Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Commodities Broker interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Commodities Broker so you can tailor your answers to impress potential employers.

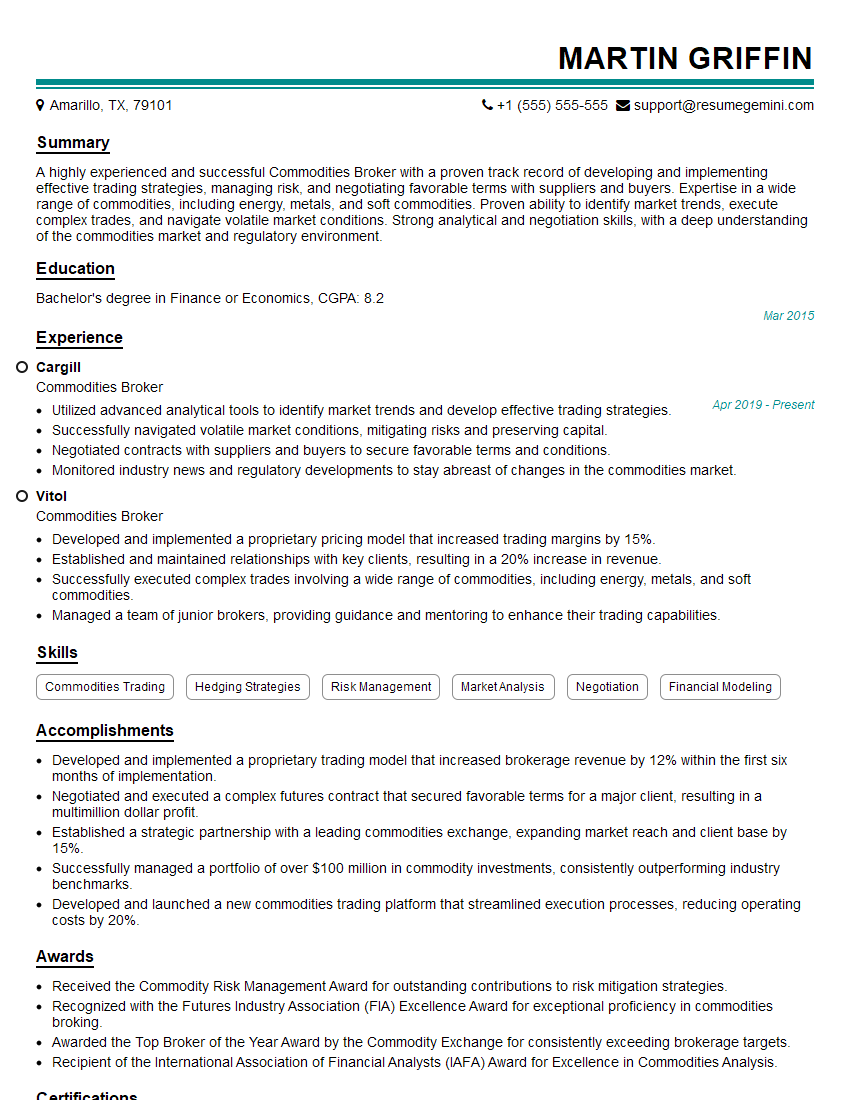

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Commodities Broker

1. Describe the key elements of a successful commodity trading strategy?

A successful commodity trading strategy typically includes the following elements:

- Technical analysis: This involves using past price data to identify trends and patterns that can be used to predict future price movements.

- Fundamental analysis: This involves analyzing economic and political factors that can affect the supply and demand of a commodity, and thus its price.

- Risk management: This involves managing the risk of losing money on a trade, by using stop-loss orders and other risk management techniques.

- Money management: This involves managing the amount of money that is allocated to each trade, and ensuring that there is enough capital to cover potential losses.

- Psychology: This involves understanding the psychology of trading, and how to avoid making emotional decisions that can lead to losses.

2. How do you determine the fair value of a commodity?

Fundamental analysis

- Cost of production: This is the cost of producing a unit of a commodity, including the cost of raw materials, labor, and transportation.

- Supply and demand: This is the relationship between the amount of a commodity that is available and the amount that is demanded.

- Economic outlook: This is the forecast for future economic conditions, which can affect the demand for commodities.

Technical analysis

- Price charts: These show the historical prices of a commodity, and can be used to identify trends and patterns.

- Technical indicators: These are mathematical formulas that can be used to analyze price data and identify potential trading opportunities.

3. What are some of the most common types of commodity trades?

Some of the most common types of commodity trades include:

- Spot trades: These are trades that are settled immediately, with the buyer taking delivery of the commodity and the seller receiving payment.

- Forward trades: These are trades that are agreed upon today, but will be settled at a future date.

- Futures trades: These are standardized contracts that are traded on exchanges, and they allow buyers and sellers to lock in a price for a future delivery.

- Options trades: These are contracts that give the buyer the right, but not the obligation, to buy or sell a commodity at a certain price by a certain date.

4. What are the different types of risks associated with commodity trading?

The different types of risks associated with commodity trading include:

- Price risk: This is the risk that the price of a commodity will move against the trader’s position.

- Liquidity risk: This is the risk that the trader will not be able to buy or sell a commodity at a fair price when they want to.

