Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Commercial Underwriter position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

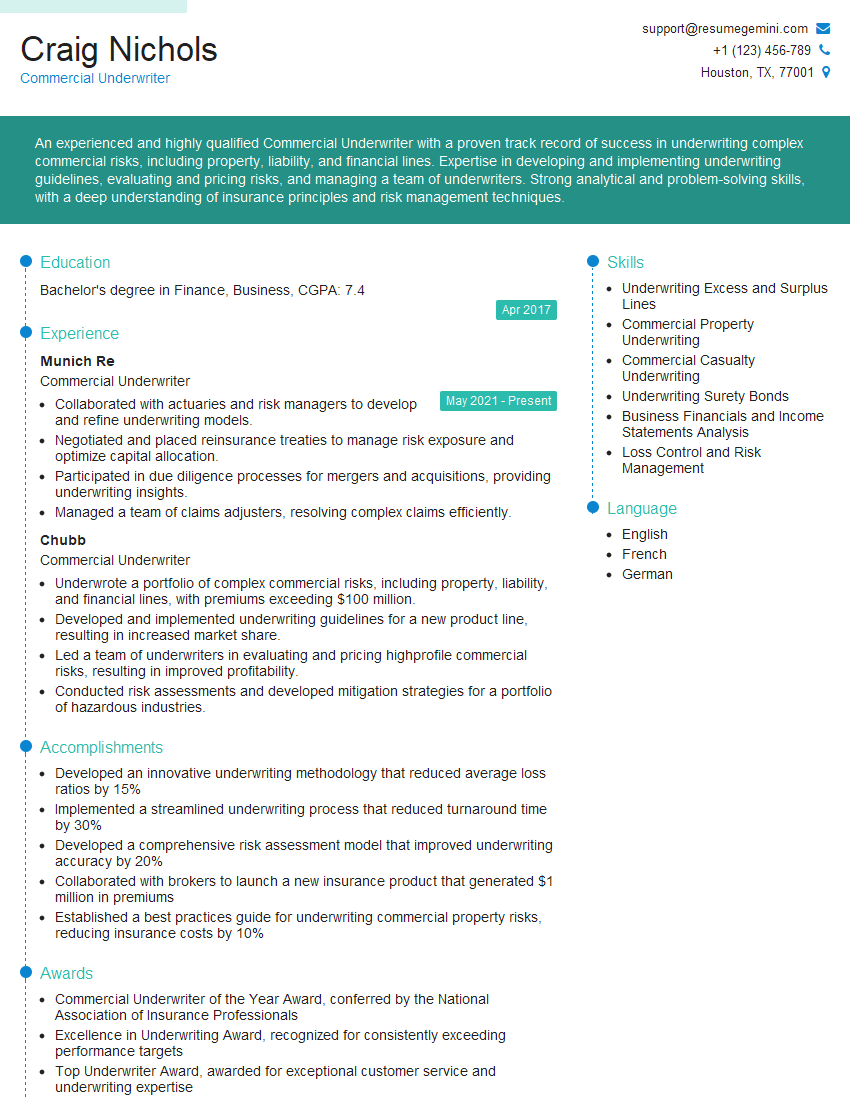

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Commercial Underwriter

1. What are the key underwriting considerations when evaluating a commercial property risk?

Answer:

- Construction and Age of Building: Type of construction, structural condition, age, and maintenance history.

- Occupancy: Nature of the business, storage or manufacturing processes, and potential hazards associated with the occupancy.

- Building Security: Protection against theft, vandalism, and fire, including alarms, surveillance systems, and access controls.

- Sprinkler System: Presence and efficiency of fire sprinkler systems for fire containment and suppression.

- Location and Exposures: Proximity to fire hydrants, hazardous materials, flood zones, and other potential hazards.

- Loss History: Previous claims history, including fire, theft, or other losses, and any identified loss trends.

2. How do you assess financial stability and creditworthiness when underwriting a commercial account?

Answer:

Financial Statement Analysis

- Review balance sheets for assets, liabilities, and equity.

