Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Corporate Finance Advisor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

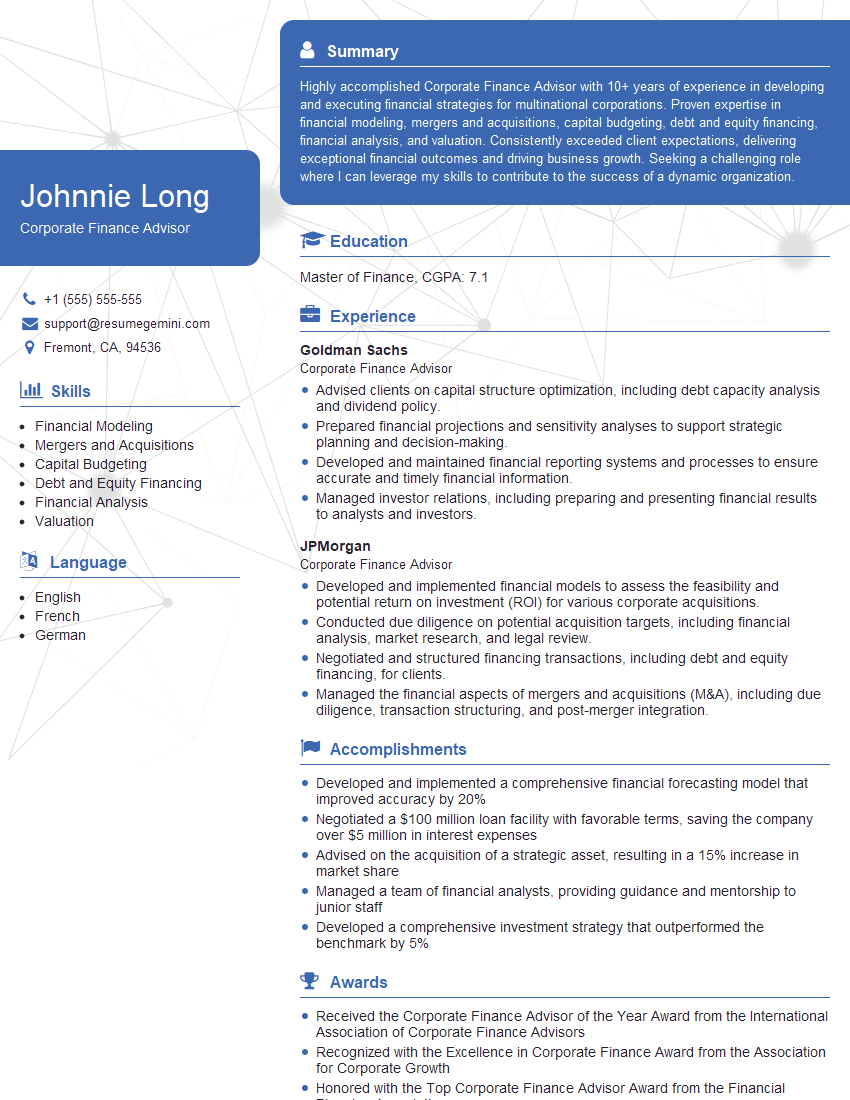

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Corporate Finance Advisor

1. What are the key financial ratios used to evaluate a company’s financial health?

- Liquidity ratios: These ratios assess a company’s ability to meet its short-term obligations, such as the current ratio and quick ratio.

- Solvency ratios: These ratios evaluate a company’s long-term solvency, such as the debt-to-equity ratio and times interest earned ratio.

- Profitability ratios: These ratios measure a company’s profitability, such as the gross profit margin and net profit margin.

- Efficiency ratios: These ratios assess how efficiently a company utilizes its assets, such as inventory turnover and accounts receivable turnover.

2. Describe the process of financial due diligence for a merger or acquisition.

Due Diligence Process

- Preparation and Planning: Define the scope, assemble a team, and prepare a due diligence plan.

- Data Collection and Analysis: Gather financial statements, management accounts, operational data, and legal documents.

- Financial Analysis: Evaluate financial performance, review financial ratios, and assess liquidity, solvency, profitability, and efficiency.

- Business Analysis: Assess market position, operations, and management team.

- Legal and Regulatory Review: Examine contracts, legal compliance, and regulatory filings.

- Reporting and Conclusions: Summarize findings, identify risks and opportunities, and make recommendations.

3. How do you approach the valuation of a privately held company?

- Discounted Cash Flow (DCF): Projects future cash flows, discounts them, and calculates a present value based on a terminal value.

- Comparable Company Analysis: Compares the target company to similar public companies based on multiples of revenue, earnings, or other metrics.

- Asset-Based Valuation: Determines the value of the company’s assets, such as inventory, property, and equipment.

- Market Approach: Considers recent acquisitions or transactions involving comparable companies.

4. What are the different types of capital structures and how do they impact a company’s financial risk?

- Debt Financing: Borrowing money from banks, issuing bonds, or taking on loans. Increases financial risk but can provide tax advantages.

