Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Claims Adjuster position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

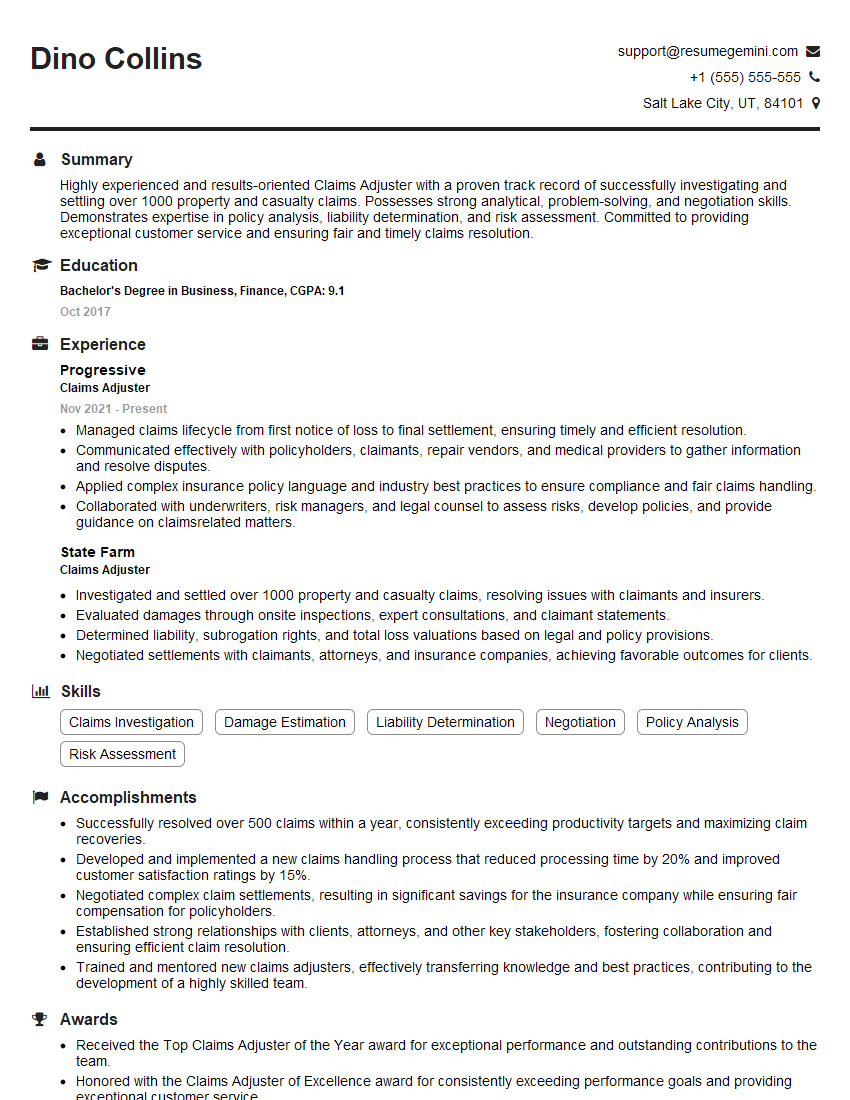

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claims Adjuster

1. Walk me through the steps involved in processing a property damage claim.

In processing a property damage claim, these steps are typically followed:

- Initial contact: Receive the claim report and gather basic information.

- Investigation: Visit the property, assess damage, and document findings.

- Scope of loss determination: Identify covered and non-covered losses, and calculate repair or replacement costs.

- Settlement negotiations: Discuss repair options with the claimant and negotiate a fair settlement.

- Payment and closure: Issue payment to the claimant and close the claim.

2. How do you determine the value of a property damage claim?

Depreciation and Replacement Cost

- Depreciate the value of damaged property.

- Consider the cost of replacing the damaged item with one of like kind and quality.

Actual Cash Value

- Determine the current market value of the damaged property.

- Deduct any applicable depreciation.

3. What are the most common types of coverage disputes you encounter?

Common coverage disputes include:

- Coverage exclusions: Determining if specific damages are covered under the policy.

- Amount of coverage: Disputes over the adequacy of coverage limits.

- Valuing the loss: Disagreements on the value of damaged property.

- Subrogation rights: Disputes over the insurer’s right to pursue recovery from third parties.

4. How do you handle claims involving fraud or misrepresentation?

When handling claims involving fraud or misrepresentation:

- Investigate thoroughly: Gather evidence to support or refute allegations.

- Document findings: Create detailed reports outlining the investigation process and findings.

- Collaborate with law enforcement: Report any suspected fraudulent activity to the appropriate authorities.

- Communicate with claimants: Inform claimants of the investigation’s outcome and any potential consequences.

5. What are the key provisions of a homeowners insurance policy?

Key provisions of a homeowners insurance policy include:

- Property coverage: Protection for the home, other structures, and personal belongings.

