Are you gearing up for an interview for a Consumer Loan Officer position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Consumer Loan Officer and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

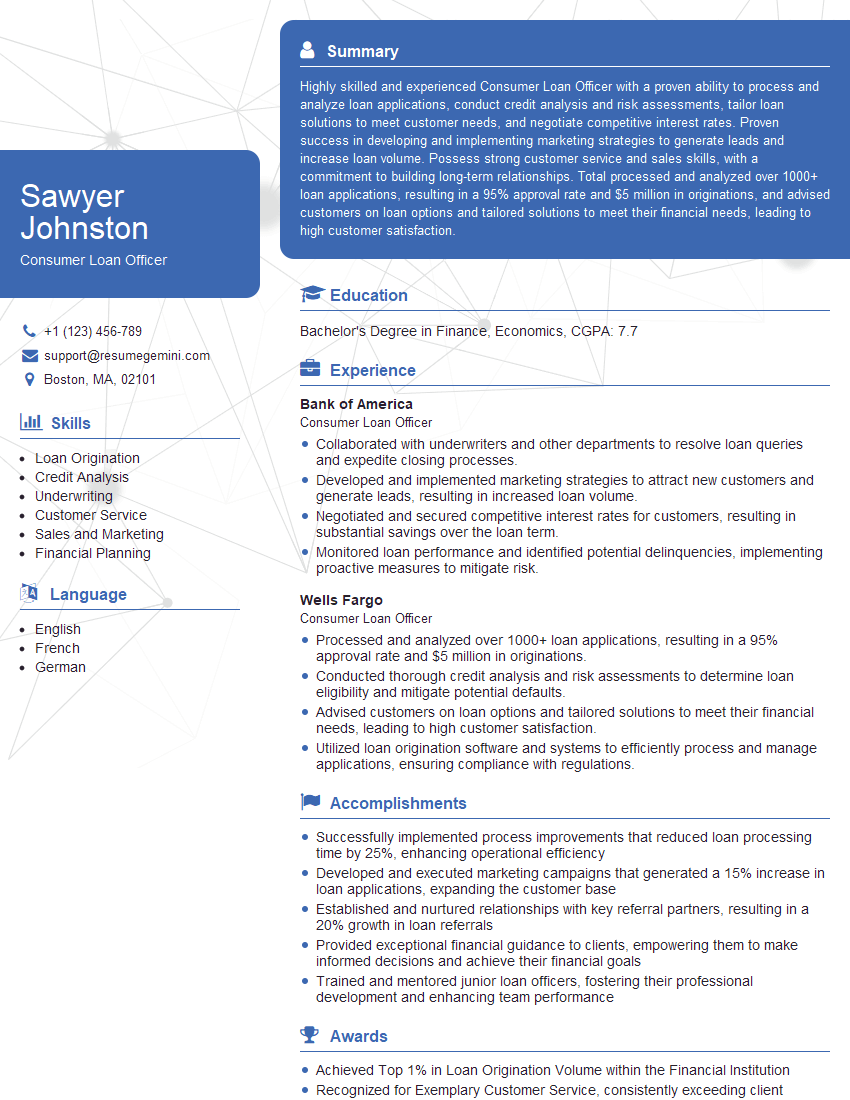

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Consumer Loan Officer

1. Explain the process of underwriting a consumer loan application?

- Review the applicant’s credit history, income, and assets.

- Assess the applicant’s risk of default.

- Determine the loan amount and terms that are appropriate for the applicant.

- Prepare a loan recommendation for approval or denial.

2. What are the different types of consumer loans?

Secured loans

- Auto loans

- Home equity loans

- Personal loans

Unsecured loans

- Credit cards

- Personal loans

- Student loans

3. What are the key factors that you consider when evaluating a consumer loan application?

- Credit history

- Income

- Debt-to-income ratio

- Loan purpose

- Collateral

4. What are the different ways to structure a consumer loan?

- Fixed-rate loans

- Variable-rate loans

- Short-term loans

- Long-term loans

- Secured loans

- Unsecured loans

5. What are the risks associated with consumer lending?

- Default risk

- Interest rate risk

- Regulatory risk

- Reputational risk

6. How do you manage the risks associated with consumer lending?

- Underwriting loans carefully

- Diversifying the loan portfolio

- Maintaining adequate capital reserves

- Complying with all applicable laws and regulations

7. What are the ethical considerations that you must take into account when working as a consumer loan officer?

- Treating all customers fairly and respectfully

- Avoiding conflicts of interest

- Maintaining confidentiality

- Complying with all applicable laws and regulations

8. What are the qualities that make a successful consumer loan officer?

- Strong analytical skills

- Excellent communication skills

- Ability to build rapport with customers

- Knowledge of consumer lending products and regulations

- Commitment to ethical behavior

9. What is your favorite part of being a consumer loan officer?

- Helping customers achieve their financial goals

- Building relationships with customers

- Learning about different industries and businesses

- Working in a challenging and rewarding environment

10. What are your goals for your career as a consumer loan officer?

- To become a top producer in my field

- To develop a deep understanding of consumer lending

- To help as many customers as possible achieve their financial goals

- To make a positive impact on my community

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Consumer Loan Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Consumer Loan Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Consumer Loan Officer, you will play a vital role in the financial well-being of our customers by providing expert guidance and tailored loan solutions to meet their unique needs.

1. Loan Origination

You will actively acquire, evaluate, and process loan applications from potential borrowers, ensuring that all necessary documentation is gathered.

- Identify and qualify potential borrowers based on established credit criteria.

- Thoroughly review loan applications, financial statements, and other relevant documents to assess creditworthiness and risk.

2. Loan Structuring and Analysis

You will structure and analyze loan proposals, recommending loan terms that align with both the borrower’s needs and the bank’s risk appetite.

- Recommend appropriate loan products and terms, including interest rates, repayment schedules, and collateral requirements.

- Analyze financial data to assess the borrower’s ability to repay the loan and identify potential risks.

3. Customer Relationship Management

You will build and maintain strong relationships with customers, providing exceptional service and support throughout the loan process.

- Meet with customers to discuss their loan needs, explain loan options, and answer questions.

- Provide ongoing support and assistance to customers during the loan application and repayment process.

4. Regulatory Compliance

You will ensure that all loan-related activities adhere to industry regulations and bank policies.

- Maintain a deep understanding of consumer lending laws and regulations.

- Document all loan transactions and activities accurately and thoroughly.

Interview Tips

Preparing for an interview can be challenging, but with the right strategies, you can increase your chances of success.

1. Research the Company and Position

Take the time to thoroughly research the financial institution and the specific Consumer Loan Officer position you are applying for.

- Visit the company website to learn about their mission, values, and products/services.

- Read industry news and articles to stay up-to-date on the latest trends and developments.

2. Practice Common Interview Questions

Anticipate common interview questions and prepare concise, well-thought-out answers.

- Tell me about your experience in consumer lending.

- Describe a time when you successfully closed a complex loan deal.

- How do you stay up-to-date on changes in the regulatory landscape?

3. Showcase Your Skills and Experience

Highlight your relevant skills and experience that make you a suitable candidate.

- Emphasize your strong analytical and problem-solving abilities.

- Provide specific examples of your success in originating and closing loans.

- Discuss your commitment to customer service and regulatory compliance.

4. Prepare Questions for the Interviewer

Asking thoughtful questions shows your interest in the position and the company.

- What are the key challenges and opportunities facing the Consumer Loan Department?

- What is the bank’s training and development program for Consumer Loan Officers?

- How does the bank measure the success of its Consumer Loan Officers?

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Consumer Loan Officer, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Consumer Loan Officer positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.