Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Collections Director position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

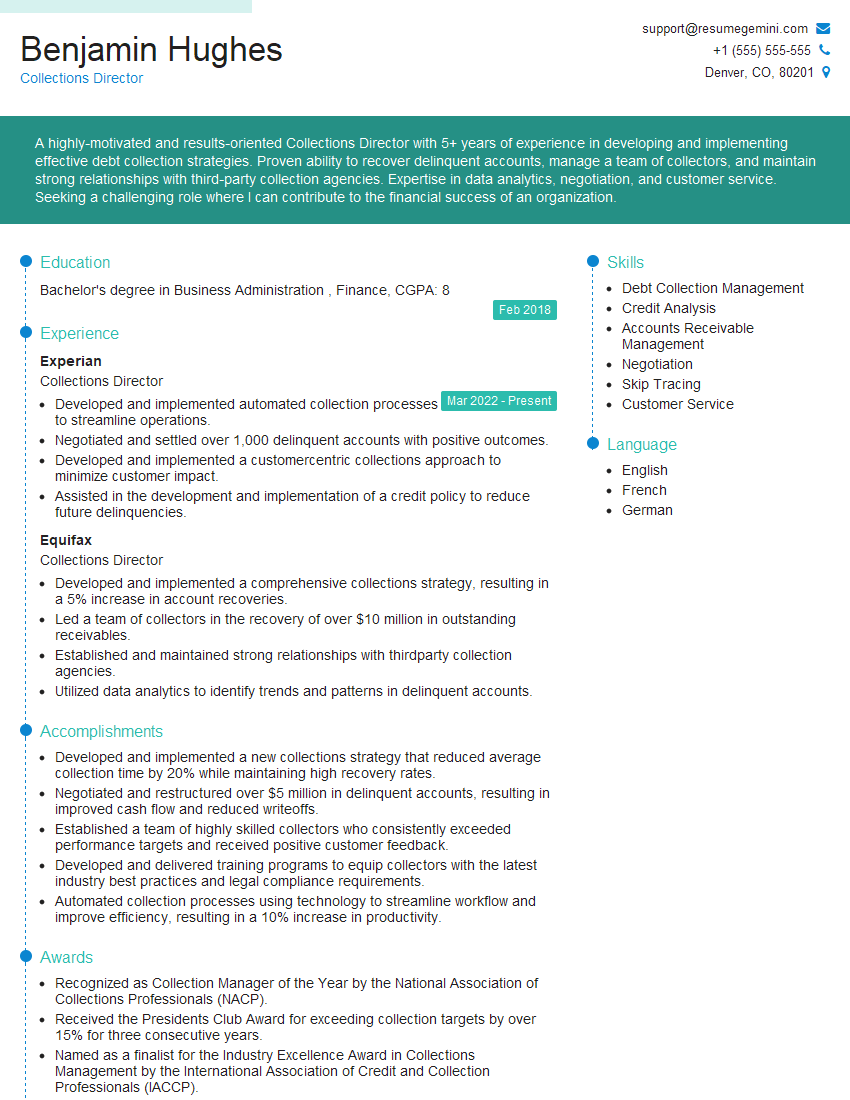

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Collections Director

1. What are the key performance indicators (KPIs) that you track to measure the effectiveness of your collections team?

The key performance indicators (KPIs) that I track to measure the effectiveness of my collections team include:

- Average days to collect: This metric measures the average number of days it takes to collect on a debt. It is a key indicator of the efficiency of the collections process.

- Collection rate: This metric measures the percentage of debt that is collected. It is a key indicator of the effectiveness of the collections process.

- Cost per collection: This metric measures the cost of collecting on a debt. It is a key indicator of the efficiency of the collections process.

- Customer satisfaction: This metric measures the satisfaction of customers with the collections process. It is a key indicator of the quality of the collections process.

2. What are the different types of collection strategies that you use?

Pre-collection strategies

- Early intervention: Contacting customers early in the delinquency process to prevent them from falling further behind.

- Payment arrangements: Working with customers to create payment arrangements that fit their budget.

- Credit counseling: Referring customers to credit counseling agencies for help with managing their debt.

Collection strategies

- Phone calls: Calling customers to discuss their account and collect payment.

- Letters: Sending letters to customers to remind them of their overdue balance and to request payment.

- Emails: Sending emails to customers to remind them of their overdue balance and to request payment.

- Home visits: Visiting customers at their home to discuss their account and collect payment.

- Legal action: Filing lawsuits against customers who refuse to pay their debt.

3. What are the ethical considerations that you take into account when collecting debt?

- Fairness: Treating customers fairly and respectfully, regardless of their financial situation.

- Transparency: Being clear and upfront with customers about the collection process and their rights.

- Confidentiality: Protecting the privacy of customers and their financial information.

- Reasonableness: Using reasonable methods to collect debt, and avoiding harassment or intimidation.

- Compliance with the law: Following all applicable laws and regulations.

4. What are the challenges that you face in your role as Collections Director?

- The increasing complexity of debt: Debts are becoming more complex, due to factors such as the rise of identity theft and fraud.

- The changing regulatory landscape: The regulatory landscape is constantly changing, which makes it difficult to keep up with the latest requirements.

