Feeling lost in a sea of interview questions? Landed that dream interview for Corporate Financial Analyst but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Corporate Financial Analyst interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

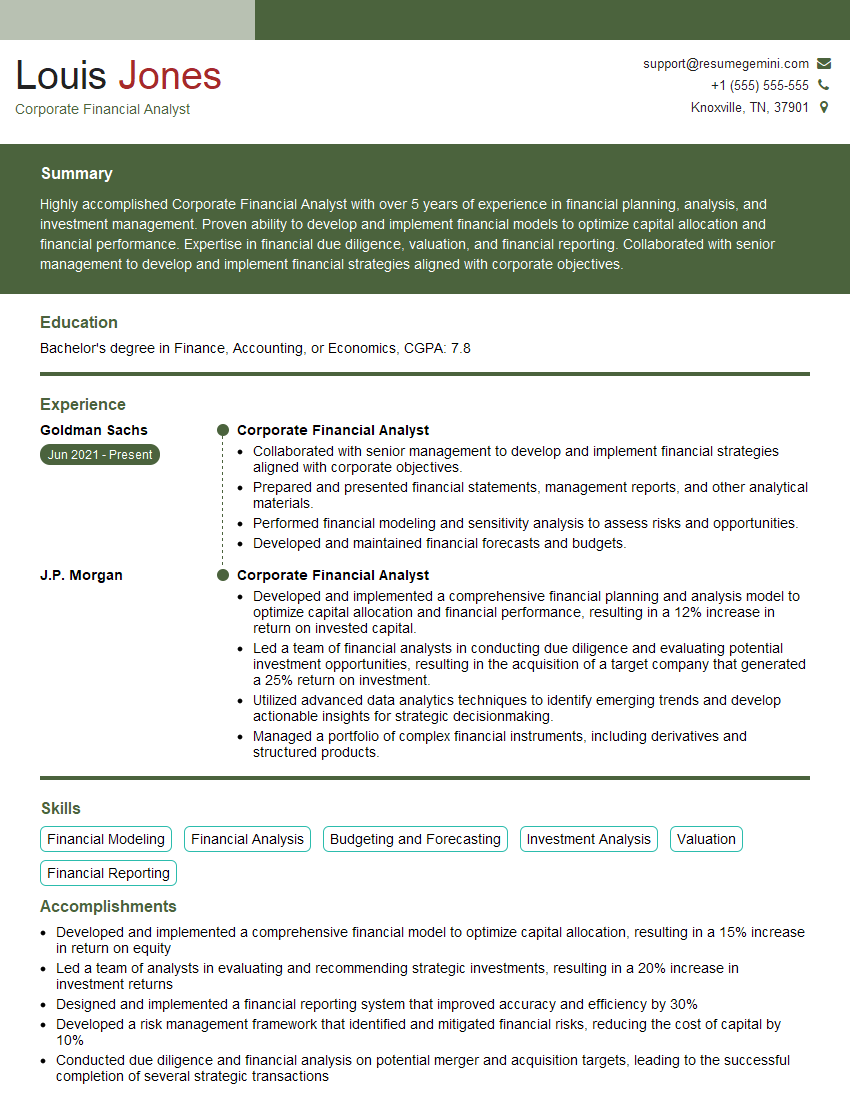

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Corporate Financial Analyst

1. Explain the key financial ratios used to evaluate a company’s financial performance.

As a Corporate Financial Analyst, it’s crucial to have a deep understanding of the key financial ratios used to evaluate a company’s financial performance. These ratios provide valuable insights into various aspects of a company, such as profitability, liquidity, solvency, and efficiency.

- Profitability ratios: Gross profit margin, operating profit margin, net profit margin, return on assets (ROA), return on equity (ROE)

- Liquidity ratios: Current ratio, quick ratio, cash ratio

- Solvency ratios: Debt-to-equity ratio, debt-to-asset ratio, interest coverage ratio

- Efficiency ratios: Inventory turnover ratio, accounts receivable turnover ratio, accounts payable turnover ratio

2. Describe the process of developing a financial model for a company.

Financial Modeling Framework

- Define the purpose and scope of the model

- Gather and analyze relevant data

Model Construction

- Build assumptions and equations

- Develop scenarios and forecasts

Model Validation and Refinement

- Test and validate the model

- Refine and update the model as needed

3. How would you analyze a company’s capital structure and make recommendations for improvement?

- Assess the current capital structure: Analyze the debt-to-equity ratio, interest coverage ratio, and other relevant ratios

- Evaluate the cost of capital: Calculate the weighted average cost of capital (WACC) to determine the overall cost of financing

- Identify potential improvements: Consider optimizing the debt-to-equity ratio, refinancing high-cost debt, or issuing new equity

- Make recommendations: Provide specific recommendations to improve the company’s capital structure and reduce the cost of capital

4. Explain how you would assess a company’s risk profile.

Assessing a company’s risk profile is a critical aspect of financial analysis. It helps investors and analysts understand the potential risks and rewards associated with investing in a particular company.

