Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Claims Vice President position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

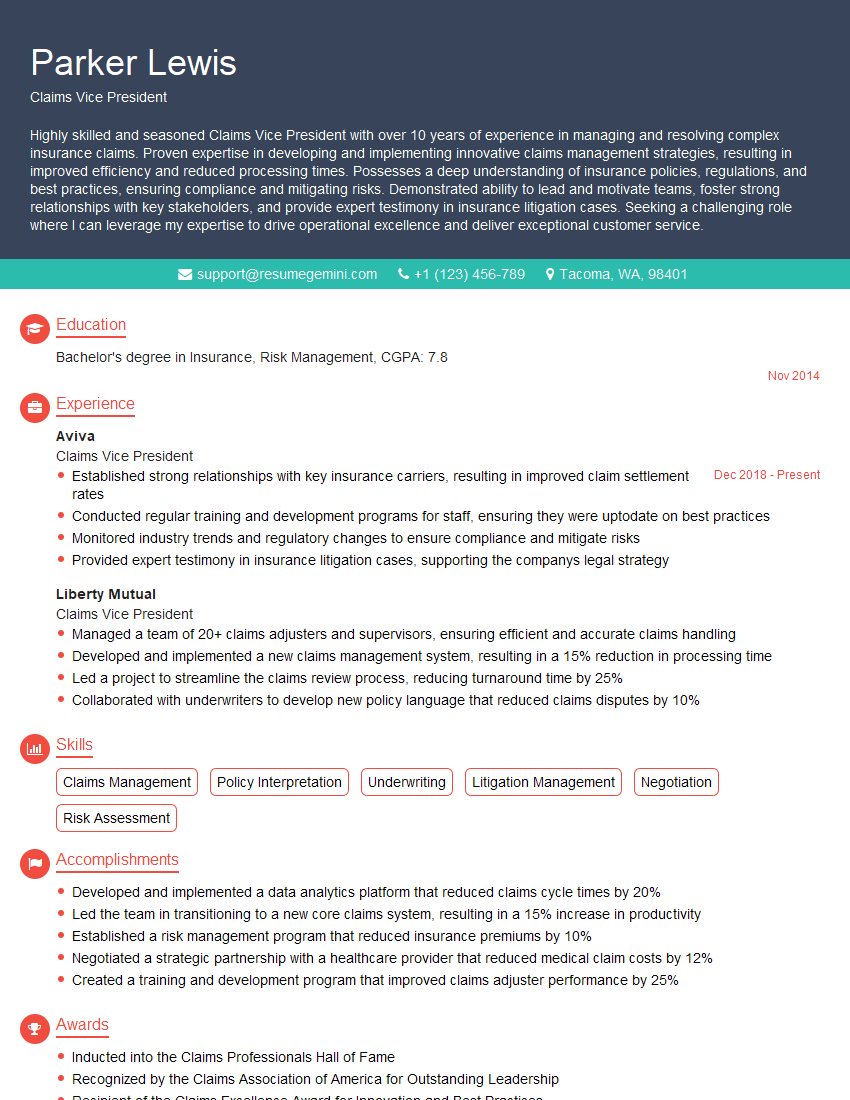

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claims Vice President

1. What is the significance of a claims management system in enhancing operational efficiency and reducing costs?

A Claims Management System (CMS) plays a crucial role in improving operational efficiency and reducing costs within the claims process. Here are its key benefits:

- Automated Workflow and Streamlined Processes: CMS automates manual tasks, eliminates repetitive data entry, and streamlines the overall claims process, leading to increased efficiency and reduced processing times.

- Improved Data Management and Analysis: CMS centralizes claims data, providing a single source of truth and enabling robust data analysis. This allows insurers to identify trends, assess performance, and make informed decisions to optimize their claims operations.

- Enhanced Collaboration and Communication: CMS facilitates seamless collaboration between claims adjusters, underwriters, and other stakeholders involved in the claims process. It provides a central platform for communication, document sharing, and status updates, improving coordination and reducing delays.

- Reduced Administrative Costs: By automating tasks and streamlining processes, CMS significantly reduces administrative costs associated with claims handling. It frees up adjusters’ time, allowing them to focus on more complex and value-added activities.

