Are you gearing up for an interview for a Corporate Controller position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Corporate Controller and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

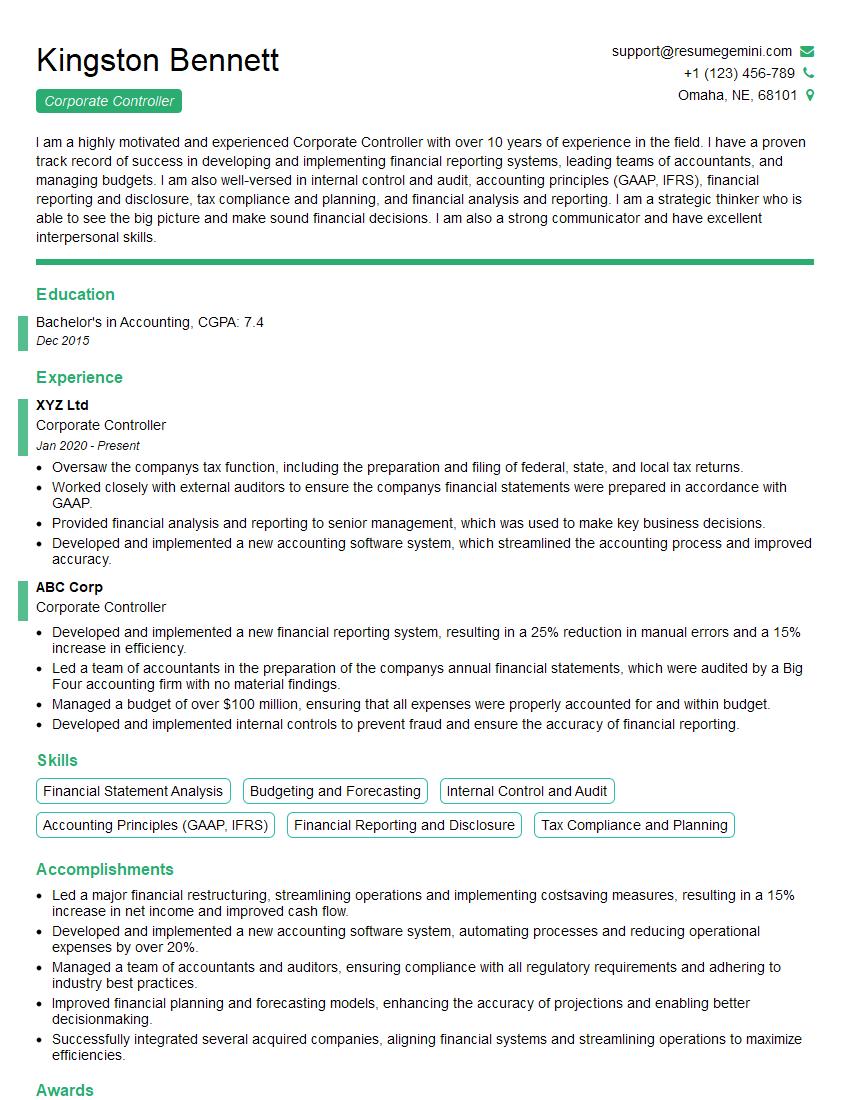

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Corporate Controller

1. Explain the responsibilities of a Corporate Controller?

As the Corporate Controller, my responsibilities encompass a wide range of financial and operational aspects of the organization. I am accountable for:

- Leading the accounting, financial reporting, and internal control functions

- Ensuring the accuracy and integrity of the company’s financial statements

- Managing cash flow and working capital

- Developing and implementing financial policies and procedures

- Overseeing the external audit process

- Providing financial analysis and insights to senior management and the board of directors

- Managing the company’s investment portfolio

- Collaborating with other departments to ensure the alignment of financial activities with overall business objectives

- Advising the CEO and CFO on financial matters

- Staying abreast of accounting and regulatory changes and ensuring compliance

2. Describe the key challenges you anticipate in this role and how you plan to address them?

Technology advancements and automation

- Utilizing technology to streamline processes and improve efficiency

- Investing in training and development programs for staff to stay updated with the latest technologies

Regulatory compliance

- Staying informed about regulatory changes and their impact on the organization

- Developing and implementing policies and procedures to ensure compliance

- Working closely with external auditors to ensure a smooth and effective audit process

Data security and risk management

- Implementing robust data security measures to protect sensitive financial information

- Developing and executing a comprehensive risk management plan to mitigate potential threats

- Regularly reviewing and updating security measures to stay ahead of emerging risks

3. How would you approach improving the efficiency of the accounting and reporting processes?

- Conduct a thorough assessment of existing processes to identify areas for improvement

- Implement technology solutions to automate manual tasks and streamline workflows

- Review and optimize accounting policies and procedures to reduce redundancies

- Foster a culture of continuous improvement by encouraging staff to suggest and implement process enhancements

- Provide regular training to ensure staff are proficient in using new technologies and processes

4. Describe your experience in managing and developing a team of finance professionals?

I have extensive experience in leading and developing finance teams. In my previous role, I managed a team of 10 accountants and financial analysts. I fostered a positive and collaborative work environment where team members were empowered to take ownership of their responsibilities. I regularly provided coaching, mentoring, and professional development opportunities to enhance their skills and knowledge. Through my leadership, the team consistently exceeded performance expectations and received recognition for their contributions to the company.

