Are you gearing up for a career in Commercial Lines Manager? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Commercial Lines Manager and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

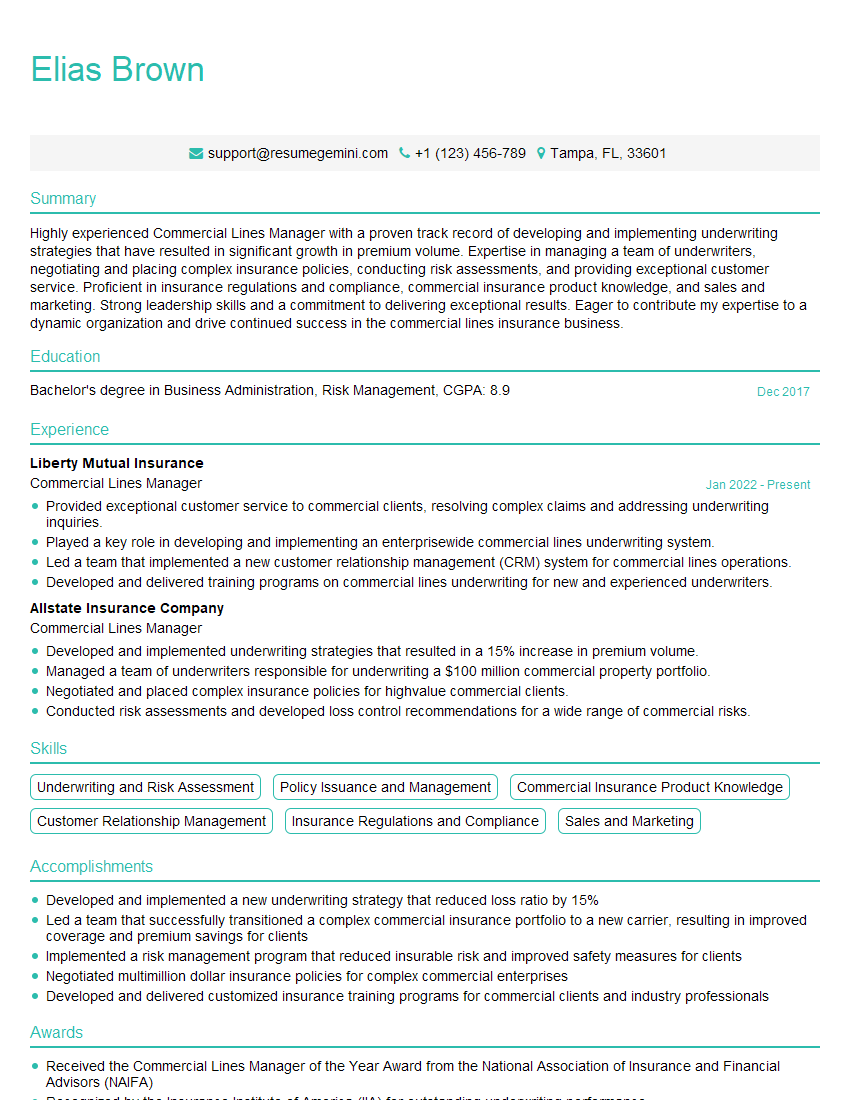

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Commercial Lines Manager

1. Describe the key challenges facing the commercial lines insurance industry in today’s market?

The commercial lines insurance industry is facing a number of key challenges in today’s market, including:

- Increased competition: The number of insurance companies offering commercial lines coverage has increased in recent years, leading to increased competition for clients.

- Rising costs: The cost of claims has been rising in recent years, due to a number of factors, such as the increasing cost of medical care and the increasing frequency of natural disasters.

- Changing regulations: The regulatory environment for the insurance industry is constantly changing, and these changes can have a significant impact on the way that insurance companies do business.

2. What is your understanding of the different types of commercial lines insurance policies available?

Property insurance

- Covers damage to or loss of physical property, such as buildings, equipment, and inventory.

Liability insurance

- Protects businesses from financial losses resulting from claims of negligence or wrongdoing.

Business interruption insurance

- Provides coverage for lost income and expenses if a business is forced to close due to a covered event.

3. How do you stay up-to-date on the latest trends in the commercial lines insurance industry?

I stay up-to-date on the latest trends in the commercial lines insurance industry by:

- Reading industry publications and attending industry events.

- Networking with other insurance professionals.

- Taking continuing education courses.

4. What are your strengths and weaknesses as a commercial lines manager?

My strengths as a commercial lines manager include:

- Strong understanding of the commercial lines insurance market.

- Excellent communication and interpersonal skills.

- Proven ability to develop and maintain relationships with clients and brokers.

My weaknesses include:

- Lack of experience in managing a large team.

- Not fluent in Spanish.

5. What is your experience with underwriting commercial lines insurance policies?

I have over 10 years of experience underwriting commercial lines insurance policies. During that time, I have underwritten a wide range of policies, including:

- Property insurance

- Liability insurance

- Business interruption insurance

- Commercial auto insurance

6. How do you handle difficult clients?

When dealing with difficult clients, I always try to remain calm and professional. I listen to their concerns and try to understand their point of view. I then work with them to find a solution that meets their needs and the needs of the company.

7. What is your experience with using insurance software?

I have experience using a variety of insurance software programs, including:

- Policy Management System (PMS)

- Rating and quoting software

- Claims management software

8. What is your leadership style?

My leadership style is collaborative and results-oriented. I believe in empowering my team members and giving them the autonomy to make decisions. I am also always available to provide support and guidance when needed.

9. How do you motivate your team?

I motivate my team by:

- Setting clear goals and expectations.

- Providing regular feedback and recognition.

- Creating a positive and supportive work environment.

10. What are your career goals?

My career goal is to become a vice president of underwriting for a major insurance company. I believe that my skills and experience make me a good fit for this role.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Commercial Lines Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Commercial Lines Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Commercial Lines Manager is responsible for leading a team of underwriters and managing the underwriting process for commercial insurance policies. They work closely with clients to assess their risk exposures and develop customized insurance solutions. The key job responsibilities of a Commercial Lines Manager include:

1. Underwriting

Underwriting is the process of evaluating and assessing the risk associated with an insurance policy. Commercial Lines Managers are responsible for reviewing applications, conducting risk assessments, and determining the appropriate coverage and pricing for each policy. They must have a strong understanding of underwriting principles and be able to make sound judgments based on their analysis of the risk.

- Review and analyze insurance applications

- Conduct risk assessments to determine the likelihood and severity of potential losses

- Determine the appropriate coverage and pricing for each policy

2. Client Management

Commercial Lines Managers work closely with clients to develop and maintain strong relationships. They are responsible for understanding the client’s business needs and providing them with the best possible insurance solutions. They must be able to communicate effectively, build rapport, and negotiate effectively on behalf of their clients.

- Develop and maintain strong relationships with clients

- Understand the client’s business needs and provide them with the best possible insurance solutions

- Communicate effectively, build rapport, and negotiate effectively on behalf of clients

3. Team Management

Commercial Lines Managers are responsible for leading and managing a team of underwriters. They must be able to motivate and inspire their team to achieve their goals, and provide them with the necessary support and training. They must also be able to resolve conflicts and create a positive and productive work environment.

- Lead and manage a team of underwriters

- Motivate and inspire the team to achieve their goals

- Provide the necessary support and training

- Resolve conflicts and create a positive and productive work environment

4. Business Development

Commercial Lines Managers are responsible for developing and growing their business. They must be able to identify new opportunities, develop marketing strategies, and close deals. They must also be able to build relationships with other professionals in the insurance industry.

- Identify new opportunities and develop marketing strategies

- Close deals and build relationships with other professionals in the insurance industry

Interview Tips

Preparing for an interview for a Commercial Lines Manager position can be daunting, but by following these tips, you can increase your chances of success.

1. Research the Company and the Position

Before the interview, take some time to research the company and the specific position you are applying for. This will help you understand the company’s culture, values, and goals, as well as the specific requirements of the position. You can find this information on the company’s website, LinkedIn page, and other online resources.

- Visit the company’s website and LinkedIn page

- Read articles and news stories about the company

- Talk to people in your network who work at the company

2. Practice Your Answers to Common Interview Questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It is important to practice your answers to these questions so that you can deliver them confidently and concisely. You can practice with a friend or family member, or you can record yourself and listen back to your answers.

- Practice answering common interview questions

- Deliver your answers confidently and concisely

- Practice with a friend or family member, or record yourself and listen back to your answers

3. Be Prepared to Talk About Your Experience and Skills

The interviewer will want to know about your experience and skills, so be prepared to talk about your accomplishments in detail. Highlight your experience in underwriting, client management, team management, and business development. Be sure to quantify your accomplishments whenever possible, using specific numbers and metrics to demonstrate your impact.

- Highlight your experience in underwriting, client management, team management, and business development

- Quantify your accomplishments whenever possible

- Use specific numbers and metrics to demonstrate your impact

4. Be Enthusiastic and Positive

The interviewer will be looking for someone who is enthusiastic and passionate about the insurance industry. Be sure to convey your excitement about the position and the opportunity to work with the company. Be positive and upbeat, and show the interviewer that you are confident in your abilities.

- Be enthusiastic and passionate about the insurance industry

- Convey your excitement about the position and the opportunity to work with the company

- Be positive and upbeat, and show the interviewer that you are confident in your abilities

Next Step:

Now that you’re armed with the knowledge of Commercial Lines Manager interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Commercial Lines Manager positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini