Feeling lost in a sea of interview questions? Landed that dream interview for Clearing Hand but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Clearing Hand interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

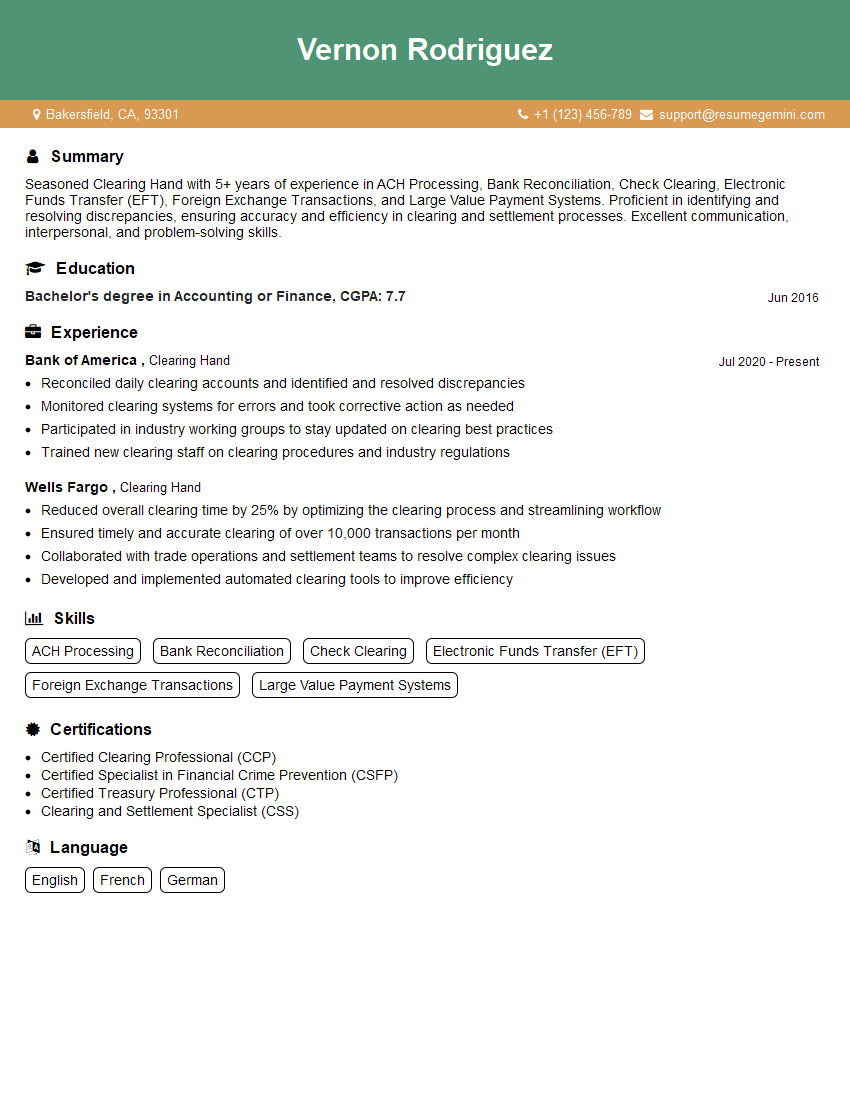

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Clearing Hand

1. what is the purpose of clearinghouse in the banking system?

A clearinghouse is a financial institution that facilitates the exchange of payments and securities between banks. It acts as an intermediary, settling transactions and ensuring the smooth flow of funds within the banking system. Clearinghouses play a crucial role in maintaining financial stability and efficiency by providing a centralized platform for interbank settlements.

2. what are the key differences between a CHIPS wire and an ACH transaction?

CHIPS wire transfer

- High-value and urgent transactions.

- Settles in real-time or near real-time.

- Higher transaction fees.

- Used for large-scale transactions, such as corporate payments and international remittances.

ACH transaction

- Lower-value and less urgent transactions.

- Settles in batches, typically overnight.

- Lower transaction fees.

- Used for recurring payments, direct deposits, and bill payments.

3. what are the main steps involved in processing a CHIPS wire transfer?

- The sender initiates the transfer through its bank.

- The sender’s bank sends the transfer request to the CHIPS system.

- The CHIPS system validates the transfer and routes it to the recipient’s bank.

- The recipient’s bank verifies the transfer and sends the funds to the recipient.

4. what are the security measures implemented by clearinghouses to prevent fraud and errors?

- Strong authentication and authorization mechanisms.

- Encryption and data protection measures.

- Regular audits and risk assessments.

- Compliance with industry standards and regulations.

- Collaboration with law enforcement and financial crime prevention agencies.

5. what is the role of a clearinghouse in facilitating cross-border payments?

Clearinghouses play a critical role in simplifying and expediting cross-border payments by providing a centralized platform for the exchange of different currencies and payment systems. They offer currency conversion services, settlement guarantees, and risk management tools to ensure the smooth flow of funds across borders.

6. what are the key factors to consider when choosing a clearinghouse for cross-border payments?

- Geographical reach and currency coverage.

- Transaction fees and processing times.

- Security and compliance measures.

- Customer support and technical capabilities.

- Reputation and track record in the industry.

7. what are the emerging trends and innovations in the clearinghouse industry?

- Blockchain technology for faster and more secure settlement.

- Artificial intelligence and machine learning for fraud detection and risk management.

