Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Corporate Claims Examiner position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

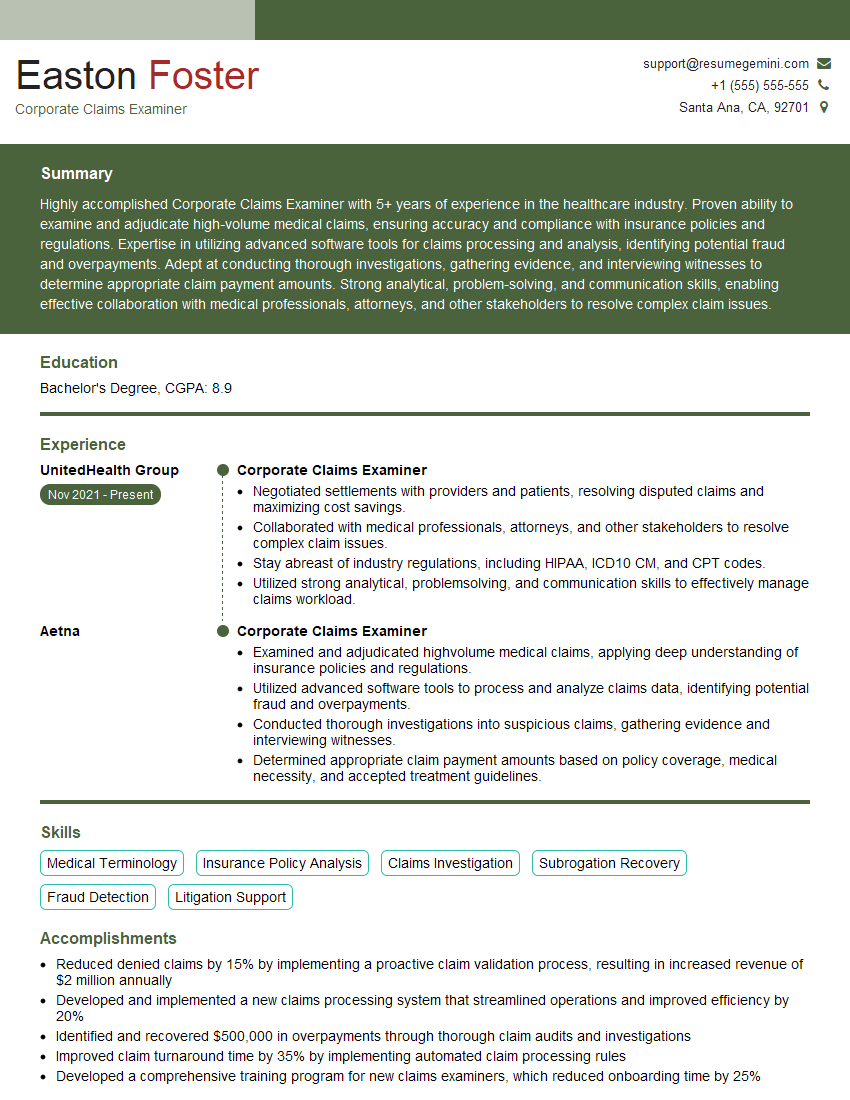

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Corporate Claims Examiner

1. What are the key responsibilities of a Corporate Claims Examiner?

As a Corporate Claims Examiner, I would be responsible for:

- Assessing and investigating insurance claims to determine coverage and liability

- Gathering and reviewing medical records, witness statements, and other relevant documentation

- Conducting interviews and witness examinations

- Determining appropriate reserves and recommending settlement amounts

- Providing expert testimony in court as needed

2. What are the most common types of claims handled by Corporate Claims Examiners?

Property damage claims

- Assess the extent of damage and determine liability

- Negotiate settlements with policyholders and third parties

Bodily injury claims

- Review medical records and determine the extent of injuries

- Assess liability and negotiate settlements

Business interruption claims

- Review financial records to determine the extent of lost income

- Negotiate settlements with policyholders

3. What are the key laws and regulations that govern the work of Corporate Claims Examiners?

As a Corporate Claims Examiner, I would be familiar with the following laws and regulations:

- The Insurance Code

- The Unfair Claims Settlement Practices Act

- The Fair Credit Reporting Act

- The Health Insurance Portability and Accountability Act

4. What are the key skills required to be a successful Corporate Claims Examiner?

To be successful in this role, I believe the following skills are essential:

