Feeling lost in a sea of interview questions? Landed that dream interview for Corporate Tax Preparer but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Corporate Tax Preparer interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

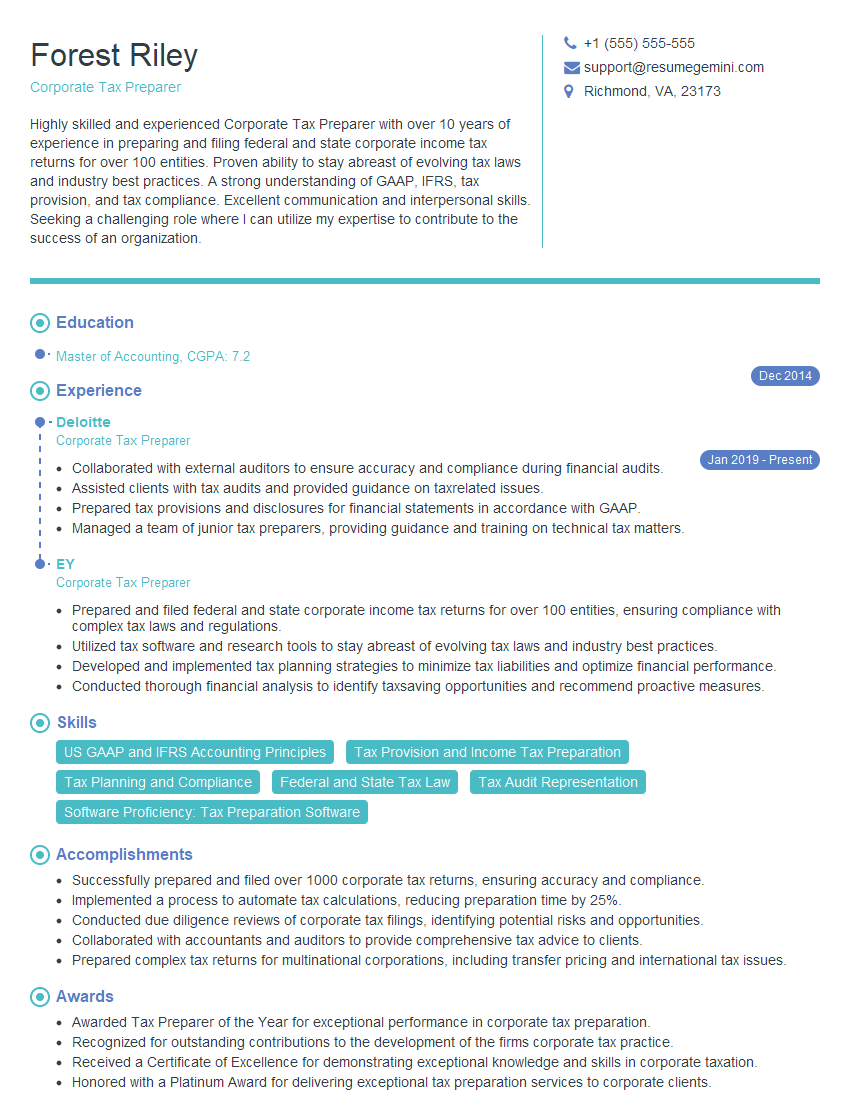

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Corporate Tax Preparer

1. Explain the concepts of tax deferral and tax avoidance?

- Tax deferral is a legal strategy that allows taxpayers to postpone paying taxes on income until a later date.

- Tax avoidance is a legal strategy that allows taxpayers to reduce or eliminate their tax liability by taking advantage of loopholes in the tax code.

- Tax deferral can be achieved through the use of retirement accounts, such as IRAs and 401(k) plans.

- Tax avoidance can be achieved through the use of tax deductions, tax credits, and tax shelters.

2. What are the different types of business entities and how are they taxed?

Sole Proprietorship

- A sole proprietorship is a one-person business.

- The owner of a sole proprietorship is personally liable for the debts and obligations of the business.

- The income of a sole proprietorship is taxed as personal income.

Partnership

- A partnership is a business owned by two or more people.

- The partners are jointly liable for the debts and obligations of the business.

- The income of a partnership is taxed as personal income.

Corporation

- A corporation is a separate legal entity from its owners.

- The shareholders of a corporation are not personally liable for the debts and obligations of the business.

- The income of a corporation is taxed at the corporate tax rate.

3. What are the different types of income that are subject to corporate income tax?

- Business income

- Investment income

- Passive income

4. What are the different types of deductions that are allowed on a corporate income tax return?

- Business expenses

- Interest expenses

- Depreciation and amortization expenses

- Charitable contributions

5. What are the different types of credits that are allowed on a corporate income tax return?

- Foreign tax credit

- Research and development credit

- Work opportunity tax credit

6. What are the different types of tax forms that are used by corporations?

- Form 1120: Corporate Income Tax Return

- Form 1120-A: Simplified Income Tax Return for Corporations

- Form 1120-H: Homesteading Credit for Corporations

7. What are the different types of tax audits that can be conducted by the IRS?

- Field audit

- Office audit

- Correspondence audit

8. What are the different types of penalties that can be imposed by the IRS for tax violations?

- Accuracy-related penalty

- Civil fraud penalty

- Criminal fraud penalty

9. What are the different types of tax planning strategies that can be used by corporations?

- Deferral of income

- Accelerated depreciation

- Charitable contributions

10. What are the different types of tax software that is available for use by tax professionals?

- TaxSlayer

- CCH ProSystem fx

- Drake Tax

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Corporate Tax Preparer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Corporate Tax Preparer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Corporate Tax Preparers are responsible for ensuring accurate and timely preparation of corporate tax returns. They collaborate with other tax professionals, gather and analyze financial data, and apply tax regulations to minimize tax liability and maximize tax savings for their clients.

1. Tax Return Preparation

Prepare and file federal, state, and local corporate tax returns in accordance with relevant tax laws and regulations.

- Review financial statements, including income statements, balance sheets, and cash flow statements.

- Analyze tax implications of business transactions.

- Calculate taxable income, deductions, and credits.

- Prepare and submit tax returns within established deadlines.

2. Tax Planning and Compliance

Provide tax planning strategies to clients to minimize their tax liability and maximize their tax savings.

- Identify potential tax issues and develop solutions.

- Stay abreast of changes in tax laws and regulations.

- Ensure compliance with tax laws and avoid penalties and interest.

3. Client Consultation and Communication

Build and maintain strong relationships with clients by understanding their tax needs and providing personalized advice.

- Meet with clients to discuss tax issues and strategies.

- Explain tax laws and regulations in a clear and concise manner.

- Respond to client inquiries promptly and professionally.

4. Research and Analysis

Conduct research and analysis to stay informed about tax laws and industry best practices.

- Read tax publications and attend seminars.

- Stay updated on current tax cases and rulings.

- Analyze tax implications of new business transactions.

Interview Tips

Preparing for a Corporate Tax Preparer interview can be daunting, but with the right approach and some helpful tips, you can increase your chances of success.

1. Research the Company and Position

Before the interview, take the time to research the company you’re applying to and the specific position you’re seeking. This will help you understand the company’s culture, values, and the responsibilities of the role.

- Visit the company’s website.

- Read articles and news about the company.

- Review the job description carefully.

2. Practice Your Answers

Once you have a good understanding of the company and the position, practice answering common interview questions. This will help you feel more confident and prepared during the actual interview.

- Prepare specific examples that demonstrate your skills and experience.

- Practice answering questions about your tax knowledge and experience.

- Be prepared to discuss your tax planning strategies.

3. Dress Professionally

First impressions matter, so dress professionally for your interview. This means wearing a suit or business dress and making sure your clothes are clean and pressed.

- Avoid wearing casual clothing, such as jeans or t-shirts.

- Make sure your shoes are clean and polished.

- Pay attention to your grooming, including your hair and nails.

4. Be On Time

Punctuality is important for any interview, but it’s especially important for a Corporate Tax Preparer interview. Tax professionals are expected to be organized and efficient, so arriving on time shows that you respect the interviewer’s time.

- Plan your route to the interview in advance.

- Leave early to allow for unexpected delays.

- If you’re running late, call the interviewer and let them know.

5. Be Enthusiastic and Engaged

During the interview, be enthusiastic and engaged. This shows the interviewer that you’re interested in the position and that you’re eager to learn more about the company.

- Make eye contact with the interviewer.

- Ask thoughtful questions.

- Show that you’re invested in the conversation.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Corporate Tax Preparer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!