Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Collections Representative position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

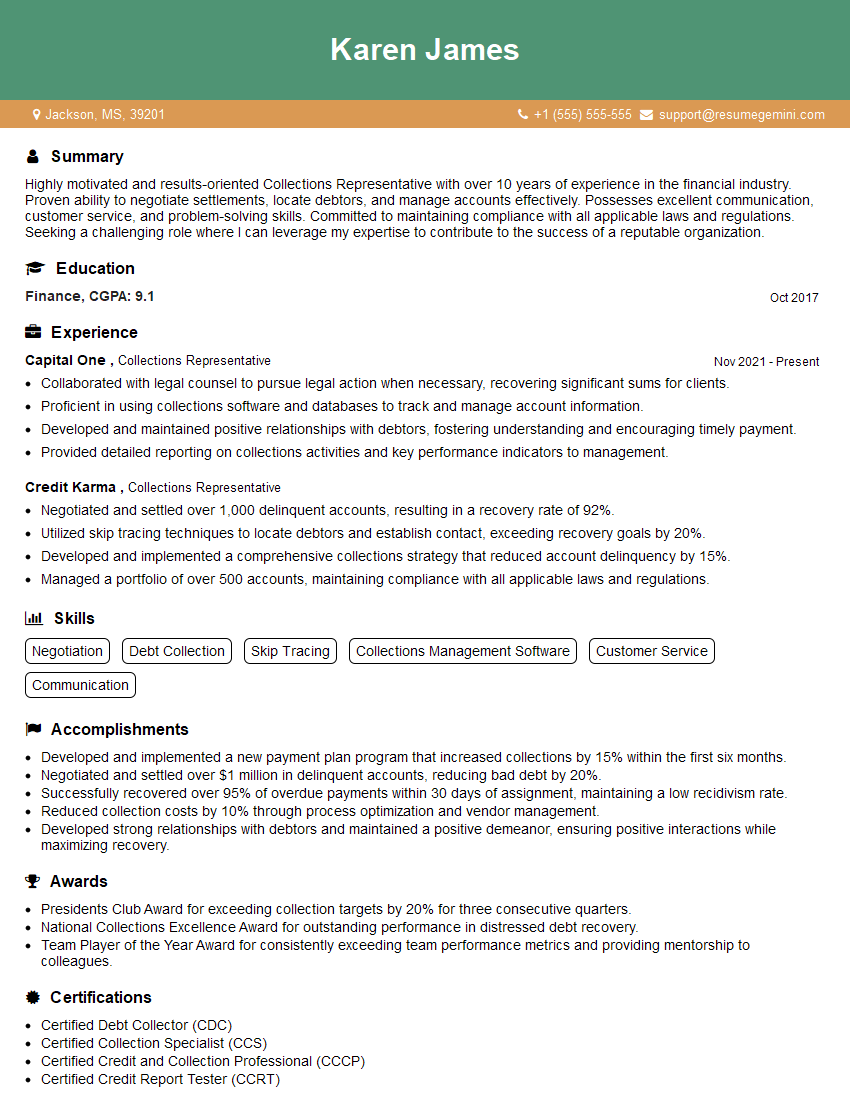

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Collections Representative

1. Describe the process you follow to collect outstanding payments from delinquent accounts.

- Establish contact with the customer via phone, email, or mail.

- Verify the customer’s account information and the amount due.

- Discuss payment options and negotiate a payment plan if necessary.

- Document all interactions with the customer and update the account accordingly.

- Follow up with the customer regularly to ensure compliance with the payment plan.

2. How do you handle difficult or uncooperative customers?

Communication and Empathy

- Maintain a calm and professional demeanor.

- Listen attentively to the customer’s concerns.

- Emphasize understanding and find common ground.

Negotiation and Flexibility

- Explore alternative payment arrangements and solutions.

- Be willing to compromise within reason.

- Explain the consequences of non-payment clearly.

Documentation and Follow-up

- Document all interactions thoroughly.

- Follow up consistently and persistently.

- Seek support from supervisors or legal counsel if necessary.

3. What strategies do you use to maximize collections while maintaining customer relationships?

- Personalize communication and build rapport.

- Offer flexible payment options and discounts for early payment.

- Provide clear and concise payment instructions.

- Respect customer privacy and confidentiality.

- Seek feedback and continuously improve collection processes.

4. How do you prioritize and manage a high volume of delinquent accounts?

- Triage accounts based on delinquency status, payment history, and amount due.

- Utilize technology and automation tools to streamline tasks.

- Delegate responsibilities and collaborate with team members.

- Monitor progress regularly and adjust strategies accordingly.

