Are you gearing up for an interview for a Consumer Credit Counselor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Consumer Credit Counselor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

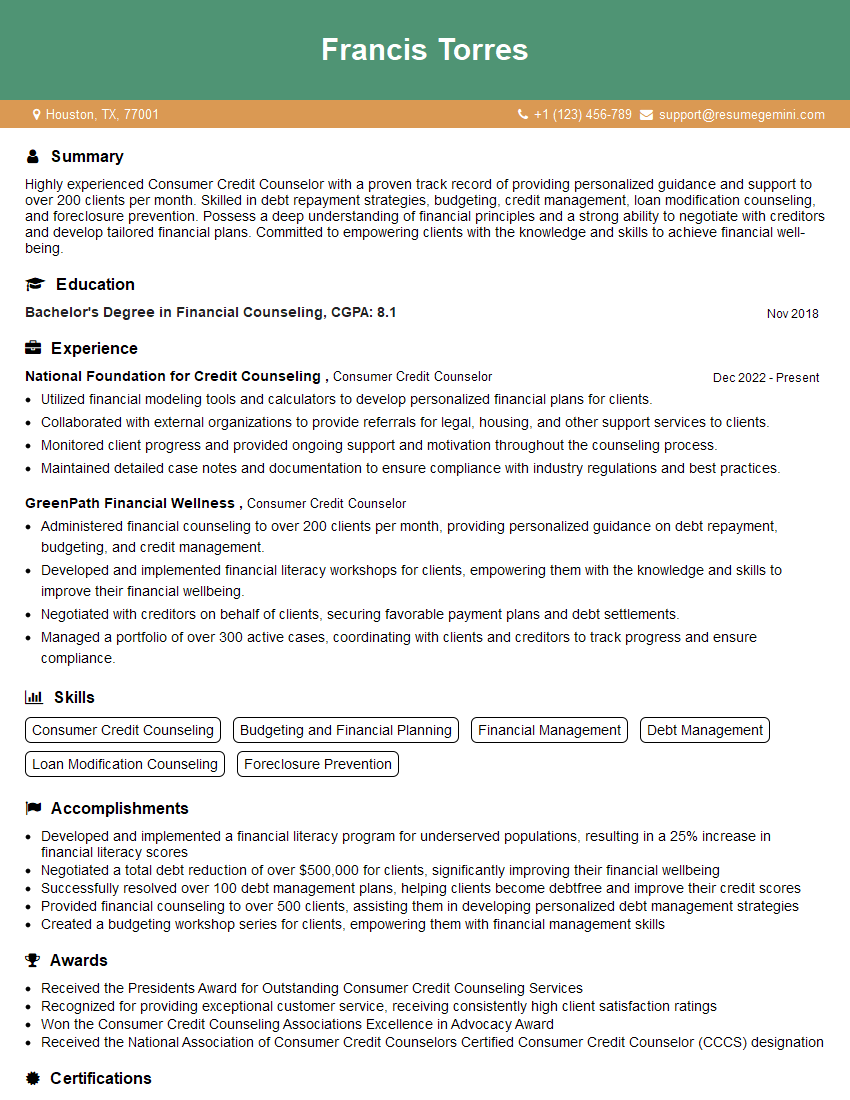

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Consumer Credit Counselor

1. Explain the key steps involved in the credit counseling process.

The credit counseling process typically involves the following key steps:

- Initial assessment: Gathering information about the client’s financial situation, including income, expenses, debts, and assets.

- Education: Providing the client with information about credit management, budgeting, and debt repayment options.

- Budgeting: Developing a personalized budget that helps the client manage their income and expenses effectively.

- Debt management: Negotiating with creditors on behalf of the client to reduce interest rates, lower monthly payments, or consolidate debts.

- Credit repair: Assisting the client with disputing inaccurate or negative information on their credit report.

- Ongoing support: Providing continued guidance and support to the client as they work towards financial stability.

2. Describe the different types of debt relief options available to clients.

- Debt consolidation loans: A personal loan used to pay off multiple debts, typically resulting in a lower interest rate and monthly payment.

- Debt management plans: A structured repayment plan negotiated with creditors to reduce interest rates and monthly payments.

- Credit counseling: Non-profit organizations that provide financial education, budgeting assistance, and debt repayment plans.

- Bankruptcy: A legal proceeding that discharges or reorganizes debts, but may negatively impact credit scores.

3. How do you determine which debt relief option is most appropriate for a client?

The most appropriate debt relief option for a client depends on their specific financial situation and goals. Factors to consider include:

- Amount and types of debt

- Income and expenses

- Credit score

- Future financial plans

- Personal preferences

4. What are the ethical considerations involved in providing credit counseling services?

- Confidentiality: Maintaining the privacy of client information.

