Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Commodity Broker position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

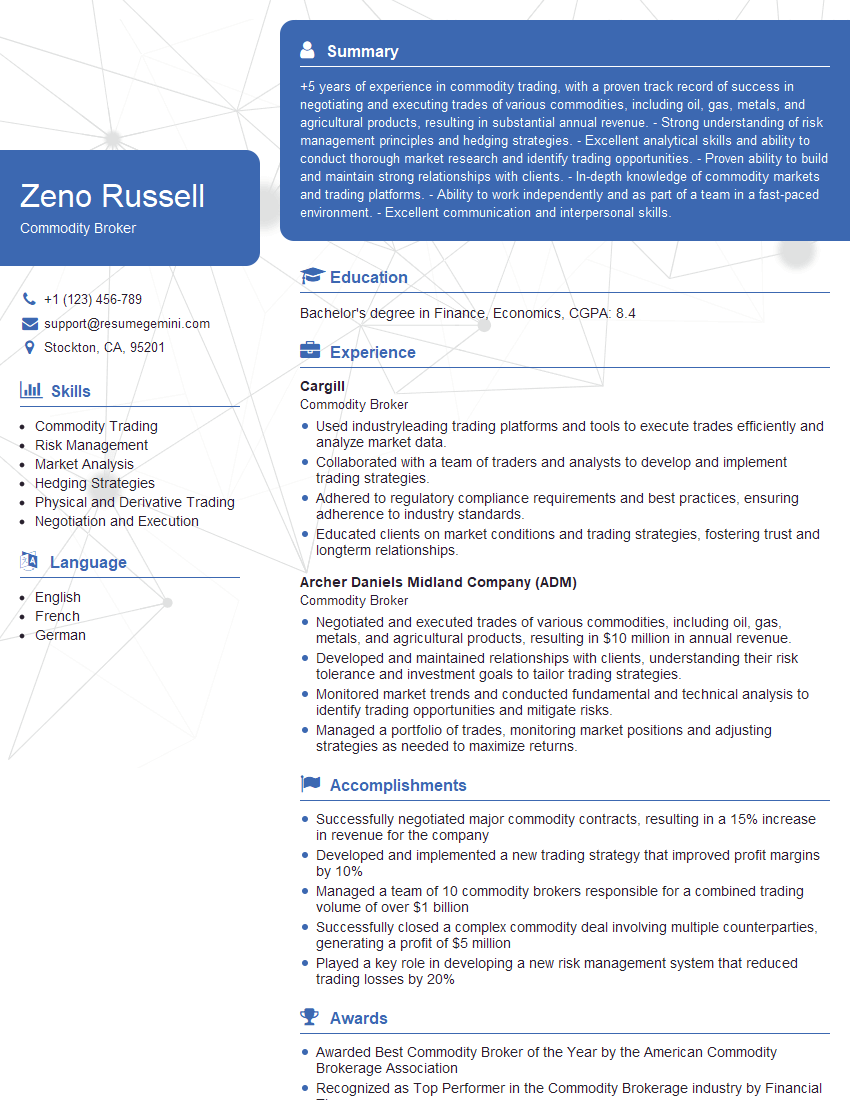

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Commodity Broker

1. Explain the concept of basis in commodity trading and how it is used to calculate futures prices?

- Basis is the difference between the spot price and the futures price of a commodity.

- It is used to calculate futures prices by adding the basis to the spot price.

- Basis can be positive or negative, depending on whether the spot price is higher or lower than the futures price.

- A positive basis indicates that the spot price is higher than the futures price, and a negative basis indicates that the spot price is lower than the futures price.

2. What are the different types of commodity futures contracts and how do they differ?

Exchange-traded futures contracts

- Traded on a regulated exchange

- Standardized in terms of quantity, quality, and delivery date

Over-the-counter futures contracts

- Traded directly between two parties

- Can be customized to meet the specific needs of the parties involved

Forward contracts

- Similar to futures contracts, but not traded on an exchange

- Typically used for shorter-term contracts

3. Describe the process of hedging using commodity futures contracts?

- Hedging involves using futures contracts to reduce price risk.

- A producer can sell futures contracts to lock in a price for their product, protecting them from a decline in prices.

- A consumer can buy futures contracts to lock in a price for their raw materials, protecting them from an increase in prices.

4. What are the key factors that affect the price of commodities?

- Supply and demand

- Economic conditions

- Political events

- Natural disasters

- Speculation

5. What are the different types of commodity indices and how are they constructed?

- Commodity indices are baskets of commodities that represent a particular sector or market.

- They are used to track the performance of a particular commodity market or to create diversified investments.

- Commodity indices can be constructed using different weighting methods, such as price-weighting, volume-weighting, or equal-weighting.

6. What are the different strategies used in commodity trading?

- Trend following

- Mean reversion

- Carry trade

- Pairs trading

- Fundamental analysis

7. What are the risks associated with commodity trading?

- Price risk

- Liquidity risk

- Counterparty risk

- Operational risk

8. What are the ethical considerations in commodity trading?

- Insider trading

- Market manipulation

- Conflicts of interest

- Sustainability

9. What are the career opportunities in commodity trading?

- Trader

- Analyst

- Broker

- Risk manager

- Compliance officer

10. How do you stay updated on the latest developments in the commodity markets?

- Read industry publications

- Attend conferences and webinars

- Network with other professionals

- Use data and analytics tools

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Commodity Broker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Commodity Broker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

1. Market Research and Analysis

Commodity brokers conduct extensive research on market trends, supply and demand factors, and geopolitical events that influence commodity prices. They use this analysis to provide clients with information and advice on potential investment opportunities.

2. Client Acquisition and Management

Brokers identify potential clients, build relationships, and develop strategies to meet their investment goals. They must have excellent communication and negotiation skills to effectively represent their clients’ interests.

3. Order Execution

Commodity brokers execute trades for clients on various trading platforms, ensuring the best possible prices and execution timing. Their expertise in navigating complex market conditions is crucial for maximizing returns.

4. Risk Management

Brokers play a vital role in managing risks for their clients. They monitor market conditions, conduct risk assessments, and implement strategies to mitigate potential losses.

5. Compliance and Regulatory Adherence

Commodity brokers must adhere to strict regulatory requirements and industry standards. They maintain accurate records, comply with reporting obligations, and ensure transparency in their operations.

Interview Tips

1. Research the Firm and Industry

Demonstrate your knowledge of the commodity brokerage firm you’re interviewing with and the broader industry. Research their history, services, market position, and any recent developments.

2. Highlight Your Skills and Experience

Emphasize your relevant skills in market research, analysis, client management, order execution, and risk management. Provide specific examples from your experience to support your claims.

3. Discuss Market Insights

Share your perspective on current market trends and how they impact the commodity sector. Demonstrate your understanding of market drivers, supply and demand dynamics, and potential investment opportunities.

4. Handle Behavioral Questions

Be prepared to answer common behavioral questions that assess your work style, teamwork abilities, and ethical standards. Use the STAR method (Situation, Task, Action, Result) to provide structured and impactful responses.

5. Demonstrate Your Passion for Commodities

Express your genuine interest and enthusiasm for the commodity markets. Explain how your knowledge and skills align with the demands of the role and why you are passionate about this industry.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Commodity Broker role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.