Feeling lost in a sea of interview questions? Landed that dream interview for Commercial Mortgage Broker but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Commercial Mortgage Broker interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

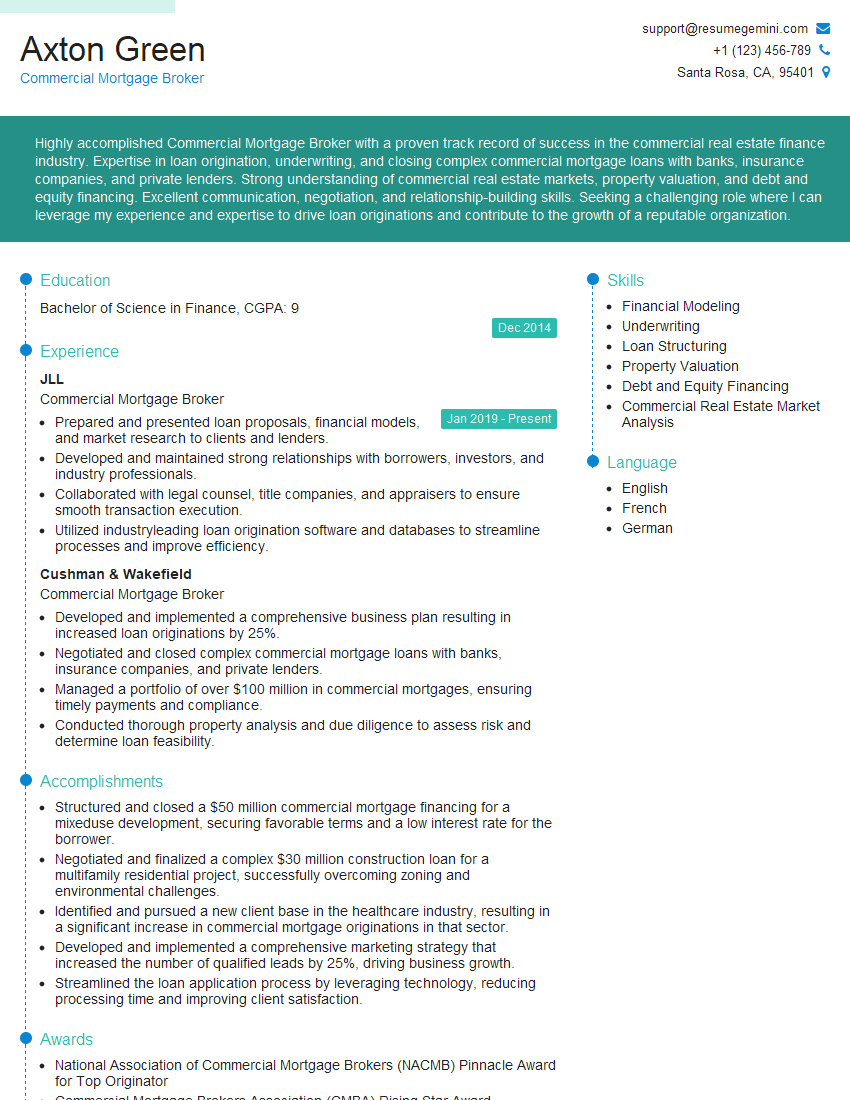

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Commercial Mortgage Broker

1. Describe the process of obtaining a commercial mortgage loan?

The process of obtaining a commercial mortgage loan typically involves the following steps:

- Pre-approval: Determine how much you can borrow and get pre-approved by a lender.

- Property search: Identify and evaluate commercial properties that meet your needs and budget.

- Loan application: Submit a loan application to a lender, including financial statements, business plans and other required documentation.

- Loan underwriting: The lender will review your application and assess the risk of the loan. They will consider factors such as your credit history, debt-to-income ratio and the property’s value.

- Loan approval: If the loan is approved, you will receive a loan commitment from the lender.

- Closing: Once you have accepted the loan commitment, you will need to attend a closing meeting to sign the loan documents and finalize the transaction.

2. What are the different types of commercial mortgage loans?

Fixed-rate loans

- Interest rate remains the same throughout the loan term.

- Provide stability in monthly payments.

Adjustable-rate loans (ARMs)

- Interest rate may change periodically based on an index.

- Can offer lower initial interest rates but come with risk of rate increases.

Interest-only loans

- Borrower only pays interest for a specified period.

- Can reduce monthly payments but may result in higher overall interest costs.

Balloon loans

- Lower monthly payments for a period, followed by a large final payment (balloon payment).

- Can be suitable for borrowers who expect to have funds available for the balloon payment.

3. What are the key factors that lenders consider when evaluating a commercial mortgage loan application?

- Credit history and credit score

- Debt-to-income ratio

- Property value and condition

- Loan-to-value ratio (LTV)

- Business plan and financial projections

- Experience and track record of the borrower

4. How can you help a client improve their chances of getting approved for a commercial mortgage loan?

- Help them build a strong credit history and score.