- Examine income statements for revenues, expenses, and profitability.

- Analyze cash flow statements for operating, investing, and financing activities.

Other Credit Assessment Tools

- Credit reports from credit bureaus for financial history and current debt.

- Industry data and benchmarks for comparisons and risk assessment.

- External financial audits or reviews for independent verification.

3. Discuss the role of insurance broker in the commercial underwriting process.

Answer:

- Risk Identification and Evaluation: Brokers help clients identify and quantify risks, informing underwriting decisions.

- Policy Selection and Placement: Brokers navigate insurance markets to find the most appropriate coverage and terms for their clients.

- Communication and Representation: Brokers represent clients in negotiations and correspondence with underwriters, ensuring their interests are protected.

- Premium Optimization: Brokers advise clients on loss control measures and insurance program design to optimize premiums.

- Claims Advocacy: Brokers support clients during the claims process, advocating for fair settlements and minimizing impact on operations.

4. Describe the underwriting cycle for a commercial lines policy.

Answer:

- Application and Risk Assessment: Gathering and reviewing information about the risk, including exposure details and financial data.

- Underwriting Analysis: Assessing the risk factors, exposures, and potential losses based on the application.

- Pricing and Binding: Determining the premium amount and issuing a binding agreement to provide coverage.

- Issuance: Formally putting the insurance policy into effect.

- Renewal: Evaluating ongoing risk factors and adjusting the policy as needed before each policy period.

5. How do you handle underwriting submissions that have complex or unusual risks?

Answer:

- Due Diligence and Research: Conduct thorough research and consult with industry experts to gather additional information and expertise.

- Risk Analysis: Carefully evaluate the unique characteristics and potential exposures of the risk, considering both standard and non-standard aspects.

- Collaboration with Reinsurance: Consult with reinsurance companies to explore risk transfer options and enhance capacity.

- Policy Modifications: Develop tailored policy clauses, endorsements, or conditions to address specific risks and mitigate exposures.

- Engaging External Experts: If necessary, seek advice from loss control consultants, actuaries, or other specialists for specialized assessments.

6. What are the most common underwriting challenges in the commercial insurance industry?

Answer:

- Cyber Risks: Emerging threats from cyber events and data breaches.

- Climate Change and Natural Catastrophes: Increasing frequency and severity of natural disasters and climate-related losses.

- Political and Economic Uncertainty: Market volatility, supply chain disruptions, and geopolitical events that impact businesses.

- New and Innovative Technologies: Underwriting challenges due to rapid technological advancements and their potential impact on risks.

- Data Analytics and Technology Integration: Effectively utilizing data and technology to enhance underwriting accuracy and efficiency.

7. Describe your approach to risk management when underwriting a large commercial account.

Answer:

- Comprehensive Risk Assessment: Identify, evaluate, and quantify all potential risks associated with the account.

- Loss Prevention and Mitigation: Recommend and implement measures to reduce the likelihood and severity of losses.

- Insurance Coverage Optimization: Design an insurance program that adequately addresses identified risks and provides sufficient protection.

- Risk Transfer Strategies: Explore options such as reinsurance or captive insurance to manage large or complex risks.

- Ongoing Risk Monitoring: Regularly review the risk profile and adjust the risk management approach as needed.

8. How do you balance risk versus reward in your underwriting decisions?

Answer:

- Risk Appetite: Establish clear risk tolerance guidelines and adhere to them while evaluating risks.

- Risk Assessment and Pricing: Accurately assess the potential losses and determine appropriate premium rates to balance risk and profitability.

- Profitability Targets: Set realistic profitability targets and adjust underwriting decisions to achieve them without compromising on risk management principles.

- Underwriting Judgment: Rely on experience and judgment to make informed decisions that consider both risk and reward factors.

- Stakeholder Alignment: Ensure that underwriting decisions align with the risk appetite and financial objectives of the organization.

9. What is your approach to underwriting a high-hazard industry?

Answer:

- Thorough Risk Assessment: Conduct comprehensive due diligence and risk inspections to fully understand the unique hazards and exposures of the industry.

