Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Controller interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Controller so you can tailor your answers to impress potential employers.

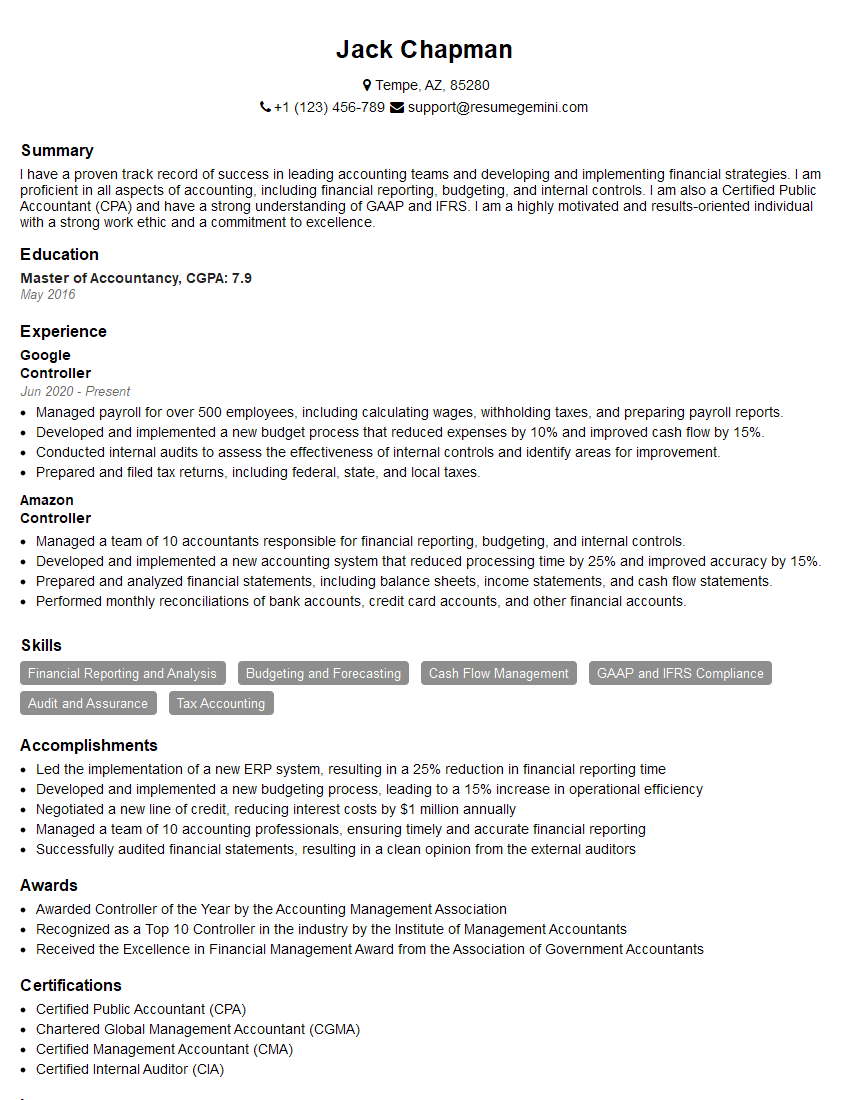

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Controller

1. What are the key responsibilities of a Controller?

The key responsibilities of a Controller generally include:

- Leading and managing the accounting and financial reporting functions

- Ensuring the accuracy and integrity of financial records and statements

- Overseeing internal controls and compliance with relevant regulations

- Providing financial analysis and insights to support decision-making

- Managing relationships with external auditors and other stakeholders

2. Describe your understanding of Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

GAAP

- US-based accounting standards

- Set by the Financial Accounting Standards Board (FASB)

- Govern the preparation and presentation of financial statements

IFRS

- International accounting standards

- Set by the International Accounting Standards Board (IASB)

- Adopted by many countries outside the US

3. What are the steps involved in preparing a financial budget?

The steps involved in preparing a financial budget typically include:

- Assessing revenue streams and expenses

- Forecasting future financial performance

- Setting financial targets and goals

- Allocating resources and planning for contingencies

- Monitoring and adjusting the budget as needed

4. How do you stay up-to-date on accounting and finance best practices?

I stay up-to-date on accounting and finance best practices through a combination of continuing education, professional development, and industry involvement, such as:

- Attending conferences and workshops

- Reading industry publications and research

- Participating in professional organizations and networks

- Seeking certifications and specialized training

5. Describe your experience in managing internal controls.

In my experience, I have played a key role in developing, implementing, and maintaining robust internal controls within various organizations. My responsibilities included:

- Identifying and assessing risks

- Designing and implementing control measures

- Monitoring and testing the effectiveness of controls

- Ensuring compliance with regulatory requirements

- Collaborating with internal and external auditors

6. How do you approach financial analysis and reporting?

My approach to financial analysis and reporting involves:

- Gathering and analyzing financial data

- Identifying trends and patterns

- Developing insights and recommendations

- Communicating financial information effectively to various stakeholders

- Using financial analysis to support decision-making and strategic planning

7. Describe your experience in working with external auditors.

Throughout my career, I have had extensive experience in working closely with external auditors. My responsibilities have included:

- Preparing for and facilitating audits

- Providing auditors with requested information and documentation

- Responding to audit inquiries and findings

- Collaborating with auditors to resolve audit issues

- Implementing auditor recommendations to strengthen internal controls

8. How do you manage relationships with key stakeholders, such as the CFO and senior management?

I believe in establishing strong and collaborative relationships with key stakeholders. My approach involves:

- Understanding their needs and priorities

- Communicating regularly and effectively

- Providing timely and accurate information

- Seeking input and feedback

- Building trust and credibility

9. What is your understanding of Sarbanes-Oxley Act (SOX) compliance?

The Sarbanes-Oxley Act (SOX) is a federal law that was enacted in 2002 in response to several high-profile corporate scandals. The act is designed to protect investors and the public by improving the accuracy and reliability of corporate financial reporting. SOX compliance requires companies to implement and maintain a system of internal controls and to have their financial statements audited by an independent accounting firm.

10. Describe your experience in developing and implementing accounting policies and procedures.

I have been involved in the development and implementation of accounting policies and procedures in several organizations. My responsibilities have included:

- Reviewing and analyzing existing policies and procedures

- Identifying areas for improvement

- Drafting and implementing new policies and procedures

- Training staff on new policies and procedures

- Ensuring compliance with applicable laws and regulations

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Controller.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Controller‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Controller is a senior-level accounting professional responsible for overseeing all aspects of an organization’s financial operations. Key job responsibilities include:

1. Financial Reporting

Preparing and delivering accurate and timely financial statements, including the balance sheet, income statement, and cash flow statement.

- Ensuring compliance with all applicable accounting standards and regulations.

- Working with auditors to ensure that financial records are accurate and reliable.

2. Budgeting and Forecasting

Developing and managing the organization’s budget, including revenue and expense projections.

- Monitoring actual results against the budget and making adjustments as needed.

- Providing financial forecasts to help management make informed decisions.

3. Internal Control

Establishing and maintaining a system of internal controls to safeguard the organization’s assets and ensure the accuracy of its financial records.

- Conducting regular audits and reviews to identify and mitigate risks.

- Working with other departments to ensure that they are following proper accounting procedures.

4. Compliance

Ensuring that the organization is in compliance with all applicable laws and regulations.

- Filing tax returns on time and paying all taxes due.

- Maintaining proper records of all financial transactions.

Interview Tips

Preparing for a Controller interview can be challenging, but there are a few things you can do to increase your chances of success.

1. Research the Company

Before the interview, take some time to research the company you are applying to. This will help you understand their industry, their financial position, and their culture.

- Visit the company’s website and read their annual report.

- Look for news articles and press releases about the company.

- Talk to people who work or have worked for the company.

2. Practice Your Answers

Once you have a good understanding of the company, you can start practicing your answers to common interview questions. Here are a few questions that you may be asked:

- Tell me about your experience in financial reporting.

- How do you stay up-to-date on accounting standards and regulations?

- Describe a time when you had to implement a new accounting system.

- What are your strengths and weaknesses as a Controller?

- Why are you interested in this position?

3. Dress Professionally

First impressions matter, so it is important to dress professionally for your interview. This means wearing a suit or dress pants and a button-down shirt or blouse.

- Make sure your clothes are clean and pressed.

- Avoid wearing too much jewelry or perfume.

4. Be Yourself

It is important to be yourself during your interview. The interviewer wants to get to know the real you, so don’t try to be someone you’re not.

- Be honest and open about your experience and skills.

- Be enthusiastic and positive about the position.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Controller interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!