Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Closing Coordinator interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Closing Coordinator so you can tailor your answers to impress potential employers.

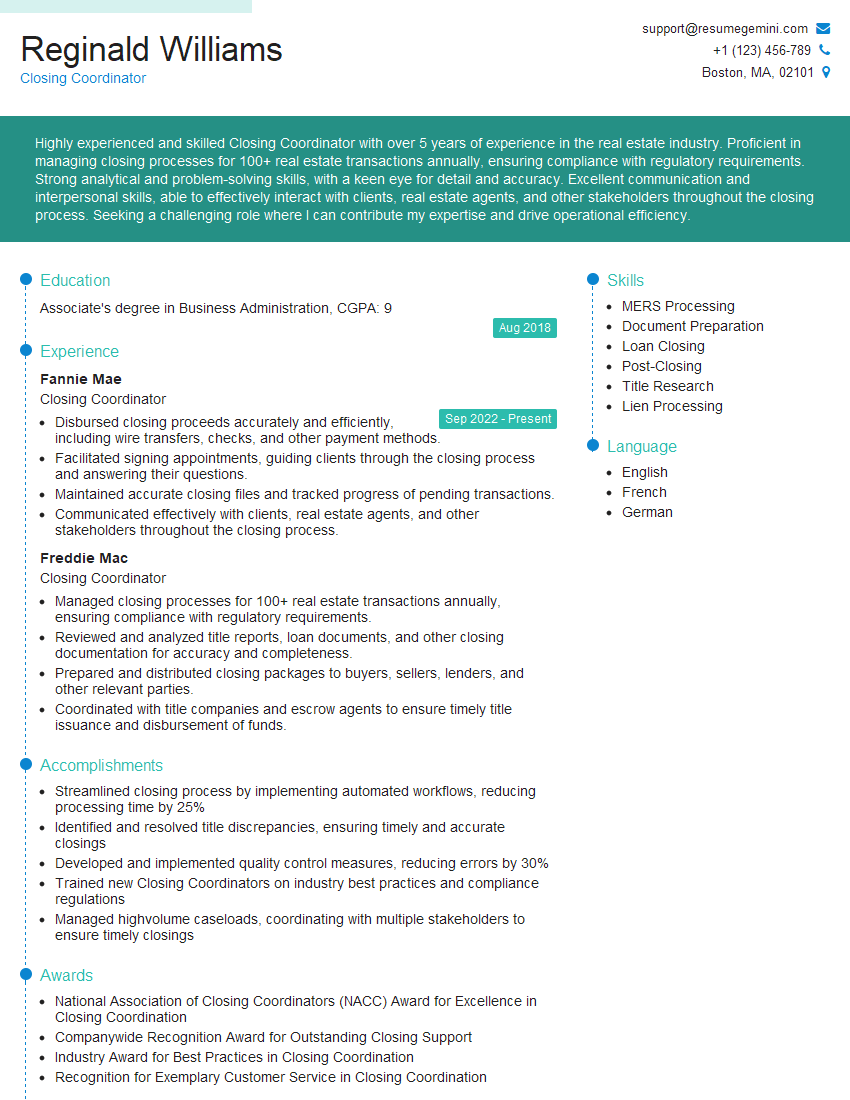

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Closing Coordinator

1. Can you explain your understanding of a Closing Coordinator’s role in the mortgage process?

A Closing Coordinator is responsible for facilitating the smooth and efficient closing of real estate transactions. My tasks include:

- Scheduling and coordinating the closing meeting between all parties involved.

- Preparing closing documents, including the deed, mortgage, and settlement statement.

- Verifying the accuracy of all closing documents.

- Disbursing funds to the appropriate parties.

- Ensuring that all legal and regulatory requirements are met.

2. How do you handle discrepancies or missing information in closing documentation?

Communication and Verification

- Promptly notify the relevant parties, including the lender, borrower, and other stakeholders.

- Collaborate with the loan officer and title company to gather the necessary information or resolve any discrepancies.

Problem-Solving and Coordination

- Review the documentation thoroughly to identify potential errors or missing information.

- Coordinate with the appropriate parties to obtain the missing information or rectify any errors.

3. What best practices do you employ to ensure accurate and timely preparation of closing documents?

To ensure accuracy and timeliness, I adhere to the following best practices:

- Utilize a comprehensive checklist to review all required documents.

- Double-check all calculations and data against the original loan application and supporting documentation.

- Communicate regularly with the lender, borrower, and other stakeholders to address any questions or concerns.

- Maintain a well-organized and efficient workspace to minimize errors.

- Continuously enhance my knowledge of industry regulations and best practices through training and professional development.

4. How do you prioritize and manage multiple closing deadlines?

To prioritize and manage multiple closing deadlines effectively, I employ the following strategies:

- Utilize a project management tool or calendar to track deadlines and tasks.

- Communicate with all parties involved to set clear expectations and identify potential delays.

- Prioritize tasks based on urgency and impact on the closing schedule.

- Delegate responsibilities and collaborate with colleagues to ensure timely completion of tasks.

- Regularly monitor progress and make adjustments as needed to stay on schedule.

