Are you gearing up for an interview for a Commission Specialist position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Commission Specialist and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

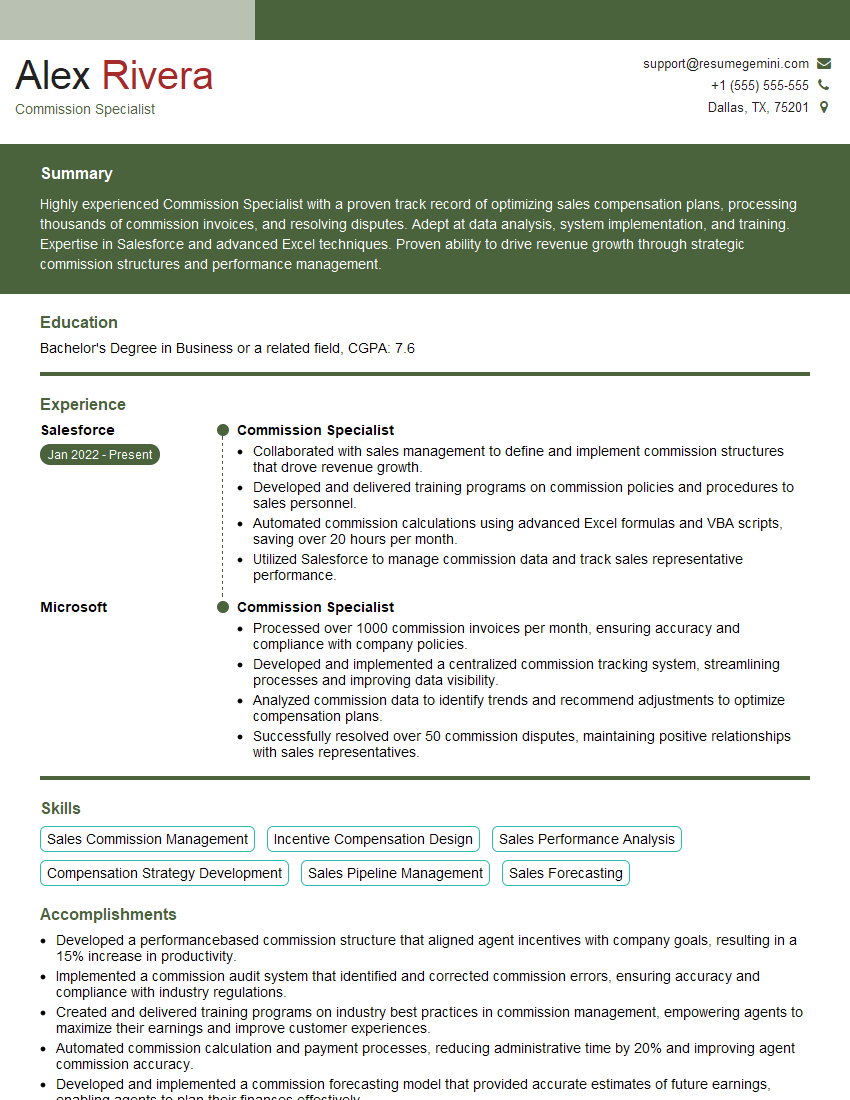

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Commission Specialist

1. What are the essential elements included in a Commission Plan?

- Sales Targets:

- Revenue or unit goals

- Timeframe for achieving targets

- Commission Structure:

- Percentage or fixed amount based on sales

- Tiered or graduated commissions

- Payment Schedule:

- Frequency of commission payments

- Minimum earnings threshold

- Qualifying Criteria:

- Conditions for earning commissions

- Sales acceptance or delivery requirements

2. Explain how you calculate commission based on a tiered structure.

- Identify the different tiers and their corresponding commission rates.

- Determine the sales volume within each tier.

- Multiply the sales volume by the commission rate for each tier.

- Add up the commissions earned from each tier to calculate the total commission.

