Are you gearing up for an interview for a Corporate Finance Associate position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Corporate Finance Associate and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

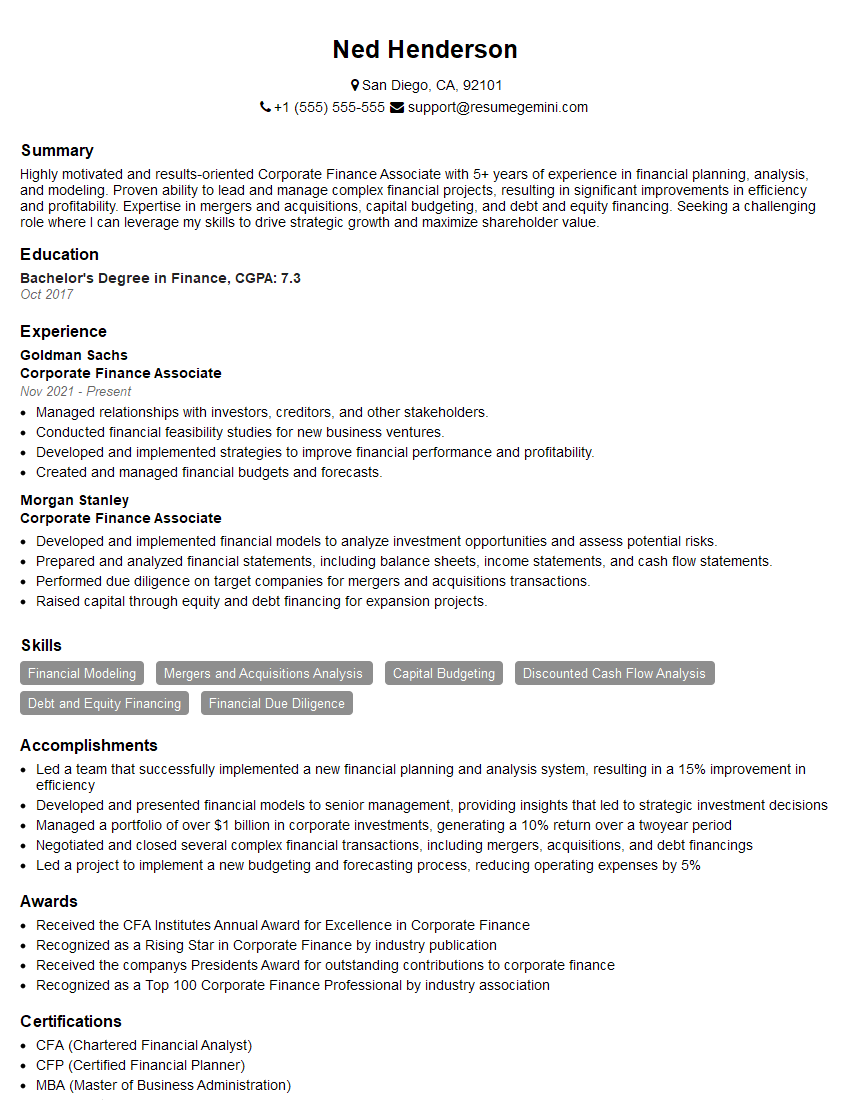

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Corporate Finance Associate

1. Walk me through a recent financial model you built. What were the key assumptions and how did you derive them?

In a recent project, I developed a financial model to evaluate the potential acquisition of a target company. The key assumptions I considered were:

- Revenue growth rate: I derived this assumption by analyzing the target company’s historical financial statements and industry trends.

- Operating expenses: I determined this assumption by examining the target company’s historical expense ratios and industry benchmarks.

- Capital expenditures: I estimated this assumption based on the target company’s investment plans and industry averages.

- Discount rate: I used a weighted average cost of capital (WACC) to determine the appropriate discount rate for the cash flows.

2. How would you determine the appropriate financing structure for a leveraged buyout?

- Debt capacity: I would analyze the target company’s cash flows, assets, and industry leverage ratios to determine the maximum amount of debt that can be supported.

- Interest rate environment: I would consider the current and expected interest rate environment to determine the cost of debt financing.

- Equity requirements: I would evaluate the target company’s ownership structure, investor appetite, and the desired return on equity to determine the appropriate equity investment.

- Tax implications: I would consider the tax implications of different financing structures, including the impact on interest deductibility and capital gains.

3. What are the key metrics you would use to track the performance of a private equity investment?

- Internal rate of return (IRR): This measures the annualized return on the investment.

- Multiple of invested capital (MOIC): This measures the return on the investment relative to the initial capital invested.

- Net asset value (NAV): This represents the value of the investment portfolio at a given point in time.

- Cash flow from operations: This shows the amount of cash generated by the investment portfolio.

- Leverage ratio: This measures the amount of debt used to finance the investment portfolio.

4. Describe a situation where you had to manage a complex financial transaction under tight deadlines. How did you approach the challenge?

