Are you gearing up for a career in Counter Former? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Counter Former and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

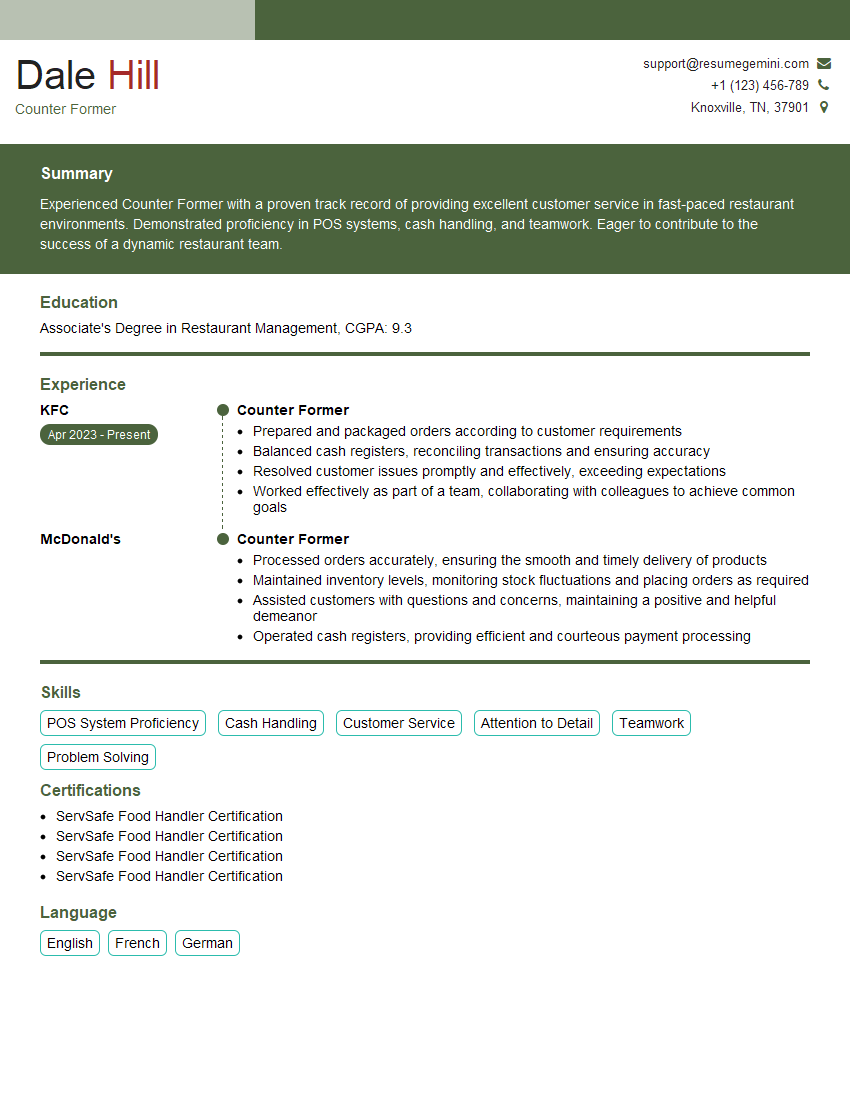

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Counter Former

1. How would you approach identifying potential threats to an organization’s financial security?

- Conduct regular risk assessments to identify potential vulnerabilities

- Monitor financial transactions for unusual patterns or suspicious activity

- Review financial statements for any inconsistencies or irregularities

- Implement strong internal controls to prevent fraud and misuse of funds

- Stay informed about emerging financial crime trends and best practices

2. What techniques are available to investigate financial fraud and money laundering?

Forensic Accounting

- Examining financial documents to uncover discrepancies and hidden transactions

- Interviewing individuals involved in financial activities

- Reconciling financial records to identify missing or misstated items

Data Analytics

- Using software to analyze large volumes of financial data

- Identifying patterns and anomalies that may indicate fraud or money laundering

- Applying machine learning algorithms to detect suspicious transactions

3. How do you stay up-to-date on new and emerging financial crime typologies?

- Attending industry conferences and workshops

- Reading professional journals and publications

- Participating in online forums and discussion groups

- Networking with other professionals in the field

- Taking continuing education courses

4. What are the key elements of an effective compliance program?

- Clear and concise policies and procedures

- Regular training and communication for employees

- Systems to monitor and detect compliance violations

- Procedures for investigating and responding to violations

- Independent oversight and auditing

5. How would you design a risk assessment for an organization’s anti-money laundering program?

- Identify the organization’s money laundering risks

- Assess the likelihood and impact of these risks

- Develop and implement controls to mitigate these risks

- Monitor and update the risk assessment on a regular basis

- Involve stakeholders from different areas of the organization

6. What are the common red flags associated with financial fraud?

- Unusually large or frequent transactions

- Transactions that do not make sense in the context of the organization’s business

- Transactions involving shell companies or other opaque entities

- Attempts to conceal or disguise the source or destination of funds

- Employees who live beyond their means

7. How would you investigate a potential case of insider trading?

- Interview the individual suspected of insider trading

- Review trading records and other relevant documents

- Identify any contacts between the individual and other parties who may have benefited from the insider trading

- Determine the extent of the insider trading activity

- Prepare a report of the investigation and recommend appropriate action

8. What are the key challenges in combatting financial crime?

- The complexity and sophistication of financial crime

- The global nature of financial crime

- The lack of cooperation between different jurisdictions

- The difficulty in detecting and investigating financial crime

- The resources required to combat financial crime

9. What are the future trends in financial crime?

- The increased use of technology in financial crime

- The rise of cryptocurrencies and other digital assets

- The growing threat of cybercrime

- The increasing complexity of financial fraud

- The need for greater cooperation between different jurisdictions

10. What is your understanding of the role of a Counter Former in a financial institution?

- To investigate and prevent financial crime, such as fraud, money laundering, and terrorist financing

- To ensure compliance with anti-money laundering and other financial crime regulations

- To work closely with law enforcement and other regulatory agencies

- To develop and implement internal policies and procedures to combat financial crime

- To train and educate employees on financial crime risks and prevention

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Counter Former.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Counter Former‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Counter Formers are highly-skilled financial professionals who play a vital role in ensuring the accuracy and integrity of financial records. Their primary responsibilities include:

1. Counter Reviewing and Approving Financial Documents

Counter Formers review and approve a variety of financial documents, including invoices, purchase orders, expense reports, and other financial transactions. They verify the accuracy and completeness of the documentation, ensure compliance with company policies and procedures, and identify any potential errors or discrepancies.

2. Preparing and Submitting Financial Reports

Counter Formers are responsible for preparing and submitting a variety of financial reports, such as income statements, balance sheets, and cash flow statements. These reports provide key insights into the financial health of the organization and are used by management to make informed decisions.

3. Maintaining Accounting Records

Counter Formers maintain accurate and up-to-date accounting records, including general ledgers, accounts payable and receivable, and other financial data. They ensure that all transactions are properly recorded and classified, and that the records are in compliance with applicable accounting standards.

4. Assisting with Internal Audits

Counter Formers may assist with internal audits by providing documentation, answering questions, and providing explanations of accounting procedures. They work with auditors to ensure that the audit process is thorough and efficient.

Interview Tips

Preparing for a Counter Former interview can be challenging, but with the right approach, you can increase your chances of success. Here are some tips to help you ace your interview:

1. Research the Company and Position

Before the interview, take the time to research the company and the specific Counter Former position you are applying for. This will give you a better understanding of the company’s culture, values, and the specific responsibilities of the role.

2. Practice Your Answers to Common Interview Questions

There are a number of common interview questions that you are likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. Practice your answers to these questions in advance so that you can deliver them confidently and concisely during the interview.

3. Be Prepared to Talk About Your Experience

The interviewer will want to know about your experience and qualifications. Be prepared to discuss your relevant skills and experience, and how they relate to the requirements of the Counter Former position.

4. Ask Questions

Asking thoughtful questions at the end of the interview shows that you are engaged and interested in the position. Prepare a few questions in advance that demonstrate your knowledge of the company and the role.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Counter Former role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.