Are you gearing up for an interview for a Collection Supervisor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Collection Supervisor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

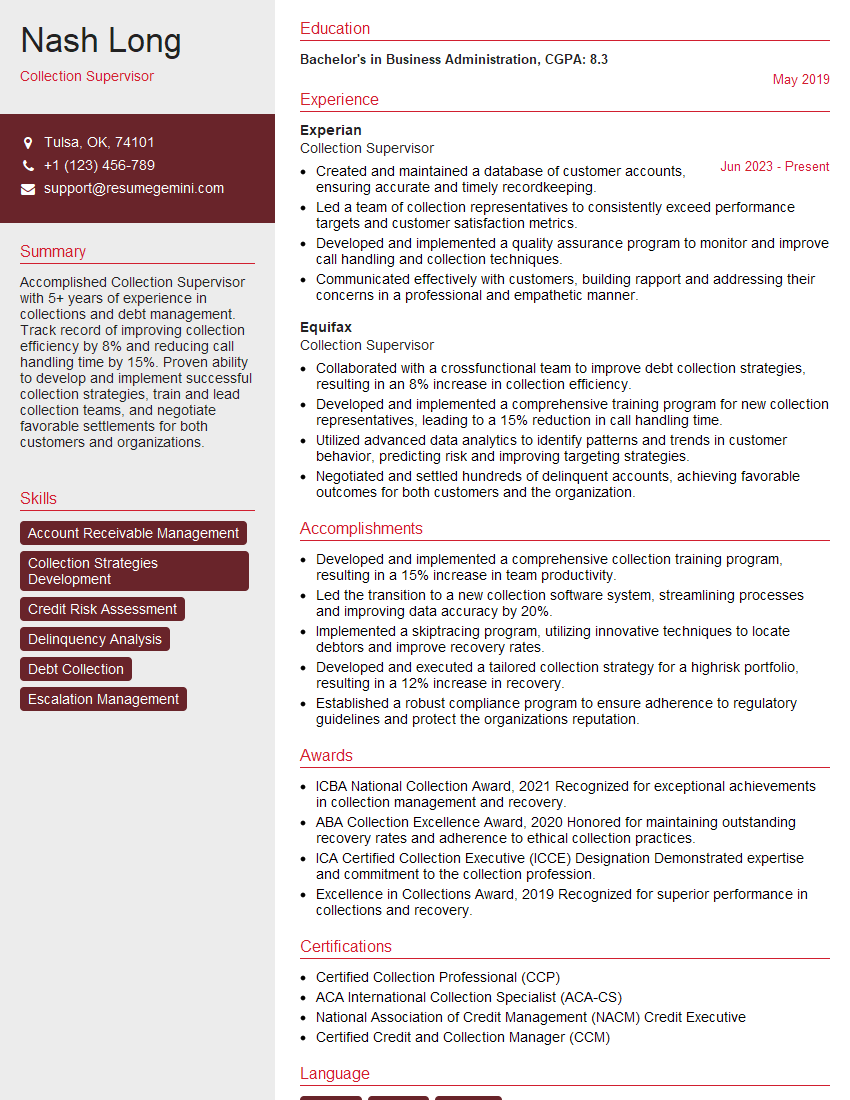

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Collection Supervisor

1. What are the key responsibilities of a Collection Supervisor?

The key responsibilities of a Collection Supervisor typically include:

- Leading and motivating a team of collectors to achieve collection goals

- Developing and implementing collection strategies and policies

- Monitoring and tracking collector performance

- Providing training and support to collectors

- Working with customers to resolve disputes and arrange payment plans

- Maintaining accurate records and reporting on collection activities

- Ensuring compliance with all applicable laws and regulations

2. What are the key challenges facing Collection Supervisors today?

The key challenges facing Collection Supervisors today include:

Increasing customer resistance to collection efforts

- Customers are becoming more aware of their rights and are less willing to tolerate aggressive collection tactics

- The rise of social media has given customers a platform to voice their complaints and share their experiences with others

Increasing regulatory scrutiny

- Government agencies are paying more attention to collection practices and are cracking down on violations

- New laws and regulations are being enacted that restrict the ability of collectors to contact customers

Economic uncertainty

- Economic downturns can lead to an increase in bad debt and make it more difficult to collect on outstanding accounts

- Customers may be less likely to make payments if they are struggling financially

3. What are the key skills and qualifications that a successful Collection Supervisor should possess?

A successful Collection Supervisor should possess the following skills and qualifications:

- Strong leadership and management skills

- Excellent communication and interpersonal skills

- A deep understanding of collection laws and regulations

- Experience in developing and implementing collection strategies

- A proven track record of success in achieving collection goals

- A strong work ethic and a commitment to excellence

4. What are the different types of collection strategies that a Collection Supervisor might use?

The different types of collection strategies that a Collection Supervisor might use include:

- Soft collection strategies: These strategies are less aggressive and focus on building relationships with customers

- Hard collection strategies: These strategies are more aggressive and may involve legal action

- Hybrid collection strategies: These strategies combine elements of both soft and hard collection strategies

The best collection strategy to use will depend on the specific circumstances of each case.

5. What are the most important metrics that a Collection Supervisor should track?

The most important metrics that a Collection Supervisor should track include:

- Collection rate

- Average days delinquent

- Customer satisfaction

- Compliance with laws and regulations

These metrics can help Collection Supervisors to measure the effectiveness of their collection efforts and identify areas for improvement.

6. What are the most common challenges that Collection Supervisors face in managing their teams?

The most common challenges that Collection Supervisors face in managing their teams include:

- Motivating collectors to achieve high performance

- Dealing with difficult customers

- Ensuring compliance with laws and regulations

- Managing workload and resources effectively

- Developing and implementing effective training programs

Collection Supervisors must be able to overcome these challenges in order to lead their teams to success.

7. What are the most important qualities that you look for in a Collection Specialist?

The most important qualities that I look for in a Collection Specialist include:

- Strong communication and interpersonal skills

- A deep understanding of collection laws and regulations

- A proven track record of success in achieving collection goals

- A strong work ethic and a commitment to excellence

Collection Specialists who possess these qualities are more likely to be successful in their roles.

8. What are the most common mistakes that Collection Specialists make?

The most common mistakes that Collection Specialists make include:

- Being too aggressive or confrontational with customers

- Not following collection laws and regulations

- Not documenting their interactions with customers properly

- Not following up on leads promptly

- Not using effective negotiation techniques

Collection Specialists should avoid these mistakes in order to be successful in their roles.

9. What are the most important trends that are impacting the collection industry today?

The most important trends that are impacting the collection industry today include:

- The increasing use of technology in collection operations

- The growing importance of customer experience

- The increasing regulatory scrutiny of collection practices

- The changing demographics of the customer base

- The globalization of the economy

Collection Supervisors must be aware of these trends and adapt their strategies accordingly.

10. What are the most important changes that you would like to see in the collection industry?

The most important changes that I would like to see in the collection industry include:

- A greater focus on customer experience

- More effective regulation of collection practices

- A more collaborative approach between collectors and customers

- A greater use of technology to improve efficiency and effectiveness

- A more positive public perception of the collection industry

I believe that these changes would benefit both collectors and customers.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Collection Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Collection Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Collection Supervisor is responsible for efficiently handling all aspects of delinquent account collection processes. They manage and oversee a team of collection agents, ensuring adherence to company policies and procedures. Let’s delve into the core responsibilities:

1. Team Management

A Collection Supervisor is the backbone of the collection team. Their primary responsibility is to lead, motivate, and supervise a team of collection agents. This involves setting clear performance expectations, providing ongoing training and support, and evaluating performance regularly.

- Set clear performance goals and provide regular feedback to improve agent productivity.

- Conduct training sessions to enhance knowledge and skills related to account collection, compliance, and customer service.

2. Case Management

Collection Supervisors play a pivotal role in managing delinquent accounts. They analyze account information, prioritize cases, and assign them to collection agents. Additionally, they monitor progress, review collection strategies, and provide guidance to agents.

- Review account history, analyze financial data, and assess the collectability of outstanding debts.

- Establish collection strategies and provide guidelines to collection agents to ensure efficient and ethical debt recovery.

3. Performance Monitoring

A Collection Supervisor is accountable for monitoring and evaluating the performance of their team. They track key performance indicators (KPIs) such as collection rates, average collection time, and customer satisfaction. This data is used to identify areas for improvement and implement strategies to enhance team performance.

- Track collection rates, average collection time, and customer satisfaction metrics.

- Analyze performance data to identify strengths, weaknesses, and areas for improvement.

4. Compliance and Risk Management

Collection Supervisors ensure compliance with all applicable laws and regulations related to debt collection. They develop and implement policies and procedures to mitigate risks and protect the company from legal and reputational issues. They also monitor industry best practices and stay abreast of regulatory updates.

- Develop and implement policies and procedures to ensure compliance with federal and state collection laws.

- Monitor industry best practices and stay updated on regulatory changes to maintain compliance.

Interview Tips

Preparing for a Collection Supervisor interview can enhance your chances of success. Here are some tips and hacks to help you ace the interview:

1. Research the Company and Position

Take the time to thoroughly research the company, their products or services, and the specific requirements of the Collection Supervisor role. This knowledge will demonstrate your genuine interest in the position and help you tailor your answers to the interviewer’s questions.

- Visit the company website to learn about their history, mission, values, and products or services.

- Review the job description carefully and identify the key skills and experience required for the role.

2. Highlight Your Relevant Skills and Experience

During the interview, emphasize your relevant skills and experience that align with the job responsibilities. Quantify your accomplishments whenever possible using specific examples and data. Prepare stories that showcase your leadership, team management, case management, and compliance expertise.

- Provide specific examples of how you have successfully led and motivated teams to achieve collection goals.

- Describe a situation where you effectively managed a complex case and achieved a positive outcome.

3. Demonstrate Your Understanding of Compliance and Risk Management

In the collection industry, compliance and risk management are paramount. Show the interviewer that you have a strong understanding of relevant laws and regulations. Discuss your experience in developing and implementing compliance policies or in handling sensitive customer information.

- Explain how you stay updated on industry best practices and regulatory changes.

- Share an example of how you handled a situation where compliance was a concern.

4. Ask Thoughtful Questions

Asking thoughtful questions at the end of the interview shows that you are engaged and genuinely interested in the position. It also gives you an opportunity to learn more about the company and the role. Prepare a few questions in advance that are specific to the company or the position.

- Inquire about the company’s collection strategies and how they balance compliance and customer satisfaction.

- Ask about the opportunities for professional development and career growth within the organization.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Collection Supervisor role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.