3. How do you handle commission disputes or discrepancies?

- Establish a clear process for resolving disputes.

- Gather evidence from sales records, invoices, and other relevant documents.

- Communicate with the sales team to identify potential errors or misunderstandings.

- Collaborate with the finance department to verify payments and calculations.

4. What metrics do you use to evaluate the effectiveness of a Commission Plan?

- Sales revenue growth:

- Compare sales before and after implementing the plan.

- Sales team motivation:

- Assess feedback from the sales team.

- Track commission earnings and goal attainment.

- Cost-effectiveness:

- Calculate the cost of commissions as a percentage of sales revenue.

- Evaluate the return on investment.

5. How do you ensure compliance with legal and regulatory requirements related to commissions?

- Stay informed about applicable laws and regulations.

- Review commission plans with legal counsel to ensure compliance.

- Maintain accurate records of commission payments.

- Provide clear and concise documentation to sales reps regarding commissions.

6. What strategies do you employ to optimize a Commission Plan?

- Gather data on sales performance and market conditions.

- Align commission structure with business objectives.

- Provide ongoing training to sales reps on commission policies.

- Monitor performance and make adjustments as needed.

7. How do you communicate changes or updates to a Commission Plan to the sales team?

- Provide advance notice of changes.

- Communicate through multiple channels (email, meetings, training sessions).

- Explain the rationale and benefits of the changes.

- Allow time for questions and feedback.

8. What tools or software do you use to manage Commission Plans?

- Sales performance management systems

- Commission calculation and payment software

- Customer relationship management (CRM) tools

9. How do you measure the ROI of a Commission Plan?

- Compare sales revenue with compensation costs

- Track sales team motivation and productivity

- Consider customer satisfaction and retention rates

10. What are some common challenges you’ve faced in implementing Commission Plans, and how did you overcome them?

Provide specific examples of challenges and solutions, such as:

- Motivating underperforming sales reps

- Managing commission disputes

- Balancing cost-effectiveness with sales incentives

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Commission Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Commission Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Commission Specialist plays a critical role in managing and processing commission payments for sales teams, ensuring accuracy, compliance, and timely distribution.

1. Commission Plan Management

Manage and administer commission plans, including calculation rules, eligibility criteria, and payment schedules.

2. Data Processing and Validation

Collect, process, and validate sales data to determine commission entitlements.

Review and reconcile data from various sources, such as CRM systems, sales reports, and spreadsheets.

3. Commission Calculation

Calculate sales commissions based on defined plans and rules, using specialized software or spreadsheets.

Verify calculations and ensure accuracy before finalizing payments.

4. Commission Reporting and Distribution

Generate commission statements and reports, detailing calculations and payment amounts.

Process and distribute commission payments to sales representatives, including direct deposits and remittances.

5. Compliance and Auditing

Maintain compliance with company policies, legal regulations, and accounting standards.

Conduct internal audits and reviews to ensure accuracy and integrity of commission processes.

Interview Preparation Tips

To ace the interview for a Commission Specialist position, it’s important to prepare both technically and interpersonally.

1. Understand the Industry and Role

Research the commission management industry, including software and best practices.

Familiarize yourself with the specific requirements and responsibilities of the Commission Specialist role.

2. Highlight Skills and Experience

Emphasize your proficiency in commission plan management, data processing, and calculation.

Quantify your accomplishments and provide examples of your accuracy and attention to detail.

3. Prepare for Common Interview Questions

- Tell me about your experience in managing commission plans.

- How do you ensure accuracy and compliance in your work?

- Describe your experience in using commission management software.

4. Ask Insightful Questions

Show interest and engagement by asking thoughtful questions about the company, the role, and the commission management processes.

This demonstrates your enthusiasm and curiosity.

5. Practice Your Presentation Skills

Rehearse your answers to common interview questions and prepare clear, concise responses.

Practice articulating your value and skills effectively.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Commission Specialist, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Commission Specialist positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.