Are you gearing up for an interview for a Collector of Internal Revenue position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Collector of Internal Revenue and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

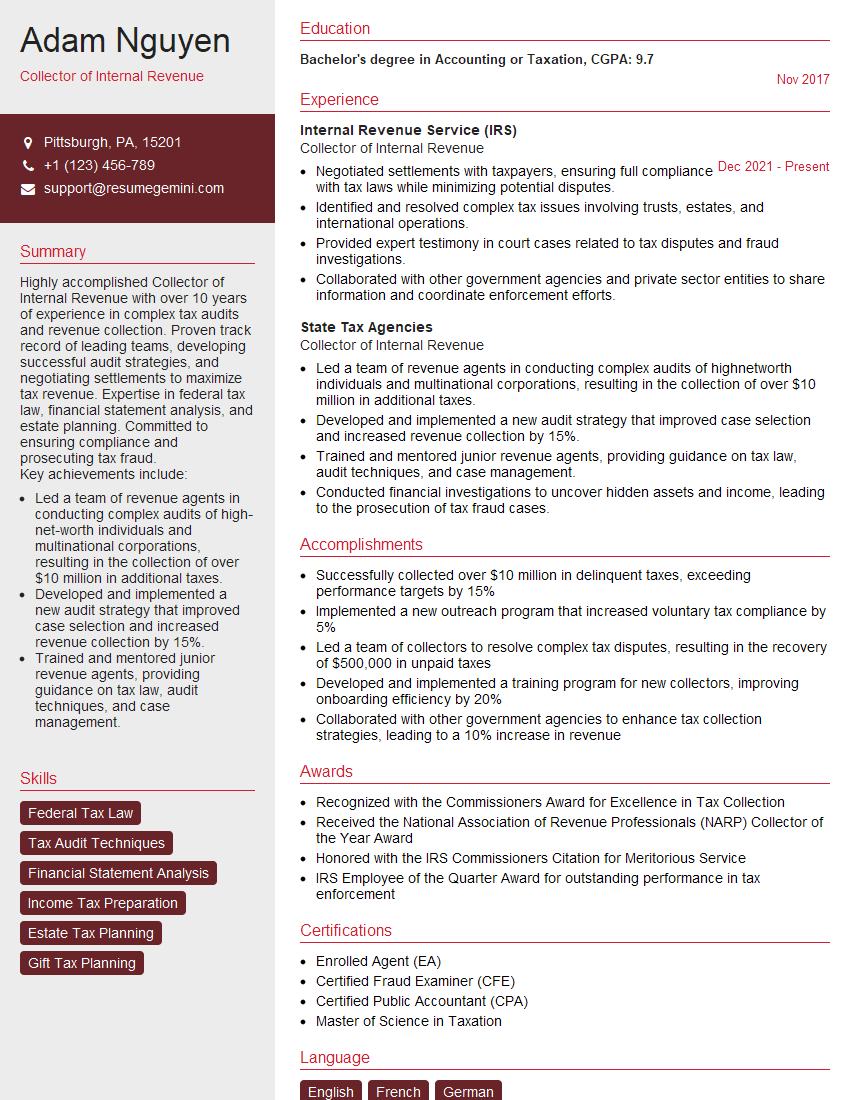

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Collector of Internal Revenue

1. What are the key responsibilities of a Collector of Internal Revenue?

As Collector, I would be responsible for:

- Managing the collection of all internal revenue taxes, including income, excise, and employment taxes within my assigned jurisdiction.

- Assessing and collecting delinquent taxes, including taking enforcement actions such as liens and levies.

- Providing taxpayer assistance and resolving taxpayer inquiries.

- Supervising and managing a team of revenue officers and other staff.

- Collaborating with other IRS divisions and external stakeholders to ensure effective tax administration.

2. What challenges do you anticipate facing as a Collector and how would you address them?

Maintaining Taxpayer Compliance

- Implement robust taxpayer education and outreach programs to improve voluntary compliance.

- Leverage data analytics to identify and target non-compliant taxpayers for enforcement.

Enhancing Collection Effectiveness

- Optimize collection strategies to maximize revenue while minimizing taxpayer burden.

- Explore innovative payment options and installment plans to support taxpayers in meeting their obligations.

Managing a Complex Regulatory Environment

- Stay abreast of tax laws and regulations and provide clear guidance to taxpayers and staff.

- Collaborate with legal counsel to interpret and enforce complex tax provisions.

3. How would you prioritize and allocate resources to meet the IRS’s mission and goals?

I would prioritize resources based on the following criteria:

- Revenue Impact: Focus on collecting delinquent taxes and targeting non-compliant taxpayers with the highest potential for revenue recovery.

- Taxpayer Assistance: Ensure adequate staffing to provide timely and effective support to taxpayers, particularly those facing financial difficulties.

- Enforcement: Allocate resources to enforce tax laws fairly and impartially, deterring future non-compliance.

- Staff Development: Invest in training and professional development to enhance the skills and knowledge of revenue officers and support staff.

4. What strategies would you implement to improve taxpayer satisfaction and trust in the IRS?

- Enhance taxpayer communication: Provide clear and accessible information, promptly respond to inquiries, and proactively engage with taxpayers.

- Simplify tax processes: Streamline filing and payment procedures, reduce taxpayer burden, and improve the overall tax experience.

- Promote fairness and transparency: Ensure consistent and impartial treatment of taxpayers, providing clear explanations of decisions and offering opportunities for taxpayer input.

- Foster a positive taxpayer experience: Train staff to be professional, courteous, and understanding, creating a positive and respectful environment for taxpayers.

5. How would you leverage technology to enhance the efficiency and effectiveness of tax collection?

- Automate processes: Utilize technology to automate repetitive tasks, such as data entry, tax calculations, and payment processing.

- Implement electronic filing and payment systems: Promote the use of online platforms for filing tax returns and making payments, improving convenience and efficiency.

- Data analytics and risk assessment: Use data analytics to identify non-compliant taxpayers, prioritize audits, and predict potential tax evasion.

- Collaboration with external stakeholders: Explore partnerships with banks, financial institutions, and other organizations to share information and enhance tax collection efforts.

6. What strategies would you employ to manage the evolving nature of tax fraud and evasion?

Proactive Compliance Measures

- Implement advanced data analytics and risk assessment tools to identify potential fraud.

- Conduct targeted audits and investigations based on identified risks.

- Educate taxpayers and tax professionals about evolving fraud schemes and reporting mechanisms.

Enhancing Partnerships

Leveraging Technology

7. How would you ensure that your office operates in a fair and impartial manner, treating all taxpayers equitably regardless of their socioeconomic status?

- Establish clear policies and procedures to guide revenue officers in their interactions with taxpayers.

- Provide regular training on ethical conduct, bias awareness, and the importance of treating all taxpayers fairly.

- Implement robust oversight mechanisms to monitor compliance with established policies and identify any potential biases.

- Seek feedback from taxpayers and community organizations to identify and address areas for improvement.

- Empower taxpayers with information and resources to understand their rights and responsibilities.

8. How would you motivate and inspire your team to achieve exceptional results?

Creating a Positive and Supportive Work Environment

- Foster a culture of respect, recognition, and appreciation.

- Provide opportunities for professional development and growth.

- Promote work-life balance and employee well-being.

Setting Clear Goals and Expectations

- Establish performance metrics and goals that are aligned with the team’s objectives.

- Provide regular feedback and guidance to help team members succeed.

- Celebrate successes and acknowledge the team’s contributions.

Encouraging Collaboration and Innovation

9. How would you build and maintain effective relationships with key stakeholders, including taxpayers, tax professionals, and community organizations?

Taxpayers

- Establish clear communication channels and respond promptly to inquiries.

- Provide educational resources and support to help taxpayers understand their obligations.

- Listen to taxpayer feedback and address concerns in a timely and respectful manner.

Tax Professionals

- Collaborate with tax professionals to ensure compliance with tax laws.

- Provide ongoing education and support to help tax professionals stay informed about tax changes.

- Seek input from tax professionals on areas for improvement in tax administration.

