Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Compliance Auditor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

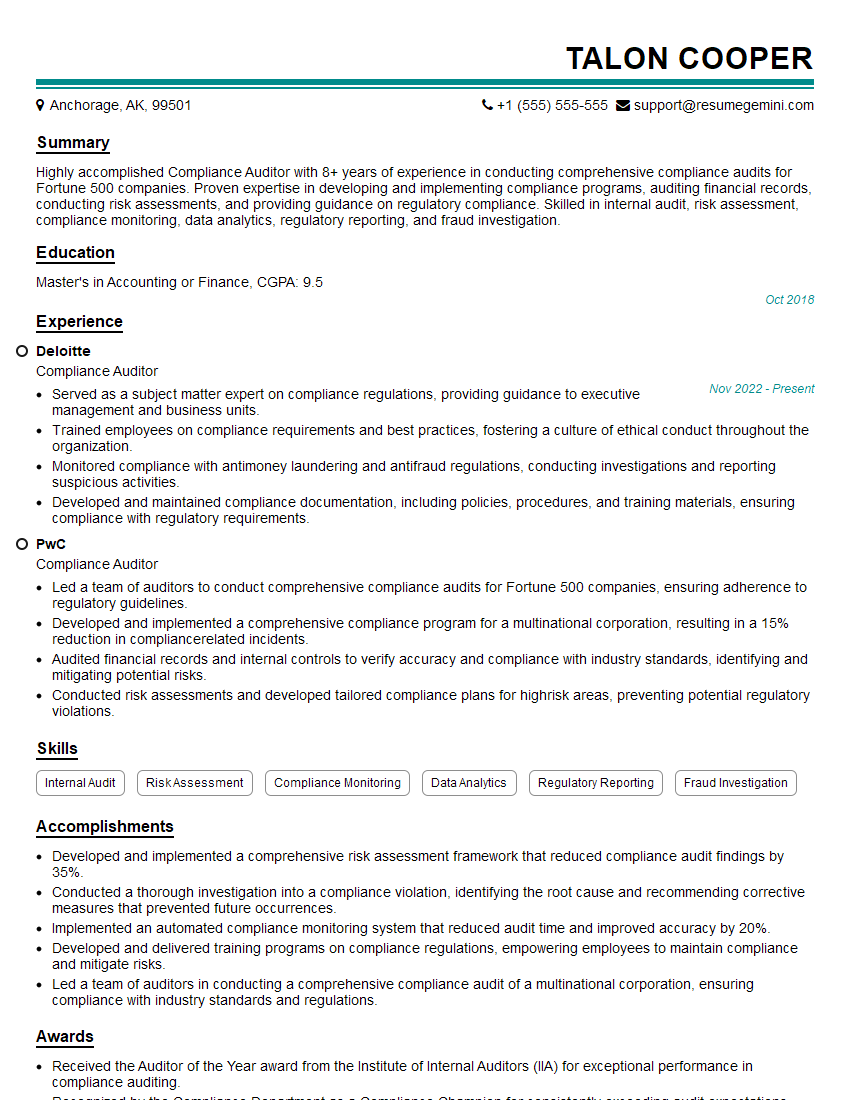

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Compliance Auditor

1. Describe the steps involved in conducting a compliance audit.

- Planning and preparation: Define the scope, objectives, and methodology of the audit.

- Data collection: Gather relevant documents, records, and interviews.

- Testing and analysis: Evaluate compliance with regulations, policies, and standards.

- Reporting and recommendations: Document findings, identify areas of non-compliance, and suggest corrective actions.

- Follow-up: Monitor implementation of recommendations and ensure sustained compliance.

2. How do you assess the effectiveness of internal controls?

Control Environment

- Evaluate the tone at the top.

- Assess the ethical values and commitment to compliance.

Information and Communication

- Verify the accuracy and completeness of financial reporting.

- Test the effectiveness of communication channels for reporting control deficiencies.

3. What are the key regulatory requirements that an organization must comply with?

The key regulatory requirements vary depending on the industry and jurisdiction. Examples include:

- Financial Reporting: US GAAP, IFRS, SOX

- Privacy and Data Protection: GDPR, CCPA

- Anti-Money Laundering: FATF Recommendations

4. How do you stay updated on regulatory changes?

- Subscriptions to industry publications and newsletters.

- Attendance at conferences and webinars.

- Regular review of regulatory agency websites.

5. Describe the role of compliance in risk management.

- Identify and assess compliance risks.

- Develop and implement risk mitigation strategies.

- Monitor and report on compliance performance.

6. How do you handle non-compliance issues?

- Document the non-compliance.

- Investigate the root cause.

- Recommend corrective actions.

- Monitor the implementation of corrective actions.

7. What are the challenges and opportunities in compliance auditing?

Challenges

- Evolving regulatory landscape.

