Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Claims Adjustor interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Claims Adjustor so you can tailor your answers to impress potential employers.

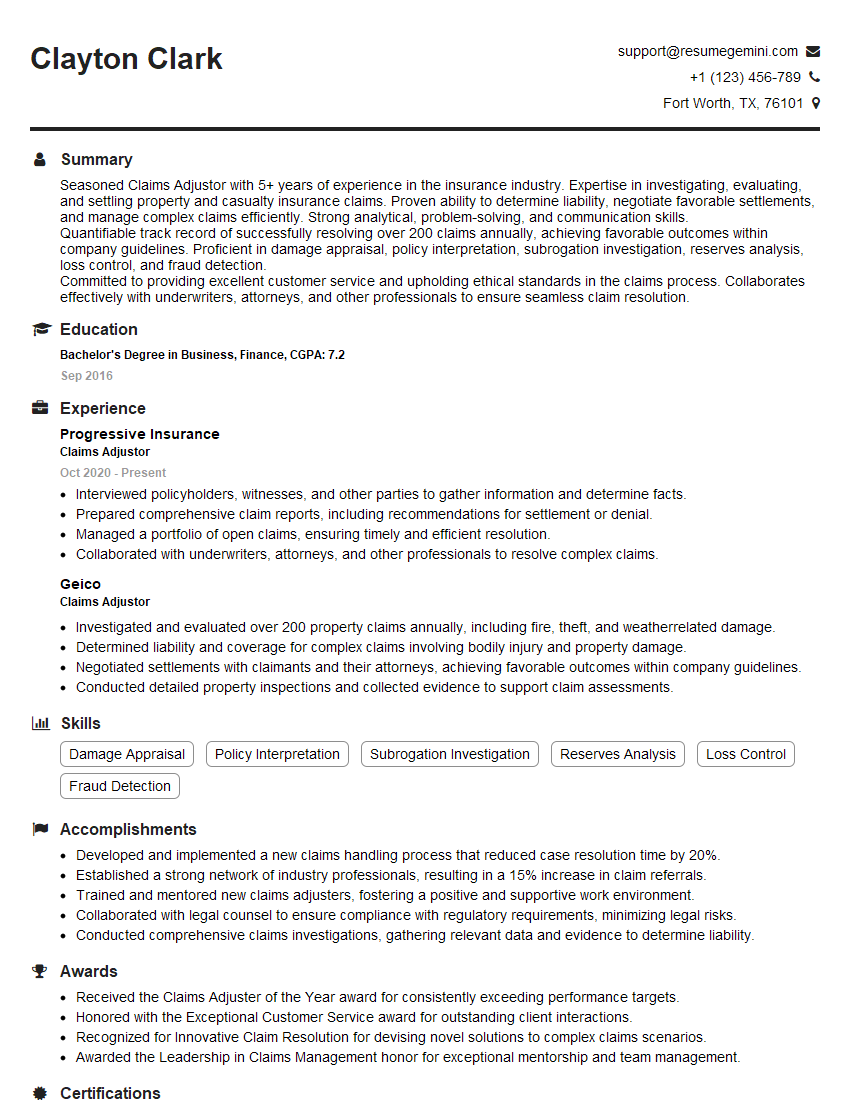

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claims Adjustor

1. Describe the steps involved in the claims adjustment process?

The claims adjustment process involves several crucial steps:

- First Notice of Loss (FNOL) Reporting: The policyholder or claimant initiates the process by reporting the loss to the insurance company.

- Assignment and Investigation: A claims adjuster is assigned to the case and conducts a thorough investigation to gather evidence, assess the damages, and determine liability.

- Coverage Determination: The adjuster reviews the policy to determine coverage and any applicable exclusions or limitations.

- Loss Evaluation: The adjuster calculates the amount of the claim based on the policy terms, evidence gathered, and industry standards.

- Negotiation and Settlement: The adjuster negotiates with the claimant to reach a fair and equitable settlement that covers the damages.

- Payment and Closing: Once the settlement is agreed upon, the insurance company issues payment to the claimant, and the claim is closed.