- Equity Financing: Raising capital by issuing shares of stock. Dilutes ownership but does not incur interest payments.

- Hybrid Financing: A combination of debt and equity financing, such as convertible bonds or preferred stock.

- Capital structure Optimization: The ideal capital structure balances risk and return, considering factors such as industry norms, growth stage, and cost of capital.

5. Explain the concept of weighted average cost of capital (WACC).

- Formula: WACC = (Cost of Equity x % Equity) + (Cost of Debt x % Debt x (1-Tax Rate))

- Components: Cost of Equity (required rate of return for shareholders) and Cost of Debt (interest rate on borrowed funds).

- Significance: Used to evaluate the overall cost of capital for a company and make investment decisions.

6. Discuss the role of financial modeling in corporate finance.

- Scenario Analysis: Creating models to project financial performance under different assumptions.

- Capital Budgeting: Evaluating investment decisions and selecting the most profitable projects.

- Financial Forecasting: Predicting future financial results to guide decision-making.

- Risk Assessment: Identifying potential financial risks and developing mitigation strategies.

7. How do you stay up-to-date on the latest trends and developments in corporate finance?

- Industry Journals and Publications: Reading Financial Times, Bloomberg, or The Economist.

- Conferences and Seminars: Attending events related to corporate finance, mergers and acquisitions, or capital markets.

- Online Courses and Certifications: Enrolling in programs offered by professional organizations or universities.

- Networking and Mentorship: Connecting with other professionals and seeking guidance from senior executives.

8. Describe a complex financial transaction you have worked on and the role you played.

- Transaction Description: Briefly outline the deal, its objectives, and the parties involved.

- Role and Responsibilities: Explain your specific involvement, such as financial modeling, due diligence, or negotiations.

- Challenges and Outcomes: Discuss the key challenges faced and the impact of your contributions to the transaction’s success.

9. What are the ethical considerations that corporate finance advisors need to be aware of?

- Conflicts of Interest: Disclosing and managing any potential conflicts that could impair judgment.

- Client Confidentiality: Maintaining the privacy and confidentiality of client information.

- Integrity and Fairness: Acting with integrity and avoiding misrepresentation or misleading clients.

- Compliance with Laws and Regulations: Adhering to all applicable securities laws and regulations.

10. What are the key challenges and opportunities for corporate finance advisors in the current market environment?

- Technology Advancements: Embracing new technologies to enhance efficiency and improve data analysis.

- Regulatory Changes: Navigating evolving regulatory frameworks and adapting to new compliance requirements.

- Global Competition: Competing with international firms and understanding cross-border transactions.

- Increasing Client Sophistication: Meeting the growing expectations of clients for value-added services and customized solutions.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Corporate Finance Advisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Corporate Finance Advisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Corporate Finance Advisors serve as strategic advisors to companies, providing expert guidance on financial matters that impact their business performance and long-term growth.

1. Financial Modeling and Analysis

Develop and maintain financial models to forecast future financial performance, assess investment opportunities, and evaluate the impact of business decisions.

- Utilize advanced financial modeling techniques to create complex models and simulations.

2. Mergers and Acquisitions Advisory

Advise clients on mergers, acquisitions, and divestitures, providing strategic insights and facilitating negotiations.

- Conduct due diligence, valuations, and market analysis to identify potential targets and opportunities.

3. Capital Raising

Assist clients in raising capital through various sources, including equity offerings, debt financing, and private placements.

- Prepare pitch books, marketing materials, and conduct meetings with potential investors and lenders.

4. Strategic Planning

Collaborate with company executives to develop and implement long-term financial strategies and capital allocation plans.

- Provide analysis and recommendations on investment projects, risk management, and capital structure optimization.

Interview Tips

Preparing thoroughly for a Corporate Finance Advisor interview is crucial for demonstrating your skills and impressing potential employers.

1. Research the Company and Industry

Show that you have a genuine interest in the company and have taken the time to understand their business, financial performance, and industry dynamics.

- Visit the company’s website, read recent financial reports, and follow industry news.

2. Highlight Your Technical Skills

Emphasize your proficiency in financial modeling, valuation techniques, and capital markets knowledge.

- Quantify your accomplishments and provide specific examples of your modeling and analysis work.

3. Showcase Your Industry Experience

If you have experience in the specific industry the company operates in, highlight your understanding of the unique financial challenges and opportunities.

- Explain how your industry knowledge can benefit the company and enhance your contributions.

4. Prepare Example Responses

Practice answering common interview questions that test your analytical, problem-solving, and communication skills.

- Prepare examples of financial models you have built, how you have evaluated investment decisions, and your experience in negotiating deals.

5. Dress Professionally and Be Confident

First impressions matter, so dress appropriately and exude confidence during the interview.

- Maintain eye contact, speak clearly, and articulate your answers in a concise and well-structured manner.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Corporate Finance Advisor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!