Feeling lost in a sea of interview questions? Landed that dream interview for Cost Accounting Clerk but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Cost Accounting Clerk interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

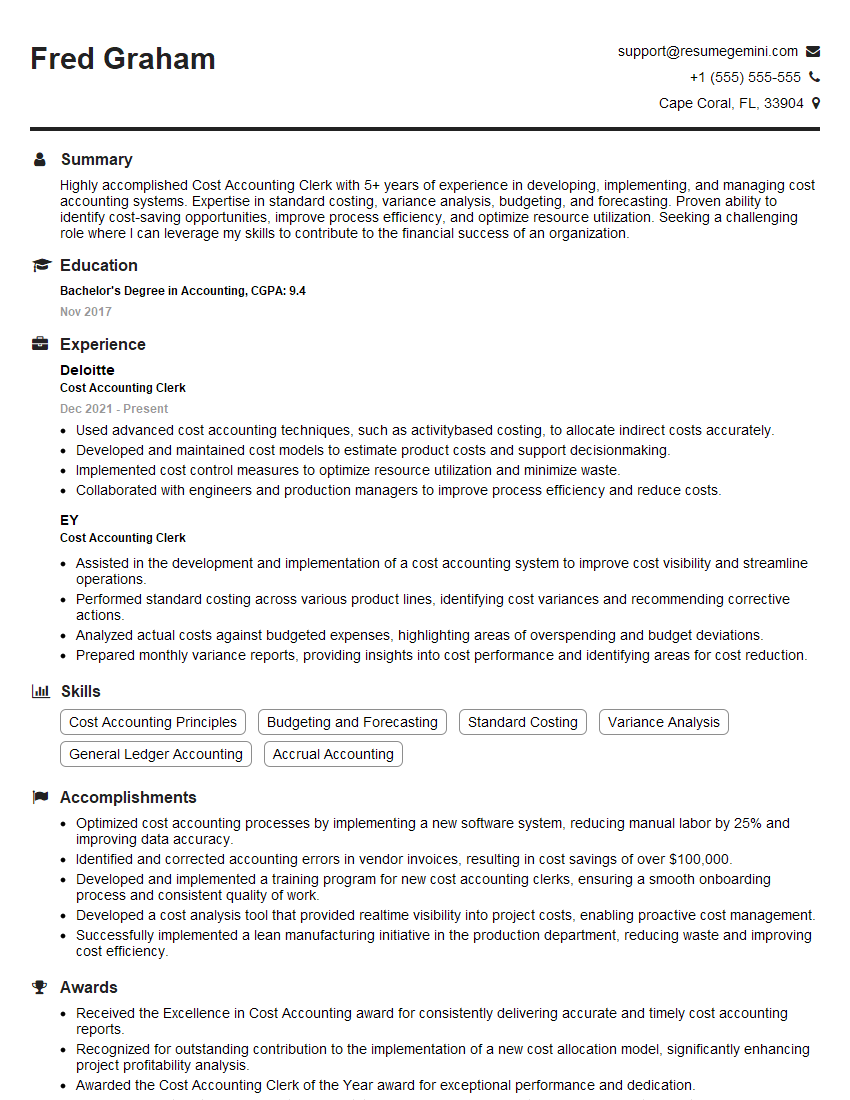

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Cost Accounting Clerk

1. Explain the purpose and importance of cost accounting in an organization.

- Cost accounting provides information about the costs of a company’s products and services, which is essential for making informed decisions about pricing, production, and other business operations.

- Cost accounting helps to identify areas where costs can be reduced, which can improve profitability.

- Cost accounting provides information that can be used to make comparisons with other companies and to set financial goals.

2. Describe the different types of cost accounting systems.

Job costing system

- Job costing is a system that accumulates costs for each job or project. This system is used when the costs associated with a particular job or project need to be tracked separately.

- Job costing is often used in industries such as construction, manufacturing, and engineering.

Process costing system

- Process costing is a system that accumulates costs for each process or department. This system is used when the costs associated with a particular process or department need to be tracked separately.

- Process costing is often used in industries such as food processing, chemical manufacturing, and oil refining.

3. Explain the difference between direct costs and indirect costs.

- Direct costs are costs that can be directly traced to a particular product or service. Examples of direct costs include raw materials, direct labor, and shipping costs.

- Indirect costs are costs that cannot be directly traced to a particular product or service. Examples of indirect costs include rent, utilities, and administrative salaries.

4. Describe the different methods of allocating indirect costs to products or services.

- There are a number of different methods that can be used to allocate indirect costs to products or services. Some of the most common methods include the following:

- Activity-based costing (ABC): This method allocates indirect costs based on the activities that are performed to produce the product or service.

- Direct labor hours: This method allocates indirect costs based on the number of direct labor hours that are required to produce the product or service.

- Machine hours: This method allocates indirect costs based on the number of machine hours that are required to produce the product or service.

5. Explain the difference between absorption costing and variable costing.

- Absorption costing is a costing method that allocates both fixed and variable costs to products or services. This method is used for financial reporting purposes.

- Variable costing is a costing method that allocates only variable costs to products or services. This method is used for decision-making purposes.

6. Describe the role of a cost accounting clerk in an organization.

- Cost accounting clerks are responsible for collecting, classifying, and summarizing cost data. They also prepare cost reports and statements.

- Cost accounting clerks work closely with other departments, such as accounting, production, and sales, to ensure that the organization’s cost accounting system is accurate and efficient.

7. What are the key skills and qualifications that a cost accounting clerk should have?

- Cost accounting clerks should have a strong understanding of cost accounting principles and practices.

- They should also have good analytical and problem-solving skills.

- Additionally, cost accounting clerks should be able to work independently and as part of a team.

8. What are the career opportunities for a cost accounting clerk?

- Cost accounting clerks can advance to positions such as cost accountant, senior cost accountant, and cost manager.

- They can also move into other areas of finance, such as financial accounting or auditing.

9. What are the challenges that a cost accounting clerk may face?

- Cost accounting clerks may face challenges such as dealing with complex cost accounting systems, interpreting cost data, and meeting deadlines.

- They may also face challenges in working with other departments and in staying up-to-date on changes in cost accounting principles and practices.

10. How do you stay up-to-date on the latest cost accounting developments?

- I stay up-to-date on the latest cost accounting developments by reading industry publications, attending conferences, and taking continuing education courses.

- I also network with other cost accounting professionals to share knowledge and best practices.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Cost Accounting Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Cost Accounting Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Cost Accounting Clerk, your primary responsibilities will encompass a wide range of tasks related to cost accounting. Key job responsibilities include:

1. Cost Data Collection and Analysis

You will be responsible for gathering and analyzing cost data from various sources, such as purchase orders, invoices, and financial statements. This data will be used to create cost reports and provide insights into the company’s financial performance.

- Collect cost data from various sources, such as purchase orders, invoices, and financial statements.

- Analyze cost data to identify trends, patterns, and areas for cost optimization.

2. Cost Allocation and Reporting

You will be tasked with allocating costs to specific products, services, or departments. You will also be responsible for preparing and presenting cost reports to management.

- Allocate costs to specific products, services, or departments using appropriate cost allocation methods.

- Prepare and present cost reports to management, providing insights and recommendations for cost control.

3. Cost Control and Analysis

You will work on identifying areas where costs can be reduced and developing strategies for cost control. You will also be involved in analyzing cost variances and recommending corrective actions.

- Identify areas where costs can be reduced and develop strategies for cost control.

- Analyze cost variances and recommend corrective actions to improve cost efficiency.

4. Other Responsibilities

In addition to the core responsibilities listed above, you may also be involved in other tasks, such as:

- Assisting with financial audits and reviews.

- Providing technical support to other departments.

- Developing and maintaining cost accounting systems and procedures.

Interview Tips

Preparing for a job interview can be daunting, but with the right strategies, you can increase your chances of success. Here are some interview tips to help you ace your Cost Accounting Clerk interview:

1. Research the Company and the Role

Before the interview, take the time to thoroughly research the company and the specific role you are applying for. This will help you understand the company’s culture, values, and business objectives. It will also help you tailor your answers to the interviewer’s questions.

- Visit the company’s website and read about their history, mission, and products or services.

- Research the specific role you are applying for and identify the key responsibilities and qualifications.

2. Practice Your Answers to Common Interview Questions

There are certain interview questions that are commonly asked in Cost Accounting Clerk interviews. By practicing your answers to these questions, you can feel more confident and prepared during the interview.

- Tell me about your experience in cost accounting.

- How do you allocate costs to different products or services?

- What are some strategies you have used to reduce costs?

3. Highlight Your Skills and Experience

During the interview, be sure to highlight your skills and experience that are most relevant to the Cost Accounting Clerk role. Use specific examples to demonstrate your abilities and how you have contributed to your previous employer’s success.

- Emphasize your strong analytical and problem-solving skills.

- Provide examples of projects where you successfully reduced costs or improved cost efficiency.

4. Ask Thoughtful Questions

At the end of the interview, you will likely be given an opportunity to ask questions. This is a valuable opportunity to demonstrate your interest in the role and the company. Prepare a few thoughtful questions that show you are engaged and curious.

- What are the biggest challenges facing the company right now?

- What is the company’s strategy for growth?

- What opportunities are there for professional development within the company?

5. Follow Up After the Interview

After the interview, be sure to follow up with the interviewer via email. Thank them for their time and reiterate your interest in the role. You can also use this opportunity to address any questions or concerns that were raised during the interview.

- Send a thank-you email within 24 hours of the interview.

- Reiterate your interest in the role and highlight your qualifications.

- Address any questions or concerns that were raised during the interview.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Cost Accounting Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!