2. How do you handle complex or high-value claims?

Handling Complex or High-Value Claims:

- Expert Consultation: Consult with experts in relevant fields (e.g., engineers, medical professionals) to obtain specialized knowledge.

- Detailed Investigation: Conduct a comprehensive investigation to gather all necessary evidence and documentation.

- Legal Considerations: Stay informed about legal precedents and consult with legal counsel as needed.

- Negotiation Strategies: Develop effective negotiation strategies to reach a fair settlement while protecting the interests of the insurance company.

- Documentation and Communication: Maintain thorough documentation and communicate effectively with all parties involved.

3. Describe the role of technology in claims adjusting and how it has impacted your work?

Role of Technology in Claims Adjusting:

- Automated Claim Processing: Streamlines FNOL reporting, assignment, and investigation processes.

- Data Analytics: Utilizes data to identify trends, predict risks, and enhance decision-making.

- Remote Inspections: Enables virtual inspections using video conferencing and drones, improving efficiency and reducing travel costs.

- Artificial Intelligence (AI): Assists in damage assessment, fraud detection, and claim settlement recommendations.

- Customer Relationship Management (CRM): Provides a centralized platform for managing claimant interactions and improving communication.

4. How do you stay updated on changes in insurance regulations and industry best practices?

Keeping Up with Regulatory Changes and Industry Best Practices:

- Continuing Education: Attend conferences, workshops, and online courses to acquire new knowledge and skills.

- Association Membership: Join professional organizations (e.g., National Association of Independent Insurance Adjusters) for industry updates and networking.

- Subscription to Publications: Subscribe to industry journals and newsletters to stay informed about regulatory changes.

- Company Training Programs: Participate in internal training programs offered by the insurance company to enhance knowledge and compliance.

- Collaboration with Legal Counsel: Consult with legal counsel to ensure compliance with regulatory requirements and ethical standards.

5. How do you prioritize multiple claims and manage your workload effectively?

Prioritizing Claims and Managing Workload:

- Triage and Assessment: Evaluate incoming claims based on severity, urgency, and potential liability.

- Caseload Management: Utilize case management software to track claim status, deadlines, and communication history.

- Time Management Techniques: Apply time management strategies (e.g., Eisenhower Matrix) to prioritize tasks and allocate time effectively.

- Delegation and Collaboration: Delegate tasks to support staff or collaborate with colleagues to manage workload.

- Communication: Communicate with claimants and other stakeholders to set clear expectations and manage workload.

6. Describe a challenging claim you have handled and how you resolved it?

Example of a Challenging Claim and Resolution:

- Description of the Claim: Briefly outline the complex or high-value claim encountered.

- Investigation and Analysis: Explain how you gathered evidence, consulted experts, and conducted a thorough investigation.

- Challenges Faced: Highlight specific complexities or obstacles encountered during the adjustment process.

- Resolution: Describe the strategies employed and negotiations conducted to reach a fair settlement.

- Lessons Learned: Share any valuable insights or lessons gained from handling the challenging claim.

7. How do you build rapport with claimants and manage their expectations?

Building Rapport and Managing Expectations:

- Empathy and Communication: Demonstrate empathy and active listening skills to understand the claimant’s perspective.

- Clear and Timely Communication: Provide regular updates and explanations to keep claimants informed throughout the process.

- Setting Realistic Expectations: Discuss policy coverages, exclusions, and potential outcomes to manage expectations.

- Professionalism and Respect: Maintain a professional demeanor and treat claimants with respect, regardless of their background or demeanor.

- Follow-Up and Availability: Promptly respond to inquiries and be available to address concerns.

8. How do you assess and mitigate fraud in claims?

Fraud Assessment and Mitigation:

- Red Flag Identification: Understand common indicators of potential fraud and be observant during claim investigations.

- Investigation Techniques: Employ various investigation techniques (e.g., document analysis, witness interviews) to uncover fraudulent activities.

- Collaboration with Law Enforcement: Report suspected fraudulent claims to law enforcement agencies for further investigation and prosecution.