- Identify patterns and trends to improve collection effectiveness.

5. How do you stay up-to-date on industry best practices and regulations?

- Attend industry conferences and workshops.

- Read industry publications and articles.

- Network with colleagues and peers.

- Complete continuing education courses.

- Stay informed about regulatory changes and compliance requirements.

6. Describe your experience in identifying and resolving disputed accounts.

- Gather and review account documentation and payment records.

- Contact the customer to understand their perspective.

- Investigate the validity of the dispute.

- Negotiate a resolution that is fair and equitable.

- Document the resolution and update the account accordingly.

7. How do you manage collections activities in a high-pressure environment?

- Prioritize tasks and allocate time effectively.

- Stay organized and maintain a clear workspace.

- Take breaks and manage stress levels.

- Communicate workload and challenges to supervisors.

- Seek support and guidance from colleagues and mentors.

8. How do you ensure that your collection efforts comply with legal and ethical guidelines?

- Adhere to all applicable laws and regulations.

- Treat customers with respect and dignity.

- Maintain confidentiality of customer information.

- Avoid harassment and intimidation tactics.

- Document all interactions and communications accurately.

9. Describe your experience in using technology and software to enhance collections productivity.

- Utilize customer relationship management (CRM) systems.

- Leverage automated dialing and messaging tools.

- Integrate payment processing systems.

- Utilize analytics and reporting tools to track progress.

- Stay abreast of new technologies and their potential applications in collections.

10. How do you stay motivated and maintain a positive attitude in a challenging role?

- Set realistic goals and track progress.

- Focus on the positive impact of collections on individuals and businesses.

- Celebrate successes and learn from setbacks.

- Build a support network of colleagues and mentors.

- Engage in activities that provide personal fulfillment outside of work.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Collections Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Collections Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Collections Representative, you will play a crucial role in managing overdue customer accounts and facilitating timely payments. Your primary responsibilities will include:

1. Contacting Customers

Initiate contact with customers via phone, email, or mail to discuss their outstanding balances. Maintain professionalism and empathy while effectively communicating payment expectations and available options.

- Negotiate payment plans and agreements that align with customer circumstances.

- Document all interactions and correspondence, ensuring accurate records for future reference.

2. Tracking Accounts

Monitor customer accounts, track payment histories, and identify patterns to prioritize follow-up actions. Utilize collection software to manage account information and automate tasks.

- Analyze customer data to understand payment behavior and identify potential risks.

- Maintain detailed records of all collections activities and outcomes.

3. Resolving Disputes

Handle customer complaints and disputes related to invoices or payments. Conduct thorough investigations and work with customers to resolve issues amicably.

- Research account history and collect evidence to support resolution.

- Negotiate payment arrangements or identify alternative solutions that satisfy both the company and the customer.

4. Reporting and Analysis

Prepare regular reports on collections performance, identify trends, and make recommendations for improvement. Analyze data to identify areas for optimization and improve collection strategies.

- Collaborate with management to develop and implement process improvements.

- Stay updated on industry best practices and regulations related to collections.

Interview Tips

To effectively prepare for your interview, consider the following tips and hacks:

1. Research the Company and Industry

Demonstrate your interest and knowledge of the company’s products, services, and financial performance. Research the industry to understand market trends and competitive landscapes.

- Visit the company website, read annual reports, and follow social media channels.

- Identify key industry players and their strategies to demonstrate your understanding of the market.

2. Practice Active Listening

During the interview, actively listen to the questions and respond thoughtfully. Paraphrase or summarize the interviewer’s questions to ensure you understand and address them fully.

- Maintain eye contact and engage in non-verbal cues to demonstrate attentiveness.

- Ask clarifying questions if needed to avoid misunderstandings.

3. Highlight Relevant Experience

Focus on showcasing your skills and experience that directly align with the job responsibilities of a Collections Representative. Quantify your accomplishments and provide specific examples of your success in resolving disputes, negotiating payment plans, and managing customer relationships.

- Use the STAR method (Situation, Task, Action, Result) to structure your responses and highlight your accomplishments.

- Prepare stories or case studies that demonstrate your problem-solving abilities and customer-oriented approach.

4. Prepare Questions for the Interviewer

At the end of the interview, prepare thoughtful questions that demonstrate your interest and engagement. This shows that you are genuinely invested in the opportunity and eager to learn more about the role and company.

- Ask about the company’s culture, values, and growth opportunities.

- Inquire about the training and support provided to new Collections Representatives.

Next Step:

Now that you’re armed with the knowledge of Collections Representative interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Collections Representative positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini