Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Claims Correspondence Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

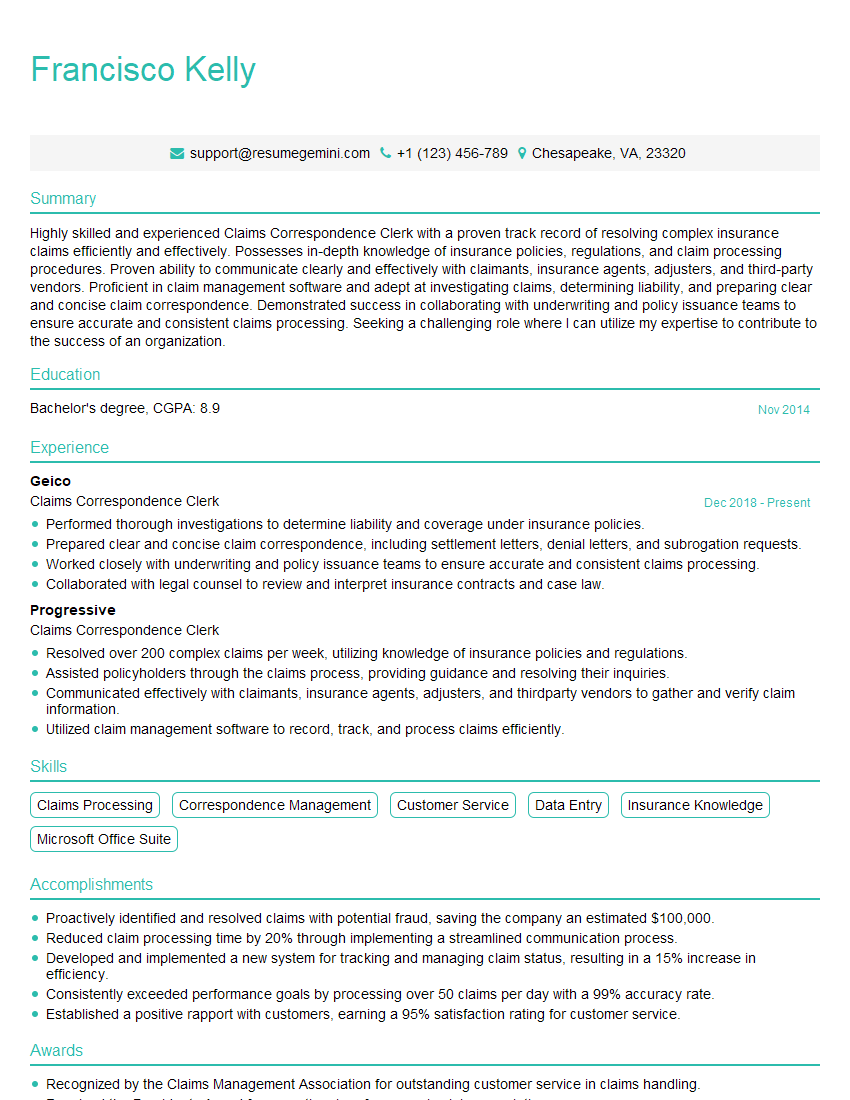

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claims Correspondence Clerk

1. Describe the process you follow when processing an incoming claim correspondence?

I would begin by identifying the type of correspondence and the specific information it contains. I would then triage the correspondence based on its priority and urgency. Next, I would review the coverage and identify any potential coverage issues. I would then determine the appropriate response and take any necessary action, such as requesting additional information from the claimant, issuing a payment, or denying the claim. Finally, I would document all actions taken and maintain a record of the correspondence.

2. How do you handle complex or unusual claim correspondence?

Research and analysis

- Consult with colleagues and supervisors

- Review relevant policies and procedures

Communication

- Contact the claimant to gather additional information

- Collaborate with other departments to resolve coverage issues

Resolution

- Determine the appropriate response and take necessary action

- Document all actions taken and maintain a record of the correspondence

3. What are the key qualities of an effective Claims Correspondence Clerk?

- Excellent communication skills

- Strong attention to detail

- Ability to work independently and as part of a team

- Knowledge of insurance policies and procedures

- Empathy and understanding

4. How do you stay up-to-date on changes in insurance regulations and industry best practices?

- Attend industry conferences and webinars

- Review trade publications and online resources

- Participate in professional development programs

- Network with colleagues and other professionals

5. What is your experience with using insurance software and technology?

I am proficient in using a variety of insurance software and technology, including claims processing systems, policy management systems, and document management systems. I am also familiar with the use of data analytics and artificial intelligence in the insurance industry.

6. How do you handle high-volume claim correspondence while maintaining accuracy and efficiency?

- Prioritize correspondence based on urgency and importance

- Use templates and standardized responses for common inquiries

- Automate tasks whenever possible

- Delegate tasks to colleagues when necessary

- Maintain a clean and organized workspace

7. Describe a situation where you had to go above and beyond to resolve a complex claim correspondence issue.

I received a claim correspondence from a claimant who had been injured in a car accident. The claimant was disputing the amount of the settlement offer and was threatening to file a lawsuit. I reviewed the claim file and determined that there was a coverage issue that had not been previously identified. I contacted the claimant and explained the coverage issue. I then worked with the claimant’s attorney to negotiate a settlement that was fair to both parties.

8. How do you manage multiple priorities and deadlines while working in a fast-paced environment?

- Create a daily to-do list and prioritize tasks

- Set realistic deadlines for myself

- Delegate tasks when necessary

- Communicate regularly with my supervisor and colleagues

- Take breaks throughout the day to clear my head and refocus

9. What is your understanding of the role of a Claims Correspondence Clerk in the insurance industry?

The role of a Claims Correspondence Clerk is to process and respond to claim correspondence in a timely and efficient manner. This includes reviewing correspondence, identifying and addressing coverage issues, determining the appropriate response, and taking any necessary action. Claims Correspondence Clerks also play an important role in maintaining a positive relationship with claimants and other stakeholders.

10. Why are you interested in this Claims Correspondence Clerk position?

I am interested in this Claims Correspondence Clerk position because I am passionate about helping people. I have a strong understanding of insurance policies and procedures, and I am confident that I can use my skills to help claimants resolve their issues. I am also a hard worker and I am always willing to go the extra mile to get the job done.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claims Correspondence Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claims Correspondence Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Claims Correspondence Clerks are responsible for handling all aspects of claims correspondence, including receiving and processing claims, investigating and resolving disputes, and communicating with customers and insurance companies. Key responsibilities include:

1. Receiving and Processing Claims

Claims Correspondence Clerks receive and process claims from customers and insurance companies. This involves reviewing claims for completeness and accuracy, inputting data into the claims system, and assigning claims to the appropriate adjuster.

2. Investigating and Resolving Disputes

Claims Correspondence Clerks investigate and resolve disputes between customers and insurance companies. This involves gathering information from the customer and the insurance company, reviewing the policy, and determining the appropriate course of action.

3. Communicating with Customers and Insurance Companies

Claims Correspondence Clerks communicate with customers and insurance companies to provide updates on the status of claims, answer questions, and resolve disputes. This involves writing letters, emails, and phone calls, as well as meeting with customers and insurance company representatives.

4. Maintaining Records and Reporting

Claims Correspondence Clerks maintain records of all claims correspondence and report on the status of claims to their supervisors. This involves tracking the progress of claims, identifying trends, and providing data to support decision-making.

Interview Tips

Preparing for a Claims Correspondence Clerk interview can help you ace the interview and land the job. Here are five tips to help you prepare:

1. Research the Company and the Position

Before your interview, take some time to research the company and the position you are applying for. This will help you understand the company’s culture and values, as well as the specific responsibilities of the role. You can find information on the company’s website, social media pages, and Glassdoor.

2. Practice Your Answers to Common Interview Questions

There are a few common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?”. Take some time to practice your answers to these questions so that you can deliver them confidently and concisely.

3. Highlight Your Skills and Experience

In your interview, be sure to highlight your skills and experience that are relevant to the position. This includes your communication skills, your ability to work independently, and your experience with claims processing. You can also mention any training or certifications that you have that are relevant to the role.

4. Ask Questions

At the end of the interview, be sure to ask the interviewer questions about the position and the company. This shows that you are interested in the role and that you are engaged in the interview process. You can also use this opportunity to clarify any information that you are unsure about.

5. Follow Up

After the interview, be sure to follow up with the interviewer. This can be done by sending a thank-you note or email. This shows that you are interested in the position and that you appreciate the interviewer’s time.

Next Step:

Now that you’re armed with the knowledge of Claims Correspondence Clerk interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Claims Correspondence Clerk positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini