Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Cost Accountant position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

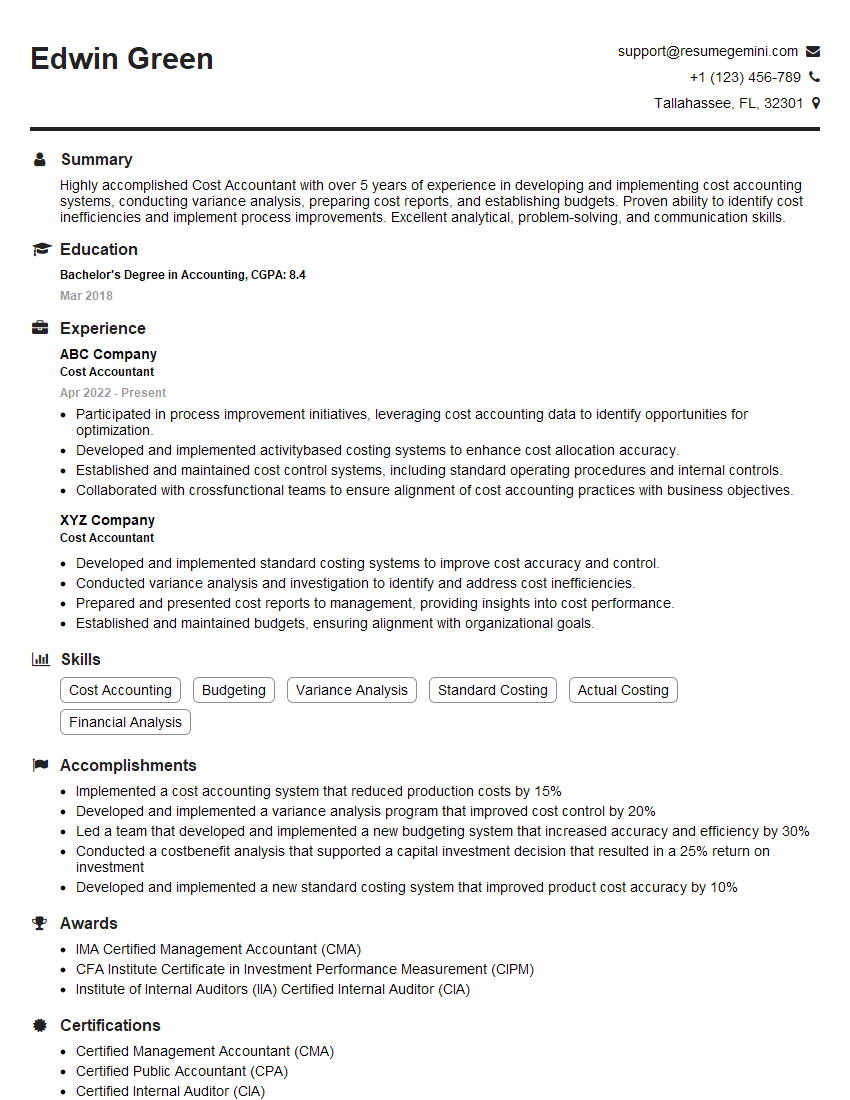

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Cost Accountant

1. Explain the different cost accounting methods and when each method should be used?

Cost accounting methods are used to allocate costs to products or services. The most common methods are:

- Job costing: This method is used when each unit of production is unique, such as in construction or shipbuilding.

- Process costing: This method is used when the production process is continuous, such as in manufacturing.

- Activity-based costing (ABC): This method is used to allocate costs to products or services based on the activities that are performed to produce them. ABC is often more accurate than traditional costing methods, but it can also be more complex and time-consuming.

The best cost accounting method for a particular company will depend on the nature of its business and the level of accuracy that is required.

2. What are the different types of costs and how are they classified?

Variable costs

- Costs that change in proportion to the level of production or activity.

- Examples: raw materials, direct labor, utilities.

Fixed costs

- Costs that do not change in proportion to the level of production or activity.

- Examples: rent, depreciation, salaries of administrative staff.

Semi-variable costs

- Costs that change with the level of production or activity, but not in proportion.

- Examples: maintenance costs, repairs, overtime pay.

3. What are the different methods of cost allocation and how are they used?

Cost allocation is the process of assigning costs to different products or services. The most common methods of cost allocation are:

- Direct costing: This method assigns costs directly to products or services based on their actual usage.

- Indirect costing: This method assigns costs to products or services based on a predetermined allocation rate.

- Activity-based costing (ABC): This method assigns costs to products or services based on the activities that are performed to produce them.

The best cost allocation method for a particular company will depend on the nature of its business and the level of accuracy that is required.

4. What are the different types of cost variances and how are they analyzed?

Cost variances are the differences between actual costs and budgeted costs. The most common types of cost variances are:

- Material price variance: The difference between the actual price of materials and the budgeted price.

- Material quantity variance: The difference between the actual quantity of materials used and the budgeted quantity.

- Labor rate variance: The difference between the actual rate of pay for labor and the budgeted rate.

- Labor efficiency variance: The difference between the actual hours of labor used and the budgeted hours.

- Overhead rate variance: The difference between the actual overhead rate and the budgeted overhead rate.

- Overhead efficiency variance: The difference between the actual overhead costs and the budgeted overhead costs.

Cost variances are analyzed to identify areas where costs are out of control. This information can be used to make improvements to the budgeting process and to reduce costs.

5. What are the different types of cost control systems and how are they used?

Cost control systems are used to monitor and control costs. The most common types of cost control systems are:

- Standard costing: This system uses standard costs to budget for and control costs.

- Budgeting: This system uses budgets to plan for and control costs.

- Variance analysis: This system analyzes cost variances to identify areas where costs are out of control.

- Cost-benefit analysis: This system evaluates the costs and benefits of different courses of action.

The best cost control system for a particular company will depend on the nature of its business and the level of control that is required.

6. What are the different types of cost reports and how are they used?

Cost reports are used to communicate cost information to management. The most common types of cost reports are:

- Income statement: This report shows the company’s revenues and expenses over a period of time.

- Balance sheet: This report shows the company’s assets, liabilities, and equity at a point in time.

- Cash flow statement: This report shows the company’s cash inflows and outflows over a period of time.

- Cost of goods sold statement: This report shows the company’s cost of goods sold over a period of time.

- Overhead cost report: This report shows the company’s overhead costs over a period of time.

Cost reports are used to help management make informed decisions about the company’s operations.

7. What are the different types of cost accounting software and how are they used?

Cost accounting software is used to automate the cost accounting process. The most common types of cost accounting software are:

- Enterprise resource planning (ERP) systems: These systems integrate all of the company’s financial and operational data into a single system.

- Cost accounting modules: These modules can be added to ERP systems or used as stand-alone systems.

- Spreadsheet software: This software can be used to create custom cost accounting reports.

Cost accounting software can help companies to improve their cost accounting processes and to reduce costs.

8. What is the role of a cost accountant in a company?

Cost accountants are responsible for providing management with information about the company’s costs. This information can be used to make informed decisions about the company’s operations and to improve profitability.

The role of a cost accountant includes:

- Developing and implementing cost accounting systems

- Collecting and analyzing cost data

- Preparing cost reports

- Advising management on cost-related matters

9. What are the qualifications for a cost accountant?

Cost accountants typically have a bachelor’s degree in accounting or a related field. They also typically have several years of experience in cost accounting.

Some of the most common qualifications for cost accountants include:

- A bachelor’s degree in accounting or a related field

- Several years of experience in cost accounting

- A strong understanding of accounting principles and cost accounting methods

- Excellent analytical and problem-solving skills

- Strong communication and interpersonal skills

10. What are the career opportunities for cost accountants?

Cost accountants can have a variety of career opportunities. They can work in a variety of industries, including manufacturing, retail, and healthcare.

Some of the most common career opportunities for cost accountants include:

- Cost accountant

- Manager of cost accounting

- Director of cost accounting

- Controller

- Chief financial officer (CFO)

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Cost Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Cost Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Cost Accountants play a crucial role in organizations by providing valuable insights into financial performance and cost-related decision-making. Their responsibilities encompass a wide range of tasks, including:

1. Cost Analysis and Reporting

Analyze and interpret financial data to identify cost inefficiencies, areas for improvement, and potential savings.

2. Budgeting and Forecasting

Develop and manage budgets, forecasting financial performance, and providing guidance on resource allocation.

3. Cost Accounting Systems

Design, implement, and maintain cost accounting systems to capture, allocate, and report cost data accurately.

4. Variance Analysis

Investigate and analyze variances between actual and budgeted costs, identifying deviations and recommending corrective actions.

Interview Preparation Tips

To ace an interview for a Cost Accountant role, candidates must thoroughly prepare and showcase their skills and experience. Here are some essential tips:

1. Research the Company and Position

Familiarize yourself with the company’s industry, business model, and specific requirements for the Cost Accountant role.

2. Practice Your Technical Skills

Review cost accounting concepts, budgeting techniques, and financial analysis methods. Practice solving case studies and hypothetical scenarios.

3. Quantify Your Accomplishments

Use specific numbers and metrics to demonstrate your contributions and impact in previous roles. Quantifying your achievements shows the tangible results of your work.

4. Emphasize Problem-Solving and Decision-Making

Highlight your ability to analyze data, identify issues, and develop solutions. Cost Accountants are expected to be critical thinkers who can make sound decisions based on financial information.

5. Prepare Relevant Questions

Ask insightful questions that show your interest in the company, the role, and the industry. Well-prepared questions demonstrate your engagement and enthusiasm.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Cost Accountant, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Cost Accountant positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.