Feeling lost in a sea of interview questions? Landed that dream interview for Corporate Treasurer but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Corporate Treasurer interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

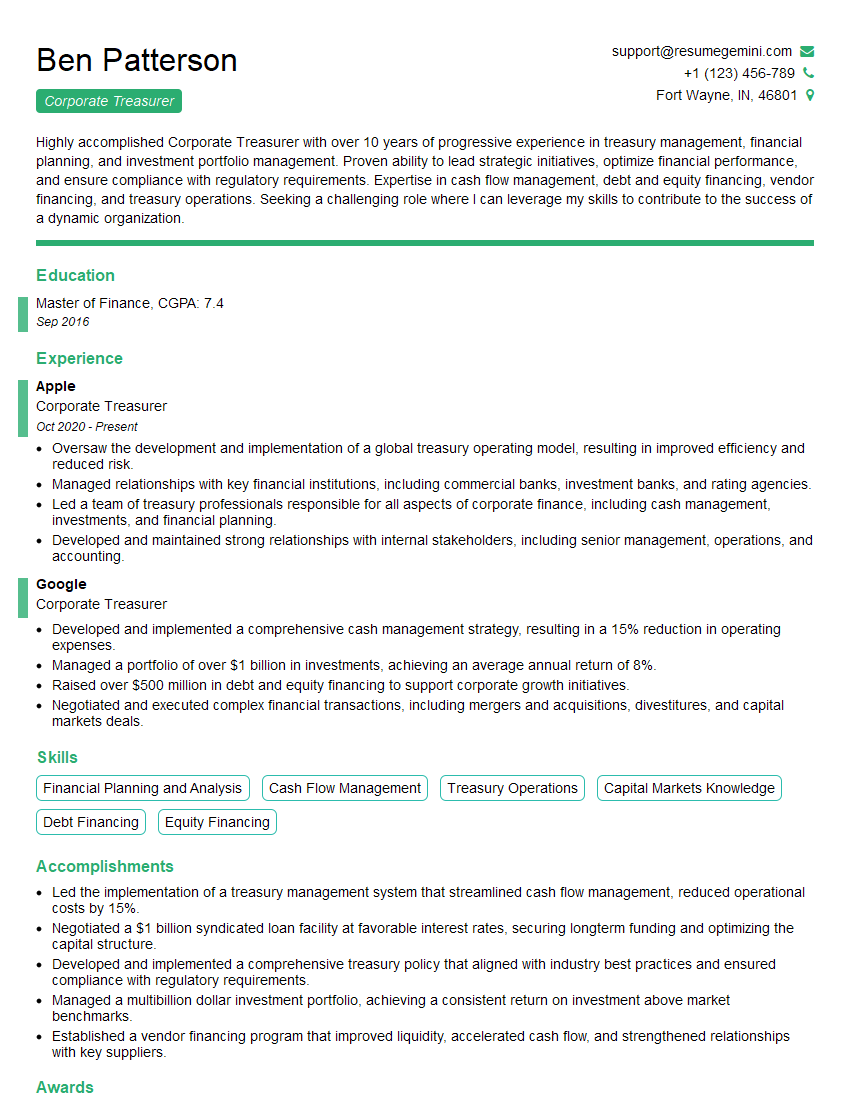

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Corporate Treasurer

1. How do you stay updated with the latest developments in treasury management?

- Attend industry conferences and seminars

- Read trade publications and news articles

- Network with other treasury professionals

- Participate in online forums and discussion groups

- Attend training courses and workshops

2. What are the key challenges facing corporate treasurers today?

Risks

- Interest rate risk

- Credit risk

- Liquidity risk

- Foreign exchange risk

- Commodity risk

Regulatory environment

- Basel III

- Dodd-Frank Act

- EMIR

Technology

- Fintech

- Blockchain

- Artificial intelligence

3. What are the most important qualities of a successful corporate treasurer?

- Strong financial acumen

- Excellent communication and interpersonal skills

- Ability to manage risk effectively

- Understanding of regulatory environment

- Ability to lead and motivate a team

4. What are your strengths and weaknesses as a corporate treasurer?

- Strengths: Strong financial acumen, excellent communication and interpersonal skills, ability to manage risk effectively, understanding of regulatory environment, ability to lead and motivate a team