- Assist them in reducing their debt-to-income ratio.

- Guide them in preparing a well-written business plan and financial projections.

- Help them find and secure a property that meets the lender’s requirements.

- Negotiate favorable loan terms on behalf of the client.

5. What are some of the challenges that commercial mortgage brokers face?

- Finding and securing the right financing for clients

- Keeping up with changing regulations and market trends

- Staying competitive in a crowded marketplace

- Managing risk and protecting clients’ interests

- Building and maintaining strong relationships with lenders and clients

6. What are the ethical responsibilities of a commercial mortgage broker?

- Act in the best interests of their clients

- Provide accurate and transparent information

- Avoid conflicts of interest

- Comply with all applicable laws and regulations

- Maintain confidentiality of client information

7. How do you stay up-to-date on the latest trends and developments in the commercial mortgage industry?

- Attend industry conferences and webinars

- Read industry publications and online resources

- Network with other professionals in the field

- Take continuing education courses

- Stay informed about government regulations and economic news

8. What is your favorite aspect of being a commercial mortgage broker?

I enjoy the challenge of finding creative financing solutions for my clients. Every deal is different, and I appreciate the opportunity to use my knowledge and experience to help my clients achieve their goals. I also enjoy building relationships with my clients and helping them succeed in their businesses.

9. What are your strengths and weaknesses as a commercial mortgage broker?

Strengths:

- Strong understanding of commercial mortgage products and underwriting

- Excellent communication and negotiation skills

- Ability to build and maintain strong relationships with clients and lenders

- Proven track record of success in closing commercial mortgage loans

Weaknesses:

- I am relatively new to the commercial mortgage industry.

- I am not yet licensed in all states.

10. Why are you interested in working for our company?

I am interested in working for your company because I am impressed by your reputation as a leading provider of commercial mortgage financing. I am also drawn to your company’s commitment to customer service and your focus on providing innovative financing solutions. I believe that my skills and experience would be a valuable asset to your team, and I am eager to contribute to the continued success of your company.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Commercial Mortgage Broker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Commercial Mortgage Broker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Commercial Mortgage Brokers are financial professionals who specialize in arranging financing for commercial properties. They work with borrowers and lenders to structure and negotiate loan terms that meet the specific needs of the borrower. Key job responsibilities include:

1. Prospecting and lead generation

Commercial Mortgage Brokers must actively prospect for new clients and generate leads. This involves networking with potential clients, attending industry events, and developing referral partnerships.

- Identify and qualify potential borrowers

- Develop marketing materials and strategies

2. Loan structuring and underwriting

Commercial Mortgage Brokers are responsible for structuring and underwriting loans. This involves analyzing the borrower’s financial situation, the property being financed, and the market conditions. They must also determine the appropriate loan amount, interest rate, and term.

- Analyze borrower’s financial statements

- Evaluate property appraisals

- Negotiate loan terms with lenders

3. Loan origination and closing

Commercial Mortgage Brokers originate and close loans. This involves preparing loan applications, submitting them to lenders, and following up with the underwriting process. They must also ensure that all required documentation is collected and that the loan closing is completed on time.

- Prepare loan applications

- Submit loan applications to lenders

- Coordinate loan closing

4. Client relationship management

Commercial Mortgage Brokers must maintain strong relationships with clients. This involves providing ongoing support and advice, as well as keeping clients informed of changes in the market.

- Provide ongoing support to clients

- Keep clients informed of market trends

- Cross-sell and upsell additional products and services

Interview Tips

Preparing for a job interview can be daunting, but following these tips can help you ace the interview and land your dream job.

1. Research the company and the position

It is important to do your research before the interview. This will help you understand the company’s culture, values, and mission. You should also learn as much as you can about the position you are applying for. This will help you answer questions about your qualifications and experience in a more informed and confident way.

- Read the company’s website

- Look for news articles and press releases about the company

- Look at the company’s social media pages

2. Practice your answers to common interview questions

There are a number of common interview questions that you can expect to be asked. It is helpful to practice your answers to these questions in advance so that you can deliver them confidently and concisely.

- “Tell me about yourself.”

- “Why are you interested in this position?”

- “What are your strengths and weaknesses?”

3. Dress professionally and arrive on time

First impressions matter, so it is important to dress professionally for the interview. You should also arrive on time. Being late for the interview will reflect poorly on you and could damage your chances of getting the job.

- Wear a suit or business casual attire

- Be on time for the interview

4. Be enthusiastic and positive

Interviewers are more likely to hire candidates who are enthusiastic and positive about the job. Be sure to smile, make eye contact, and speak confidently during the interview. You should also be prepared to answer questions about your accomplishments and how you can contribute to the company.

- Smile and make eye contact

- Speak confidently

- Be prepared to answer questions about your accomplishments

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Commercial Mortgage Broker interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!