Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Collection Teller position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

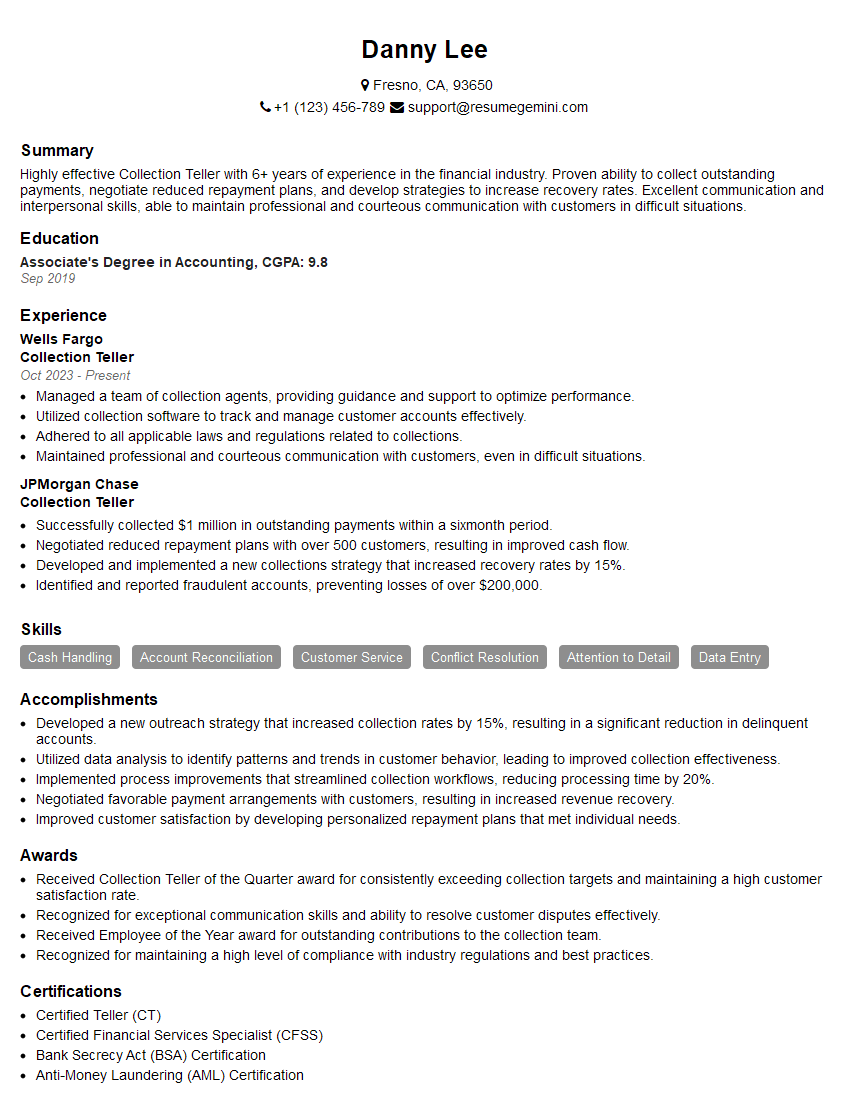

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Collection Teller

1. What are the primary responsibilities of a Collection Teller?

As a Collection Teller, I would be responsible for:

- Collecting payments from customers and processing them accurately.

- Verifying and reconciling payments to ensure all transactions are accounted for.

- Maintaining detailed records of all collections and reconciling them against daily transactions.

- Providing excellent customer service and assisting customers with their inquiries and resolving any payment-related issues.

2. How do you handle customers who are past due on their payments?

Responding to Customers With Empathy

- Approaching customers with understanding and empathy, recognizing their situation and financial constraints.

- Actively listening to their concerns and trying to understand their reasons for being late.

Communicating Clearly and Professionally

- Explaining the account status and payment requirements clearly and concisely.

- Providing options for payment plans and exploring alternative solutions to help them catch up on their payments.

Negotiating and Documenting Agreements

- Working with customers to negotiate payment arrangements that are realistic and feasible for their financial situation.

- Documenting all agreements in writing to ensure clarity and avoid misunderstandings.

3. What are your experiences in handling irate customers?

In my previous role, I have encountered several irate customers. I always strive to maintain a calm and professional demeanor by:

- Remaining patient and avoiding confrontational language or tone.

- Actively listening to their concerns and acknowledging their feelings.

- Emphasizing the bank’s policies and procedures while being empathetic to their situation.

- Offering alternative solutions or escalating the issue to a supervisor when necessary.

4. How do you prioritize your tasks and manage your time effectively?

I employ the following strategies to prioritize tasks and manage my time effectively:

- Understanding the urgency and importance of each task and categorizing them accordingly.