- Weaknesses: Lack of experience in some specific areas, such as foreign exchange risk management

5. What are your career goals?

- To become a CFO

- To lead a treasury team at a Fortune 500 company

- To develop innovative treasury solutions

6. Why are you interested in this particular role?

- The opportunity to lead a team of talented treasury professionals

- The challenge of managing a complex treasury function

- The opportunity to contribute to the success of a growing company

7. What is your experience with managing interest rate risk?

- Developed and implemented a comprehensive interest rate risk management strategy

- Used a variety of hedging instruments to mitigate interest rate risk

- Monitored interest rate movements and adjusted hedging strategy as needed

8. What is your experience with managing credit risk?

- Developed and implemented a credit risk management framework

- Conducted credit analysis on potential borrowers

- Monitored credit ratings and financial statements of existing borrowers

9. What is your experience with managing liquidity risk?

- Developed and implemented a liquidity risk management strategy

- Forecasted cash flows and managed liquidity accordingly

- Established relationships with banks and other financial institutions

10. What is your experience with managing foreign exchange risk?

- Developed and implemented a foreign exchange risk management strategy

- Used a variety of hedging instruments to mitigate foreign exchange risk

- Monitored foreign exchange rates and adjusted hedging strategy as needed

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Corporate Treasurer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Corporate Treasurer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Corporate Treasurer plays a pivotal role in managing the financial health and risk exposure of a company. Their key job responsibilities encompass:

1. Capital Structure Management

Manage the company’s capital structure by structuring and negotiating debt and equity financing, ensuring optimal cost and risk balance.

- Analyze capital markets and identify financing opportunities.

- Develop and implement strategies to mitigate financing risks.

2. Cash Management

Oversee the company’s cash flow, ensuring efficient utilization and minimizing idle funds. Manage liquidity and solvency to maintain financial stability.

- Forecast cash flows and implement cash management strategies.

- Establish banking relationships and negotiate favorable terms.

3. Risk Management

Identify, assess, and mitigate financial risks across the organization, including credit risk, market risk, and operational risk.

- Develop and implement risk management policies and procedures.

- Monitor risk exposure and take appropriate actions to mitigate potential losses.

4. Investor Relations

Represent the company to investors and analysts, providing financial information and insights to maintain investor confidence.

- Prepare and present financial reports and investor presentations.

- Engage with investors and respond to their inquiries and concerns.

Interview Tips

To prepare effectively for an interview as a Corporate Treasurer, consider the following tips:

1. Research the Company and Industry

Thoroughly research the company’s financial position, industry trends, and competitive landscape. This knowledge will enable you to ask insightful questions and demonstrate your understanding of the business.

- Review financial statements, annual reports, and industry research.

- Attend industry conferences and webinars to stay abreast of current trends.

2. Prepare Case Studies and Examples

Be prepared to share specific examples of your experience in capital management, risk mitigation, and investor relations. Quantify your achievements and highlight the impact of your contributions.

- Example: “I successfully negotiated a syndicated loan facility that reduced the company’s borrowing costs by 10%.”

- Example: “I implemented a risk management framework that led to a 25% decrease in operational risk exposure.”

3. Practice Behavioral Questions

Anticipate behavioral interview questions that probe your skills and traits. Prepare concise and structured responses that highlight your problem-solving, analytical, and communication abilities.

- Example Question: “Describe a time you successfully managed a financial crisis.”

- Example Response: “During the recent economic downturn, I proactively implemented a cash conservation plan that preserved 15% of the company’s operating capital.”

4. Ask Thoughtful Questions

Ask thoughtful questions during the interview that demonstrate your engagement and interest in the role and company. This also provides an opportunity to assess the company’s culture and values.

- Example Question: “What are the company’s strategic priorities for the next fiscal year and how does the Corporate Treasurer contribute to these goals?”

- Example Question: “Can you provide insights into the company’s approach to ESG and sustainability reporting?”

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Corporate Treasurer interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.