Feeling lost in a sea of interview questions? Landed that dream interview for Collections Officer but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Collections Officer interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

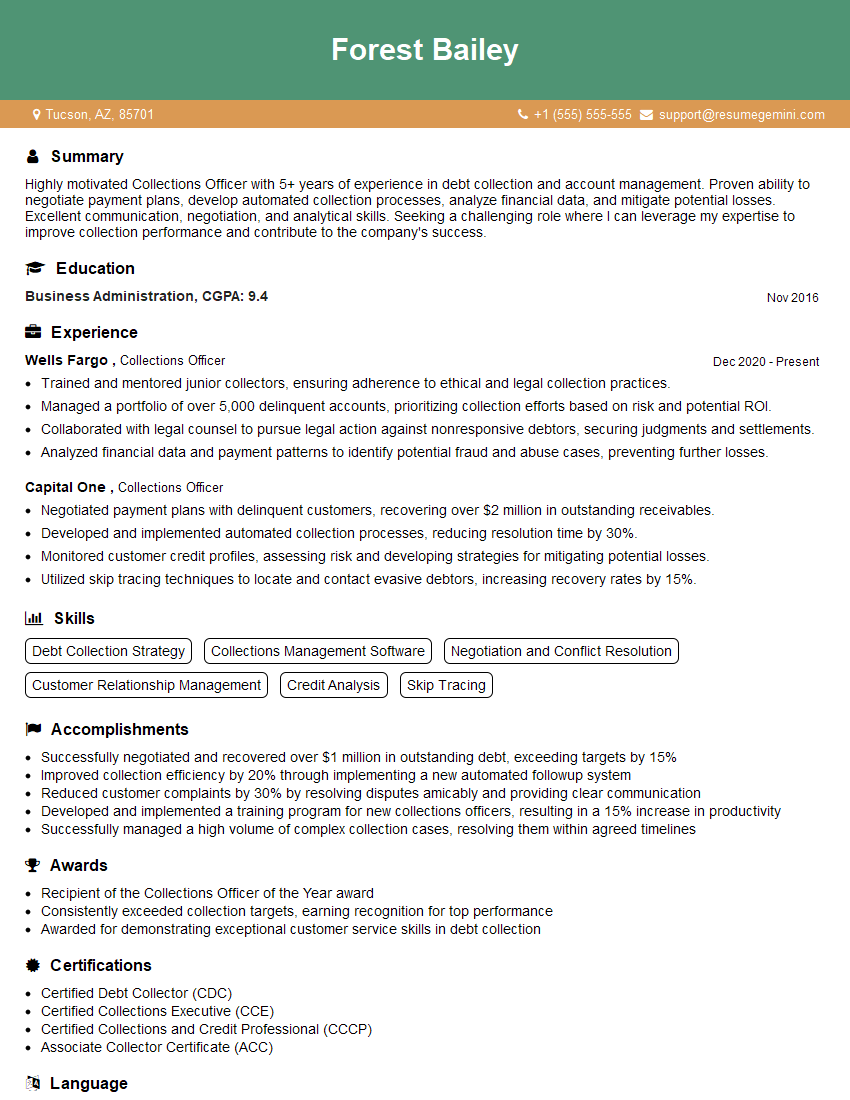

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Collections Officer

1. How do you prioritize collection accounts when you have a large workload?

- Categorize accounts based on delinquency status and balance.

- Focus on accounts with the highest balance and most recent delinquency.

- Consider the customer’s payment history and financial situation.

- Prioritize accounts with legal implications or potential for write-offs.

2. Describe the key strategies you use to negotiate settlements with debtors.

- Emphasize empathy and understanding: Acknowledge the debtor’s situation and financial challenges.

- Provide flexible payment options: Offer tailored solutions that align with the debtor’s ability to pay.

- Negotiate a fair settlement amount: Balance the creditor’s financial interests with the debtor’s affordability.

- Document the agreement clearly: Obtain a written settlement agreement outlining the terms and conditions.

3. How do you maintain a positive and professional demeanor when interacting with sometimes irate or difficult debtors?

- Remain calm and composed, even under pressure.

- Use active listening techniques to understand the debtor’s perspective.

- Maintain a respectful and empathetic tone, acknowledging their emotions.

- Focus on finding a mutually acceptable solution rather than arguing or escalating the situation.

4. What are the most common legal considerations that arise in collections?

- Fair Debt Collection Practices Act (FDCPA)

- State and local debt collection laws

- Bankruptcy and foreclosure proceedings

- Statutes of limitations on debt collection

5. Describe your approach to skip tracing debtors who have relocated or are evasive.

- Utilize social media, online databases, and public records.

- Contact family members, friends, and former employers.

- Hire a skip tracing agency for professional assistance.

- Utilize GPS tracking in extreme cases, with legal compliance.

6. What types of software or technology do you have experience using for collections management?

- Collections management software (e.g., Salesforce, Oracle NetSuite)

- Automated dialer systems

- Credit reporting and monitoring tools

- CRM systems

7. How do you handle situations where debtors make false or disputed claims about their financial situation?

- Inquire thoroughly and document the details: Gather supporting evidence, such as bank statements or payment records.

- Contact third parties, if necessary: Verify information with employers, landlords, or other creditors.

- Negotiate a resolution based on evidence: Present the facts and discuss options that are fair and supported by the documentation.

- Consider legal action as a last resort: If the debtor is intentionally misrepresenting their situation, explore legal remedies.

8. How do you manage your time effectively when working on multiple collection accounts simultaneously?

- Prioritize tasks based on urgency and importance: Focus on high-priority accounts with the greatest potential for recovery.

- Use technology to automate workflows: Utilize software for tasks such as scheduling calls, sending emails, and generating reports.

- Delegate responsibilities: If possible, delegate tasks to team members or outsource certain functions to improve efficiency.

- Take regular breaks: Breaks can help prevent burnout and maintain focus throughout the day.

9. How do you measure your performance as a Collections Officer?

- Collection rate: Percentage of accounts successfully collected.

- Average days to collect: Time taken from account assignment to collection.

- Customer satisfaction: Feedback on professionalism, communication, and resolution outcomes.

- Legal compliance: Adherence to industry regulations and legal guidelines.

10. What are some ethical dilemmas that you have faced in the collections profession and how did you handle them?

- Balancing financial recovery with customer well-being: Ensuring that collection efforts do not create undue hardship or violate ethical principles.

- Confidentiality and privacy: Respecting debtors’ privacy and handling personal information responsibly.

- Fairness and impartiality: Treating all debtors fairly, regardless of their circumstances or background.

- Legal compliance: Ensuring that all collection activities adhere to applicable laws and regulations.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Collections Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Collections Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Collections Officer plays a crucial role in maintaining the financial health of an organization by effectively collecting outstanding debts and ensuring timely payments. Their responsibilities involve:

1. Managing Accounts Receivable

Maintaining accurate records of accounts receivable and monitoring payment status of customers.

- Reconciling invoices with payments and identifying discrepancies.

- Updating customer accounts and tracking overdue payments.

2. Communicating with Customers

Establishing and maintaining positive relationships with customers to facilitate timely payments.

- Contacting customers via phone, email, or mail to discuss overdue invoices and payment arrangements.

- Negotiating payment plans and resolving disputes amicably.

3. Credit and Risk Management

Assessing customers’ creditworthiness and managing risk exposure.

- Evaluating financial statements and credit reports to determine payment likelihood.

- Monitoring customer behavior and identifying early warning signs of defaults.

4. Reporting and Analysis

Providing regular reports and analysis on collections performance to management.

- Tracking key metrics such as collection rates, average days to collect, and bad debt expense.

- Identifying trends and recommending improvements to streamline collections processes.

Interview Tips

To ace your Collections Officer interview, consider the following tips:

1. Research the Company and Industry

Familiarize yourself with the organization’s financial standing, industry trends, and specific collection practices.

- Visit the company website, read industry publications, and connect with professionals on LinkedIn.

- Highlight your understanding of the company’s business model and collection challenges during the interview.

2. Emphasize Communication Skills

Collections Officers need to communicate effectively with customers of various backgrounds and temperaments.

- Provide specific examples of how you have successfully negotiated payment arrangements and resolved disputes.

- Demonstrate your empathy, patience, and ability to maintain composure under pressure.

3. Showcase Analytical and Problem-Solving Abilities

Collections Officers must analyze data and identify patterns to improve collection strategies.

- Highlight your experience in using analytical tools to assess customer risk and optimize collection efforts.

- Discuss how you have used data to identify trends and make recommendations for process improvements.

4. Prepare for Common Interview Questions

Research common Collections Officer interview questions and prepare thoughtful responses.

- Explain your approach to collecting overdue debts.

- Describe a difficult collections situation you faced and how you resolved it.

- Discuss your experience in using technology to enhance collection processes.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Collections Officer interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.