- Industry Expertise: Seek knowledge and advice from experts in the specific industry to gain insights and best practices for risk management.

- Loss Prevention and Control: Emphasize the importance of loss prevention measures, such as safety protocols and employee training.

- Specialized Policy Language: Develop customized policy endorsements and clauses to address industry-specific risks and exposures.

- Risk Transfer Considerations: Explore options such as deductibles, coinsurance, and reinsurance to manage potential large losses.

10. Describe a time when you had to make a difficult underwriting decision. How did you approach it and what was the outcome?

Answer:

- Scenario Description: Provide a brief overview of the challenging underwriting situation, including the risk factors and complexities involved.

- Decision-Making Process: Explain the steps taken to gather information, assess the risk, and consider the options available.

- Rationale and Justification: Describe the rationale behind the underwriting decision and the factors that influenced it.

- Outcome and Lessons Learned: Discuss the outcome of the decision and any valuable lessons learned from the experience.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Commercial Underwriter.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Commercial Underwriter‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Commercial Underwriters are responsible for assessing and pricing risks associated with commercial insurance policies. They play a crucial role in determining the insurability of a risk and the appropriate premium to charge. Key job responsibilities include:

1. Risk Assessment and Analysis

Evaluating and analyzing potential risks associated with commercial insurance policies, including property damage, business interruption, liability, and workers’ compensation.

- Reviewing financial statements, loss history, and other relevant data to assess the financial stability and risk profile of potential policyholders.

- Conducting site visits to inspect properties and assess potential hazards.

2. Underwriting and Policy Issuance

Determining the insurability of risks and establishing appropriate premium rates based on the risk assessment.

- Developing and issuing insurance policies that meet the specific needs and requirements of policyholders.

- Negotiating policy terms and conditions to ensure adequate coverage and risk mitigation.

3. Portfolio Management

Managing a portfolio of commercial insurance policies, monitoring claims activity, and assessing the overall profitability of the portfolio.

- Maintaining accurate records and documentation of underwriting decisions and policy transactions.

- Reviewing loss ratios and other performance metrics to identify areas for improvement.

4. Client Relationship Management

Building and maintaining relationships with clients, brokers, and other stakeholders in the insurance industry.

- Providing guidance and support to policyholders on insurance-related matters.

- Participating in industry conferences and networking events to stay up-to-date on market trends.

Interview Tips

Preparing for a Commercial Underwriter interview requires a thorough understanding of the role and the industry. Here are some tips to help you ace the interview:

1. Research the Company and Industry

Learn about the company’s history, products, and target market. Stay updated on the latest trends and developments in the commercial insurance industry.

- Visit the company website and read industry publications to gain insights into their business practices.

- Research the types of commercial insurance products and the underwriting process.

2. Prepare for Technical Questions

Commercial Underwriters are expected to have a strong understanding of insurance principles, risk assessment, and underwriting techniques. Prepare for questions that test your knowledge of these areas.

- Review basic insurance concepts, such as insurable interest, perils, and coverage types.

- Practice risk assessment techniques and be prepared to discuss how you would assess a specific risk scenario.

3. Showcase Your Analytical and Problem-Solving Abilities

Commercial Underwriting requires strong analytical and problem-solving skills. In the interview, be prepared to demonstrate your ability to analyze data, identify potential risks, and develop solutions.

- Provide examples of how you have used data to make informed decisions in previous roles.

- Explain how you approach solving complex underwriting problems and mitigating risks.

4. Highlight Your Communication and Interpersonal Skills

Commercial Underwriters need to be effective communicators and have strong interpersonal skills. They interact with clients, brokers, and other stakeholders throughout the underwriting process.

- Demonstrate your ability to clearly explain insurance concepts and underwriting decisions to non-technical audiences.

- Share examples of how you have built and maintained positive relationships with clients and colleagues.

Next Step:

Now that you’re armed with the knowledge of Commercial Underwriter interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Commercial Underwriter positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini