Feeling lost in a sea of interview questions? Landed that dream interview for Commercial Appraiser but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Commercial Appraiser interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

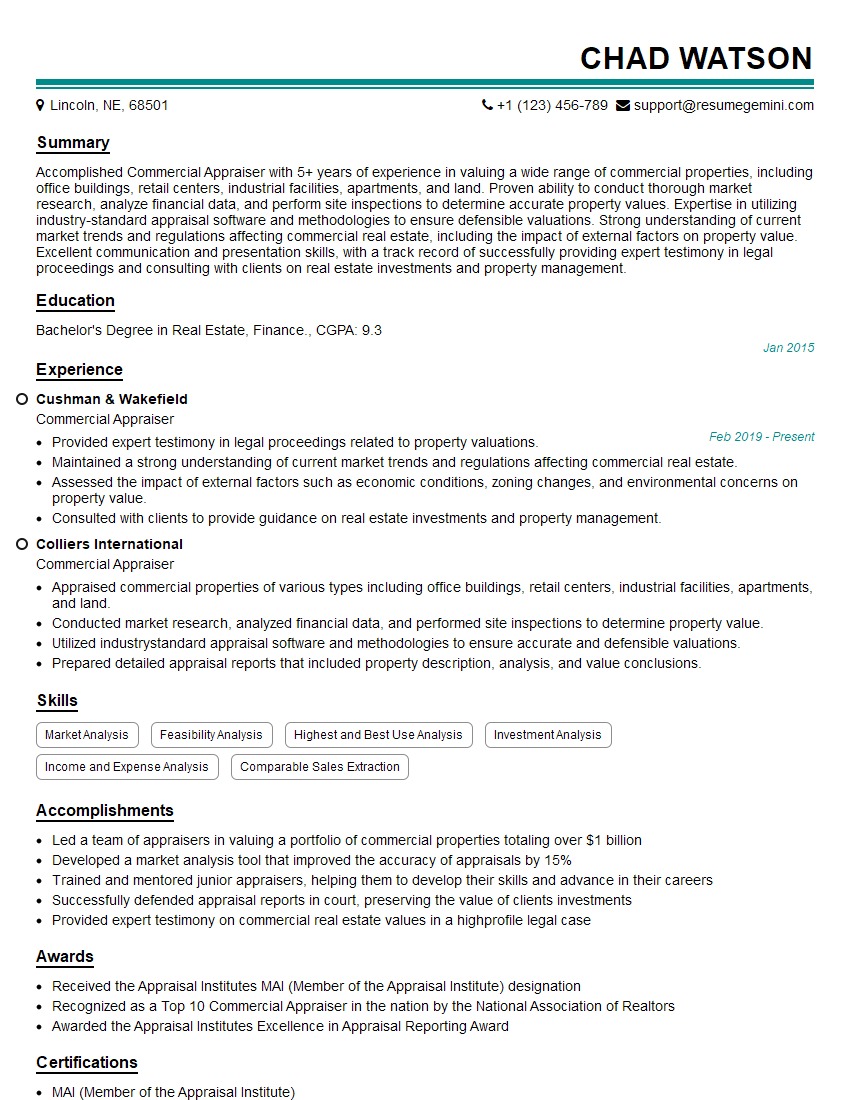

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Commercial Appraiser

1. How do you determine the value of a commercial property using the income capitalization approach?

In the income capitalization approach, the value of a commercial property is determined by dividing the net operating income (NOI) by the capitalization rate. NOI is calculated by subtracting operating expenses from the effective gross income. The capitalization rate is a percentage that represents the rate of return that investors expect to receive on their investment. It is typically based on market data and the risk associated with the property.

2. What are the different methods used to estimate the capitalization rate?

Market Data Approach

- Sales comparison approach: Compares the property to similar properties that have recently sold.

- Income capitalization approach: Divides the property’s net operating income (NOI) by the capitalization rate.

Band of Investment Approach

- Uses data from a group of properties that are similar to the subject property in terms of risk and return.

- Calculates a range of capitalization rates that are considered reasonable for the subject property.

Risk Premium Approach

- Starts with a risk-free rate of return, such as the yield on U.S. Treasury bonds.

- Adds a risk premium to the risk-free rate to reflect the additional risk associated with the subject property.

3. How do you adjust for the effects of obsolescence in a commercial appraisal?

Obsolescence is a decrease in the value of a property due to factors such as physical deterioration, functional obsolescence, and economic obsolescence. To adjust for the effects of obsolescence in a commercial appraisal, the appraiser will typically estimate the cost of repairs or renovations that would be necessary to bring the property up to current standards. The appraiser may also consider the impact of obsolescence on the property’s income-producing potential.

4. What are the different types of highest and best use analyses?

The highest and best use analysis is a process of determining the most profitable and feasible use of a piece of property. There are three main types of highest and best use analyses:

- As-is highest and best use: Assumes that the property will continue to be used for its current purpose.