In a previous role, I was involved in a large-scale acquisition that had a very tight deadline. To manage the challenge, I:

- Prioritized tasks: I identified the most critical tasks and focused on completing them first.

- Delegated responsibilities: I assigned specific tasks to team members based on their expertise and abilities.

- Communicated regularly: I kept all stakeholders updated on the progress of the transaction and any potential roadblocks.

- Managed expectations: I set realistic expectations with stakeholders and kept them informed of any changes to the timeline.

5. How do you stay up to date with the latest trends and developments in corporate finance?

- Industry publications: I subscribe to industry magazines and journals to stay informed about the latest news and trends.

- Conferences and seminars: I attend industry conferences and seminars to learn from experts and network with professionals.

- Online resources: I use online resources such as news websites, blogs, and webinars to stay updated on current events.

- Networking: I connect with other professionals in the field through LinkedIn and industry events to exchange knowledge and insights.

6. What are your thoughts on the current state of the global economy?

The global economy is currently facing a number of challenges, including rising inflation, supply chain disruptions, and geopolitical tensions. These factors are creating uncertainty for businesses and investors.

However, there are also some positive signs. Strong consumer demand and government stimulus measures are supporting economic growth in some regions. The development of new technologies is also creating opportunities for innovation and productivity gains.

Overall, the outlook for the global economy is mixed. It is important for businesses to be prepared for both challenges and opportunities in the coming months.

7. How do you handle working in a fast-paced and demanding environment?

I thrive in fast-paced and demanding environments. I am able to prioritize tasks, manage my time effectively, and work under pressure without compromising quality.

I also have a strong work ethic and am willing to go the extra mile to meet deadlines. I am confident that I can handle the demands of this role and contribute to the success of your team.

8. What are your career goals?

My long-term goal is to become a CFO of a publicly traded company. I believe that my skills and experience in corporate finance, combined with my strong work ethic and leadership abilities, will enable me to achieve this goal.

In the short term, I am looking for a role where I can continue to develop my skills and gain experience in managing complex financial transactions. I am confident that this role with your company will provide me with the opportunity to do so.

9. Why are you interested in working for our company?

I am interested in working for your company because I am impressed by your reputation as a leader in the financial services industry. I believe that my skills and experience would be a valuable asset to your team.

I am also attracted to your company’s commitment to diversity and inclusion. I believe that a diverse workforce is essential for innovation and success.

I am confident that I can make a significant contribution to your company and I am excited about the opportunity to learn and grow with your team.

10. Do you have any questions for me?

I do have a few questions for you. First, I would like to know more about the specific responsibilities of this role. Second, I am interested in learning more about the company’s culture and values. Finally, I would like to know about the opportunities for professional development within the company.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Corporate Finance Associate.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Corporate Finance Associate‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Corporate Finance Associates play a vital role in the financial operations of a company. They are responsible for a wide range of tasks, including:

1. Financial Modeling and Analysis

Analyzing financial data and developing financial models to forecast future performance

- Creating financial projections and sensitivity analyses

- Conducting due diligence and evaluating potential investments

2. Capital Raising and Structuring

Advising on and executing capital raising transactions, such as debt and equity offerings

- Developing and presenting financial presentations to potential investors

- Negotiating terms and conditions of financing

3. Mergers and Acquisitions

Participating in mergers and acquisitions transactions, including due diligence, valuation, and integration planning

- Supporting the negotiation and execution of transaction agreements

- Managing post-acquisition integration processes

4. Strategic Planning and Analysis

Providing financial analysis and insights to support strategic planning and decision-making

- Developing and analyzing strategic plans and initiatives

- Evaluating the financial impact of strategic decisions

Interview Preparation Tips

To ace your interview for a Corporate Finance Associate position, preparation is key. Here are some tips to help you stand out:

1. Research the Company and Industry

Demonstrate your interest in the company and the industry by researching their financial performance, recent news, and competitive landscape.

- Visit the company’s website and LinkedIn page

- Read industry reports and articles

2. Practice Your Financial Modeling Skills

Corporate Finance Associates are expected to have strong financial modeling skills. Practice building financial models and be prepared to discuss your approach to modeling.

- Use Excel or other modeling software to develop financial models

- Participate in online modeling challenges or competitions

3. Be Prepared to Discuss Your Experience

Highlight your relevant experience and skills in your resume and during the interview. Quantify your accomplishments and provide specific examples of your work.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers

- Prepare for common interview questions, such as “Tell me about a time when you had to overcome a financial challenge”

4. Ask Insightful Questions

Asking thoughtful questions at the end of the interview shows your interest and engagement. Prepare a few questions about the company, the role, or the industry.

- Ask about the company’s current financial priorities

- Inquire about the challenges and opportunities the industry is facing

5. Follow Up

After the interview, send a thank-you note to the interviewer. Reiterate your interest in the position and highlight any key points you want to emphasize.

- Thank the interviewer for their time

- Re-state your key qualifications and how they align with the role

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Corporate Finance Associate interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!