- Educational Programs: Participate in educational programs to stay informed about emerging fraud trends and mitigation strategies.

- Technology Utilization: Leverage technology (e.g., fraud detection software) to enhance fraud detection capabilities.

9. Describe your knowledge of subrogation and how you handle subrogation claims?

Subrogation Knowledge and Handling:

- Understanding Subrogation: Explain the concept of subrogation and the rights of the insurance company to pursue recovery.

- Identification and Notification: Identify potential subrogation opportunities during claim investigations and notify relevant parties.

- Negotiation and Recovery: Engage in negotiations with third parties to recover subrogation claims and maximize recoveries.

- Legal Considerations: Stay informed about legal precedents and consult with legal counsel to ensure compliance with subrogation laws.

- Documentation and Reporting: Maintain thorough documentation and report subrogation recoveries to the insurance company.

10. How do you handle disputes and navigate the litigation process?

Dispute Resolution and Litigation:

- Negotiation and Mediation: Engage in negotiations and mediation to resolve disputes amicably and avoid litigation.

- Litigation Preparation: Gather evidence, prepare witness statements, and build a strong case in preparation for litigation.

- Collaboration with Legal Counsel: Work closely with legal counsel to develop legal strategies and represent the insurance company in court.

- Settlement Negotiation: Participate in settlement negotiations to reach a fair and equitable resolution during litigation.

- Trial Advocacy: Present evidence and advocate for the insurance company’s position effectively during trial.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claims Adjustor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claims Adjustor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

1. Investigate and Evaluate Claims

Claims adjusters investigate and evaluate claims to determine the extent of coverage and liability. They may visit the scene of an accident or incident, interview witnesses, and gather evidence.

- Interview claimants, witnesses, and other parties involved in the claim.

- Review insurance policies and other relevant documents.

- Inspect damaged property and assess the extent of damage.

- Determine the cause of the loss and the amount of damages.

- Recommend a settlement amount.

2. Negotiate and Settle Claims

Claims adjusters negotiate and settle claims with claimants. They must be able to communicate effectively and persuasively, and they must have a strong understanding of insurance law and policy.

- Negotiate with claimants to reach a fair and equitable settlement.

- Explain the terms of the settlement to the claimant.

- Prepare and issue settlement checks.

- Maintain a record of all settlements.

3. Provide Customer Service

Claims adjusters provide customer service to claimants throughout the claims process. They must be patient, empathetic, and responsive.

- Answer questions from claimants about their claims.

- Keep claimants informed about the status of their claims.

- Resolve complaints and grievances.

4. Manage the Claims Process

Claims adjusters manage the claims process from start to finish. They must be able to prioritize their workload, meet deadlines, and work independently.

- Assign claims to the appropriate staff.

- Monitor the progress of claims.

- Review and approve claim settlements.

- Maintain accurate records of all claims.

Interview Tips

1. Research the company and the position

Make sure you have a good understanding of the company’s culture, values, and products/services. This will help you answer questions intelligently and show that you’re genuinely interested in the position.

- Visit the company’s website.

- Read articles and news stories about the company.

- Talk to people who work at the company.

2. Practice your answers to common interview questions

There are a few common interview questions that you’re likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” Take some time to practice your answers to these questions so that you can deliver them confidently and concisely.

- Write out your answers to common interview questions.

- Practice saying your answers out loud.

- Ask a friend or family member to give you feedback on your answers.

3. Be yourself

Don’t try to be someone you’re not. The interviewer wants to get to know the real you, so be yourself and let your personality shine through.

- Be honest and genuine in your answers.

- Don’t try to sound like someone you’re not.

- Show the interviewer your enthusiasm for the position.

4. Follow up after the interview

After the interview, send a thank-you note to the interviewer. This is a great way to reiterate your interest in the position and show that you’re still enthusiastic about the opportunity.

- Send a thank-you note within 24 hours of the interview.

- Keep your thank-you note brief and to the point.

- Use the thank-you note to reiterate your interest in the position and highlight your qualifications.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Claims Adjustor role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.