Are you gearing up for a career in Compensation Adjuster? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Compensation Adjuster and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

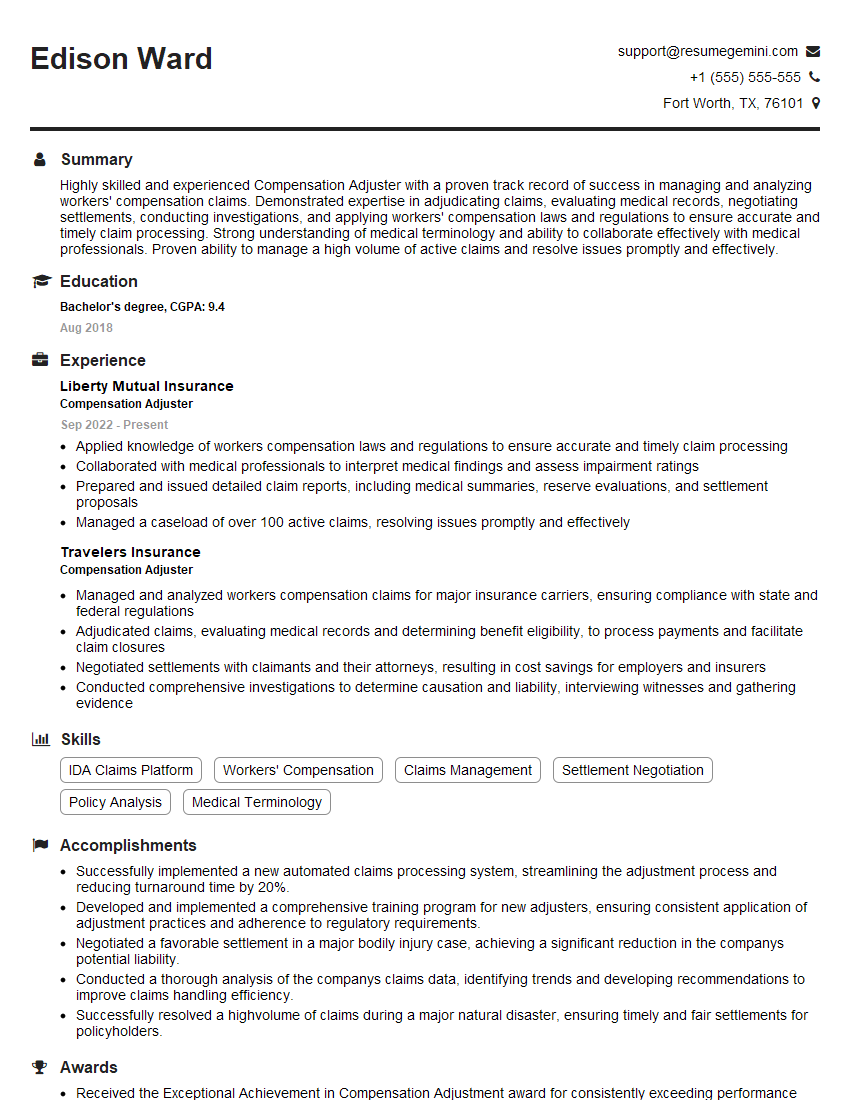

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Compensation Adjuster

1. What are the key responsibilities of a Compensation Adjuster?

- Investigate and evaluate claims for workers’ compensation benefits

- Determine the extent of disability and the appropriate benefits to be paid

- Negotiate settlements with injured workers and their attorneys

- Testify in court or at hearings regarding claims

- Maintain accurate records of all claims and investigations

2. What are the different types of workers’ compensation benefits?

Medical benefits

- Cover the cost of medical treatment, including hospital stays, doctor visits, and prescription drugs

- May also include rehabilitation services and vocational training

Wage replacement benefits

- Provide a portion of the injured worker’s lost wages while they are unable to work

- Typically calculated as a percentage of the worker’s average weekly wage

Disability benefits

- Provide a permanent income stream to workers who are permanently disabled

- The amount of benefits is based on the extent of the disability and the worker’s earning capacity

Death benefits

- Provide financial support to the dependents of workers who are killed on the job