- Liability coverage: Covers legal expenses and damages caused to others by the policyholder.

- Additional living expenses: Reimburses expenses incurred if the home becomes uninhabitable.

- Exclusions: Specifies which losses are not covered by the policy.

- Deductibles: The amount the policyholder pays before coverage kicks in.

6. How do you prioritize multiple claims when your workload is heavy?

To prioritize multiple claims:

- Severity of loss: Prioritize claims involving major damage or potential liability.

- Policyholder needs: Consider the urgency of the policyholder’s situation.

- Regulatory deadlines: Meet all applicable deadlines to avoid penalties.

- First-in, first-out: Handle claims in the order they were received, unless circumstances warrant otherwise.

7. What software or tools do you use to manage claims?

Common software and tools used by claims adjusters include:

- Claim management systems: Centralize claim data and streamline workflows.

- Estimating software: Calculate repair or replacement costs accurately.

- Communication platforms: Facilitate communication with claimants, policyholders, and third parties.

- Document management systems: Organize and store claim-related documents.

- Fraud detection tools: Identify and investigate potential fraudulent claims.

8. What are the ethical considerations in claims adjusting?

Ethical considerations in claims adjusting include:

- Fairness and impartiality: Treat all parties involved in the claim fairly and without bias.

- Confidentiality: Maintain the privacy of sensitive information obtained during the claims process.

- Transparency: Disclose all relevant information to claimants and policyholders.

- Objectivity: Avoid personal opinions or interests that could influence claim decisions.

- Professional conduct: Adhere to industry standards and maintain a high level of professionalism.

9. How do you stay up-to-date on industry trends and best practices?

To stay up-to-date on industry trends and best practices:

- Attend industry conferences and workshops: Learn about the latest developments and network with professionals.

- Read industry publications and online resources: Stay informed on legal updates, policy changes, and best practices.

- Participate in professional development programs: Enhance skills and knowledge through formal training.

- Seek mentorship: Learn from experienced claims professionals who can share their insights.

- Utilize insurance industry organizations: Join organizations that provide access to resources, networking opportunities, and educational programs.

10. What is your understanding of subrogation and how do you apply it in your work?

Subrogation is the insurer’s right to pursue recovery from a third party responsible for causing or contributing to a loss. In my work, I apply subrogation by:

- Identifying potential third-party liability: Investigating claims to determine if another party is at fault.

- Filing subrogation claims: Pursuing recovery from responsible third parties to minimize the insurer’s financial losses.

- Negotiating settlements: Negotiating fair settlements with third parties or their insurers.

- Coordinating with legal counsel: Collaborating with legal experts to ensure proper handling of subrogation cases.

- Protecting the insured’s interests: Ensuring that the insured’s rights are maintained throughout the subrogation process.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claims Adjuster.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claims Adjuster‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Claims Adjusters are responsible for investigating and settling insurance claims. Their key job responsibilities include:

1. Investigating Claims

Claims adjusters investigate claims by gathering information from policyholders, witnesses, and other relevant parties. They analyze the information to determine the cause of the loss, the extent of the damage, and the amount of coverage available under the policy.

2. Negotiating Settlements

Once the claim has been investigated, the claims adjuster negotiates a settlement with the policyholder. The settlement must be fair and reasonable, and it must take into account the policyholder’s needs and the insurance company’s obligations.

3. Preparing Reports

Claims adjusters prepare reports that document the investigation and settlement of the claim. These reports are used by the insurance company to make decisions about coverage and to process payments.

4. Customer Service

Claims adjusters provide customer service to policyholders throughout the claims process. They answer questions, explain the claims process, and help policyholders recover from their losses.

Interview Preparation Tips

To ace your interview for a claims adjuster position, follow these tips:

1. Research the insurance industry and the company

Learn about the different types of insurance policies, the claims process, and the company’s history and financial performance. This will help you understand the industry and the company’s culture.

2. Prepare for common interview questions

Review common interview questions and practice your answers out loud. This will help you feel confident and prepared during the interview.

Example Outline: * Tell me about yourself. * Start with your relevant experience and skills. * Highlight your passion for helping people and your strong work ethic. * Keep your answer concise and to the point. * Why are you interested in a career as a claims adjuster? * Explain how your skills and experience make you a good fit for the role. * Talk about your interest in the insurance industry and your desire to help people recover from their losses. * What are your strengths and weaknesses? * Strengths: Highlight your ability to investigate claims, negotiate settlements, and provide excellent customer service. * Weaknesses: Be honest about your weaknesses, but focus on how you are working to improve them.3. Dress professionally and arrive on time

First impressions matter, so dress professionally and arrive on time for your interview. This will show the interviewer that you are serious about the position.

4. Be enthusiastic and positive

Claims adjusters interact with people who have experienced losses, so it is important to be enthusiastic and positive. Show the interviewer that you are passionate about helping people.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Claims Adjuster, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Claims Adjuster positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.