Are you gearing up for a career in Collections Specialist? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Collections Specialist and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

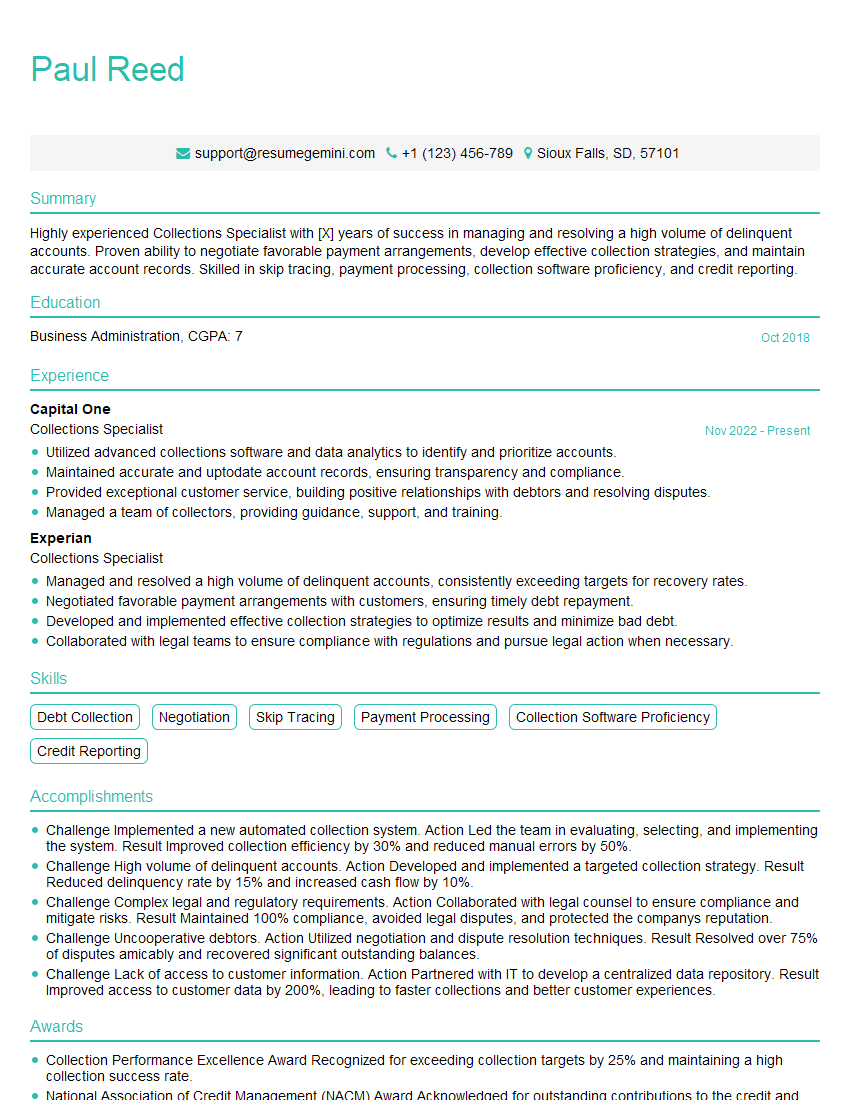

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Collections Specialist

1. How would you prioritize a high-volume of past-due accounts?

- Age of the debt:

- Payment history:

- Total amount due:

- Debtor contact and communication:

- Collateral or assets available:

2. Explain your approach to negotiating payment plans with debtors?

Establishing Contact:

- Attempting to contact via phone, email, and mail:

- Being persistent and leaving detailed messages:

Building Rapport:

- Establishing a professional and empathetic tone:

- Listening to the debtor’s concerns and situation:

Exploring Options:

- Discussing different payment options and flexibility:

- Considering the debtor’s financial capacity and circumstances:

Setting Expectations:

- Clearly outlining the payment plan and expectations:

- Setting realistic goals and timelines:

Documenting and Monitoring:

- Documenting the agreement in writing:

- Regularly monitoring progress and following up:

3. How do you handle debtors who are uncooperative or hostile?

- Maintain a professional and respectful demeanor:

- Attempt to understand the debtor’s perspective and concerns:

- Avoid confrontational language or tactics:

- Document all interactions and communications:

- Consider legal options as a last resort:

4. What collection tools and techniques are you proficient in using?

- Phone and email communication:

- Written demand letters and collection notices:

- Skip tracing and asset searches:

- Negotiating payment plans and settlements:

- Legal proceedings and enforcement actions:

5. How do you stay updated on industry best practices and legal compliance in collections?

- Attending industry conferences and webinars:

- Reading trade publications and legal journals:

- Participating in professional organizations:

- Consulting with legal counsel as needed:

- Regularly reviewing company policies and procedures:

6. Describe your experience in managing a large caseload of delinquent accounts?

- Developing and implementing a structured collection process:

- Prioritizing accounts and allocating resources effectively:

- Using technology and automation to streamline tasks:

- Delegating responsibilities and monitoring team performance:

- Maintaining accurate and up-to-date records:

7. How do you evaluate the effectiveness of your collection efforts?

- Tracking key performance indicators (KPIs) such as collection rate:

- Analyzing data to identify trends and areas for improvement:

- Seeking feedback from debtors and stakeholders:

- Adjusting strategies and tactics based on performance:

- Continuously monitoring industry benchmarks:

8. What do you consider to be the ethical responsibilities of a Collections Specialist?

- Treating debtors with respect and dignity:

- Complying with all applicable laws and regulations:

- Maintaining confidentiality of debtor information:

- Avoiding harassment or intimidation tactics:

- Acting in a fair and impartial manner:

9. How would you deal with a debtor who claims financial hardship?

- Requesting financial documentation and verifying the claim:

- Exploring alternative payment arrangements such as reduced payments:

- Referring the debtor to financial counseling or assistance programs:

- Exploring legal options as a last resort:

- Documenting all interactions and communications:

10. What are some of the challenges and rewards of working as a Collections Specialist?

Challenges:

- Dealing with difficult or uncooperative debtors:

- Managing a high-volume of cases:

- Working under pressure and meeting performance targets:

- Complying with complex laws and regulations:

- Balancing ethical considerations with business objectives:

Rewards:

- Making a positive impact on the company’s financial performance:

- Helping debtors resolve their financial obligations:

- Developing strong negotiation and communication skills:

- Career growth and advancement opportunities:

- Personal satisfaction in contributing to the company’s success:

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Collections Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Collections Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Collections Specialists are responsible for collecting overdue payments from customers. They work with customers to create payment plans, negotiate settlements, and resolve disputes.

1. Communicate with Customers

Collections Specialists must be able to communicate effectively with customers, both verbally and in writing. They need to be able to explain the company’s policies and procedures, and answer questions about the customer’s account.

- Contact customers by phone, email, or mail to discuss overdue payments.

- Explain the company’s collection policies and procedures.

- Answer questions about the customer’s account.

2. Negotiate Payment Plans

Collections Specialists often need to negotiate payment plans with customers. They need to be able to assess the customer’s financial situation and determine a payment plan that is both affordable and realistic.

- Work with customers to create payment plans that are affordable and realistic.

- Negotiate settlements with customers who are unable to pay their full balance.

3. Resolve Disputes

Collections Specialists may also need to resolve disputes with customers. They need to be able to investigate the dispute and determine a fair resolution.

- Investigate disputes and determine a fair resolution.

- Work with customers to resolve disputes and improve customer satisfaction.

4. Maintain Records

Collections Specialists must maintain accurate records of all customer interactions. This includes tracking payments, promises to pay, and disputes.

- Maintain accurate records of all customer interactions.

- Track payments, promises to pay, and disputes.

Interview Tips

To prepare for your Collections Specialist interview, you should:

1. Research the Company

Learn as much as you can about the company and its collection policies. This will help you answer questions about the company and its approach to collections.

- Visit the company’s website.

- Read articles about the company in the news.

- Talk to people who work for the company.

2. Practice Your Communication Skills

Collections Specialists need to be able to communicate effectively with customers. Practice your communication skills by role-playing with a friend or family member.

- Role-play different customer scenarios.

- Practice explaining the company’s collection policies and procedures.

- Practice negotiating payment plans.

3. Be Prepared to Answer Questions About Collections

You should be prepared to answer questions about your experience with collections. This includes questions about your methods for collecting payments, negotiating settlements, and resolving disputes.

- Use the

- STAR method

- to answer questions about your experience.

4. Dress Professionally

Dress professionally for your interview. This shows that you are serious about the job and that you respect the interviewer.

- Wear a suit or business casual attire.

- Make sure your clothes are clean and pressed.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Collections Specialist interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!