Feeling lost in a sea of interview questions? Landed that dream interview for Claims Customer Service Representative but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Claims Customer Service Representative interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

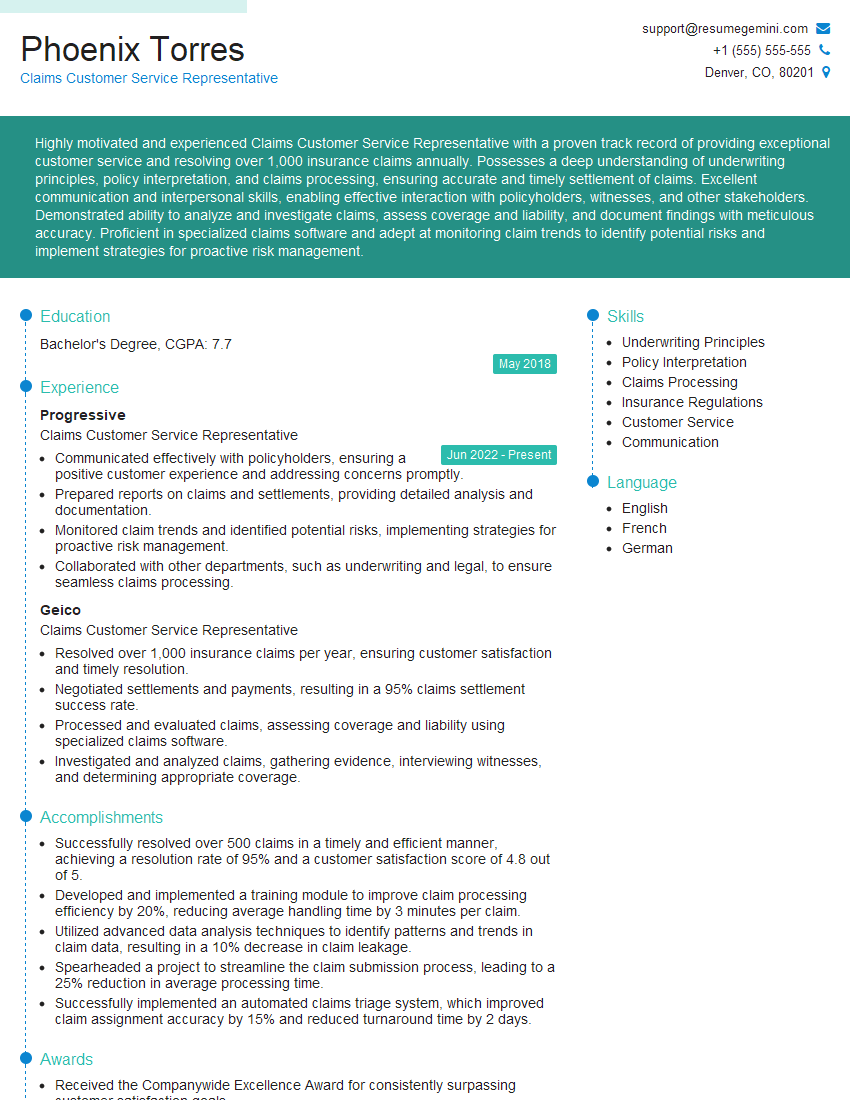

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claims Customer Service Representative

1. What are the different types of insurance claims that you have handled in your previous role?

During my time working as a Claims Customer Service Representative at [Previous Company Name], I was responsible for handling a wide range of insurance claims, including:

- Auto claims

- Homeowners claims

- Business claims

- Liability claims

- Workers’ compensation claims

2. How do you prioritize and manage multiple claims simultaneously?

Managing Expectations

- Set clear expectations with customers regarding response times and claim processing timelines.

- Communicate regularly to keep customers informed and reduce anxiety.

Triage and Prioritization

- Triage claims based on severity and urgency, focusing on critical and time-sensitive cases first.

- Use claim management software and tools to track claim progress and identify potential bottlenecks.

Teamwork and Resource Allocation

- Collaborate with colleagues to share workload and expedite claim resolution.

- Delegate tasks to appropriate team members based on their skills and availability.

3. How do you handle difficult or upset customers?

When dealing with difficult or upset customers, I employ the following techniques:

- Remain calm and empathetic, acknowledging their emotions.

- Actively listen to their concerns and try to understand their perspective.

- Use clear and concise language, and avoid jargon or technical terms.

- Provide regular updates and demonstrate that their concerns are being taken seriously.

- Offer solutions and options to resolve their issues promptly.

