately and efficiently.

• Highlight your meticulous approach to gathering information, identifying coverage, and calculating benefits.

5. Prepare for Common Interview Questions

• Anticipate questions about your claims adjudication experience, skills, and knowledge.

• Prepare thoughtful answers that demonstrate your qualifications and enthusiasm for the role.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Claims Adjudicator interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!