Feeling lost in a sea of interview questions? Landed that dream interview for Compliance Coordinator but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Compliance Coordinator interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

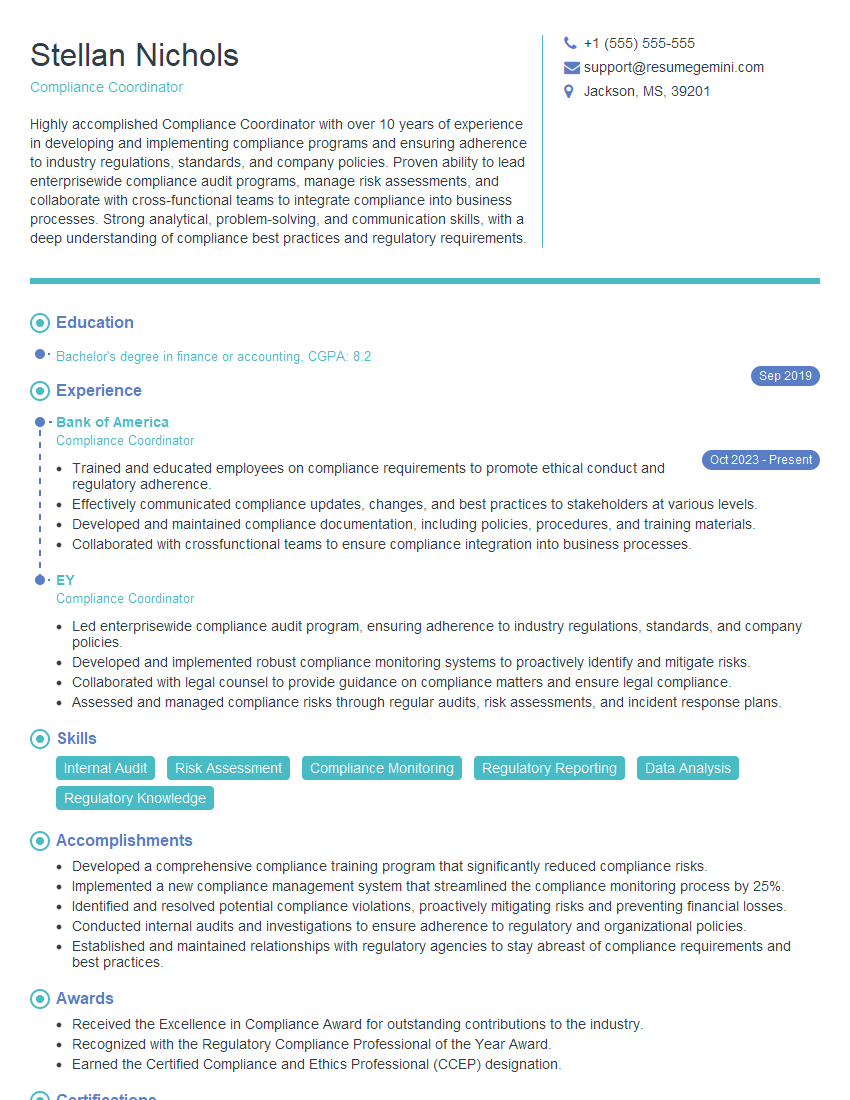

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Compliance Coordinator

1. What are the key compliance regulations that are applicable to your industry?

In the financial services industry, we must adhere to a comprehensive set of regulations, including:

- Bank Secrecy Act (BSA)

- Anti-Money Laundering (AML) regulations

- Know Your Customer (KYC) requirements

- Dodd-Frank Wall Street Reform and Consumer Protection Act

2. How do you stay up-to-date on changes to compliance regulations?

I subscribe to industry publications, attend conferences, and participate in webinars to stay informed about the latest regulatory developments.

Additionally, I have established relationships with key regulators and industry experts who provide valuable insights and updates.

3. What is your process for identifying and assessing compliance risks?

I employ a risk-based approach to compliance, which involves the following steps:

Risk Identification

- Reviewing regulatory requirements

- Conducting risk assessments

- Identifying potential vulnerabilities

Risk Assessment

- Evaluating the likelihood and impact of risks

- Prioritizing risks based on their potential impact

- Developing mitigation strategies

4. How do you develop and implement compliance policies and procedures?

I collaborate with key stakeholders, including legal counsel, business unit leaders, and technology experts, to develop comprehensive compliance policies and procedures.