4. What are the key regulations and compliance requirements related to claims processing?

I am familiar with the following key regulations and compliance requirements related to claims processing:

- National Association of Insurance Commissioners (NAIC) Claims Settlement Practices Model Act

- Unfair Claims Settlement Practices Act (UCSPA)

- Fair Credit Reporting Act (FCRA)

- Health Insurance Portability and Accountability Act (HIPAA)

- Company-specific policies and procedures

5. Describe a situation where you had to go above and beyond to resolve a complex claim.

In one instance, I handled a complex homeowner’s claim involving a major fire loss. The policyholder was distraught and facing significant financial hardship. I:

- Quickly arranged for emergency repairs to secure their home.

- Worked closely with the adjuster to document the extent of the damage and negotiate a fair settlement.

- Coordinated with contractors and vendors to ensure repairs were completed efficiently and to the policyholder’s satisfaction.

- Provided regular updates and support throughout the process, easing the policyholder’s stress and anxiety.

6. How do you stay up-to-date with industry best practices and legal changes?

To stay current with industry best practices and legal changes, I regularly:

- Attend industry conferences and workshops.

- Read insurance trade publications and online resources.

- Participate in continuing education courses.

- Review company bulletins and updates.

- Seek guidance from experienced colleagues and supervisors.

7. What is your understanding of subrogation and how do you handle it in claims processing?

Subrogation is the right of an insurance company to recover payments made to an insured from the party responsible for the loss. In claims processing, I handle subrogation by:

- Identifying potential subrogation opportunities by investigating the cause of loss.

- Gathering evidence and documentation to support the subrogation claim.

- Negotiating with the responsible party or their insurance carrier to recover the insurer’s expenses.

- Maintaining open communication with the policyholder throughout the subrogation process.

8. What are the ethical considerations that you take into account when processing claims?

When processing claims, I adhere to the following ethical considerations:

- Honesty and integrity: Disclosing all relevant information and avoiding any misrepresentation.

- Fairness and impartiality: Treating all claimants equitably and not allowing personal biases to influence decisions.

- Confidentiality: Maintaining the privacy of policyholder information and respecting their rights.

- Professionalism: Conducting myself in a respectful and ethical manner at all times.

9. How do you measure and evaluate your performance as a Claims Customer Service Representative?

I measure and evaluate my performance as a Claims Customer Service Representative based on the following metrics:

- Customer satisfaction: Positive feedback and testimonials from policyholders.

- Claim resolution time: Efficiency in handling and resolving claims.

- Quality of work: Accuracy and thoroughness in claims processing.

- Compliance adherence: Meeting all applicable regulations and company standards.

- Continuous improvement: Seeking feedback and identifying areas for growth.

10. What are your career goals and aspirations?

My career goal is to advance my skills and knowledge in claims handling and insurance operations. I aspire to eventually take on a leadership role in claims management, where I can contribute to improving processes and delivering exceptional customer experiences.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claims Customer Service Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claims Customer Service Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Claims Customer Service Representatives are critical to the operations of any insurance company. They are the first point of contact for customers who have filed a claim, and they play a vital role in ensuring that the claims process is handled smoothly and efficiently.

1. Receive and Process Claims

Claims Customer Service Representatives receive and process claims from customers over the phone, by mail, or online. They gather information about the claim, such as the date of the loss, the type of property damage, and the amount of the claim.

2. Investigate Claims

Once a claim has been received, Claims Customer Service Representatives may need to investigate the claim to verify the information and determine the extent of the damage. They may contact the policyholder, witnesses, or other parties involved in the claim.

3. Determine Coverage

Claims Customer Service Representatives determine whether a claim is covered under the policy. They review the policy language and the facts of the claim to make this determination.

4. Settle Claims

If a claim is covered, Claims Customer Service Representatives negotiate a settlement with the customer. They work to ensure that the settlement is fair and reasonable for both the customer and the insurance company.

5. Provide Customer Service

Claims Customer Service Representatives provide excellent customer service to all claimants. They are patient, understanding, and helpful. They strive to make the claims process as easy and stress-free as possible for customers.

Interview Tips

The following are some tips for acing an interview for a Claims Customer Service Representative position:

1. Research the company and the position

Take some time to learn about the insurance company and the specific position you are applying for. This will help you understand the company’s culture and what they are looking for in a candidate.

2. Practice your answers to common interview questions

There are a few common interview questions that you are likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. Practice your answers to these questions so that you can deliver them confidently and concisely.

3. Emphasize your customer service skills

Claims Customer Service Representatives need to have excellent customer service skills. In your interview, be sure to highlight your experience providing customer service, and explain how you have handled difficult customers in the past.

4. Show your knowledge of insurance

If you have any experience in the insurance industry, be sure to mention it in your interview. If you don’t have any experience, you can still show your knowledge of insurance by reading about the industry and talking to people who work in the field.

5. Be prepared to talk about your salary expectations

At some point in the interview, you will likely be asked about your salary expectations. It is important to be prepared to answer this question, and to have a realistic idea of what you are worth. You can research salary ranges for Claims Customer Service Representatives in your area to get an idea of what you should expect.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Claims Customer Service Representative interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!