- Increased data volumes and complexity.

- Resource constraints.

Opportunities

- Leverage technology for efficiency.

- Partner with business units to improve compliance awareness.

- Drive organizational change and ethical behavior.

8. What are your strengths and weaknesses as a compliance auditor?

Strengths

- Strong understanding of accounting principles and regulatory requirements.

- Excellent analytical and problem-solving skills.

- Ability to communicate effectively with management and other stakeholders.

Weaknesses

- Limited experience in a specific industry (if applicable).

- Openness to learning and continuous improvement.

9. What are your salary expectations?

I am open to discussing a salary that is commensurate with my experience, qualifications, and the market rate for similar roles. I am also willing to negotiate based on the overall compensation package, including benefits and growth opportunities.

10. Why are you interested in this position?

I am highly interested in this compliance auditor position because it aligns with my skills, experience, and career aspirations. I am passionate about ensuring compliance and promoting ethical behavior within organizations. I am eager to contribute my expertise to your team and help the company achieve its compliance goals.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Compliance Auditor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Compliance Auditor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Compliance Auditors are responsible for ensuring that an organization’s activities are in compliance with all applicable laws, regulations, and policies. This includes conducting audits to identify and assess risks, developing and implementing compliance programs, and training employees on compliance requirements.

1. Conducting Audits

Compliance Auditors conduct audits to assess an organization’s compliance with applicable laws, regulations, and policies. This involves reviewing documentation, interviewing employees, and observing operations.

- Reviewing financial statements and other accounting records to ensure that they are accurate and in compliance with applicable laws and regulations.

- Interviewing employees and management to gather information about the organization’s compliance practices.

- Observing operations to identify any potential compliance risks.

2. Developing and Implementing Compliance Programs

Compliance Auditors develop and implement compliance programs to help organizations prevent and detect violations of laws, regulations, and policies. This involves developing policies and procedures, training employees on compliance requirements, and monitoring compliance.

- Developing policies and procedures to ensure that the organization’s activities are in compliance with applicable laws and regulations.

- Training employees on compliance requirements to help them understand their responsibilities and how to comply with the organization’s policies and procedures.

- Monitoring compliance to identify any areas where the organization may not be in compliance with applicable laws and regulations.

3. Reporting on Compliance

Compliance Auditors report on their findings to management and other stakeholders. This includes providing information on the organization’s compliance status, identifying any areas of non-compliance, and recommending corrective actions.

- Preparing reports on the organization’s compliance status to provide management and other stakeholders with an overview of the organization’s compliance efforts.

- Identifying any areas of non-compliance to help the organization understand where it is not meeting its compliance obligations.

- Recommending corrective actions to help the organization address any areas of non-compliance and improve its compliance efforts.

4. Staying Up-to-Date on Laws and Regulations

Compliance Auditors must stay up-to-date on all applicable laws and regulations. This involves attending training, reading industry publications, and networking with other compliance professionals.

- Attending training to learn about new laws and regulations that may impact the organization’s compliance efforts.

- Reading industry publications to stay informed about the latest compliance trends and best practices.

- Networking with other compliance professionals to exchange ideas and learn from each other’s experiences.

Interview Tips

Preparing for a Compliance Auditor interview can be daunting, but there are a few things you can do to increase your chances of success. Here are a few tips:

1. Research the company and the position

Before you go to your interview, take some time to research the company and the position you are applying for. This will help you understand the company’s culture, values, and goals, and it will also help you tailor your answers to the specific requirements of the position.

- Visit the company’s website to learn about its history, mission, and products or services.

- Read the job description carefully and identify the key skills and qualifications that the company is looking for.

- Talk to people in your network who work at the company or who have worked there in the past.

2. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It is helpful to practice your answers to these questions in advance so that you can deliver them confidently and concisely.

- Make a list of common interview questions and practice answering them out loud.

- Ask a friend or family member to conduct a mock interview with you.

- Record yourself answering interview questions and then watch the recording to identify areas where you can improve.

3. Prepare questions to ask the interviewer

Asking thoughtful questions at the end of an interview shows that you are engaged and interested in the position. It also gives you an opportunity to learn more about the company and the position.

- Prepare a list of questions to ask the interviewer about the company, the position, and the team.

- Listen carefully to the interviewer’s answers and ask follow-up questions to show that you are interested in what they have to say.

- Don’t be afraid to ask questions that are specific to your skills and experience.

4. Follow up after the interview

After the interview, be sure to send a thank-you note to the interviewer. This is a simple way to show your appreciation and to reinforce your interest in the position.

- Send a thank-you note within 24 hours of the interview.

- In your thank-you note, reiterate your interest in the position and highlight your key skills and qualifications.

- If you have any questions or concerns, you can also use your thank-you note to address them.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Compliance Auditor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!