Are you gearing up for a career in Commercial Loan Collection Officer? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Commercial Loan Collection Officer and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

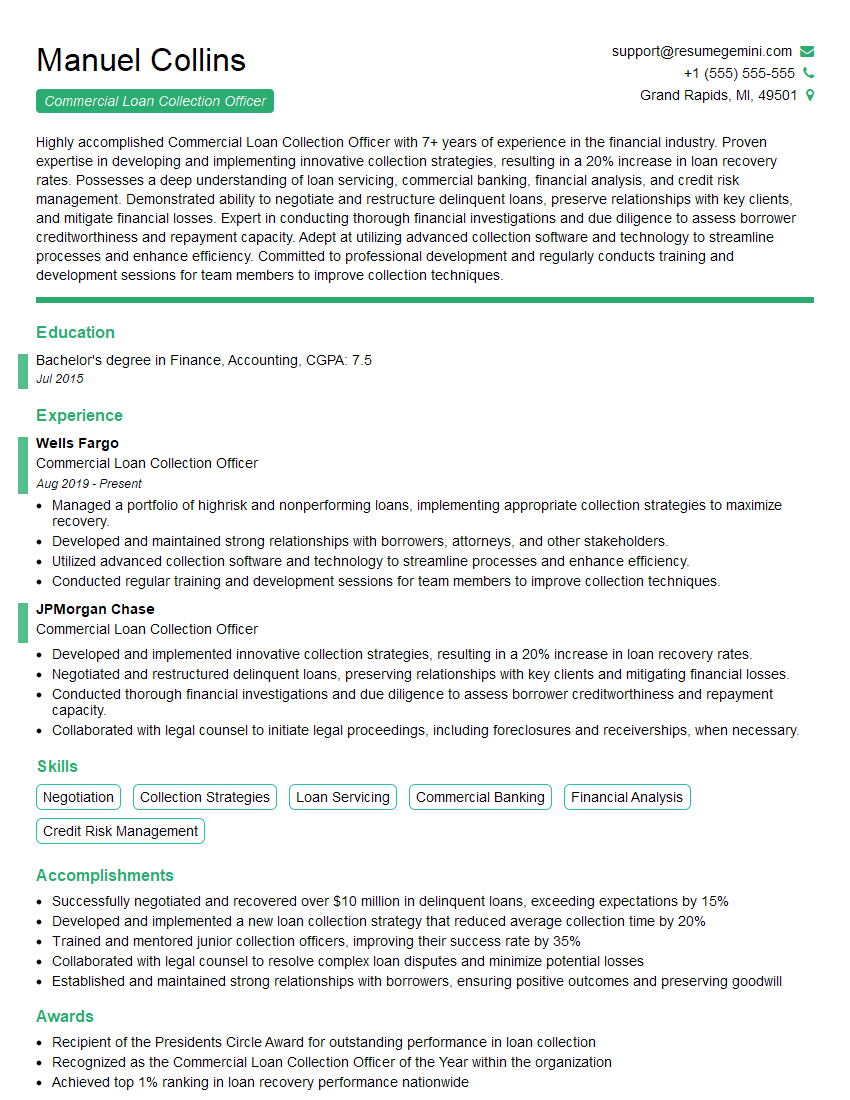

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Commercial Loan Collection Officer

1. Describe the process you would follow to recover a delinquent commercial loan account?

- Establish contact with the borrower and determine the reason for delinquency.

- Review the loan agreement and collateral documents to understand the borrower’s obligations and the bank’s rights.

- Develop a collection strategy based on the borrower’s financial situation and the nature of the delinquency.

- Negotiate a repayment agreement or work out plan with the borrower.

- Monitor the borrower’s compliance with the repayment agreement and take appropriate action if the borrower defaults.

2. What are some of the challenges you have faced in your previous role as a Commercial Loan Collection Officer?

Communication with borrowers

- Borrowers may be difficult to reach or unresponsive to communication attempts.

- Language barriers or cultural differences can make communication challenging.

Negotiation and agreement

- Borrowers may be unwilling or unable to make payments as agreed.

- Negotiating a repayment agreement that is both fair to the borrower and protects the bank’s interests can be difficult.

3. How do you stay up-to-date on the latest collection laws and regulations?

- Attend industry conferences and workshops.

- Read trade publications and legal journals.

- Consult with attorneys and other experts as needed.

4. Describe a time when you successfully collected on a delinquent loan.

In my previous role, I was responsible for collecting on a $1 million delinquent commercial loan. The borrower was a small business owner who had been experiencing financial difficulties due to the economic downturn. I worked with the borrower to develop a repayment plan that allowed him to make gradual payments over a period of time. I also provided him with resources to help him improve his financial situation. As a result of my efforts, the borrower was able to repay the loan in full and avoid foreclosure.

5. What are your strengths and weaknesses as a Commercial Loan Collection Officer?

Strengths:- Excellent communication and negotiation skills.

- Strong understanding of commercial lending and collection laws and regulations.

- Ability to build rapport with borrowers and understand their financial situation.

- Proven track record of successful loan collections.

- Limited experience with large-scale commercial loan collections.

- Can sometimes be too empathetic towards borrowers.

6. Why are you interested in working as a Commercial Loan Collection Officer at our bank?

I am interested in working as a Commercial Loan Collection Officer at your bank because I am confident that I have the skills and experience necessary to be successful in this role. I am also excited about the opportunity to work with a team of experienced professionals and contribute to the success of your bank.

7. What is your salary expectation?

My salary expectation is commensurate with my experience and qualifications. I am open to discussing a salary that is fair and competitive for this role.

8. What are your career goals?

My career goal is to become a leader in the commercial loan collection industry. I am confident that I can achieve this goal by working hard, developing my skills, and building strong relationships with my colleagues and clients.

9. Do you have any questions for me?

Yes, I have a few questions:

- What is the bank’s policy on loan workouts and modifications?

- What is the size of the average commercial loan portfolio that you manage?

- What is the bank’s expectation for loan collection success rates?

10. Anything else you would like to add?

I am confident that I have the skills and experience necessary to be successful as a Commercial Loan Collection Officer at your bank. I am a hard worker, I am committed to providing excellent customer service, and I am confident that I can make a positive contribution to your team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Commercial Loan Collection Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Commercial Loan Collection Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

1. Maintain Positive Customer Relationships

A Commercial Loan Collection Officer is responsible for maintaining positive relationships with customers, even in challenging situations. This involves understanding the customer’s situation, being empathetic, and working with them to find a solution that meets both their needs and the bank’s.

2. Effectively Communicate with Customers

Excellent communication skills are essential for a Commercial Loan Collection Officer. They must be able to clearly and effectively communicate with customers, both verbally and in writing. This includes explaining complex financial concepts in a way that customers can understand, and being able to negotiate and resolve disputes.

3. Manage Accounts and Track Progress

A Commercial Loan Collection Officer is responsible for managing customer accounts and tracking progress. This involves tracking payments, identifying problem accounts, and working with customers to develop and implement repayment plans.

4. Investigate and Resolve Delinquent Accounts

Investigating and resolving delinquent accounts is a key responsibility of a Commercial Loan Collection Officer. This involves contacting customers, reviewing financial statements, and taking appropriate action to collect on overdue debts.

5. Stay Up-to-Date on Regulations and Compliance

Commercial Loan Collection Officers must stay up-to-date on all applicable regulations and compliance requirements. This includes understanding the Fair Debt Collection Practices Act (FDCPA) and other relevant laws.

Interview Preparation Tips

1. Research the Company and the Role

Before the interview, take the time to research the company and the specific role you are applying for. This will help you understand the company’s culture, goals, and what they are looking for in a Commercial Loan Collection Officer.

2. Practice Your Answers to Common Interview Questions

There are a number of common interview questions that you are likely to be asked, such as “Why are you interested in this role?” and “What are your strengths and weaknesses?”. Practice answering these questions in advance so that you can deliver confident and articulate responses.

3. Be Prepared to Talk About Your Experience

The interviewer will want to know about your experience in commercial loan collection. Be prepared to talk about your successes and any challenges you have faced. Use specific examples to illustrate your skills and abilities.

4. Ask Questions

At the end of the interview, be sure to ask the interviewer questions about the role and the company. This shows that you are interested and engaged in the opportunity. It also gives you a chance to clarify any questions you have.

5. Follow Up

After the interview, send a thank-you note to the interviewer. This is a simple way to show your appreciation for their time and to reiterate your interest in the role.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Commercial Loan Collection Officer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!