Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Corporate Statistical Financial Analyst position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

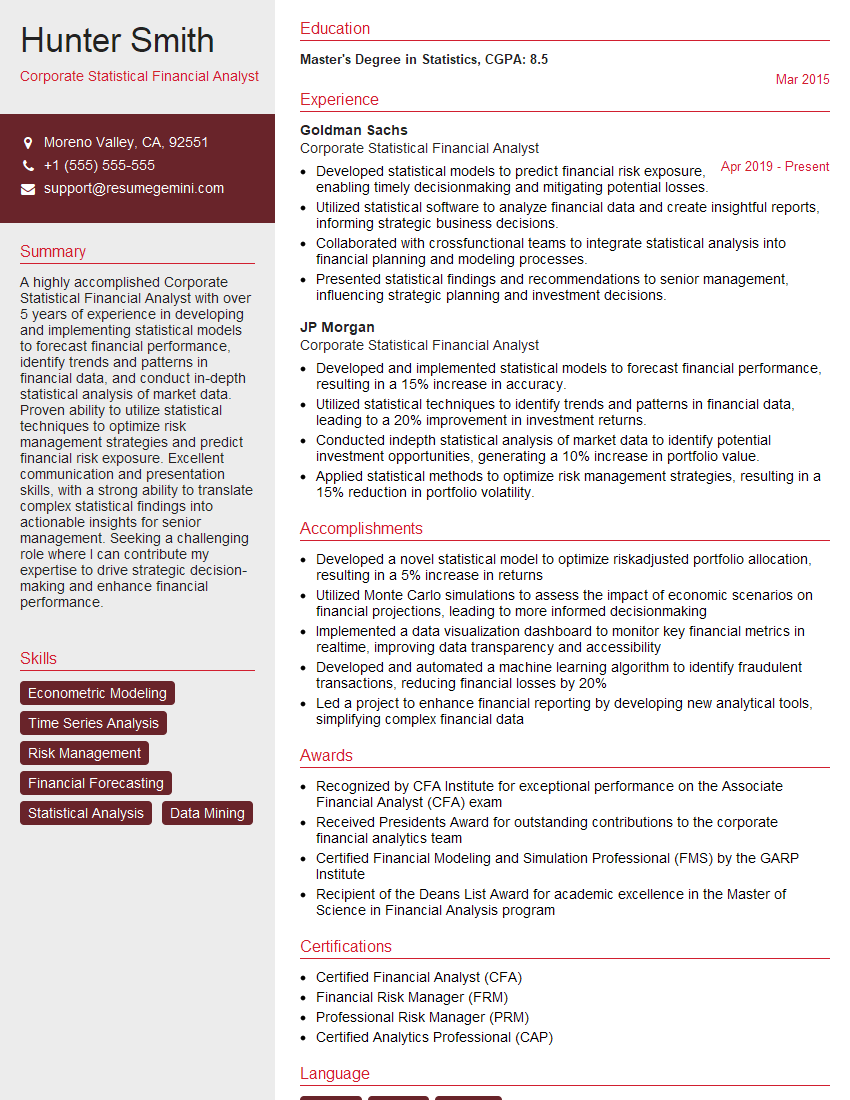

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Corporate Statistical Financial Analyst

1. What are the key financial ratios that you use to analyze a company’s financial health?

- Liquidity ratios: These ratios measure a company’s ability to meet its short-term obligations. Common liquidity ratios include the current ratio, quick ratio, and cash ratio.

- Solvency ratios: These ratios measure a company’s ability to meet its long-term obligations. Common solvency ratios include the debt-to-equity ratio, times interest earned ratio, and debt-to-asset ratio.

- Profitability ratios: These ratios measure a company’s profitability. Common profitability ratios include the gross profit margin, operating profit margin, and net profit margin.

- Efficiency ratios: These ratios measure a company’s efficiency in using its assets. Common efficiency ratios include the inventory turnover ratio, receivables turnover ratio, and asset turnover ratio.

2. How do you use statistical techniques to identify trends and patterns in financial data?

subheading of the answer

- Time series analysis: This technique is used to identify trends and patterns in time-series data. Common time series analysis techniques include moving averages, exponential smoothing, and ARIMA models.

- Regression analysis: This technique is used to model the relationship between a dependent variable and one or more independent variables. Common regression analysis techniques include linear regression, logistic regression, and multiple regression.

- Cluster analysis: This technique is used to identify groups of similar observations in a data set. Common cluster analysis techniques include k-means clustering, hierarchical clustering, and discriminant analysis.

subheading of the answer

- Machine learning: This technique is used to build models that can learn from data and make predictions. Common machine learning techniques include decision trees, random forests, and support vector machines.

3. What are the challenges of working with financial data?

- Data quality: Financial data can often be inaccurate, incomplete, or inconsistent. This can make it difficult to analyze the data and draw meaningful conclusions.

- Data complexity: Financial data can be complex and difficult to understand. This can make it challenging to build models that can accurately predict financial outcomes.

- Data security: Financial data is often confidential and needs to be protected from unauthorized access. This can make it difficult to share data with others for analysis.