- May include funeral expenses, burial costs, and a weekly income benefit

3. What are the factors that you consider when evaluating a workers’ compensation claim?

- The nature and extent of the injury or illness

- The worker’s pre-injury occupation and earning capacity

- The worker’s age, education, and training

- The availability of suitable work for the worker

- The worker’s medical prognosis and treatment plan

4. What are the most common challenges that you face as a Compensation Adjuster?

- Dealing with claimants who are uncooperative or dishonest

- Interpreting complex medical evidence

- Determining the appropriate level of benefits to be paid

- Negotiating settlements with claimants and their attorneys

- Testifying in court or at hearings regarding claims

5. What are some of the best practices for conducting a workers’ compensation investigation?

- Interview the injured worker and any witnesses

- Review the medical records and other relevant evidence

- Conduct a site inspection of the workplace

- Consult with medical experts and vocational counselors

- Document all of your findings thoroughly

6. What are the different methods that you use to calculate wage replacement benefits?

- Average weekly wage method

- Date of injury method

- High-low method

- Actual earnings method

- Modified earnings method

7. What are the different types of vocational rehabilitation services that may be provided to injured workers?

- Job placement assistance

- Vocational training and retraining

- Job coaching and counseling

- Adaptive equipment and assistive technology

- Work hardening programs

8. What are the advantages and disadvantages of settling a workers’ compensation claim?

Advantages

- Provides certainty and finality to the claim

- Can save time and money for both the claimant and the employer

- Can help to preserve the relationship between the claimant and the employer

Disadvantages

- May result in the claimant receiving less than they would be entitled to if they went to trial

- Can be difficult to get the claimant to agree to a fair settlement

- May not be possible to settle the claim if there is a dispute about the facts or the law

9. What are the ethical considerations that you must keep in mind when handling workers’ compensation claims?

- The duty to act fairly and impartially

- The duty to protect the privacy of the claimant

- The duty to avoid conflicts of interest

- The duty to comply with all applicable laws and regulations

10. What are the latest trends in workers’ compensation?

- The increasing use of managed care programs

- The development of new medical technologies

- The increasing focus on vocational rehabilitation

- The rise of alternative dispute resolution methods

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Compensation Adjuster.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Compensation Adjuster‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Compensation Adjusters are responsible for handling all aspects of the compensation claims process, which may include reviewing policies, underwriting risk, assessing financial exposure, and settling claims.

1. Reviewing Policies

Compensation Adjusters must be familiar with the various insurance policies that cover compensation claims. They need to be able to interpret the policy language and determine whether or not the claim is covered.

- Analyze insurance policies to determine coverage and liability.

- Interpret policy provisions and exclusions to assess coverage.

2. Underwriting Risk

Compensation Adjusters must be able to assess the risk associated with a claim. They need to consider the factors that could affect the outcome of the claim, such as the claimant’s injuries, the defendant’s liability, and the potential for litigation.

- Evaluate claims to determine their potential financial impact.

- Assess the severity of injuries and damages to estimate claim costs.

3. Assessing Financial Exposure

Compensation Adjusters must be able to assess the financial exposure of the insurance company. They need to determine the amount of money that the company is likely to pay out on the claim, and they need to make sure that the company has enough money in reserve to cover the claim.

- Calculate claim reserves to ensure adequate financial resources are allocated.

- Monitor claim payments and expenses to control costs.

4. Settling Claims

Compensation Adjusters are responsible for settling claims. They need to negotiate with the claimant and their attorney to reach a fair and reasonable settlement. They also need to prepare and submit the settlement documents to the insurance company.

- Negotiate and settle claims with claimants and their representatives.

- Prepare and submit settlement documentation for approval.

Interview Tips

Interviewing for a Compensation Adjuster position can be a competitive process. To increase your chances of success, it is important to prepare thoroughly for your interview. Here are a few tips to help you ace the interview:

1. Research the Company

Before your interview, take some time to research the insurance company that you are interviewing with. Learn about their history, their products, and their claims process. This will show the interviewer that you are interested in the company and that you have taken the time to learn about their business.

- Visit the company’s website.

- Read articles about the company in the news.

- Talk to people who work for the company.

2. Prepare for Common Interview Questions

There are a few common interview questions that you are likely to be asked during an interview for a Compensation Adjuster position. These questions may include:

- Tell me about yourself.

- Why are you interested in this position?

- What are your strengths and weaknesses?

It is important to practice answering these questions before your interview. This will help you to feel more confident and prepared during the interview.

3. Highlight Your Skills and Experience

During your interview, be sure to highlight your skills and experience that are relevant to the Compensation Adjuster position. These skills may include:

- Insurance policy analysis

- Risk assessment

- Financial analysis

- Negotiation

- Customer service

Be sure to provide specific examples of how you have used these skills in your previous work experience.

4. Be Yourself

The most important thing is to be yourself during your interview. The interviewer wants to get to know the real you, so don’t try to be someone you’re not. Just be confident and articulate, and let your personality shine through.

- Be honest about your experience and qualifications.

- Don’t try to be someone you’re not.

- Let your personality shine through.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Compensation Adjuster interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.