Are you gearing up for an interview for a Corporate Banking Officer position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Corporate Banking Officer and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

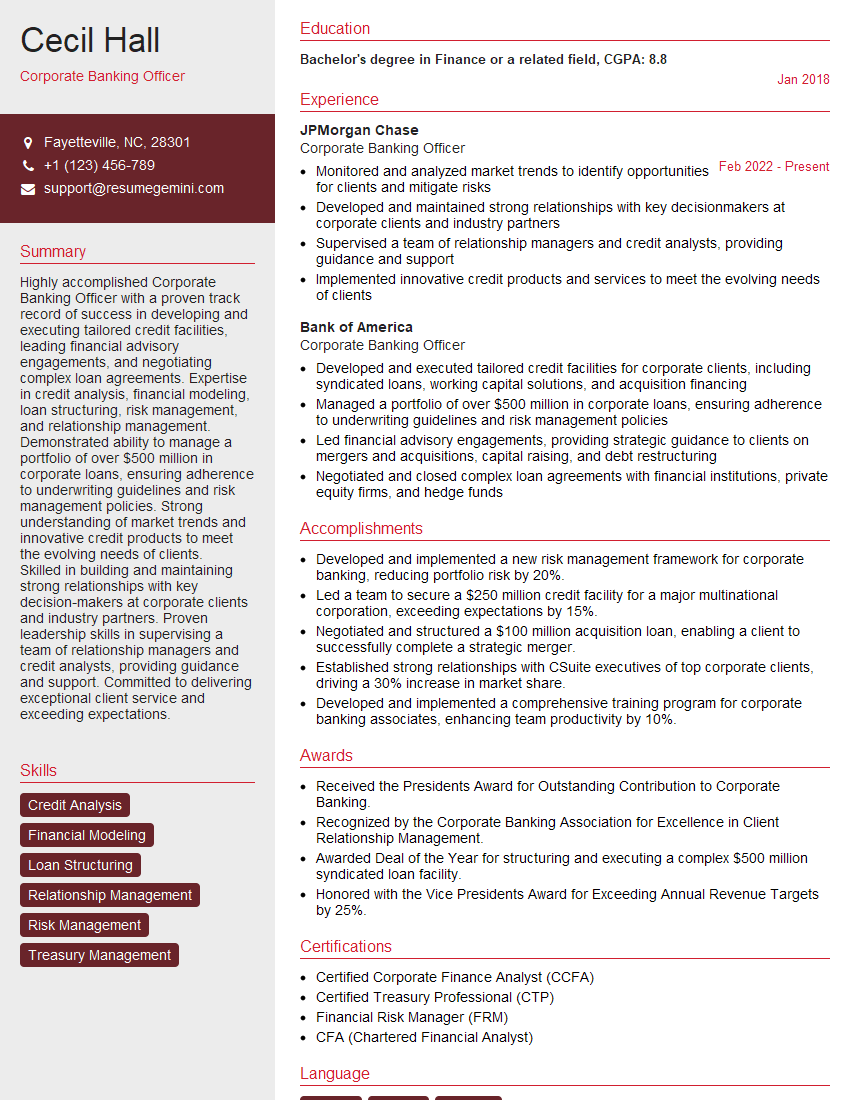

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Corporate Banking Officer

1. How would you assess the creditworthiness of a potential corporate client?

I would assess the creditworthiness of a potential corporate client by considering the following factors:

- Financial performance: I would analyze the company’s financial statements to assess its profitability, liquidity, and solvency.

- Business risk: I would evaluate the industry in which the company operates, its competitive position, and its management team.

- Credit history: I would review the company’s credit history to see if it has any outstanding debts or has been involved in any legal disputes.

2. What are the different types of corporate banking products and services?

Lending products

- Term loans

- Revolving lines of credit

- Equipment financing

Deposit products

- Commercial checking accounts

- Commercial savings accounts

- Money market accounts

Treasury management services

- Cash management

- Trade finance

- Foreign exchange services

3. What are the key risks associated with corporate banking?

- Credit risk: The risk that a corporate client will default on its loan obligations.

- Interest rate risk: The risk that changes in interest rates will affect the profitability of the bank’s lending portfolio.

- Liquidity risk: The risk that the bank will not be able to meet its short-term obligations.

- Operational risk: The risk of losses resulting from inadequate internal controls or human error.

4. How do you manage the relationship between the bank and its corporate clients?

- Building strong relationships with key decision-makers within the client’s organization.

- Understanding the client’s business and financial needs.

- Providing tailored solutions that meet the client’s specific requirements.

- Maintaining regular communication with the client to keep them informed of the bank’s products and services.

5. What are the ethical considerations that corporate banking officers must be aware of?

- Confidentiality: Corporate banking officers must keep client information confidential.

- Conflicts of interest: Corporate banking officers must avoid conflicts of interest that could compromise their ability to provide objective advice to clients.

- Fair lending: Corporate banking officers must comply with all fair lending laws and regulations.

- Anti-money laundering: Corporate banking officers must be aware of the bank’s anti-money laundering policies and procedures.

6. What are the challenges facing corporate banking today?

- Increased competition from non-bank lenders.

- Regulatory changes that have increased the cost of compliance.

- The need to adapt to new technologies.

- The changing needs of corporate clients.

7. How do you stay up-to-date on the latest developments in corporate banking?

- Reading industry publications and attending conferences.

- Taking continuing education courses.

- Networking with other corporate banking professionals.

- Following industry thought leaders on social media.

8. What are your strengths as a corporate banking officer?

- Strong analytical and problem-solving skills.

- Excellent communication and interpersonal skills.

- A deep understanding of corporate finance and banking.

- A proven track record of success in managing corporate banking relationships.

9. What are your weaknesses as a corporate banking officer?

- I can sometimes be too detail-oriented.

- I can be too focused on getting the job done quickly and efficiently.

- I can sometimes be too blunt in my communication.

10. Why are you interested in this position?

- I am passionate about corporate banking and I believe that I have the skills and experience to be successful in this role.

- I am eager to learn more about your bank and how I can contribute to its success.

- I am confident that I can build strong relationships with your corporate clients and help them achieve their financial goals.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Corporate Banking Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Corporate Banking Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Corporate Banking Officer is a highly skilled professional responsible for managing and developing relationships with corporate clients. Key job responsibilities include:

1. Client Relationship Management

Establish, maintain, and develop strong relationships with corporate clients by understanding their financial needs and business objectives.

- Identify and acquire new clients that align with the bank’s target market.

- Regularly visit clients’ offices to discuss their financial situation and provide advice.

2. Financial Advisory Services

Provide customized financial advisory services to clients, including:

- Structuring and executing debt financing, including loans, bonds, and securitizations.

- Advising on mergers and acquisitions, capital markets transactions, and risk management.

3. Product and Service Sales

Sell and cross-sell a range of banking products and services to clients, including:

- Commercial loans

- Treasury management services

4. Relationship Profitability and Growth

Manage and grow client relationships to maximize profitability and drive revenue generation:

- Monitor client performance and identify opportunities for additional business.

- Develop and implement strategies to increase client loyalty and retain existing relationships.

Interview Tips

Preparing for an interview for a Corporate Banking Officer role requires thorough preparation. Here are some tips:

1. Research the Company and the Role

Research the bank’s financial performance, business lines, and industry reputation. Understand the specific responsibilities of the Corporate Banking Officer role and how it aligns with the bank’s overall strategy.

2. Practice Answering Common Interview Questions

Prepare answers to common interview questions, such as:

- Tell me about your experience in corporate banking.

- How do you build and maintain strong client relationships?

- What are your strengths and weaknesses as a Corporate Banking Officer?

3. Highlight Skills and Experience

Emphasize your skills in financial analysis, financial modeling, and relationship management. Showcase your experience in developing and implementing financial solutions for corporate clients.

4. Prepare Questions for the Interviewer

Ask thoughtful questions to demonstrate your interest in the role and the bank. This shows that you are engaged and genuinely interested in the opportunity.

5. Dress Professionally and Arrive on Time

First impressions matter. Dress appropriately for the interview and arrive punctually to show respect for the interviewer and the organization.

6. Practice Active Listening and Engage in Conversation

Listen attentively to the interviewer’s questions and respond thoughtfully. Ask clarifying questions to show that you are engaged in the conversation and fully understand the role and responsibilities.

7. Follow Up After the Interview

Within 24 hours of the interview, send a thank-you note to the interviewer. Restate your interest in the role and reiterate your key strengths and qualifications.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Corporate Banking Officer, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Corporate Banking Officer positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.