2. How do you stay abreast of the latest trends and advancements in claims technology?

- Industry Conferences and Webinars: Attending industry conferences and webinars allows me to stay informed about emerging technologies, regulatory changes, and best practices in claims management.

- Research and Publications: I regularly read industry publications, research reports, and white papers to gain insights into the latest innovations and trends in claims technology.

- Networking with Peers: Collaborating and exchanging ideas with other claims professionals through industry events and online forums helps me stay connected with the latest advancements and gain valuable perspectives.

- Vendor Demonstrations and Pilots: I engage with technology vendors to learn about their latest offerings and participate in pilot programs to evaluate the effectiveness of new solutions before implementing them.

3. What are the key considerations when evaluating the performance of a claims team?

- Cycle Time: The average time taken from claim initiation to resolution is a crucial metric that measures the efficiency of the claims process.

- Loss Ratio: This metric compares the incurred claims costs to the earned premiums, indicating the profitability of the claims operation.

- Customer Satisfaction: Gathering feedback and analyzing customer satisfaction levels helps assess the effectiveness of the claims process from the policyholder’s perspective.

- Adherence to Regulatory Compliance: Ensuring compliance with relevant regulations and industry standards is essential to avoid penalties or legal implications.

- Expense Ratio: This metric compares the claims expenses to the earned premiums, providing insights into the cost-effectiveness of the claims operation.

4. How do you build a strong and collaborative relationship with brokers and agents?

- Open Communication: Regular communication and timely updates on claims status foster trust and transparency.

- Understanding Needs: Identifying and addressing the specific needs and priorities of brokers and agents strengthens the relationship.

- Joint Training and Education: Collaborative training sessions and workshops enhance understanding and alignment on industry trends and best practices.

- Feedback and Input: Seeking feedback and involving brokers and agents in decision-making processes shows value for their input.

- Recognition and Appreciation: Acknowledging the contributions and successes of brokers and agents builds rapport and strengthens the partnership.

5. What strategies have you implemented to improve the customer experience during the claims process?

- Empathy and Understanding: Treating policyholders with compassion and understanding during difficult times fosters a positive experience.

- Simplified Claim Reporting: Providing multiple convenient channels for claim reporting, including online portals and mobile apps, enhances accessibility.

- Clear and Transparent Communication: Keeping policyholders informed throughout the claims process and providing timely updates reduces anxiety and builds trust.

- Efficient Resolution: Prompt and fair claim settlements demonstrate the insurer’s commitment to customer satisfaction.

- Feedback and Improvement: Regularly collecting customer feedback and using it to identify areas for improvement ensures a continuous cycle of enhancement.

6. How do you handle complex and high-value claims?

- Expert Team: Assigning experienced and specialized adjusters to handle complex claims ensures proper assessment and resolution.

- Thorough Investigation: Conducting a comprehensive investigation, gathering evidence, and analyzing the facts provides a solid foundation for decision-making.

- External Collaboration: Seeking expertise from external consultants, attorneys, or industry specialists when necessary ensures access to specialized knowledge.

- Stakeholder Management: Keeping all stakeholders, including policyholders, brokers, and legal counsel, informed and involved throughout the process fosters transparency and minimizes disputes.

- Risk Management: Assessing the potential financial impact and implementing appropriate risk management strategies mitigates potential losses.

7. What are your thoughts on the increasing use of Artificial Intelligence (AI) in claims processing?

- Enhanced Efficiency: AI algorithms can automate repetitive tasks, freeing up adjusters for more value-added activities.

- Improved Fraud Detection: AI can analyze large volumes of data to identify suspicious claims patterns and potential fraud, reducing losses.

- Personalized Claims Experience: AI-powered chatbots and virtual assistants can provide personalized support and instant responses to policyholders.

- Data-Driven Insights: AI enables insurers to analyze claims data and identify trends, helping make informed decisions and improve overall claims performance.

8. How do you stay compliant with evolving privacy regulations, such as GDPR and CCPA?

- Regular Training: Conduct regular training programs to educate employees about privacy regulations and best practices.

- Data Governance: Implement robust data governance policies to ensure the secure collection, storage, and handling of personal information.

- Privacy Impact Assessments: Conduct privacy impact assessments before implementing new technologies or processes to identify and mitigate potential risks.

- Vendor Management: Ensure that third-party vendors comply with privacy regulations through contractual agreements and regular audits.

- Incident Response Plan: Develop a comprehensive incident response plan to address privacy breaches and data security incidents promptly and effectively.

9. What is your approach to managing claims reserves?

- Accurate Forecasting: Utilize statistical models, historical data, and industry benchmarks to make informed reserve estimates.

- Regular Reviews and Adjustments: Conduct periodic reviews of reserves and make adjustments as necessary based on new information and developments.

- Actuarial Support: Collaborate with actuaries to develop and refine reserving methodologies and ensure actuarial soundness.

- Scenario Analysis: Perform scenario analysis to assess the impact of potential events on reserve adequacy.

- Regulatory Compliance: Ensure compliance with relevant accounting and regulatory standards for reserve management.

10. How do you motivate and engage your claims team?

- Set Clear Expectations: Clearly communicate performance goals, objectives, and expectations to the team.

- Recognize and Reward Success: Acknowledge and reward individual and team achievements to foster a positive and motivated work environment.

- Provide Development Opportunities: Offer training, mentorship, and professional development opportunities to enhance skills and career growth.

- Encourage Collaboration: Create a collaborative environment where team members can share knowledge, ideas, and best practices.

- Promote Work-Life Balance: Support a healthy work-life balance to prevent burnout and maintain employee well-being.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claims Vice President.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claims Vice President‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As Claims Vice President, you will take on the following key responsibilities:

1. Claim Resolution

Oversee the end-to-end claims lifecycle management, ensuring timely and efficient resolution of insurance claims with the highest quality of service.

- Develop and implement claims handling policies and procedures.

- Set performance standards and monitor team performance.

2. Claims Strategy

Lead the development and execution of the organization’s claims strategy, ensuring alignment with overall business objectives.

- Conduct market research and analysis to identify trends and emerging risks.

- Develop and implement strategies to reduce claims costs and improve claims outcomes.

3. Expense Management

Control and manage the overall claims expense, ensuring efficient use of resources and compliance with regulatory requirements.

- Monitor and analyze claims data to identify areas for cost reduction.

- Negotiate with vendors and service providers to secure favorable contracts.

4. Team Management

Lead, motivate, and develop a high-performing team of claims professionals.

- Identify and foster talent within the team.

- Provide training and development opportunities to enhance team capabilities.

Interview Tips

Acing an interview for a Claims Vice President position requires careful preparation. Here are some crucial tips:

1. Research the Company and Position

Thoroughly study the company’s website, annual reports, and industry news to gain insights into its business, culture, and specific claims-related challenges.

- Review the job description to identify the key responsibilities and qualifications expected.

- Network with industry professionals or company employees on LinkedIn to gather additional information.

2. Highlight Relevant Experience

Emphasize your experience in leading and managing claims operations, demonstrating your ability to drive efficiency, reduce costs, and improve customer satisfaction.

- Use the STAR method (Situation, Task, Action, Result) to quantify your accomplishments and showcase your impact.

- Provide specific examples of how you have resolved complex claims, negotiated settlements, and implemented successful claims strategies.

3. Demonstrate Leadership and Communication Skills

Claims Vice Presidents often lead large teams and interact with various stakeholders. Highlight your leadership abilities and communication skills to demonstrate your effectiveness in motivating and inspiring others.

- Share examples of how you have built a positive and collaborative work environment.

- Emphasize your ability to communicate complex technical information clearly to both internal and external audiences.

4. Prepare for Industry Questions

Expect questions related to industry trends, regulatory updates, and innovative claims handling techniques.

- Stay abreast of the latest developments in the insurance industry by reading industry publications and attending conferences.

- Discuss your knowledge of emerging technologies and their potential impact on claims processing.

5. Practice Your Answers

Prepare thoughtful and concise answers to anticipated interview questions. Practice them out loud to improve your delivery and confidence.

- Consider using a mock interview with a friend, family member, or career coach to receive feedback and refine your responses.

- Time yourself to ensure your answers are concise and within the expected time frame.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Claims Vice President role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.