Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Claims Manager interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Claims Manager so you can tailor your answers to impress potential employers.

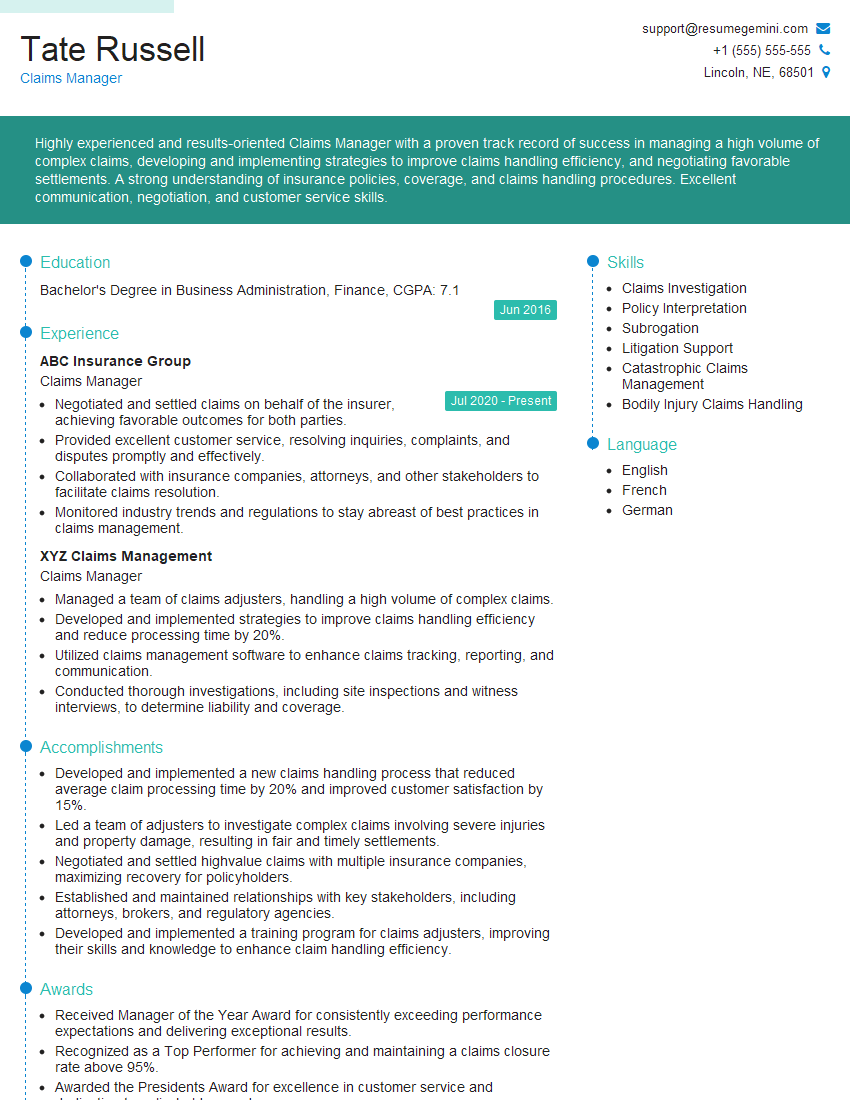

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claims Manager

1. What are the key steps involved in handling a claim?

The key steps involved in handling a claim include:

- Receiving and logging the claim

- Investigating the claim to determine coverage and liability

- Negotiating with the claimant to reach a settlement

- Processing the claim payment

- Closing the claim

2. What factors do you consider when evaluating a claim?

Factors to Consider

- The terms and conditions of the policy

- The facts and circumstances of the claim

- The claimant’s financial situation

- The company’s financial situation

- The potential impact of the claim on the company’s reputation

Impact on Decision Making

- The above factors help me make informed decisions about the coverage and liability of the claim.

- They also help me determine the appropriate settlement amount and payment schedule.

3. How do you handle claims that are fraudulent or exaggerated?

When handling fraudulent or exaggerated claims, I take the following steps:

- Investigate the claim thoroughly to gather evidence of fraud or exaggeration

- Document the evidence and present it to the claimant

- Negotiate with the claimant to reach a fair settlement

- Report the fraud or exaggeration to the appropriate authorities

4. What is your experience with subrogation?

In my previous role, I was responsible for subrogating claims against third parties. I have experience in:

- Identifying and pursuing subrogation opportunities

- Negotiating with third parties to recover funds

- Litigating subrogation claims when necessary

5. How do you stay up-to-date on the latest changes in insurance regulations?

I stay up-to-date on the latest changes in insurance regulations by:

- Reading industry publications

- Attending industry conferences

- Taking continuing education courses

- Consulting with legal counsel

6. What is your experience with managing a team of claims adjusters?

In my previous role, I was responsible for managing a team of claims adjusters. I have experience in:

- Hiring, training, and developing claims adjusters

- Setting performance goals and expectations

- Providing feedback and coaching

- Evaluating performance and making recommendations for improvement

7. What are your strengths and weaknesses as a Claims Manager?

Strengths

- Excellent communication and negotiation skills

- Strong understanding of insurance regulations and policies

- Proven ability to manage a team of claims adjusters

- Experience in handling a wide range of claims, including complex and high-value claims

Weaknesses

- I am not an attorney, so I sometimes need to consult with legal counsel on complex legal issues

- I am always looking for ways to improve my efficiency and effectiveness, but I sometimes get bogged down in details

8. What are your salary expectations?

My salary expectations are in line with the market rate for Claims Managers with my experience and qualifications. I am confident that I can bring value to your company and am willing to negotiate a salary that is fair and equitable.

9. Why are you interested in working for our company?

I am interested in working for your company because I am impressed by your company’s reputation for excellence in the insurance industry. I am also drawn to your company’s commitment to customer service and innovation. I believe that my skills and experience would be a valuable asset to your team.

10. Do you have any questions for me?

Yes, I do have a few questions:

- What are the company’s goals for the Claims Department in the next year?

- How does the company measure the success of its Claims Department?

- What opportunities are there for professional development within the company?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claims Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claims Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Claims Managers are responsible for managing the claims process from initial report to final settlement. They work closely with policyholders, claimants, and insurance companies to ensure that claims are processed efficiently and fairly.

1. Claims Processing

Claims Managers review and evaluate claims, determine coverage, and authorize payments. They also investigate claims, negotiate settlements, and represent the company in legal proceedings.

2. Customer Service

Claims Managers provide excellent customer service to both policyholders and claimants. They are responsible for explaining the claims process, answering questions, and resolving complaints.

3. Risk Assessment

Claims Managers assess the risk of claims and develop strategies to mitigate risk. They work with underwriters and other insurance professionals to identify potential risks and develop policies to minimize losses.

4. Compliance

Claims Managers ensure that the company complies with all applicable laws and regulations. They also work with regulators and other government agencies to ensure that the company’s claims practices are fair and consistent.

Interview Tips

Preparing for an interview for a Claims Manager position can be overwhelming, but there are some simple tips that can help you increase your chances of success.

1. Research the Company

Before your interview, take some time to research the company you’re applying to. Learn about their history, their products or services, and their claims philosophy. This will show the interviewer that you’re interested in the company and that you’ve taken the time to prepare.

2. Practice Your Answers to Common Interview Questions

There are a few common interview questions that you’re likely to be asked in an interview for a Claims Manager position. Practice answering these questions in a clear and concise manner. Some common questions include:

- “Tell me about your experience in claims management.”

- “What are your strengths and weaknesses as a Claims Manager?”

- “How do you handle difficult customers?”

- “What is your claims philosophy?”

- “Why do you want to work for this company?”

3. Dress Professionally

First impressions matter, so dress professionally for your interview. This means wearing a suit or business casual attire. Make sure your clothes are clean and pressed, and that you’re well-groomed.

4. Be Yourself

The most important tip is to be yourself. The interviewer wants to get to know the real you, so don’t try to be someone you’re not. Just relax, be confident, and answer the questions honestly.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Claims Manager interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.