Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Commercial Lender position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

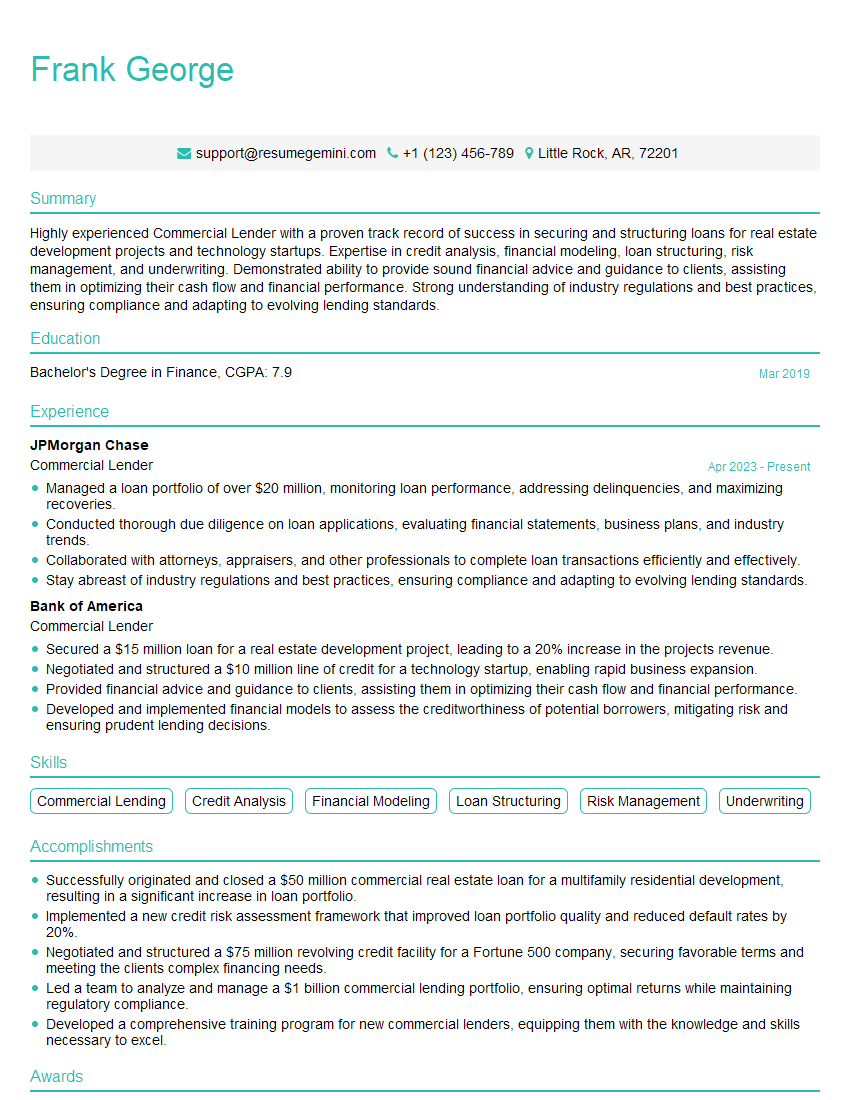

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Commercial Lender

1. Walk me through the steps of credit analysis for a commercial loan.

Answer:

- Gather and review financial statements: Analyze balance sheets, income statements, and cash flow statements to assess the borrower’s financial health.

- Evaluate management team: Consider the experience, track record, and financial acumen of the company’s management.

- Assess industry and competitive factors: Analyze the industry dynamics, competitive landscape, and potential risks affecting the borrower’s operations.

- Underwrite the loan: Determine the loan amount, terms, covenants, and collateral based on the analysis and risk assessment.

- Monitor the loan: Regularly review the borrower’s financial performance, industry trends, and any potential risks to maintain loan quality.

2. Describe the key ratios you use to evaluate a commercial loan application.

Financial Health Ratios

- Debt-to-Equity Ratio: Assesses the borrower’s leverage and financial risk.

- Current Ratio: Measures the ability to pay short-term obligations.

- Quick Ratio: A more conservative measure of liquidity, excluding inventory.

- Return on Equity: Indicates the efficiency of using shareholders’ equity.

Profitability Ratios

- Gross Profit Margin: Shows the profitability of core business operations.

- Net Profit Margin: Demonstrates the overall profitability after expenses.

- Return on Assets: Measures how effectively assets generate profit.

3. How do you assess the collateral value for a commercial loan?

Answer:

- Appraisal: Obtain an independent appraisal to determine the fair market value of the collateral.

- Inspection: Physically inspect the collateral to assess its condition and potential risks.

- Market Analysis: Research comparable properties or assets to support the appraisal value.

- Loan-to-Value Ratio: Calculate the loan amount as a percentage of the collateral value to ensure adequate coverage.

- Legal Due Diligence: Review legal documents to verify ownership, liens, or other encumbrances.

4. What are the different types of commercial loans, and when would you recommend each type?

Answer:

- Term Loans: Long-term loans with fixed or variable interest rates, secured or unsecured.

- Lines of Credit: Flexible borrowing facilities for short-term working capital needs.

- Equipment Loans: Loans specifically designed to finance the acquisition of equipment.

- Real Estate Loans: Secured loans used to purchase or refinance commercial properties.

5. How do you handle loan covenants and how do you ensure compliance?

Answer:

- Review and negotiate covenants: Carefully analyze loan covenants to understand the borrower’s obligations and restrictions.