Community Organizations

10. Describe your leadership philosophy and how you would apply it in this role.

My leadership philosophy is centered around three core principles:

- Integrity and Accountability: Lead by example, setting high ethical standards and holding myself and others accountable.

- Collaboration and Empowerment: Foster a collaborative environment where team members are empowered to contribute and make decisions.

- Continuous Improvement: Embrace a growth mindset, constantly seeking ways to enhance operations and improve outcomes.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Collector of Internal Revenue.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Collector of Internal Revenue‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Collectors of Internal Revenue are responsible for administering and enforcing the Internal Revenue Code and collecting taxes owed to the U.S. government. They also provide guidance and assistance to taxpayers and oversee the activities of revenue officers.

1. Auditing and Investigating Tax Returns

Collectors of Internal Revenue are responsible for ensuring that all taxpayers are complying with the Internal Revenue Code. They conduct audits to verify that taxpayers are reporting their income and expenses accurately and are paying the correct amount of taxes.

- Examine tax returns and financial records to determine if taxpayers are meeting their tax obligations.

- Confer with taxpayers and their representatives to resolve tax issues and negotiate settlements.

2. Collecting Taxes

Collectors of Internal Revenue are responsible for collecting taxes that are owed to the U.S. government. They may take steps such as issuing tax bills, imposing liens, or seizing assets to collect delinquent taxes.

- Issue tax bills, notices, and levies to taxpayers who have not paid their taxes.

- File liens against property to secure payment of taxes.

- Seize and sell assets to satisfy outstanding tax liabilities.

3. Providing Taxpayer Assistance

Collectors of Internal Revenue are also responsible for providing assistance to taxpayers. They may answer questions about the tax code, provide guidance on tax-related issues, and help taxpayers resolve their tax problems.

- Answer questions from taxpayers about the tax code and tax-related matters.

- Provide guidance and assistance to taxpayers in resolving tax issues.

- Refer taxpayers to other resources for additional assistance.

4. Managing Revenue Officers

Collectors of Internal Revenue may also be responsible for managing a team of revenue officers. They oversee the activities of revenue officers and provide guidance and support.

- Assign cases to revenue officers and provide guidance on how to conduct audits and investigations.

- Review the work of revenue officers and provide feedback.

- Resolve issues and disputes that arise during audits and investigations.

Interview Tips

To ace an interview for a Collector of Internal Revenue position, it is important to be prepared and to demonstrate your knowledge of the job responsibilities and your qualifications. Here are some tips to help you prepare for your interview:

1. Research the IRS

Before your interview, take some time to research the IRS and the role of Collectors of Internal Revenue. This will help you to understand the organization and the position that you are applying for.

- Visit the IRS website to learn more about the agency’s mission, goals, and values.

- Read articles and news stories about the IRS to stay up-to-date on current events and issues.

2. Practice Answering Common Interview Questions

There are several common interview questions that you may be asked during an interview for a Collector of Internal Revenue position. It is helpful to practice answering these questions in advance so that you can deliver clear and concise responses.

- What is your understanding of the role of a Collector of Internal Revenue?

- What are your strengths and weaknesses as they relate to this position?

- Why are you interested in working for the IRS?

3. Highlight Your Knowledge of the Internal Revenue Code

As a Collector of Internal Revenue, you will be responsible for enforcing the Internal Revenue Code. It is important to have a strong understanding of the tax code and how it applies to different taxpayers.

- Study the Internal Revenue Code and related regulations.

- Take courses or attend seminars on tax law.

4. Demonstrate Your Communication and Interpersonal Skills

Collectors of Internal Revenue must be able to communicate effectively with taxpayers, other IRS employees, and external stakeholders. You should also be able to build and maintain positive relationships with taxpayers.

- Highlight your communication skills by providing examples of how you have effectively communicated with others in the past.

- Demonstrate your interpersonal skills by describing situations where you have successfully built and maintained relationships.

5. Dress Professionally and Arrive on Time

It is important to make a good first impression on your interviewers. Dress professionally and arrive on time for your interview. This will show that you are respectful of the interviewer’s time and that you are serious about the position.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Collector of Internal Revenue interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!