- Qualitative factors: Industry analysis, competitive landscape, management team, regulatory environment

- Quantitative factors: Beta, debt-to-equity ratio, interest coverage ratio, return on equity

5. Describe your experience in using financial databases and software.

As a Corporate Financial Analyst, proficiency in financial databases and software is essential for efficient data analysis and modeling.

- Financial databases: Bloomberg, Capital IQ, FactSet

- Financial modeling software: Excel, PowerPoint

6. Explain how you would communicate complex financial information to non-financial stakeholders.

- Simplify and clarify: Use clear and concise language, avoiding technical jargon

- Use visual aids: Charts, graphs, and tables can help present information visually

- Provide context and relevance: Explain the impact of financial data on the company’s performance and strategy

- Tailor the message: Consider the audience’s knowledge and interests

7. Describe your approach to staying up-to-date with financial markets and industry trends.

- Read financial publications: The Wall Street Journal, Financial Times, Bloomberg

- Attend industry conferences and webinars: Stay informed about emerging trends and best practices

- Network with professionals: Connect with other financial analysts and industry experts

8. Explain how you would contribute to our team of Corporate Financial Analysts.

- Technical skills: Highlight your expertise in financial modeling, data analysis, and industry knowledge

- Communication and teamwork: Emphasize your ability to communicate complex financial information and work effectively in a team environment

- Motivation and drive: Express your passion for financial analysis and your commitment to continuous learning

9. Describe a challenging financial analysis project you worked on and how you overcame the challenges.

- Project description: Briefly explain the project’s purpose and scope

- Challenges encountered: Outline the specific challenges you faced during the project

- Solutions implemented: Describe how you overcame the challenges and resolved the issues

- Results achieved: Highlight the positive outcomes of your efforts

10. How do you stay motivated and continue to develop your skills as a Corporate Financial Analyst?

- Professional development: Pursue certifications, attend training programs, and engage in self-study

- Mentorship and networking: Seek guidance from experienced professionals and build relationships within the industry

- Continuous learning: Stay abreast of financial markets, industry trends, and new technologies

- Passion and curiosity: Maintain a genuine interest in financial analysis and explore new areas of knowledge

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Corporate Financial Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Corporate Financial Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Corporate Financial Analysts play a crucial role in supporting critical financial decisions within an organization. Their primary responsibilities include:

1. Financial Planning and Analysis

Develop and analyze financial models, budgets, and forecasts to project future financial performance and identify potential risks and opportunities.

- Prepare financial reports and presentations for management and investors.

- Monitor financial results and identify trends and variances.

2. Investment Analysis and Due Diligence

Conduct in-depth analysis of potential investments to assess their viability, risk, and potential returns.

- Perform due diligence on potential mergers, acquisitions, and other financial transactions.

- Provide recommendations on investment strategies and asset allocation.

3. Capital Raising and Financing

Develop and execute financial plans to raise capital and manage debt.

- Advise management on debt and equity financing options.

- Negotiate and structure financing agreements.

4. Risk Management and Internal Controls

Identify and assess financial risks faced by the organization and develop strategies to mitigate them.

- Establish and monitor internal controls to ensure financial reporting accuracy and compliance.

- Perform financial audits and reviews to ensure adherence to regulatory requirements.

Interview Tips

To ace the interview for a Corporate Financial Analyst role, candidates should focus on demonstrating their technical skills, analytical abilities, and communication prowess. Here are some tips:

1. Research the Company and Role

Thoroughly research the company’s financial performance, industry trends, and the specific role you’re applying for.

- Review the company’s financial statements, annual reports, and industry publications.

- Identify key challenges and opportunities facing the company.

2. Prepare for Technical Questions

Expect technical questions on financial modeling, valuation techniques, and investment analysis. Practice solving case studies and prepare to discuss your understanding of complex financial concepts.

- Review financial modeling software and techniques.

- Practice answering case study questions that focus on financial analysis and decision-making.

3. Showcase Analytical Skills

Highlight your ability to interpret financial data, identify trends, and develop astute insights.

- Provide examples of projects where you conducted in-depth financial analysis and made recommendations.

- Demonstrate your understanding of financial ratios, valuation metrics, and risk assessment.

4. Practice Your Communication Skills

Corporate Financial Analysts often need to communicate complex financial information to a wide audience. Prepare to articulately present your findings and recommendations.

- Role-play presenting financial models and analysis to both technical and non-technical audiences.

- Practice answering behavioral interview questions that focus on your communication style and teamwork abilities.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Corporate Financial Analyst interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!