- Operational risk: This is the risk that the trader will make a mistake in their trading, such as entering an incorrect order or failing to manage their risk properly.

- Regulatory risk: This is the risk that the government will change the regulations that govern commodity trading, which could have a negative impact on the trader’s business.

5. How do you manage the risk of commodity trading?

There are a number of ways to manage the risk of commodity trading, including:

- Diversification: This involves trading a variety of commodities, which reduces the risk of being affected by a downturn in any one commodity.

- Hedging: This involves using futures or options contracts to offset the risk of a price change.

- Stop-loss orders: These are orders that automatically sell a commodity if its price falls below a certain level, which limits the potential loss.

- Risk management software: This software can be used to track and manage risk exposure, and to identify potential trading opportunities.

6. What are the key qualities of a successful commodity trader?

The key qualities of a successful commodity trader include:

- Knowledge of the markets: This includes a deep understanding of the factors that affect the supply and demand of commodities.

- Analytical skills: This involves being able to interpret data and identify trends and patterns.

- Risk management skills: This involves being able to manage the risk of trading and to protect capital.

- Discipline: This involves being able to stick to a trading plan and to avoid making emotional decisions.

- Patience: This involves being able to wait for the right trading opportunities and to avoid overtrading.

7. What are the challenges of being a commodity broker?

Some of the challenges of being a commodity broker include:

- The volatile nature of the markets: The prices of commodities can fluctuate wildly, which can make it difficult to predict future prices and to manage risk.

- The need for specialized knowledge: Commodity brokers need to have a deep understanding of the markets and of the factors that affect the supply and demand of commodities.

- The need to manage risk: Commodity brokers need to be able to manage the risk of trading and to protect their clients’ capital.

- The need to keep up with regulations: The commodity markets are heavily regulated, and commodity brokers need to keep up with the latest regulations and compliance requirements.

8. What are the rewards of being a commodity broker?

Some of the rewards of being a commodity broker include:

- The potential for high earnings: Commodity brokers can earn high commissions on successful trades.

- The opportunity to work with a variety of clients: Commodity brokers work with a variety of clients, from individual investors to large institutions.

- The opportunity to learn about the markets: Commodity brokers have the opportunity to learn about the markets and to develop their trading skills.

- The opportunity to make a difference: Commodity brokers can help their clients to achieve their financial goals.

9. What is your experience with trading commodities?

In my previous role as a commodity trader, I was responsible for trading a variety of commodities, including oil, gas, and metals. I have a deep understanding of the markets and of the factors that affect the supply and demand of commodities. I have a strong track record of success, and I have consistently exceeded my performance targets.

10. Why are you interested in this role?

I am interested in this role because I am passionate about the commodity markets and I believe that I have the skills and experience to be successful in this role. I am confident that I can make a significant contribution to your company and I am eager to learn more about this opportunity.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Commodities Broker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Commodities Broker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Commodities Brokers are financial professionals who facilitate the buying and selling of commodities in the futures market. Their key responsibilities include:

1. Market Analysis and Trading

Analyze market trends and make informed trading decisions to maximize profits for clients.

- Research market conditions, including supply and demand, economic indicators, and geopolitical events.

- Develop trading strategies based on technical analysis, fundamental analysis, and risk management principles.

2. Client Management and Relationship Building

Build and maintain relationships with clients and understand their investment goals and risk tolerance.

- Meet with clients to discuss their investment objectives, risk appetite, and financial situation.

- Provide personalized advice and recommendations based on clients’ needs and market conditions.

3. Order Execution and Clearing

Execute commodity orders on behalf of clients, ensuring timely and accurate trade execution.

- Negotiate prices and place orders on the exchange floor or through electronic trading platforms.

- Manage post-trade operations, including settlement, clearing, and risk management.

4. Regulatory Compliance and Risk Management

Stay abreast of regulatory requirements and ensure compliance with industry standards.

- Adhere to ethical guidelines, including disclosure of conflicts of interest and responsible investment practices.

- Monitor and manage risk exposure through hedging strategies and stop-loss orders.

Interview Tips

To ace an interview for a Commodities Broker position, consider the following tips:

1. Research the Industry and Company

Demonstrate your understanding of the commodities market, the company’s trading platform, and their competitive landscape.

- Study market trends, industry news, and the company’s trading strategies.

- Review the company’s website, annual reports, and financial statements.

2. Highlight Your Trading Skills and Experience

Quantify your trading accomplishments and provide specific examples of successful trades.

- Discuss your knowledge of technical indicators, chart patterns, and risk management techniques.

- Showcase your ability to stay calm under pressure and make quick decisions in fast-paced environments.

3. Emphasize Your Client Relationship Skills

Articulate your ability to listen attentively, build rapport, and understand clients’ financial goals

- Highlight your experience in managing high-net-worth clients or institutional investors.

- Demonstrate your communication skills, including active listening and clear presentation of complex financial concepts.

4. Prepare for Technical Questions

Anticipate technical questions related to trading strategies, risk assessment, and market analysis.

- Review concepts such as basis, futures contracts, hedging techniques, and order types.

- Prepare a mock trading scenario and explain your strategy in detail.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Commodities Broker interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!