5. How do you handle challenging or difficult clients during the closing process?

Professionalism and Empathy

- Maintain a professional and courteous demeanor at all times.

- Listen actively to the client’s concerns and empathize with their perspective.

Communication and Problem-Solving

- Communicate clearly and effectively to explain the closing process and address any questions.

- Work collaboratively with the client to find mutually acceptable solutions to any challenges.

6. What methods do you use to stay up-to-date on industry regulations and best practices?

To maintain my knowledge of industry regulations and best practices, I actively engage in the following activities:

- Attend industry conferences, webinars, and training programs.

- Read industry publications and articles.

- Participate in professional organizations and networking events.

- Collaborate with colleagues and stay abreast of company updates and policies.

7. How do you ensure compliance with legal and regulatory requirements in mortgage closings?

To ensure compliance with legal and regulatory requirements, I adhere to the following principles:

- Maintain a deep understanding of applicable laws and regulations, including RESPA, TILA, and Dodd-Frank.

- Review and verify all closing documents thoroughly to identify potential compliance issues.

- Stay up-to-date on industry best practices and regulatory updates.

- Collaborate with legal counsel and industry experts as needed to ensure compliance.

8. How do you handle post-closing issues or disputes?

Communication and Responsiveness

- Promptly address any post-closing issues or disputes brought to my attention.

- Communicate clearly and effectively with all parties involved to gather information and understand their perspectives.

Problem-Solving and Resolution

- Analyze the situation and identify the root cause of the issue or dispute.

- Work collaboratively with the relevant parties to find mutually acceptable solutions.

9. Describe your experience with managing complex or high-value real estate transactions.

In my previous role, I successfully managed numerous complex and high-value real estate transactions. These transactions involved:

- Multi-million dollar commercial properties

- International transactions with complex legal and regulatory requirements

- Transactions involving multiple parties and stakeholders

- Negotiating and drafting complex closing documents

10. How do you stay organized and manage the high volume of documentation associated with mortgage closings?

To stay organized and manage the high volume of documentation, I utilize the following strategies:

- Implement a comprehensive document management system.

- Create and maintain detailed checklists for each closing.

- Use technology tools, such as electronic signatures and document sharing platforms.

- Delegate responsibilities and collaborate with colleagues to distribute the workload.

- Prioritize tasks and allocate time effectively to ensure timely completion of deliverables.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Closing Coordinator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Closing Coordinator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Closing Coordinators play a crucial role in facilitating the smooth completion of mortgage transactions, ensuring that all necessary documentation is properly executed and funds are disbursed accordingly.

1. Loan Document Preparation and Execution

Preparing and organizing loan closing documents, including deeds, mortgages, and other legal agreements

- Reviewing and verifying the accuracy and completeness of loan documents

- Coordinating with lenders, borrowers, and attorneys to obtain signatures and notarizations

2. Escrow Management

Managing escrow accounts to hold funds until closing, ensuring that all funds are disbursed appropriately

- Calculating and collecting closing costs and fees

- Disbursing funds to lenders, vendors, and other parties involved in the transaction

3. Closing Process Coordination

Coordinating the closing process, scheduling appointments and ensuring that all parties are present at the closing

- Communicating with all stakeholders, including lenders, borrowers, and title companies

- Addressing any issues or delays that may arise during the closing process

4. Compliance and Quality Control

Ensuring compliance with all applicable laws and regulations governing mortgage transactions

- Maintaining accurate and complete records of all closing transactions

- Adhering to industry best practices and ethical guidelines

Interview Tips

Preparing thoroughly for a Closing Coordinator interview can significantly increase your chances of success. Here are some tips to help you ace the interview:

1. Research the Company and the Role

Familiarize yourself with the company’s profile, history, and culture. Learn about their specific requirements for the Closing Coordinator role and how your skills and experience align with them.

Example: Mention in the interview that you were impressed by the company’s commitment to customer satisfaction and that your past experience in handling complex closing transactions has equipped you to contribute to this goal effectively.

2. Highlight Your Relevant Skills and Experience

Emphasize your proficiency in loan document preparation, escrow management, and closing process coordination. Quantify your accomplishments and provide specific examples of how you have successfully coordinated closings.

Example: Describe a situation where you successfully resolved a discrepancy in loan documentation, preventing delays in the closing process.

3. Demonstrate Your Attention to Detail and Accuracy

Closing Coordinators must be meticulous and have a keen eye for detail. Highlight your ability to review documents thoroughly, identify errors, and ensure accuracy throughout the closing process.

Example: Explain your process for double-checking loan documents and your commitment to adhering to industry standards.

4. Showcase Your Communication and Interpersonal Skills

Effective communication is vital in this role. Emphasize your ability to communicate clearly and concisely with various stakeholders, including lenders, borrowers, and attorneys.

Example: Share an example of how you effectively managed a challenging conversation with a borrower and resolved their concerns.

5. Prepare Questions to Ask

Asking thoughtful questions during the interview demonstrates your interest and engagement. Prepare questions that show your understanding of the role and the company, as well as your eagerness to learn and contribute.

Example: Ask about the company’s training and development opportunities or their approach to ensuring compliance in the mortgage industry.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Closing Coordinator, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Closing Coordinator positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.