Are you gearing up for an interview for a Collection Correspondent position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Collection Correspondent and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

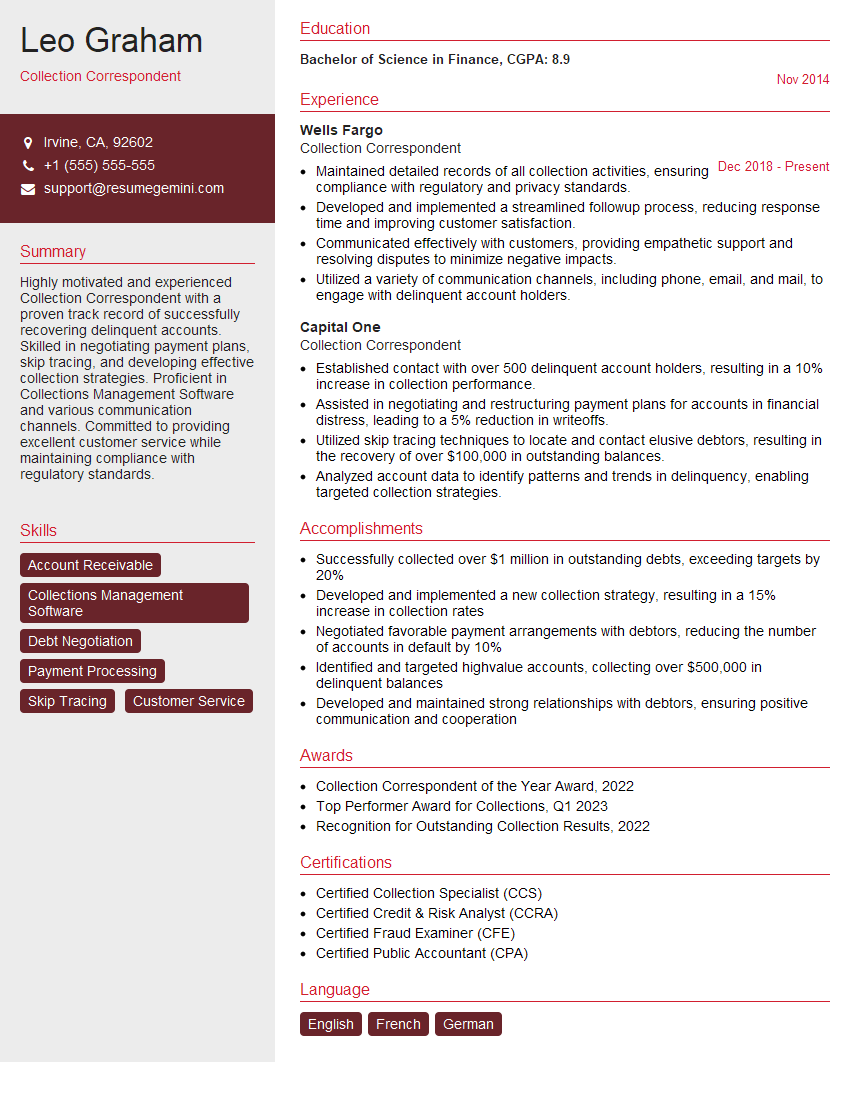

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Collection Correspondent

1. How do you prioritize and manage a large number of accounts with varying collection statuses?

- Utilize a collections management system to track account status, payment history, and interactions.

- Establish clear prioritization criteria based on factors such as account balance, delinquency age, and customer behavior.

- Segment accounts into different categories based on priority and develop targeted collection strategies for each segment.

- Monitor account activity regularly and adjust prioritization as needed to maximize collection efforts.

- Automate collection processes such as reminder notifications and payment plan arrangements to improve efficiency and consistency.

2. Can you explain the different collection techniques you’ve used in your previous roles and their effectiveness?

Negotiating payment plans

- Emphasize customer communication and understanding to establish feasible payment plans.

- Explore various payment options, including extended terms, installment payments, and reduced balances, to meet customer needs.

- Document payment plans clearly and ensure customer comprehension to avoid misunderstandings.

- Monitor compliance with payment plans and provide support to ensure successful completion.

Phone calls and emails

- Establish a professional and empathetic tone in all communications.

- Tailor messages to the specific account status and customer situation.

- Listen attentively to customer concerns and provide clear explanations of the collection process.

- Document all interactions and maintain a record of contact attempts.

3. How do you maintain a professional and empathetic demeanor while dealing with customers who may be experiencing financial difficulties?

- Recognize that customers are facing challenging circumstances and approach them with empathy and understanding.

- Listen actively to their concerns and acknowledge their financial situation without judgment.

- Maintain a respectful and professional tone, even when dealing with difficult or irate customers.

- Explain the collection process clearly and transparently to help customers understand their obligations.