5. How do you stay up-to-date with the latest accounting and financial reporting standards?

- Attending industry conferences and webinars

- Reading professional publications and journals

- Participating in continuing professional education courses

- Networking with other finance professionals

- Leveraging online resources and databases

6. Describe your understanding of GAAP and IFRS?

I have a comprehensive understanding of both GAAP and IFRS. GAAP (Generally Accepted Accounting Principles) is the accounting framework used in the United States and is based on the principles of accrual accounting. IFRS (International Financial Reporting Standards) is a set of accounting standards that are used in over 140 countries around the world. IFRS is based on the principles of fair value accounting. I am proficient in applying both GAAP and IFRS in my work and have experience in preparing financial statements under both frameworks.

7. How do you ensure the accuracy and reliability of financial reporting?

- Establishing and maintaining a robust system of internal controls

- Implementing a rigorous review and approval process for financial statements

- Working closely with external auditors to ensure the integrity of the audit process

- Providing ongoing training to accounting staff on accounting principles and reporting requirements

- Encouraging a culture of ethical behavior and integrity throughout the organization

8. Describe your experience in managing relationships with external stakeholders, such as investors, creditors, and regulators?

I have extensive experience in managing relationships with external stakeholders. In my previous role, I was responsible for communicating with investors, creditors, and regulators on a regular basis. I developed strong relationships with these stakeholders by providing them with timely and accurate information about the company’s financial performance and operations. I also worked closely with external auditors to ensure a smooth and effective audit process.

9. How do you prioritize multiple projects and responsibilities effectively?

- Using a project management tool to track progress and deadlines

- Delegating tasks to team members and providing clear expectations

- Communicating regularly with stakeholders to keep them informed of progress

- Focusing on the most important tasks and projects first

- Saying no to additional projects or responsibilities when necessary

10. Tell us about a time when you had to make a difficult decision that impacted the organization’s financial performance?

In my previous role, I was faced with the difficult decision of whether to write off a significant amount of bad debt. The decision would have a material impact on the company’s financial performance in the short term. However, I knew that it was the right decision for the long-term health of the company. I carefully analyzed the situation, consulted with other senior management, and ultimately made the decision to write off the bad debt. This decision was not popular with all stakeholders, but it was the right decision for the company in the long run.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Corporate Controller.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Corporate Controller‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Corporate Controller serves as a key financial executive responsible for overseeing and managing the financial activities of the organization. The role requires a deep understanding of accounting principles, financial planning, and strategic decision-making.

1. Financial Reporting and Compliance

Oversees the preparation and accuracy of the company’s financial statements, ensuring compliance with Generally Accepted Accounting Principles (GAAP) and all relevant regulations.

- Directs the preparation of financial statements, including balance sheets, income statements, and cash flow statements.

- Ensures timely filing of financial reports to regulatory agencies and stakeholders.

2. Budget Management and Financial Planning

Develops and implements the company’s financial plan, including setting financial goals, allocating resources, and managing expenses.

- Prepares long-term financial projections and analyzes financial performance.

- Collaborates with senior management to develop and execute business strategies.

3. Internal Control and Risk Management

Establish and maintain an effective system of internal controls to ensure the safeguarding of assets, accuracy of financial information, and compliance with legal and regulatory requirements.

- Conducts risk assessments and develops mitigation strategies.

- Oversees internal audits and reviews.

4. Financial Analysis and Reporting

Provides financial insights and analysis to support decision-making, identifying opportunities and potential risks.

- Analyzes financial data to identify trends and patterns.

- Prepares financial reports and presentations for management and external stakeholders.

Interview Tips

To ace the interview for a Corporate Controller position, it is essential to be well-prepared and showcase your skills and experience.

1. Research the Company and Position

Take the time to thoroughly research the company’s industry, financial performance, and the specific responsibilities of the Corporate Controller role. This knowledge will demonstrate your interest in the opportunity and understanding of the company’s financial landscape.

2. Highlight Your Expertise and Experience

Showcase your proficiency in accounting principles, financial modeling, and risk management. Quantify your accomplishments and provide specific examples of your impact on financial performance.

3. Emphasize Leadership and Communication

The Corporate Controller role requires strong leadership and communication skills. Highlight your ability to manage a team, build relationships, and communicate complex financial information effectively to various stakeholders.

4. Be Ready to Discuss Industry Trends

Demonstrate your awareness of emerging accounting standards and industry best practices. Discuss how these trends will impact the company’s financial operations and how you plan to address them.

5. Prepare Questions for the Interviewer

Asking thoughtful questions shows your engagement and interest in the role. Prepare questions that demonstrate your understanding of the business and your desire to contribute to its success.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Corporate Controller interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.