- Prospective highest and best use: Considers the potential for future development or redevelopment of the property.

- Interim highest and best use: Considers the best use of the property for a period of time before it is redeveloped or converted to a higher and better use.

5. How do you determine the appropriate discount rate to use in a discounted cash flow analysis?

The discount rate is the rate of return that is used to convert future cash flows into present value. The appropriate discount rate to use in a discounted cash flow analysis will vary depending on the risk and uncertainty associated with the cash flows. Some of the factors that can affect the discount rate include:

- The risk-free rate of return

- The property’s beta

- The property’s capitalization rate

6. What are the different types of appraisal reports?

There are many different types of appraisal reports, each with its own specific purpose and format. Some of the most common types of appraisal reports include:

- Market value appraisal: Estimates the current market value of a property.

- Feasibility study: Analyzes the feasibility of a proposed development or redevelopment project.

- Cost appraisal: Estimates the cost to construct or renovate a property.

- Insurance appraisal: Estimates the value of a property for insurance purposes.

7. What are the ethical responsibilities of a commercial appraiser?

Commercial appraisers have a number of ethical responsibilities, including:

- Maintaining objectivity and impartiality

- Protecting the confidentiality of client information

- Disclosing any conflicts of interest

- Following all applicable laws and regulations

8. What are the current trends in the commercial real estate market?

The commercial real estate market is constantly evolving, with new trends emerging all the time. Some of the current trends in the market include:

- The rise of e-commerce and the impact on retail properties

- The growing demand for industrial properties

- The increasing popularity of mixed-use developments

- The impact of technology on the way that commercial properties are used and managed

9. What are the qualities of a successful commercial appraiser?

Successful commercial appraisers typically possess the following qualities:

- Strong analytical skills

- Excellent communication skills

- A deep understanding of the commercial real estate market

- The ability to work independently and as part of a team

- A commitment to ethical behavior

10. What is your experience with using appraisal software?

I have experience using a variety of appraisal software programs, including ARGUS, CoStar, and Real Estate Manager. I am proficient in using these programs to create and analyze appraisal reports, manage data, and perform financial modeling.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Commercial Appraiser.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Commercial Appraiser‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Commercial Appraisers are responsible for conducting valuations of various types of commercial properties, including office buildings, retail centers, industrial warehouses, and multi-family developments. Their primary objective is to determine the fair market value of these properties for various purposes such as lending, investment, taxation, and legal proceedings.

1. Property Inspection and Data Collection

Involves visiting the subject property to conduct a thorough inspection. During the inspection, appraisers note details such as the property’s physical condition, size, layout, and amenities. They also gather necessary data from various sources, such as county records, property tax assessments, and comparable sales.

2. Market Analysis and Comparables

Commercial Appraisers analyze market trends, economic indicators, and recent sales of comparable properties within the area where the subject property is located. This helps them determine the appropriate market-based value for the property.

3. Valuation Methods

There are several appraisal methods used to determine the value of commercial properties, such as the sales comparison approach, the income capitalization approach, and the cost approach. Appraisers select the most applicable method based on the property type, market conditions, and data availability.

4. Report Writing

After completing the valuation process, Commercial Appraisers prepare detailed reports that include their analysis, findings, and estimated value of the property. These reports must be clear, well-supported, and compliant with industry standards.

Interview Tips

To ace an interview for a Commercial Appraiser position, candidates should be well-prepared and demonstrate their knowledge, skills, and professionalism. Here are some helpful tips:

1. Research the Company and Position

Before the interview, take time to thoroughly research the company and the specific Commercial Appraiser role. This will allow you to understand the company’s culture, values, and business objectives. It will also help you tailor your answers to show how your skills and experience align with the company’s needs.

2. Quantify Your Experience

When describing your previous work experience in property valuation, use specific examples and quantify your accomplishments whenever possible. Instead of simply saying you analyzed market data, provide details on the size and complexity of the projects you worked on and how your analysis contributed to the success of the appraisals.

3. Highlight Applicable Skills and Certifications

Emphasize the skills and certifications that are most relevant to the job. This could include your expertise in using appraisal software, your understanding of real estate market trends, or your experience with specific property types. If you have any professional designations, such as MAI or SRA, be sure to mention them.

4. Prepare for Technical Questions

Commercial Appraiser interviews often involve technical questions about valuation methods, property types, and market analysis. Be prepared to discuss your understanding of these topics and demonstrate your ability to apply them in real-world scenarios.

5. Ask Thoughtful Questions

At the end of the interview, take the opportunity to ask the interviewer thoughtful questions about the company, the position, or the industry. This shows that you are genuinely interested in the job and that you have done your research. Some examples of good questions include asking about the company’s growth plans, the current market trends in the area, or the opportunities for professional development.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Commercial Appraiser, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Commercial Appraiser positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.