- Monitor compliance: Regularly request financial statements and other information to monitor the borrower’s performance against the covenants.

- Communicate with the borrower: Establish clear communication channels to promptly address any potential compliance issues.

- Enforce covenants: If necessary, take action to enforce covenants and protect the lender’s interests.

6. How do you build and maintain relationships with commercial loan customers?

Answer:

- Proactive communication: Regularly reach out to customers, inquire about their business performance, and provide updates on the loan.

- Value-added services: Offer financial advisory, credit analysis, or other services to support the customer’s business goals.

- Industry knowledge: Stay informed about the customer’s industry, market trends, and potential opportunities.

- Personal touch: Build personal relationships with key contacts within the customer’s organization.

7. What are the key trends and challenges in the commercial lending industry?

Answer:

- Technology advancements: Automation, data analytics, and mobile banking are transforming the lending process.

- Regulatory compliance: Increased regulations and scrutiny require lenders to strengthen risk management and compliance practices.

- Competition: Non-traditional lenders and fintech companies are entering the market, creating increased competition.

- Economic uncertainty: Economic downturns or market volatility can impact loan demand and repayment ability.

8. How do you assess the creditworthiness of a business?

Answer:

- Financial analysis: Evaluate financial statements to determine financial health, profitability, and cash flow.

- Industry analysis: Research the industry’s competitive landscape, growth potential, and regulatory environment.

- Management team assessment: Consider the experience, track record, and depth of the management team.

- Credit history: Review the borrower’s previous credit performance, including payment history and any defaults.

9. Describe your approach to managing risk in commercial lending.

Answer:

- Diversification: Spread loan portfolio across different industries, asset classes, and customers to reduce concentration risk.

- Credit risk analysis: Thoroughly assess the creditworthiness of borrowers before approving loans.

- Collateralization: Require collateral to secure loans, providing a cushion in case of default.

- Loan covenants: Include loan covenants that restrict the borrower’s financial actions and protect the lender’s interests.

10. How do you handle loan workouts when a borrower faces financial difficulties?

Answer:

- Early intervention: Monitor borrowers closely and address potential problems early on.

- Communication and negotiation: Engage with borrowers to understand their situation and explore possible solutions.

- Workout options: Negotiate loan modifications, payment plans, or other arrangements to help the borrower overcome difficulties.

- Foreclosure: If other options are not feasible, consider foreclosure as a last resort to protect the lender’s interests.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Commercial Lender.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Commercial Lender‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Commercial Lenders are responsible for managing the financial needs of businesses and organizations. They evaluate loan applications, determine creditworthiness, negotiate loan terms, and manage loan portfolios. Key job responsibilities include:

1. Loan Origination

Identifying potential borrowers, evaluating loan applications, and assessing the creditworthiness of borrowers.

- Analyzing financial statements, business plans, and other relevant documents.

- Conducting due diligence to verify the accuracy of information provided by borrowers.

2. Loan Structuring and Negotiation

Negotiating loan terms, including interest rates, repayment schedules, and collateral requirements.

- Ensuring that loan terms comply with bank policies and regulatory requirements.

- Protecting the bank’s interests by securing appropriate collateral and personal guarantees.

3. Loan Administration

Managing loan portfolios, monitoring loan performance, and collecting payments.

- Tracking loan balances, interest payments, and maturity dates.

- Responding to borrower inquiries and resolving any issues that may arise.

4. Customer Relationship Management

Building and maintaining relationships with borrowers and other stakeholders.

- Understanding the business needs of borrowers and providing tailored financial solutions.

- Nurturing relationships with key decision-makers and influencers.

Interview Tips

Preparing for a Commercial Lender interview requires a thorough understanding of the role, industry knowledge, and effective communication skills. Here are some tips to help you ace the interview:

1. Research the Company and Industry

Learn about the bank’s history, products, and financial performance. Study industry trends and recent developments in commercial lending.

- Visit the bank’s website and read its annual reports.

- Stay up-to-date on industry news and regulations through publications and webinars.

2. Highlight Relevant Experience and Skills

Emphasize your experience in loan origination, underwriting, or portfolio management. Quantify your accomplishments and provide specific examples of your successes.

- Use the STAR method (Situation, Task, Action, Result) to describe your experiences.

- Be prepared to discuss how your skills align with the job requirements.

3. Practice Answering Common Interview Questions

Common interview questions for Commercial Lenders include:

- Tell me about your experience in commercial lending.

- How do you evaluate the creditworthiness of a borrower?

- What are the key factors you consider when structuring a loan?

- How do you manage a loan portfolio?

- What is your understanding of the regulatory environment for commercial lending?

4. Prepare Questions for the Interviewer

Asking thoughtful questions demonstrates your interest in the role and the company. Prepare questions about the bank’s lending strategy, growth plans, and corporate culture.

- Ask about the bank’s target market and the types of loans it specializes in.

- Inquire about the bank’s plans for growth and expansion.

- Ask about the bank’s culture and values, and how they align with your own.

5. Dress Professionally and Arrive Punctually

First impressions matter. Dress professionally and arrive at the interview on time. Maintain a positive and confident demeanor throughout the interview process.

- Choose a suit or business casual attire that is appropriate for the bank’s culture.

- Be punctual and arrive at the interview location 10-15 minutes early.

6. Follow Up

After the interview, send a thank-you note to the interviewer. Reiterate your interest in the position and highlight any key points from the interview.

- Send the thank-you note within 24 hours of the interview.

- Keep the note brief and professional, and avoid repeating everything you said in the interview.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Commercial Lender role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.