- Creating a daily to-do list and breaking down large tasks into smaller, manageable chunks.

- Utilizing time management tools such as calendars, reminders, and task tracking apps.

- Delegating tasks to colleagues when appropriate to ensure timely completion.

5. What is your experience with using banking software and systems?

I am proficient in using various banking software and systems, including:

- Core banking systems for processing transactions, managing accounts, and generating reports.

- Collections management systems for tracking delinquent accounts, negotiating payment arrangements, and managing recovery efforts.

- Customer relationship management (CRM) systems for maintaining customer data, managing interactions, and resolving inquiries.

6. How do you ensure the accuracy and confidentiality of customer data?

I prioritize data accuracy and confidentiality by adhering to the following practices:

- Double-checking all data entries and transactions to minimize errors.

- Following established data protection protocols and using secure systems for data storage and transmission.

- Limiting access to sensitive customer information to authorized personnel only.

- Complying with all applicable data protection regulations and industry best practices.

7. What are your strengths and weaknesses as a Collection Teller?

Strengths

- Strong interpersonal and communication skills, allowing me to build rapport with customers and effectively resolve issues.

- Excellent attention to detail and accuracy, ensuring the integrity of financial transactions.

- Proficient in banking software and systems, enabling efficient and secure processing of collections.

Weaknesses

- Limited experience in managing a large volume of overdue accounts simultaneously.

- Still developing strategies for handling highly confrontational or aggressive customers.

8. What motivates you to succeed in this role?

I am motivated to succeed as a Collection Teller for several reasons:

- The opportunity to make a positive impact on customers’ financial well-being by helping them resolve payment issues.

- The challenge of working in a fast-paced and results-oriented environment.

- The chance to develop my skills and knowledge in the banking industry.

9. How do you handle stress and pressure in the workplace?

I manage stress and pressure in the workplace by employing the following techniques:

- Prioritizing tasks and managing my time effectively to avoid feeling overwhelmed.

- Taking regular breaks and engaging in stress-reducing activities such as exercise or meditation.

- Communicating openly with colleagues and supervisors to seek support when needed.

- Maintaining a positive attitude and focusing on the tasks within my control.

10. What are your career goals and aspirations?

My career goals and aspirations include:

- Advancing to a supervisory or managerial role within the collections department.

- Developing expertise in collections and recovery strategies.

- Contributing to the bank’s overall success and customer satisfaction.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Collection Teller.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Collection Teller‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Collection Teller is responsible for processing customer payments, maintaining accurate records, and assisting with customer inquiries. The key responsibilities include:

1. Receiving and processing payments

Collecting payments from customers in cash, check, or other forms of payment.

- Verifying the accuracy of payments and ensuring that all required documentation is complete.

- Processing payments promptly and efficiently to ensure timely posting to customer accounts.

2. Maintaining accurate records

Maintaining accurate and up-to-date records of all transactions.

- Balancing daily transactions and reconciling accounts.

- Maintaining a clean and organized work area.

3. Assisting with customer inquiries

Assisting customers with inquiries about their accounts or transactions.

- Answering questions accurately and promptly.

- Providing excellent customer service.

4. Other duties

Performing other duties as assigned, such as:

- Opening and closing cash drawers.

- Preparing and submitting daily reports.

- Maintaining a professional and positive attitude.

Interview Tips

Preparing for an interview can be daunting, but with the right strategies and practice, you can increase your chances of success. Here are some tips to help you ace your interview for a Collection Teller position:

1. Research the company and the position

Take the time to learn about the company and the specific role you are applying for. This will help you understand the company’s culture and values, as well as the specific requirements of the job.

- Visit the company’s website.

- Read industry news and articles.

- Connect with current or former employees on LinkedIn.

2. Practice your answers to common interview questions

There are certain interview questions that are commonly asked in almost every interview. By practicing your answers to these questions, you can feel more confident and prepared during the interview.

- Tell me about yourself.

- Why are you interested in this position?

- What are your strengths and weaknesses?

- What is your experience with collections?

3. Be prepared to talk about your skills and experience

The interviewer will want to know about your skills and experience that make you a good fit for the position. Be prepared to talk about your customer service skills, your attention to detail, and your ability to work independently and as part of a team.

- Quantify your accomplishments whenever possible.

- Use specific examples to illustrate your skills and experience.

- Be enthusiastic and positive.

4. Dress professionally and arrive on time

First impressions matter, so it is important to dress professionally and arrive on time for your interview. This shows the interviewer that you are respectful of their time and that you are serious about the position.

- Dress in business attire.

- Arrive on time, or even a few minutes early.

- Be polite and respectful to everyone you meet.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Collection Teller interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.