- Real-time payment systems for instant fund transfers.

- Cross-border payment platforms for seamless global transactions.

- Collaboration between clearinghouses and fintech companies to drive innovation.

8. what is the difference between a multilateral clearinghouse and a bilateral clearinghouse?

Multilateral clearinghouse

- Involves multiple participants.

- Settles payments on a net basis, reducing the number of transactions and settlement risk.

- Examples include CHIPS and CLS.

Bilateral clearinghouse

- Involves only two participants.

- Settles payments on a gross basis.

- Examples include correspondent banking relationships.

9. what is the importance of risk management in clearinghouse operations?

Risk management is crucial in clearinghouse operations to mitigate potential losses and ensure the stability of the financial system. Clearinghouses implement comprehensive risk management strategies that include:

- Credit risk assessment of participants.

- Collateral requirements and margin calls.

- Stress testing and scenario analysis.

- Contingency plans and disaster recovery procedures.

10. what are the ethical considerations and best practices in clearinghouse operations?

- Maintaining confidentiality and protecting customer data.

- Avoiding conflicts of interest and ensuring fair and transparent practices.

- Complying with regulatory requirements and industry standards.

- Promoting financial inclusion and access to payment services.

- Collaborating with stakeholders to enhance the overall efficiency and effectiveness of the clearinghouse system.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Clearing Hand.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Clearing Hand‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Clearing Hand is responsible for settling failed trades and resolving discrepancies in the settlement process. This critical role ensures the smooth functioning of the financial markets by facilitating the timely completion of transactions and minimizing risks.

1. Failed Trade Resolution

The Clearing Hand is the primary point of contact for resolving failed trades. This may involve investigating the cause of the failure, coordinating with other parties involved in the trade, and negotiating a resolution that satisfies both parties.

- Investigate the cause of failed trades, such as errors in execution, communication failures, or insufficient liquidity.

- Coordinate with brokers, custodians, and other counterparties to gather relevant information and documentation.

- Negotiate a resolution that is fair and equitable to both parties involved in the failed trade.

2. Discrepancy Management

The Clearing Hand is also responsible for identifying and resolving discrepancies in the settlement process. This may involve identifying errors in trade data, reconciling differences in account balances, and ensuring that all transactions are properly recorded and settled.

- Identify and resolve discrepancies in trade data, such as errors in pricing, quantities, or settlement dates.

- Reconcile differences in account balances between brokers and clearinghouses.

- Ensure that all transactions are properly recorded and settled in accordance with regulatory requirements.

3. Risk Management

The Clearing Hand plays a vital role in managing risks associated with failed trades and discrepancies. This may involve assessing the potential impact of failed trades, developing contingency plans, and implementing risk mitigation strategies.

- Assess the potential impact of failed trades on the financial markets and individual market participants.

- Develop contingency plans to mitigate the impact of failed trades, such as backup settlement systems and liquidity pools.

- Implement risk mitigation strategies, such as credit checks, collateral requirements, and clearing limits.

4. Compliance and Reporting

The Clearing Hand must comply with all applicable laws and regulations related to clearing and settlement. This may involve maintaining accurate records, submitting regulatory reports, and cooperating with regulatory authorities.

- Maintain accurate records of all trades cleared and settled.

- Submit regulatory reports to relevant authorities, such as trade reports and settlement statistics.

- Cooperate with regulatory authorities in investigations and enforcement actions.

Interview Tips

Preparing thoroughly for a Clearing Hand interview is crucial to showcase your skills and qualifications. Here are some tips to help you ace the interview:

1. Research the Company and Industry

Before the interview, take the time to research the specific company and the clearing and settlement industry. This will demonstrate your interest in the role and the organization, and it will help you understand the challenges and opportunities facing the company.

- Visit the company’s website to learn about their business, products, and services.

- Read industry news and articles to stay up-to-date on the latest trends and developments.

2. Practice Answering Common Interview Questions

Prepare for common interview questions related to your skills, experience, and knowledge of the clearing and settlement process. Practicing your answers will help you articulate your qualifications effectively and present yourself confidently.

- Describe your experience with failed trade resolution and discrepancy management.

- How do you assess and mitigate the risks associated with failed trades?

- Explain your understanding of the regulatory requirements for clearing and settlement.

3. Emphasize Your Problem-Solving and Analytical Skills

Clearing Hands must be able to solve complex problems and analyze data. Highlight your ability to identify and resolve issues, and provide examples of situations where you have successfully done so.

- Describe a time when you identified and resolved a discrepancy in a trade settlement.

- Explain how you analyzed data to identify potential risks associated with a failed trade.

4. Showcase Your Communication and Interpersonal Skills

Clearing Hands must be able to communicate effectively and build relationships with a wide range of stakeholders. Demonstrate your ability to communicate clearly, both verbally and in writing, and highlight your interpersonal skills.

- Provide examples of how you have successfully negotiated resolutions with counterparties involved in failed trades.

- Describe your experience in building and maintaining relationships with brokers, custodians, and other market participants.

5. Be Enthusiastic and Professional

Throughout the interview, maintain a positive and enthusiastic attitude. Show the interviewer that you are passionate about the role and the clearing and settlement industry. Dress professionally, arrive on time, and be respectful of the interviewer’s time.

Next Step:

Now that you’re armed with the knowledge of Clearing Hand interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Clearing Hand positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini