Feeling lost in a sea of interview questions? Landed that dream interview for Corporate Bond Trader but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Corporate Bond Trader interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

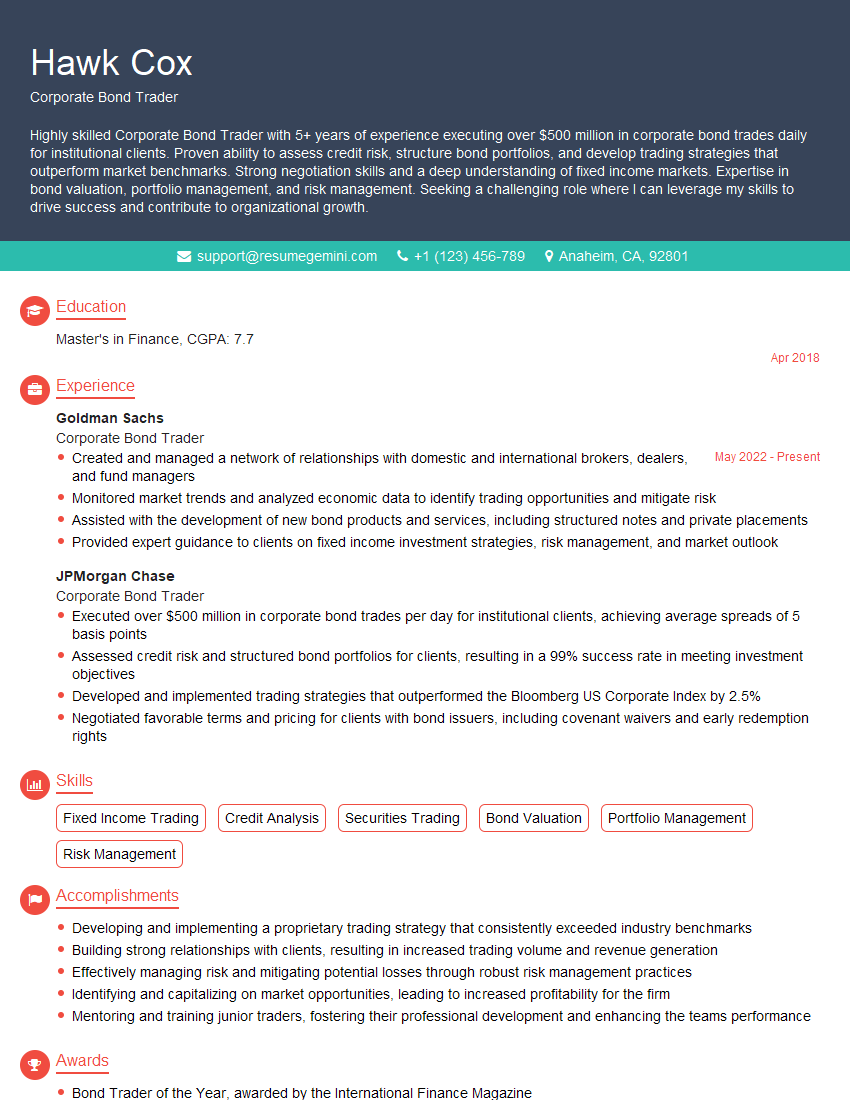

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Corporate Bond Trader

1. Explain the role of a Corporate Bond Trader in a financial institution.

As a Corporate Bond Trader, I play a crucial role in facilitating the buying and selling of corporate bonds for our clients. My responsibilities include:

- Executing trades on behalf of investors and institutions

- Providing liquidity to the market by making bids and offers

- Assessing credit risk and evaluating bond issuers

- Monitoring market trends and economic data to make informed trading decisions

2. Describe the different types of corporate bonds and their key characteristics.

Investment-Grade Bonds

- Issued by companies with strong credit profiles

- Carry lower interest rates and lower risk

High-Yield Bonds (Junk Bonds)

- Issued by companies with lower credit ratings

- Offer higher interest rates with higher risk

Convertible Bonds

- Can be exchanged into equity shares of the issuing company

- Offer a balance of fixed income and equity returns

3. Explain the concept of yield to maturity (YTM) and how it is calculated.

Yield to Maturity (YTM) is the annualized return an investor can expect to receive if they hold a bond until its maturity date. It is calculated using the following formula:

YTM = (C + (F – P) / N) / ((F + P) / 2)

- C = Annual coupon payment

- F = Face value of the bond

- P = Current price of the bond

- N = Number of years to maturity

4. Discuss the factors that affect the pricing of corporate bonds.

- Creditworthiness of the issuer

- Term to maturity

- Interest rate environment

- Economic conditions

- Supply and demand in the market

5. Describe the different trading strategies used by Corporate Bond Traders.

Fundamental Analysis

- Evaluate the financial health and prospects of the issuing company

- Identify undervalued bonds with potential for appreciation

Technical Analysis

- Study price charts and patterns to identify trends and trading opportunities

- Use indicators and oscillators to predict market direction

Market Making

- Providing liquidity to the market by continuously quoting bid and ask prices

- Profiting from the spread between buying and selling prices

6. How do you manage risk in corporate bond trading?

- Assess credit risk through credit analysis and due diligence

- Diversify portfolio across different issuers, sectors, and maturities

- Use hedging strategies to mitigate interest rate and market volatility

- Monitor market conditions and adjust trading strategies accordingly

7. Explain the regulatory environment for corporate bond trading.

Corporate bond trading is regulated by various agencies such as the SEC, FINRA, and the ISDA. These regulations ensure market integrity, transparency, and investor protection. They include:

- Registration requirements for brokers and dealers

- Disclosure and reporting obligations

- Best execution and conflict of interest rules

- Anti-fraud and anti-manipulation provisions

8. Discuss the current trends and challenges in the corporate bond market.

- Low interest rates and search for yield

- Increased issuance of high-yield bonds

- Regulatory changes and increased compliance costs

- Technological advancements and automated trading

- Impact of economic and geopolitical events

9. Describe a time when you successfully executed a complex corporate bond trade.

In a recent transaction, I was responsible for executing a large block trade of high-yield bonds. The trade involved multiple counterparties and required careful coordination. I analyzed the market, assessed the potential risks, and negotiated favorable terms for my client.

- Identified a seller who was willing to liquidate a large position

- Negotiated a price that was below the prevailing market price

- Executed the trade in a timely and efficient manner, minimizing market impact

10. How do you stay updated on market trends and economic developments?

- Regularly monitor financial news and market data

- Read industry reports and publications

- Attend conferences and webinars

- Engage with industry professionals and analysts

- Conduct independent research and analysis

11. What are your career goals and aspirations as a Corporate Bond Trader?

I am passionate about the corporate bond market and aspire to become a leading trader in the industry. My long-term goal is to manage a large portfolio of corporate bonds and make significant contributions to my firm and clients.

- Develop expertise in various sectors and bond types

- Build strong relationships with clients and counterparties

- Contribute to the development of innovative trading strategies

- Mentor and train junior traders

- Play a leadership role in the industry

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Corporate Bond Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Corporate Bond Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Corporate Bond Trader is a finance professional who buys and sells corporate bonds for their clients. They work closely with portfolio managers and other financial advisors to help them make investment decisions. The key job responsibilities of a Corporate Bond Trader include:

1. Executing Bond Trades

Corporate Bond Traders are responsible for executing bond trades on behalf of their clients. This involves buying and selling bonds in the secondary market, and ensuring that the trades are executed at the best possible price.

- Negotiating prices with other traders

- Placing orders through electronic trading platforms

2. Market Analysis

Corporate Bond Traders need to have a deep understanding of the bond market, and be able to analyze market trends and make informed investment decisions. This involves:

- Monitoring economic data

- Analyzing company financial statements

- Following industry news and events

3. Risk Management

Corporate Bond Traders need to be able to manage risk, and this involves understanding the different types of risks associated with bond trading. This includes:

- Interest rate risk

- Credit risk

- Liquidity risk

4. Client Service

Corporate Bond Traders need to be able to provide excellent customer service to their clients. This involves:

- Answering client questions

- Providing investment advice

- Executing trades in a timely and efficient manner

Interview Tips

Preparing for a Corporate Bond Trader interview can be daunting, but there are a few things you can do to increase your chances of success.

1. Research the Company and the Position

Before you go on an interview, it is important to do your research on the company and the position you are applying for. This will help you understand the company’s culture, goals, and expectations for the role, and will allow you to answer questions intelligently and confidently.

- Visit the company website

- Read news articles about the company

- Talk to people in your network who work at the company

2. Practice Your Answers to Common Interview Questions

There are a few common interview questions that you are likely to be asked in a Corporate Bond Trader interview. It is helpful to practice your answers to these questions in advance so that you can deliver them smoothly and confidently. Some common interview questions include:

- Tell me about your experience in bond trading.

- What is your understanding of the bond market?

- How do you manage risk in your bond trading?

- What are your strengths and weaknesses as a bond trader?

3. Prepare Questions for the Interviewer

Asking questions at the end of an interview shows that you are interested in the position and the company, and that you have taken the time to prepare. It also gives you an opportunity to learn more about the company and the role.

- What are the biggest challenges facing the company right now?

- What are the company’s goals for the next year?

- What is the company’s culture like?

4. Dress Professionally and Be on Time

First impressions matter, so it is important to dress professionally and be on time for your interview. This shows that you respect the interviewer’s time and that you are serious about the position.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Corporate Bond Trader interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!