Once developed, I implement these policies and procedures through training programs, communication campaigns, and ongoing monitoring.

5. How do you ensure that employees are aware of and comply with compliance requirements?

I develop and deliver tailored training programs to educate employees on all applicable compliance regulations and policies.

Additionally, I establish clear communication channels to provide regular updates and guidance, and I monitor compliance through regular audits and reviews.

6. What is your approach to investigating and resolving compliance incidents?

Upon identifying a compliance incident, I conduct a thorough investigation to determine the root cause and extent of the incident.

I then work with the appropriate stakeholders to develop and implement corrective action plans and preventative measures to mitigate future risks.

7. How do you measure and report on the effectiveness of your compliance program?

I establish key performance indicators (KPIs) to measure the effectiveness of the compliance program.

These KPIs include metrics such as the number of compliance incidents, the level of employee compliance, and the extent to which the program aligns with regulatory requirements.

8. What are your strengths as a compliance coordinator?

- Excellent knowledge of compliance regulations and best practices

- Strong analytical and problem-solving skills

- Exceptional communication and interpersonal skills

- Ability to build and maintain strong relationships with stakeholders

9. What are your areas for improvement as a compliance coordinator?

- Would like to gain more experience in developing and implementing compliance training programs

- Interested in obtaining additional certifications in compliance

10. What motivates you to work in the field of compliance?

I am passionate about ensuring that organizations operate ethically and responsibly.

I believe that a strong compliance program is essential for protecting customers, shareholders, and the reputation of the organization.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Compliance Coordinator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Compliance Coordinator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Compliance Coordinators are responsible for ensuring that their organization adheres to all applicable laws, regulations, and ethical standards. They play a vital role in managing risk and protecting the organization’s reputation, assets, and employees. Key job responsibilities include:

1. Compliance Monitoring

Monitor and track compliance with internal policies and procedures, industry regulations, and government laws.

- Conduct regular compliance audits and risk assessments.

- Investigate and resolve compliance issues promptly and effectively.

2. Compliance Training and Education

Develop and deliver compliance training programs for employees at all levels.

- Provide ongoing education and support to help employees understand and comply with all applicable regulations.

- Stay up-to-date on the latest compliance developments and best practices.

3. Compliance Reporting and Documentation

Prepare and submit compliance reports to management, regulatory agencies, and other stakeholders.

- Maintain accurate and complete compliance documentation.

- Respond to inquiries from regulatory agencies and other external parties.

4. Risk Management

Identify and assess compliance risks facing the organization.

- Develop and implement strategies to mitigate compliance risks.

- Monitor and track compliance risks on an ongoing basis.

Interview Tips

Preparing for a Compliance Coordinator interview can be daunting, but with the right approach, you can ace your interview and showcase your skills and knowledge. Here are some interview tips:

1. Research the Organization and the Role

Take the time to learn about the organization’s culture, values, and compliance program. Understand the specific responsibilities of the Compliance Coordinator role and how it fits within the organization’s overall compliance strategy.

- Visit the organization’s website and read its annual reports and other public documents.

- Network with people in the industry to gain insights into the organization and the role.

2. Highlight Your Expertise

Be prepared to articulate your compliance knowledge and experience. Highlight your understanding of the relevant laws, regulations, and industry best practices. Share examples of your work in developing and implementing compliance programs and training materials.

- Describe your experience in conducting compliance audits and risk assessments.

- Discuss your ability to communicate complex compliance issues to a variety of audiences.

3. Showcase Your Soft Skills

In addition to your technical skills, interviewers will be looking for strong communication, interpersonal, and problem-solving skills. Compliance Coordinators need to be able to work effectively with people at all levels of the organization, from entry-level employees to senior management.

- Provide examples of your ability to build relationships and gain buy-in from stakeholders.

- Describe your experience in resolving compliance issues and handling difficult conversations.

4. Prepare Questions for the Interviewer

Asking thoughtful questions at the end of the interview demonstrates your interest in the role and the organization. It also gives you an opportunity to learn more about the company’s culture and values.

- Ask about the organization’s compliance priorities.

- Inquire about the organization’s commitment to employee training and development.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Compliance Coordinator interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.