- Work collaboratively with customers to explore payment options and find mutually acceptable solutions.

4. How do you handle situations where customers become aggressive or resistant during collection calls?

- Remain calm and professional, regardless of the customer’s behavior.

- Acknowledge the customer’s emotions and empathize with their frustrations.

- Use active listening skills to understand their concerns and identify underlying issues.

- Reframe the conversation to focus on finding a mutually acceptable solution.

- Set clear boundaries and inform the customer that aggressive behavior will not be tolerated.

5. Can you describe a challenging collection case you handled and how you resolved it successfully?

- Provide a brief overview of the case, including the customer’s situation and the challenges involved.

- Describe the specific strategies and techniques you used to resolve the case.

- Explain how you negotiated a payment plan, overcame objections, or addressed any other obstacles.

- Highlight the positive outcome and the lessons learned from the experience.

6. How do you stay updated on changes in collection laws and regulations?

- Attend industry conferences and webinars on collection best practices and legal updates.

- Subscribe to industry publications and newsletters for regular updates on regulatory changes.

- Network with other collection professionals and participate in online forums to stay informed.

- Consult legal counsel to ensure compliance with applicable laws and regulations.

7. What are your strengths and weaknesses as a Collection Correspondent?

Strengths

- Strong communication and negotiation skills.

- Ability to maintain a professional and empathetic demeanor.

- Thorough understanding of collection laws and regulations.

- Proven success in resolving complex collection cases.

- Excellent time management and organizational skills.

Weaknesses

- Limited experience in managing a large team.

- Occasional lack of patience when dealing with difficult customers.

8. Why are you interested in this Collection Correspondent position at our company?

- Research the company’s reputation, values, and collection practices.

- Align your skills and experience with the specific requirements of the role.

- Express your interest in the industry and your passion for helping customers resolve financial challenges.

- Demonstrate your commitment to ethical and compliant collection practices.

- Explain how your values align with the company’s culture and mission.

9. What are your salary expectations for this position?

- Research industry benchmarks for similar roles in your area.

- Consider your experience, skills, and qualifications.

- Be prepared to negotiate and justify your salary expectations.

- Provide a range rather than a specific figure to allow for flexibility.

10. Do you have any questions for us about the position or the company?

- Inquire about the company’s collection policies and procedures.

- Ask about the training and support provided to new hires.

- Explore the company’s commitment to ethical and compliant collection practices.

- Seek clarity on the career advancement opportunities available.

- Express your enthusiasm for the role and your eagerness to contribute to the company’s success.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Collection Correspondent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Collection Correspondent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Collection Correspondent is responsible for collecting delinquent accounts, and may also perform other duties such as processing payments, updating account information, and providing customer service. Key job responsibilities include:

1. Contacting Debtors

Collection Correspondents are responsible for contacting debtors by phone, email, or mail to collect overdue payments. They must be able to communicate effectively and professionally, and must be able to build rapport with debtors while also maintaining a firm stance on collecting the debt.

2. Negotiating Payment Plans

Collection Correspondents often work with debtors to negotiate payment plans that will allow them to repay their debt over time. They must be able to assess the debtor’s financial situation and ability to repay, and must be able to negotiate a payment plan that is both fair to the debtor and the creditor.

3. Updating Account Information

Collection Correspondents are responsible for updating account information, such as contact information, payment history, and balance. They must be able to maintain accurate records and keep track of all correspondence with debtors.

4. Providing Customer Service

Collection Correspondents may also provide customer service to debtors, such as answering questions about their account balance or payment options. They must be able to provide clear and concise information, and must be able to resolve customer complaints in a timely and professional manner.

Interview Tips

Preparing for a Collection Correspondent interview can help you increase your chances of success. Here are a few tips:

1. Research the Company

Take some time to research the company you’re applying to. This will help you understand their business, their values, and their culture. You can also use this information to tailor your answers to the interviewer’s questions.

2. Practice Your Communication Skills

Collection Correspondents need to be able to communicate effectively and professionally. You can practice your skills by role-playing with a friend or family member. This will help you develop your confidence and build your skills.

3. Prepare for Common Interview Questions

There are a few common interview questions that you can expect to be asked. These questions include:

- Tell me about your experience in collections.

- How do you handle difficult debtors?

- What is your strategy for negotiating payment plans?

- How do you stay organized and keep track of your work?

- Why do you want to work for our company?

You can prepare for these questions by thinking about your experiences and developing your answers in advance.

4. Dress Professionally

First impressions matter, so it’s important to dress professionally for your interview. This means wearing a suit or business casual attire.

5. Be Confident

Confidence is key in any interview. Make sure you walk into the interview with your head held high and your shoulders back. This will make a positive impression on the interviewer and show them that you’re confident in your abilities.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Collection Correspondent interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!