- The need to balance profitability with customer satisfaction: Collections directors need to balance the need to collect debt with the need to maintain customer satisfaction.

- The high turnover rate in the collections industry: The collections industry has a high turnover rate, which can make it difficult to build a strong and experienced team.

5. What are your goals for the collections department in the next year?

- Increase the collection rate: I want to increase the collection rate by 5% in the next year.

- Reduce the cost per collection: I want to reduce the cost per collection by 10% in the next year.

- Improve customer satisfaction: I want to improve customer satisfaction by 10% in the next year.

- Reduce the turnover rate: I want to reduce the turnover rate by 5% in the next year.

6. What are your strengths as a Collections Director?

- Strong leadership skills: I have a proven track record of leading and motivating teams to achieve success.

- Excellent communication skills: I am able to communicate effectively with customers, employees, and other stakeholders.

- Deep understanding of the collections industry: I have over 10 years of experience in the collections industry, and I am familiar with all aspects of the business.

- Strong work ethic: I am a hard worker and I am dedicated to achieving my goals.

7. What are your weaknesses as a Collections Director?

- I can be impatient at times: I am sometimes impatient when things don’t go according to plan.

- I can be too demanding: I sometimes expect too much from my employees.

- I am not always good at delegating: I sometimes have a hard time letting go of control.

8. Why are you interested in this position?

- I am passionate about the collections industry: I believe that collections is a vital part of the financial system.

- I am confident that I have the skills and experience to be successful in this role: I have a proven track record of success in the collections industry, and I am confident that I can help your company achieve its goals.

- I am excited about the opportunity to work with your team: I am impressed by your company’s culture and values, and I believe that I would be a good fit for your team.

9. What are your salary expectations?

- My salary expectations are in line with the market rate for Collections Directors: I am confident that I can bring value to your company, and I am looking for a salary that is commensurate with my experience and skills.

- I am willing to negotiate: I am open to negotiating a salary that is fair for both parties.

10. What are your career goals?

- My long-term career goal is to become a Chief Financial Officer (CFO): I believe that my experience in the collections industry has given me the skills and knowledge necessary to be successful in this role.

- I am also interested in pursuing a career in consulting: I believe that my experience in the collections industry would be valuable to clients who are looking to improve their collections operations.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Collections Director.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Collections Director‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Collections Director is a senior-level manager responsible for developing and implementing strategies to maximize collections revenue while minimizing bad debt losses. The role involves overseeing all aspects of the collections process, including staff management, policy development, and risk assessment. Key responsibilities include:

1. Strategic Planning and Execution

Develop and implement comprehensive collections strategies aligned with the organization’s financial goals.

- Analyze historical data and industry trends to identify areas for improvement in collections efficiency.

- Establish key performance indicators (KPIs) to monitor and measure the effectiveness of collections efforts.

2. Risk Management and Compliance

Ensure compliance with all applicable laws and regulations related to collections activities.

- Develop and implement policies and procedures to mitigate risks associated with collections, including fraud and identity theft.

- Monitor and assess the creditworthiness of customers and develop strategies to manage high-risk accounts.

3. Team Management and Development

Lead and manage a team of collections professionals, providing guidance and support.

- Hire, train, and develop staff to ensure they have the skills and knowledge to effectively perform their roles.

- Foster a positive and productive work environment that promotes collaboration and teamwork.

4. Operations Management

Oversee the day-to-day operations of the collections department, ensuring efficiency and effectiveness.

- Implement and maintain automated systems and processes to streamline collections activities.

- Monitor and analyze collections data to identify trends and areas for improvement.

Interview Tips

To ace an interview for a Collections Director position, consider the following tips:

1. Research the Company and Role

Thoroughly research the company’s business, industry, and financial performance. This will help you understand the organization’s needs and how your skills and experience align with their requirements.

- Review the company’s website, annual reports, and any relevant news articles.

- Identify the specific responsibilities and qualifications outlined in the job description.

2. Highlight Your Experience and Skills

Emphasize your relevant experience in collections management, risk assessment, and team leadership. Provide specific examples of successful strategies you have implemented.

- Quantify your accomplishments whenever possible, using metrics to demonstrate the impact of your work.

- Describe how you have effectively managed and motivated teams to achieve goals.

3. Demonstrate Your Industry Knowledge

Show that you are up-to-date with industry trends and best practices. Discuss your understanding of the regulatory landscape and emerging technologies in the collections field.

- Share insights on recent changes in collection laws or regulations.

- Discuss how you have implemented innovative solutions to improve collections efficiency.

4. Be Prepared to Address Ethical Considerations

Collections is a sensitive field that requires ethical considerations. Be prepared to discuss your approach to handling customer interactions, balancing compliance with compassion.

- Explain how you prioritize customer care while adhering to legal requirements.

- Discuss strategies for minimizing the negative impact of collections on customers.

5. Practice Your Answers and Ask Thoughtful Questions

Prepare for common interview questions and practice your answers to ensure clarity and conciseness. Also, prepare thoughtful questions to ask the interviewer, demonstrating your interest in the role and the company.

- Consider questions about the company’s financial strategy, collections performance, and plans for future growth.

- Ask about the company culture and opportunities for professional development.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Collections Director interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!