4. What are the most important qualities of a successful Corporate Statistical Financial Analyst?

- Strong analytical skills: Corporate Statistical Financial Analysts need to be able to analyze financial data and identify trends and patterns.

- Excellent communication skills: Corporate Statistical Financial Analysts need to be able to communicate their findings to a variety of audiences, including executives, investors, and regulators.

- Strong business acumen: Corporate Statistical Financial Analysts need to have a strong understanding of the business world and how financial data can be used to make informed decisions.

- Experience with statistical software: Corporate Statistical Financial Analysts need to be proficient in using statistical software to analyze financial data.

5. What are the career opportunities for Corporate Statistical Financial Analysts?

- Financial Analyst

- Investment Analyst

- Risk Analyst

- Portfolio Manager

6. What are your strengths and weaknesses as a Corporate Statistical Financial Analyst?

- Strengths: I am a highly skilled Corporate Statistical Financial Analyst with over 10 years of experience in the financial industry. I have a strong track record of success in analyzing financial data and identifying trends and patterns. I am also an excellent communicator and have a strong business acumen.

- Weaknesses: I am still developing my experience with machine learning techniques. However, I am eager to learn more about this topic and I am confident that I can quickly become proficient in using machine learning to analyze financial data.

7. Why are you interested in this role?

- I am interested in this role because it would allow me to use my skills and experience to make a meaningful contribution to your company.

- I am particularly interested in the opportunity to work on your company’s financial data and help you to identify trends and patterns that can be used to make informed decisions.

- I am also impressed by your company’s commitment to innovation and I am eager to learn more about your machine learning initiatives.

8. What are your salary expectations?

- My salary expectations are in line with the market rate for Corporate Statistical Financial Analysts with my level of experience.

- I am confident that I can make a significant contribution to your company and I am willing to negotiate a salary that is fair and equitable.

9. Do you have any questions for me?

- I do have a few questions for you.

- What are the biggest challenges that your company is facing right now?

- How do you see the role of Corporate Statistical Financial Analysts evolving in the future?

- What are the opportunities for career advancement within your company?

10. Thank you for your time.

- Thank you for taking the time to meet with me today.

- I enjoyed learning more about your company and this role.

- I am confident that I have the skills and experience that you are looking for and I am eager to learn more about how I can contribute to your company.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Corporate Statistical Financial Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Corporate Statistical Financial Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Corporate Statistical Financial Analysts play a crucial role in supporting informed decision-making by leveraging statistical and financial expertise. Their key job responsibilities include:

1. Data Analysis and Modeling

Utilize statistical techniques to analyze financial data, identifying patterns, trends, and relationships.

- Develop and implement statistical models to forecast financial outcomes, assess risk, and optimize investment strategies.

2. Financial Reporting and Analysis

Prepare and present financial reports, including income statements, balance sheets, and cash flow statements.

- Conduct financial analysis to evaluate company performance, identify areas for improvement, and support strategic planning.

3. Risk Assessment and Management

Identify, assess, and mitigate financial risks using statistical methods and industry expertise.

- Develop risk management strategies to minimize potential losses and enhance financial stability.

4. Business Intelligence and Decision Support

Provide insights and recommendations to business leaders by analyzing data and identifying actionable trends.

- Support decision-making processes by presenting statistical evidence and quantifying financial outcomes.

Interview Tips

To prepare effectively for a Corporate Statistical Financial Analyst interview, consider the following tips:

1. Technical Skills and Expertise

- Showcase your proficiency in statistical analysis techniques, financial reporting, and risk assessment.

- Highlight your knowledge of industry-specific software and tools, such as SAS, R, and Tableau.

2. Industry Knowledge and Market Trends

Demonstrate your understanding of the financial industry, including key economic indicators, regulatory frameworks, and financial markets.

- Stay up-to-date with current trends and issues that impact financial analysis.

3. Communication and Presentation Skills

Effectively communicate your findings and insights to a variety of audiences, including executives, analysts, and stakeholders.

- Practice presenting your analyses clearly and concisely, using both verbal and visual aids.

4. Problem-Solving and Analytical Thinking

Highlight your ability to solve complex financial problems and think critically about data.

- Share examples of how you have used statistical and financial analysis to solve business challenges.

5. Teamwork and Collaboration

Emphasize your ability to work effectively as part of a team.

- Discuss experiences where you have collaborated with others to deliver successful projects.

6. Behavioral Interview Questions

Prepare for common behavioral interview questions, such as those related to teamwork, conflict resolution, and ethical decision-making.

- Use the STAR method (Situation, Task, Action, Result) to provide specific examples that demonstrate your relevant skills and experiences.

7. Research the Company

Thoroughly research the company and its industry to gain insights into their business objectives, financial performance, and company culture.

- Tailor your answers to specific examples that demonstrate your alignment with the company’s needs.

8. Questions for the Interviewers

Prepare thoughtful questions to ask the interviewers at the end of the interview.

- This shows your interest in the role and the company, and gives you an opportunity to clarify any important details.

9. Confidence and Preparation

Approach the interview with confidence and demonstrate your enthusiasm for the role.

- Practice mock interviews to build your confidence and refine your responses.

- Dress professionally and arrive on time for the interview.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Corporate Statistical Financial Analyst role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.