- Objectivity: Providing unbiased advice and promoting the best interests of the client.

- Transparency: Disclosing all fees and potential conflicts of interest.

- Competency: Possessing the necessary knowledge and skills to provide effective credit counseling.

- Compliance: Adhering to all applicable laws and regulations.

5. How do you stay up-to-date on the latest changes in credit laws and regulations?

- Attend industry conferences and webinars.

- Read trade publications and newsletters.

- Network with other credit counselors.

- Complete continuing education courses.

6. Describe your experience in working with clients from diverse backgrounds and financial situations.

I have worked with clients from a wide range of backgrounds and financial situations, including:

- Individuals and families with low incomes

- Individuals with high levels of debt

- Clients with poor credit scores

- Clients facing foreclosure or eviction

- Clients with disabilities

- Non-native English speakers

7. What are some of the challenges you have faced as a credit counselor?

- Helping clients overcome emotional and psychological barriers to financial well-being.

- Negotiating with creditors who may be resistant to reducing debt obligations.

- Educating clients about complex financial concepts and options.

- Managing a high caseload and meeting the diverse needs of clients.

- Staying up-to-date on the latest changes in credit laws and regulations.

8. What are your strengths as a credit counselor?

- Excellent communication and interpersonal skills.

- Strong understanding of credit and debt management principles.

- Ability to build rapport with clients and gain their trust.

- Passion for helping others achieve financial stability.

- Commitment to ethical and professional standards.

9. What are your goals for your career as a credit counselor?

- To continue providing high-quality credit counseling services to clients from all walks of life.

- To become a recognized expert in the field of credit counseling.

- To develop and implement innovative programs that help clients achieve financial well-being.

- To advocate for policies that promote financial literacy and consumer protection.

10. Why are you interested in working for our organization?

I am interested in working for your organization because of your commitment to providing high-quality, affordable credit counseling services to the community. I am particularly impressed by your focus on empowering clients to take control of their finances and achieve their financial goals. I believe that my skills and experience would be a valuable asset to your team, and I am eager to contribute to the success of your organization.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Consumer Credit Counselor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Consumer Credit Counselor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Consumer Credit Counselors play a crucial role in assisting individuals with financial difficulties. Their primary responsibilities include:

1. Debt Counseling

Providing comprehensive debt counseling services to clients facing financial challenges.

- Assessing clients’ financial situations and identifying areas of concern.

- Developing personalized debt management plans tailored to clients’ specific needs.

- Negotiating with creditors on behalf of clients to reduce interest rates, waive fees, and create manageable repayment schedules.

2. Credit Education

Educating clients on responsible credit practices and financial management.

- Providing workshops and seminars on topics such as budgeting, credit repair, and avoiding common financial pitfalls.

- Teaching clients how to manage their credit effectively, including reducing credit utilization, improving credit scores, and establishing good credit habits.

3. Advocacy and Support

Advocating for clients’ rights and providing emotional support throughout the financial recovery process.

- Assisting clients in understanding and enforcing their legal rights regarding debt collection and credit reporting.

- Providing emotional support and encouragement to clients, helping them stay motivated and overcome challenges.

4. Community Outreach

Participating in community outreach programs to promote financial literacy and prevent financial distress.

- Collaborating with community organizations, schools, and businesses to provide financial education and resources.

- Conducting workshops, presentations, and educational initiatives to raise awareness about financial planning and debt management.

Interview Tips

To ace the interview for a Consumer Credit Counselor position, consider the following preparation tips:

1. Research the Organization

Familiarize yourself with the organization’s mission, values, and services. This demonstrates your interest and enthusiasm for the role.

- Visit the organization’s website to learn about its history, goals, and programs.

- Read articles or news releases about the organization to stay informed about its recent activities and initiatives.

2. Practice Your Counseling Skills

You may be asked to demonstrate your counseling abilities during the interview. Practice active listening, empathy, and problem-solving skills.

- Role-play with a friend or family member to practice your counseling approach and techniques.

- Review common scenarios that you may encounter as a Credit Counselor and prepare your responses.

3. Highlight Your Financial Expertise

Emphasize your knowledge of personal finance, debt management, and credit laws. Quantify your accomplishments and provide specific examples.

- Share statistics or success stories that demonstrate the positive impact of your counseling services.

- Explain how you have helped clients improve their financial situations and achieve their goals.

4. Show Your Passion for Helping Others

Let the interviewer know that you are genuinely passionate about helping people overcome financial challenges.

- Describe your motivations for pursuing a career in Consumer Credit Counseling.

- Share personal experiences or stories that illustrate your empathy and commitment to helping others.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Consumer Credit Counselor, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Consumer Credit Counselor positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.