- Strong analytical and problem-solving skills

- Excellent communication and interpersonal skills

- Attention to detail and accuracy

- Ability to work independently and as part of a team

- Up-to-date knowledge of insurance laws and regulations

5. What are the common challenges faced by Corporate Claims Examiners?

Some of the common challenges faced by Corporate Claims Examiners include:

- Dealing with difficult or uncooperative claimants

- Managing a high volume of claims

- Staying up-to-date on changes in laws and regulations

- Balancing the need for thorough investigations with the need to resolve claims quickly

6. What is your approach to conducting a claim investigation?

My approach to conducting a claim investigation is as follows:

- Gather all relevant information about the claim, including the policy, the incident report, and any witness statements

- Review the information to identify any inconsistencies or gaps

- Interview the claimant and any witnesses to obtain their accounts of the incident

- Inspect the damaged property or visit the scene of the accident

- Analyze the information gathered to determine the cause of the loss and the extent of the damage

- Prepare a report summarizing my findings and recommending a course of action

7. How do you determine the liability of a policyholder in a claim?

To determine the liability of a policyholder in a claim, I would consider the following factors:

- The terms of the insurance policy

- The cause of the loss

- The actions of the policyholder

- Any applicable laws or regulations

8. What is your experience with using insurance software and databases?

I have experience using a variety of insurance software and databases, including:

- Claims management systems

- Policy administration systems

- Fraud detection systems

- Medical research databases

9. How do you stay up-to-date on changes in insurance laws and regulations?

I stay up-to-date on changes in insurance laws and regulations by:

- Reading industry publications

- Attending conferences and webinars

- Taking continuing education courses

- Networking with other insurance professionals

10. What are your career goals?

My career goal is to become a senior claims examiner and eventually a claims manager. I am confident that my skills and experience would enable me to be successful in these roles.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Corporate Claims Examiner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Corporate Claims Examiner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

## Key Job Responsibilities Corporate Claims Examiners play a crucial role in evaluating and processing insurance claims. Key responsibilities include: – Reviewing and analyzing claims: Examining claims for completeness, accuracy, and validity, ensuring compliance with policies and guidelines. – Investigating claims: Conducting thorough investigations, gathering evidence, and interviewing witnesses to determine the cause and extent of loss. – Negotiating settlements: Negotiating fair and equitable settlement agreements with claimants, considering factors such as coverage, liability, and degree of fault. – Authorizing payments: Approving and authorizing payments to claimants, ensuring timely and appropriate compensation. – Maintaining claim files: Maintaining detailed and organized claim files, including all relevant documentation and communications. – Collaborating with other departments: Working closely with adjusters, underwriters, and legal counsel to ensure a comprehensive claims handling process. – Monitoring industry trends: Staying abreast of industry trends and best practices to enhance claims handling efficiency and effectiveness. ## Interview Tips To ace a Corporate Claims Examiner interview, follow these proven tips: 1. Research the Company and Position: – Thoroughly research the company’s business, insurance products, and claims management processes. – Understand the specific responsibilities and expectations of the Claims Examiner role. 2. Highlight Relevant Skills and Experience: – Quantify your claims handling experience, including the number and types of claims processed. – Emphasize your analytical, investigative, and negotiation skills. – Showcase your knowledge of insurance policies and claims regulations. 3. Prepare for Common Interview Questions: – Prepare answers to common interview questions, such as: – Tell me about your claims handling experience. – How do you approach complex or high-risk claims? – What are the key factors you consider when negotiating settlements? 4. Demonstrate a Professional Demeanor: – Dress professionally and arrive on time for the interview. – Maintain eye contact, speak clearly, and demonstrate a confident yet respectful demeanor. – Be prepared to ask informed questions about the company and position. 5. Use Industry Jargon: – Familiarize yourself with industry-specific terms and use them appropriately during the interview. – This shows your understanding of claims handling processes and your professional credibility. 6. Prepare Questions for the Interviewer: – Ask thoughtful questions that demonstrate your interest and enthusiasm for the role. – Examples include: – What are the company’s key performance indicators for claims handling? – How does the company prioritize training and professional development for Claims Examiners? 7. Follow Up: – Thank the interviewer for their time and express your appreciation for the opportunity. – Reiterate your key skills and qualifications, and inquire about the next steps in the hiring process.Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Corporate Claims Examiner interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!