Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Clearing Supervisor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

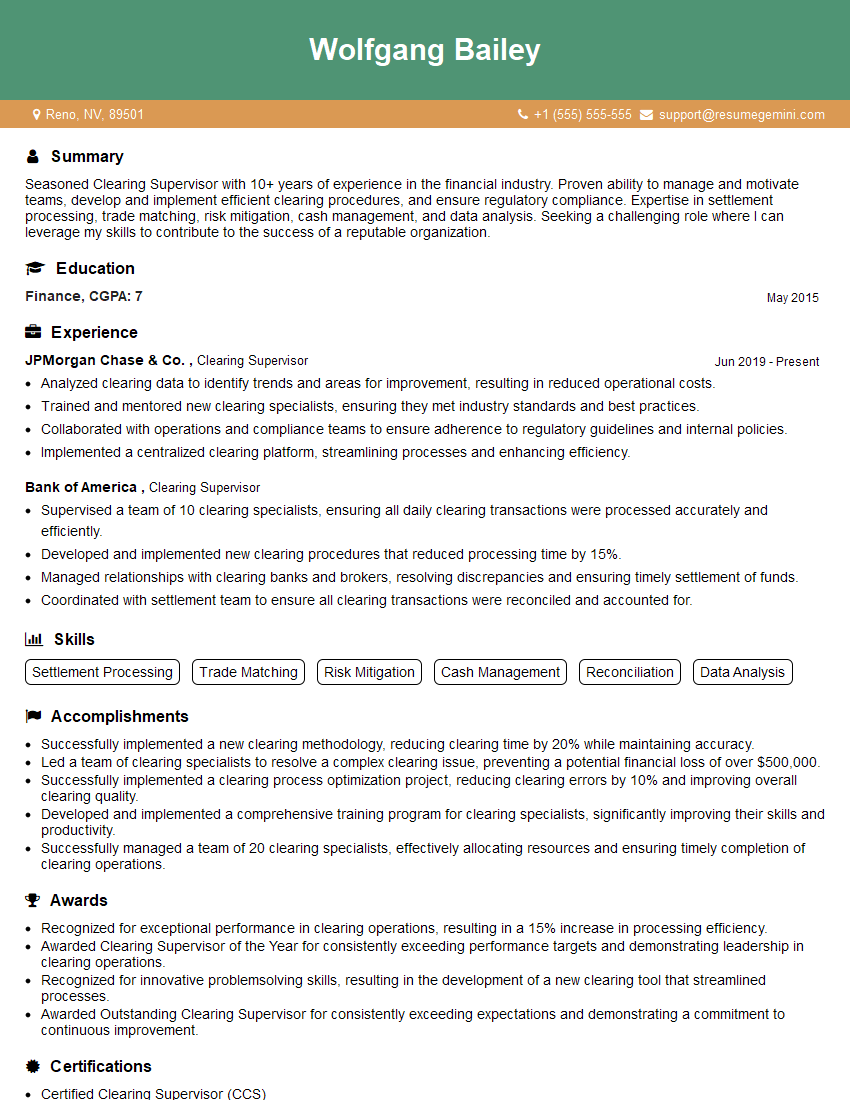

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Clearing Supervisor

1. What are the key responsibilities of a Clearing Supervisor in banking operations?

The key responsibilities of a Clearing Supervisor in banking operations may include:

- Managing and overseeing the clearing process to ensure efficient and accurate processing of financial transactions.

- Monitoring and analyzing clearing data to identify potential risks and opportunities for improvement.

- Working with internal and external stakeholders to resolve clearing issues and maintain smooth operations.

- Developing and implementing policies and procedures to optimize clearing operations and ensure compliance with regulatory requirements.

- Supervising and mentoring staff involved in clearing operations to enhance their skills and knowledge.

2. What are the common challenges faced by Clearing Supervisors and how do you plan to address them?

Effective Communication:

- Ensure clear communication channels with internal and external stakeholders.

- Establish regular meetings and communication protocols to address issues and provide updates.

Efficient Dispute Resolution:

- Develop a standardized dispute resolution process to handle discrepancies and errors.

- Foster collaboration between clearing teams and relationship managers to resolve disputes promptly.

Compliance with Regulations:

- Stay abreast of regulatory changes and ensure adherence to relevant laws and guidelines.

- Implement robust compliance measures and conduct regular audits to maintain integrity and avoid penalties.

3. Describe the steps involved in the clearing process and highlight any areas where automation can be implemented.

- Transaction Initiation: Capture transaction details and validate sender and receiver information.

- Clearing: Exchange transaction data with other financial institutions through a clearinghouse.

- Settlement: Process and settle transactions, ensuring funds are transferred between accounts.

- Reconciliation: Match transaction records and ensure balances are accurate. Automation Opportunities:

- Automating data entry and validation to improve accuracy and efficiency.

- Implementing electronic clearing systems to streamline transaction processing.

- Utilizing reconciliation software to reduce manual effort and improve data accuracy.

4. How do you measure the performance of a clearing team and identify areas for improvement?

- Accuracy Rate: Monitor the percentage of transactions processed without errors.

- Timeliness: Track the average time taken to process transactions and identify bottlenecks.

- Compliance Adherence: Review compliance audits and identify areas where improvements can be made.

- Customer Satisfaction: Gather feedback from internal and external stakeholders to assess the quality of clearing services.

- Continuous Improvement: Regularly analyze performance data and implement initiatives to enhance efficiency and effectiveness.

5. What is your approach to managing risk in clearing operations?

- Identify and Assess Risks: Determine potential risks associated with clearing activities, such as fraud, errors, and regulatory non-compliance.

- Develop Mitigation Strategies: Implement controls and processes to minimize and mitigate identified risks.

- Monitor and Review: Continuously monitor clearing operations and review risk management strategies to ensure their effectiveness.

- Collaborate with Stakeholders: Engage with internal audit, compliance, and risk management teams to stay updated on emerging risks and best practices.

6. How do you stay updated on regulatory changes and industry best practices in clearing operations?

- Attend Conferences and Webinars: Participate in industry events and conferences to learn about new regulations and best practices.

- Read Industry Publications: Subscribe to industry magazines and journals to stay informed about current trends and developments.

- Network with Peers: Connect with other Clearing Supervisors and professionals in the field to exchange knowledge and insights.

- Participate in Training Programs: Attend training courses and workshops to enhance knowledge and skills in clearing operations and regulatory compliance.

7. Describe your experience in managing a team of clearing professionals.

- Leadership and Motivation: Provide clear direction, motivate team members, and foster a positive work environment.

- Performance Management: Set clear goals, provide regular feedback, and recognize achievements to enhance performance.

- Skill Development: Identify training needs and develop programs to enhance team members’ skills and knowledge.

- Team Building: Encourage collaboration, open communication, and teamwork to achieve shared goals.

8. How do you prioritize tasks and manage multiple projects simultaneously in a fast-paced clearing environment?

- Prioritization: Use a risk-based approach to prioritize tasks based on their impact and urgency.

- Time Management: Utilize time management techniques such as the Eisenhower Matrix to allocate time effectively.

- Delegation: Delegate tasks to team members based on their strengths and availability to optimize efficiency.

- Communication: Keep stakeholders informed of progress and potential roadblocks to ensure smooth coordination.

9. What is your understanding of blockchain technology and its potential impact on clearing operations?

- Distributed Ledger: Explain that blockchain provides a secure and transparent distributed ledger for recording transactions.

- Reduced Costs: Discuss how blockchain can reduce clearing costs by eliminating intermediaries and automating processes.

- Increased Efficiency: Highlight the potential for faster settlement times and reduced processing delays.

- Enhanced Security: Emphasize the immutability and cryptography of blockchain, making it resistant to fraud and tampering.

10. What are your career goals and how do you see this role contributing to your professional development?

- Advancement in Clearing Operations: Express interest in advancing within the field of clearing operations and assuming leadership roles.

- Contribution to the Industry: Describe aspirations to contribute to industry initiatives and shape the future of clearing.

- Professional Development: Highlight the opportunity to enhance skills, knowledge, and experience in a challenging and rewarding role.

- Personal Growth: Emphasize the value of working in a dynamic environment and the personal growth it can foster.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Clearing Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Clearing Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Within a clearing environment, the Clearing Supervisor plays a critical role in maximizing operational efficiency, mitigating financial risks, and ensuring seamless post-trade settlement processes.

1. Managing Settlement Operations

Oversees the settlement process, ensuring timely and accurate settlement of trades across various counterparties.

- Monitors trade flows and identifies potential settlement issues.

- Collaborates with settlement teams to resolve settlement exceptions and discrepancies.

2. Risk Management

Assesses and mitigates settlement and counterparty risks. Ensures compliance with risk management policies and procedures.

- Reviews settlement instructions for accuracy and adherence to risk limits.

- Monitors counterparty creditworthiness and adjusts credit limits accordingly.

3. Team Management and Collaboration

Leads and manages a team of clearing specialists, providing guidance and support.

- Sets clear expectations, delegates tasks, and provides constructive feedback.

- Collaborates with trading, operations, and risk management teams to ensure smooth coordination.

4. Process Improvement

Analyzes clearing processes and identifies areas for improvement. Implements and monitors process enhancements.

- Automates clearing tasks to increase efficiency and reduce operational costs.

- Introduces new technologies to optimize settlement and risk management processes.

Interview Tips

To ace an interview for a Clearing Supervisor role, it is essential to demonstrate a thorough understanding of the job responsibilities and the industry.

1. Prepare for Technical Questions

Be well-versed in clearing concepts, settlement processes, and risk management principles. Study industry publications and attend industry events to stay updated.

- Example: Prepare for questions on trade matching, clearing house operations, and settlement risk.

- Example: Research current market trends and regulatory changes in the clearing industry.

2. Highlight Relevant Skills and Experience

Emphasize your experience in managing clearing operations, mitigating financial risks, and leading teams. Quantify your accomplishments with specific examples.

- Example: Highlight your role in implementing process improvements that reduced settlement failures by 25%.

- Example: Quantify the financial impact of your risk management strategies on reducing counterparty exposure.

3. Display Industry Knowledge

Demonstrate your understanding of the clearing industry landscape, including clearing house regulations, market practices, and emerging technologies.

- Example: Discuss your knowledge of CCP (Central Counterparty) clearing models and their impact on settlement processes.

- Example: Share your insights on the latest technological advancements in post-trade processing.

4. Articulate Leadership and Communication Skills

Effective communication and leadership abilities are crucial for a Clearing Supervisor. Showcase your ability to motivate and manage teams effectively.

- Example: Provide examples of how you successfully led and motivated your clearing team to achieve performance goals.

- Example: Highlight your ability to build strong relationships with counterparties and other stakeholders.

Next Step:

Now that you’re armed with the knowledge of Clearing Supervisor interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Clearing Supervisor positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini