Feeling lost in a sea of interview questions? Landed that dream interview for Commercial Loan Reviewer but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Commercial Loan Reviewer interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

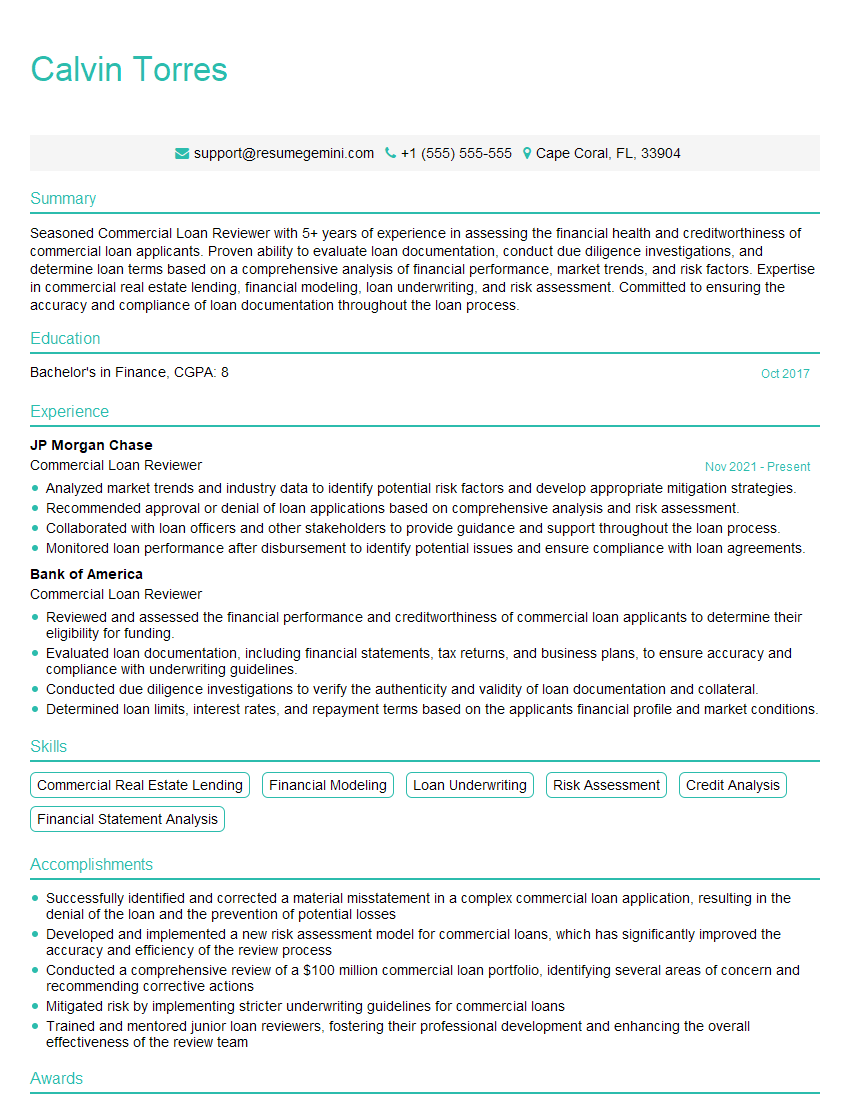

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Commercial Loan Reviewer

1. What is the purpose of a commercial loan review?

- To assess the borrower’s creditworthiness and ability to repay the loan

- To identify any potential risks associated with the loan

- To ensure that the loan is in compliance with all applicable regulations

2. What are the key factors that you consider when reviewing a commercial loan application?

- The borrower’s financial strength and stability

- The purpose of the loan

- The collateral securing the loan

- The loan terms and conditions

3. What are the different types of commercial loan products that you are familiar with?

- Term loans

- Lines of credit

- Equipment loans

- Real estate loans

4. What are the most common red flags that you look for when reviewing a commercial loan application?

- Inconsistent or incomplete financial information

- Unrealistic financial projections

- Insufficient collateral

- Negative credit history

5. What are the different types of due diligence that you perform as part of a commercial loan review?

- Financial due diligence

- Legal due diligence

- Environmental due diligence

- Operational due diligence

6. What are the different types of reports that you prepare as part of a commercial loan review?

- Loan summary reports

- Credit risk reports

- Due diligence reports

- Loan recommendation reports

7. What are the different types of software that you use to perform commercial loan reviews?

- Loan origination software

- Credit analysis software

- Due diligence software

- Loan portfolio management software

8. What are the different types of regulations that apply to commercial loan reviews?

- The Truth in Lending Act

- The Equal Credit Opportunity Act

- The Fair Credit Reporting Act

- The Dodd-Frank Wall Street Reform and Consumer Protection Act

9. What are the different types of skills and experience that are required to be a successful commercial loan reviewer?

- Strong analytical skills

- Excellent communication skills

- Working knowledge of commercial lending products and regulations

- Experience with loan origination, credit analysis, and due diligence

10. What are the different types of career opportunities that are available to commercial loan reviewers?

- Loan officer

- Credit analyst

- Due diligence analyst

- Loan portfolio manager

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Commercial Loan Reviewer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Commercial Loan Reviewer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Commercial Loan Reviewers play a crucial role in the financial sector by thoroughly examining loan applications and assessing the financial health of potential borrowers. Their primary responsibilities include:

1. Loan Application Review

Reviewing loan applications to determine the borrower’s creditworthiness, financial stability, and repayment capacity.

- Analyzing financial statements, tax returns, and other relevant documents.

- Assessing the borrower’s income, assets, and liabilities.

2. Risk Assessment

Evaluating the potential risks associated with lending to the borrower. This involves:

- Identifying potential red flags or areas of concern in the application.

- Assessing the borrower’s ability to repay the loan under various economic scenarios.

3. Recommendation and Documentation

Making a recommendation on whether to approve or deny the loan application.

- Preparing detailed reports outlining the findings and risk assessment.

- Documenting the rationale behind the recommendation.

4. Portfolio Monitoring

Monitoring the performance of approved loans and identifying any potential issues or early warning signs.

- Tracking loan repayments and adherence to loan covenants.

- Assessing the financial health of the borrower and any changes in their circumstances.

Interview Tips

To ace the interview for a Commercial Loan Reviewer position, it is essential to prepare thoroughly and demonstrate your understanding of the role and the industry.

1. Research the Industry and Company

Familiarize yourself with the commercial loan review process, industry best practices, and the specific lending guidelines of the organization you are interviewing with.

- Review industry publications, attend webinars, and network with professionals in the field.

- Thoroughly research the company’s website, annual reports, and press releases to gain insights into their business practices.

2. Highlight Your Technical Skills

Emphasize your proficiency in financial analysis, including:

- Financial statement analysis techniques.

- Credit risk assessment models.

- Loan documentation and compliance requirements.

3. Showcase Your Problem-Solving Abilities

Discuss your approach to analyzing complex financial data and identifying potential risks. Use specific examples from your previous experience to demonstrate how you have effectively solved loan review challenges.

- Highlight your ability to think critically and make sound judgments.

4. Prepare for Behavioral Questions

Anticipate behavioral questions that assess your teamwork, attention to detail, and ability to work under pressure.

- Use the STAR method (Situation, Task, Action, Result) to структурировать your answers and provide specific examples.

5. Ask Thoughtful Questions

Prepare a list of insightful questions to ask the interviewer. This shows your engagement, interest in the role, and desire to learn more about the organization.

- Ask about the company’s risk management policies or recent industry trends.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Commercial Loan Reviewer role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.