Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted County Assessor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

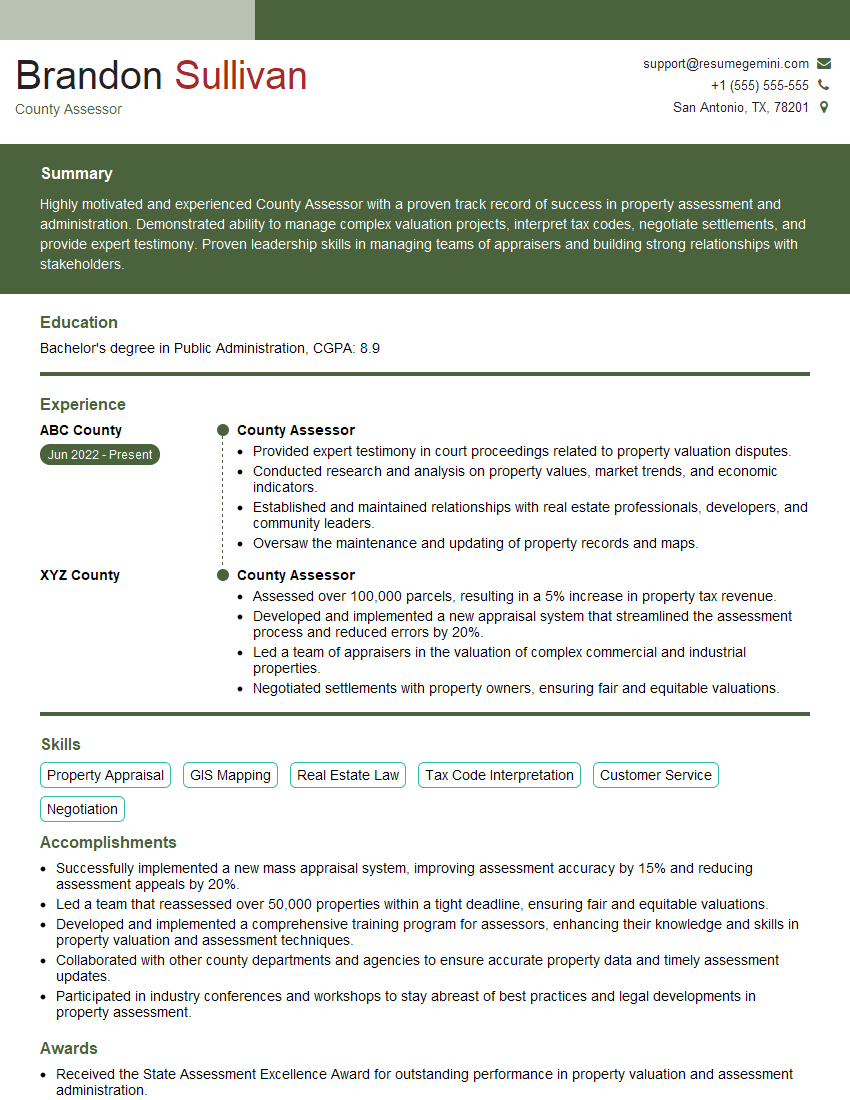

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For County Assessor

1. How do you maintain the accuracy and consistency of property assessments?

To maintain accuracy and consistency in property assessments, I utilize a comprehensive approach that encompasses the following key elements:

- Rigorous Data Collection: I ensure that all relevant data, including sales prices, building permits, and market trends, is meticulously gathered and analyzed.

- Advanced Valuation Techniques: I employ sophisticated valuation techniques such as mass appraisal models and comparative market analysis to determine property values.

- Regular Audits and Reviews: I conduct regular audits and reviews of assessment records to identify and rectify any potential errors or inconsistencies.

- Collaboration with Experts: I consult with third-party experts, including appraisers and real estate professionals, to gain additional insights and ensure the fairness and accuracy of assessments.

2. How do you handle property tax appeals?

Objectivity and Impartiality

- I approach property tax appeals with objectivity and impartiality, recognizing the taxpayer’s right to due process.

- I thoroughly review all evidence presented by the taxpayer and consider their arguments fairly.

Assessment Review

- I carefully examine the property’s assessment and the evidence provided by the taxpayer to determine if the assessment is accurate and in accordance with established regulations.

- If necessary, I conduct a site visit to gather additional information and assess the property’s condition.

Communication and Resolution

- I communicate effectively with the taxpayer throughout the appeal process, keeping them informed of the status and providing clear explanations of the assessment.

- I strive to reach a mutually acceptable resolution that is fair and equitable to both the taxpayer and the county.

3. How do you ensure that the county’s property tax system is equitable and fair?

I implement a comprehensive strategy to promote equity and fairness in the county’s property tax system:

- Uniform Assessment Standards: I apply consistent assessment standards across all properties, ensuring that similar properties are valued equitably.

- Market-Driven Valuations: I utilize market-driven valuation techniques that reflect the actual value of properties in the open market.

- Regular Market Analysis: I continuously monitor market trends and conduct regular market analyses to ensure that assessments remain current and aligned with market conditions.

- Public Outreach and Education: I actively engage with the community through public outreach programs to educate taxpayers about the assessment process and their rights.

4. How do you manage the county’s property tax revenue?

I employ a fiscally responsible and transparent approach to managing the county’s property tax revenue:

- Revenue Forecasting: I accurately forecast property tax revenue based on historical trends, economic indicators, and market conditions.

- Budget Planning: I collaborate with the county’s elected officials to develop budget plans that allocate property tax revenue effectively to support essential county services.

- Revenue Administration: I oversee the collection and administration of property taxes, ensuring timely payments and minimizing delinquencies.

- Taxpayer Assistance: I provide assistance to taxpayers with payment plans, exemptions, and other tax-related matters.

5. How do you stay up-to-date on changes in property tax laws and regulations?

To stay abreast of evolving property tax laws and regulations, I employ the following strategies:

- Professional Development: I regularly attend conferences, seminars, and training programs to enhance my knowledge of current laws and best practices.

- Industry Publications: I subscribe to industry publications and periodicals to stay informed about emerging trends and legal updates.

- Collaboration with Professionals: I network with other assessors, attorneys, and real estate professionals to share insights and exchange information.

- Legal Research: I conduct thorough legal research to ensure that my assessments and decisions are compliant with applicable laws and regulations.

6. How do you handle complex property tax issues, such as the valuation of commercial or industrial properties?

When dealing with complex property tax issues, I utilize the following approach:

- Expert Consultation: I consult with independent appraisers, engineers, and other industry experts to gain specialized knowledge and insights.

- Income and Expense Analysis: I carefully analyze the income and expense data of commercial and industrial properties to determine their earning capacity.

- Market Research: I conduct thorough market research to assess the demand for similar properties in the area.

- Comparable Sales Analysis: I compare the subject property to recent sales of comparable properties to derive an accurate valuation.

7. How do you manage the workload and prioritize tasks in a fast-paced environment?

To effectively manage my workload and prioritize tasks in a demanding environment:

- Time Management: I employ effective time management techniques, including setting priorities, creating to-do lists, and delegating tasks to staff.

- Project Management: I utilize project management tools to track the progress of multiple tasks and ensure timely completion.

- Team Collaboration: I work closely with my team members to distribute workload and support each other during peak periods.

- Automation: I implement automated processes to streamline tasks and improve efficiency.

8. How do you communicate effectively with taxpayers, other county officials, and the general public?

I believe in clear and effective communication across all levels:

- Taxpayer Communication: I make myself accessible to taxpayers, responding promptly to inquiries, explaining assessments, and providing guidance on tax-related matters.

- Intergovernmental Collaboration: I maintain strong relationships with other county officials, collaborating on matters such as tax policy and economic development.

- Public Outreach: I conduct public outreach programs to educate the community about property taxes, assessment procedures, and taxpayer rights.

- Written Communication: I communicate clearly and concisely through written reports, presentations, and correspondence.

9. What are the key challenges facing property tax administration in the current economic climate?

Property tax administration in the current economic climate presents several challenges:

- Market Volatility: Rapid fluctuations in property values can make it difficult to maintain accurate assessments.

- Economic Uncertainty: Economic downturns and recessions can lead to decreased property values and reduced tax revenue.

- Political Pressure: Taxpayers may face financial hardship and demand tax relief, placing pressure on assessors to reduce assessments.

- Technological Advancements: Property tax administration requires constant adaptation to evolving technology and data management systems.

10. How do you stay motivated and maintain a positive attitude in a demanding role?

Motivation and a positive attitude are essential in this demanding role:

- Passion for Public Service: I am driven by my commitment to providing fair and equitable property tax administration for the community.

- Teamwork and Collaboration: Working with a supportive team and collaborating with stakeholders keeps me energized.

- Professional Growth: I actively seek opportunities for professional development to enhance my knowledge and skills.

- Positive Mindset: I focus on the positive aspects of my work, such as the impact it has on the community.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for County Assessor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the County Assessor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The County Assessor is a crucial role responsible for many significant duties, including administering property assessment and taxation processes, ensuring fairness and accuracy in property valuations, and promoting equity in the tax system.

1. Property Assessment

The County Assessor’s primary responsibility is to determine the fair market value of all taxable properties within the county.

- Conducts physical inspections of properties to determine their characteristics and condition.

- Analyzes market data, comparable sales, and appraisal techniques to estimate property values.

- Maintains property records and maps to ensure accurate and up-to-date information.

2. Tax Administration

The Assessor is responsible for calculating property taxes based on assessed values and ensuring timely tax collection.

- Prepares and issues property tax bills to property owners.

- Collects and processes property tax payments.

- Investigates and resolves tax-related disputes and appeals.

3. Public Service

The Assessor serves as a public official and is committed to providing excellent customer service.

- Responds to inquiries and provides information to property owners, taxpayers, and other stakeholders.

- Conducts outreach programs to educate the public about property assessment and taxation processes.

- Collaborates with other county departments and agencies to ensure efficient and effective service delivery.

4. Leadership and Management

The Assessor leads and manages a team of professionals responsible for various aspects of property assessment and taxation.

- Supervises and mentors staff, providing guidance and support.

- Establishes and maintains effective policies and procedures to ensure the smooth operation of the department.

- Manages the department’s budget and resources to optimize performance.

Interview Tips

Preparing thoroughly for an interview is key to making a positive impression and increasing your chances of success. Here are some tips to help you ace your interview for a County Assessor position:

1. Research the County and Position

Familiarize yourself with the county where you’re applying, its tax laws and regulations, and the specific responsibilities of the County Assessor.

- Visit the county’s website and review relevant documents.

- Attend public meetings or workshops related to property assessment and taxation.

2. Practice Answering Common Interview Questions

Anticipate typical interview questions and prepare well-structured responses that highlight your skills and experience.

- Tell me about your experience in property assessment and taxation.

- How do you ensure fairness and accuracy in property valuations?

- What are your strategies for promoting equity in the tax system?

- How do you handle tax-related disputes and appeals?

- What are your leadership and management skills?

3. Showcase Your Relevant Skills and Experience

Emphasize your qualifications that directly align with the job requirements.

- Highlight your experience in property appraisal, tax administration, and customer service.

- Quantify your accomplishments whenever possible to demonstrate impact.

4. Be Enthusiastic and Confident

Convey your passion for the role and your commitment to serving the community.

- Speak about your interest in property assessment and taxation.

- Share examples of your dedication to providing excellent customer service.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a County Assessor, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for County Assessor positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.