Feeling lost in a sea of interview questions? Landed that dream interview for Commercial Lines Insurance Agent but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Commercial Lines Insurance Agent interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

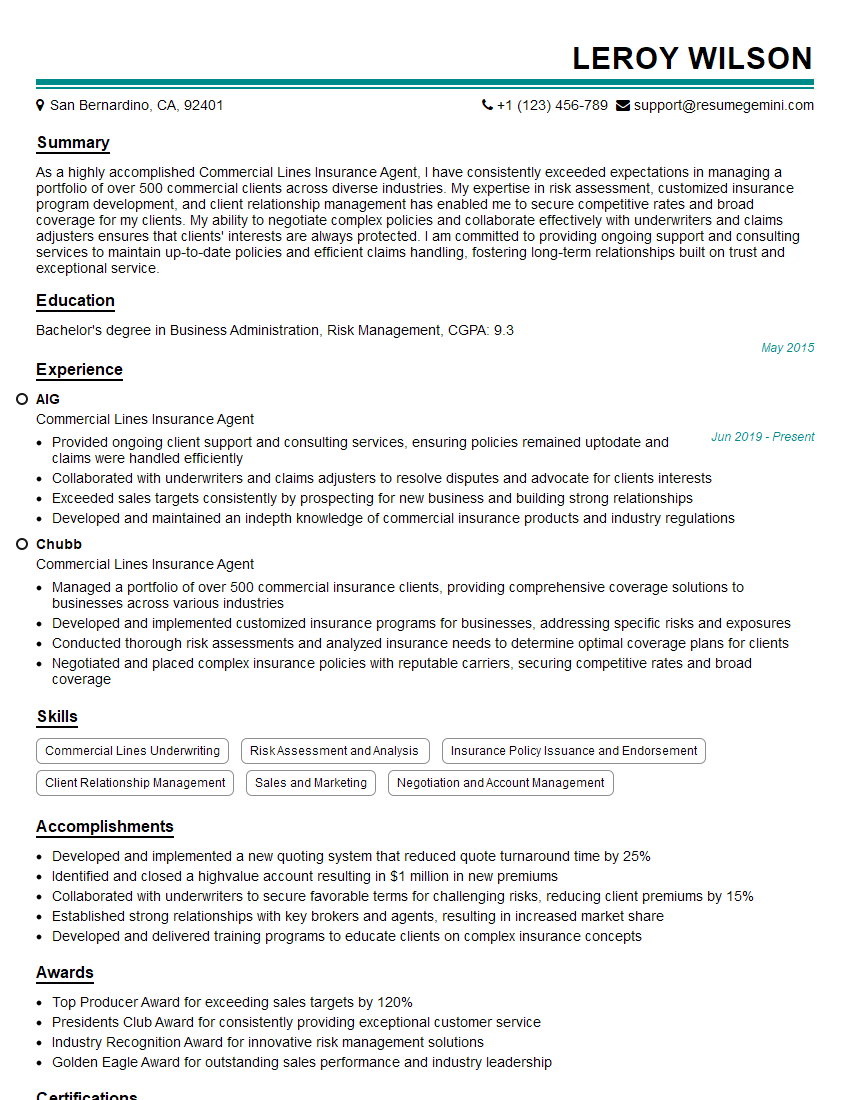

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Commercial Lines Insurance Agent

1. Explain the key differences between Commercial General Liability (CGL) and Business Owners Policy (BOP)?

Answer:

- Coverage Scope: CGL provides comprehensive liability coverage for third-party claims, while BOP offers a broader range of coverage, including property, business income, and crime.

- Target Audience: CGL is designed for businesses of all sizes, while BOP is typically targeted towards smaller businesses with relatively low risk exposures.

- Premiums: CGL premiums are generally higher than BOP premiums due to the broader coverage offered.

2. Describe the underwriting process for a large commercial property risk?

Answer:

Risk Assessment:

- Review property details, including location, construction, and occupancy.

- Assess the potential for natural disasters, crime, and other hazards.

- Inspect the property to identify any safety or maintenance issues.

Financial Analysis:

- Review the company’s financial statements to determine its financial stability.

- Assess the company’s ability to pay premiums and withstand losses.

- Determine appropriate deductibles and limits of coverage.

Pricing and Risk Mitigation:

- Calculate the premium based on the risk assessment and financial analysis.

- Identify risk mitigation measures to reduce the potential for claims.

- Negotiate terms and conditions of the policy with the insured.

3. How would you approach a new commercial client who is currently uninsured?

Answer:

- Identify Client Needs: Conduct a thorough risk assessment to understand their exposures and insurance needs.

- Explain Value Proposition: Highlight the benefits of insurance, including protection from financial losses and peace of mind.

- Compare Options: Present different insurance options that align with their budget and risk profile.

- Build Trust: Establish a positive rapport and answer their questions thoroughly to demonstrate your expertise.

- Close the Deal: Negotiate terms and conditions, and guide the client through the application process.

4. Describe the common types of endorsements used on Commercial Auto policies and their applications?

Answer:

- Hired and Non-Owned Auto: Extends coverage to vehicles rented or borrowed by the insured.

- Additional Insured: Adds third parties as insured under the policy.

- Commercial Umbrella: Provides excess liability coverage above the limits of the underlying policy.

- Extended Reporting Period: Extends the time available to report claims after the policy expiration date.

- Loss of Use: Covers expenses incurred when an insured vehicle is damaged or disabled.

5. Explain the concepts of subrogation and contribution in commercial insurance?

Answer:

- Subrogation: The insurer’s right to pursue recovery from a third party who caused or contributed to a loss covered by the policy.

- Contribution: The principle that two or more insurers sharing responsibility for a loss can require each other to contribute their proportionate share of the settlement.

6. Describe the process of issuing a certificate of insurance to a third party?

Answer:

- Verify Coverage: Confirm that the coverage requested by the third party is included in the policy.

- Prepare Certificate: Complete the certificate of insurance form with accurate policy information, including coverage limits and effective dates.

- Send Certificate: Provide the certificate to the third party electronically or by mail.

- Maintain Records: Keep a copy of the issued certificate for future reference.

7. Explain the role of technology in commercial lines insurance?

Answer:

- Policy Management: Online platforms and mobile apps allow agents and clients to access policy information, track claims, and make payments conveniently.

- Risk Assessment: Advanced analytics and data-driven tools assist insurers in assessing risks more accurately and tailoring policies accordingly.

- Claims Processing: Automated claims processing systems streamline the claims handling process, reducing delays and improving customer satisfaction.

- Customer Engagement: Chatbots and virtual assistants provide 24/7 support and enhance communication between agents and clients.

8. Describe the key elements of a well-structured insurance program for a manufacturing company?

Answer:

- Property Coverage: Protection against damage or loss to the company’s physical assets, including buildings, equipment, and inventory.

- Business Interruption Insurance: Coverage for lost income due to business disruptions caused by covered events.

- Workers’ Compensation: Insurance that provides benefits to employees who are injured or become ill as a result of their work.

- Cyber Liability: Coverage against risks associated with data breaches, hacking, and ransomware attacks.

- Product Liability: Coverage for damages caused by defective products or services.

9. Explain the different types of coverage options available for cyber insurance?

Answer:

- First-Party Coverage: Covers the policyholder’s own expenses and losses related to a cyber incident, including breach response costs and lost income.

- Third-Party Coverage: Protects the policyholder against liability for damages caused to others, such as customers or partners, due to a cyber incident.

- Crime Coverage: Covers losses resulting from employee theft or fraud involving electronic funds and data.

- Business Interruption Coverage: Reimburses the policyholder for lost income and extra expenses caused by a cyber incident that disrupts business operations.

10. Describe the regulatory environment for commercial lines insurance and how it impacts your role?

Answer:

- Solvency and Capital Requirements: Insurance companies must maintain sufficient financial resources to meet their obligations to policyholders.

- Fair Dealing Laws: Insurers are required to treat policyholders fairly and not engage in unfair or deceptive practices.

- Privacy Regulations: Insurance companies must comply with privacy laws that protect the confidentiality of clients’ personal information.

- Anti-Trust Laws: Insurers are prohibited from engaging in anti-competitive practices, such as price-fixing or market division.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Commercial Lines Insurance Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Commercial Lines Insurance Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities for Commercial Lines Insurance Agent

Commercial Lines Insurance Agents play a crucial role in the insurance industry. They work with businesses to help them assess their risks and develop insurance policies to mitigate those risks. Key job responsibilities include:1. Prospecting and Lead Generation

Identifying and reaching out to potential customers who have commercial insurance needs

- Developing targeted marketing campaigns

- Networking with business owners and brokers

2. Risk Assessment and Policy Development

Evaluating the risks faced by businesses and designing customized insurance plans that meet their unique needs

- Analyzing financial statements, loss history, and industry trends

- Recommending tailored coverage options

3. Client Management and Relationship Building

Maintaining strong relationships with existing clients and building new ones

- Providing exceptional customer service

- Understanding clients’ business objectives and goals

4. Sales and Commission Management

Selling commercial insurance policies and generating revenue for the agency

- Negotiating policy terms and premiums

- Tracking commission earnings

5. Market Research and Knowledge Management

Staying abreast of industry trends and best practices to provide clients with expert advice

- Attending industry events and webinars

- Reading industry publications and researching new products

Interview Tips to Ace the Interview

Preparing for an interview for a Commercial Lines Insurance Agent position requires a combination of technical knowledge, communication skills, and industry-specific insights. Here are some tips to help you ace the interview:1. Research the Company and Position

Familiarize yourself with the company’s website, recent news, and industry reputation

- Identify the specific job requirements and how your skills and experience match

- Prepare questions that demonstrate your knowledge and interest in the company

2. Practice Your Communication Skills

Be confident and articulate in your answers during the interview

- Use clear and concise language, and avoid jargon

- Practice answering common interview questions, such as “Tell me about yourself” and “Why are you interested in this position?”

3. Showcase Your Technical Expertise

Demonstrate your understanding of commercial insurance policies, risk assessment, and underwriting processes

- Explain your experience in different lines of commercial insurance, such as property, liability, or workers’ compensation

- Provide examples of successful insurance plans you have developed for clients

4. Highlight Your Client-Building Skills

Emphasize your ability to build and maintain relationships with clients

- Share stories of how you have resolved client issues and exceeded their expectations

- Explain how you approach client onboarding and provide ongoing support

5. Be Enthusiastic and Professional

Show your passion for the insurance industry and your desire to join the team

- Dress professionally and arrive on time for your interview

- Be positive and enthusiastic throughout the interview, and ask thoughtful questions

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Commercial Lines Insurance Agent interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!